Deadline Approaches For Claiming $1,400 Stimulus Check From 2021: Don't Miss Out!

Mar 18 2025

As the deadline approaches for claiming the $1,400 stimulus check from 2021, millions of eligible Americans are at risk of losing out on this crucial financial support. The IRS has set a firm timeline for processing claims, and those who have not yet acted may face irreversible consequences. If you believe you qualify for this stimulus payment, now is the time to act.

The $1,400 stimulus check was part of the American Rescue Plan Act, aimed at providing relief to individuals and families impacted by the economic challenges brought on by the pandemic. Despite its implementation over two years ago, many eligible recipients still haven't claimed their rightful payments. Understanding the process and requirements is essential to ensure you don't miss out.

With the IRS deadline looming, it's crucial to gather all necessary documents and file your claim promptly. This article will guide you through the process, highlight important deadlines, and provide valuable tips to maximize your chances of receiving the stimulus check. Stay informed and take action before it's too late.

Read also:How To Consultar Lugar De Votacioacuten Por Nuacutemero De Ceacutedula En Venezuela A Complete Guide

Table of Contents

- Background on the $1,400 Stimulus Check

- Who Is Eligible for the $1,400 Stimulus Check?

- Understanding the Deadline

- Steps to Claim Your Stimulus Check

- Common Issues and How to Resolve Them

- Tax Implications of the Stimulus Check

- Resources for Further Assistance

- Key Statistics on Stimulus Check Claims

- Expert Advice on Maximizing Your Payment

- Conclusion and Call to Action

Background on the $1,400 Stimulus Check

The $1,400 stimulus check was a significant component of the American Rescue Plan Act, enacted in March 2021. Designed to provide financial relief during the pandemic, this payment was part of a broader effort to stabilize the economy and support individuals and families. The IRS distributed these checks based on income levels and eligibility criteria.

Despite widespread distribution, many eligible individuals either missed out on their payments or failed to claim them due to various reasons. As the deadline approaches for claiming these funds, it's essential to revisit the program's origins and understand its significance.

Why Was the Stimulus Check Necessary?

The pandemic caused unprecedented economic disruptions, leading to job losses and financial instability for millions of Americans. The $1,400 stimulus check aimed to alleviate some of these burdens by providing direct financial assistance to those most affected. By boosting consumer spending, the program also sought to stimulate economic recovery.

Who Is Eligible for the $1,400 Stimulus Check?

Eligibility for the $1,400 stimulus check depends on several factors, including income, filing status, and dependent status. The IRS used 2019 or 2020 tax returns to determine eligibility, making it crucial for individuals to ensure their tax information was up to date.

Key Eligibility Criteria

- Single filers with an adjusted gross income (AGI) below $75,000 qualify for the full amount.

- Head of household filers with AGI below $112,500 are eligible for the full payment.

- Married couples filing jointly with AGI below $150,000 qualify for the full payment.

- Dependents, including adult dependents, were eligible for payments.

Those who did not receive their payments or believe they may qualify should review their eligibility carefully.

Understanding the Deadline

The IRS has set a firm deadline for claiming the $1,400 stimulus check, and time is running out. Individuals who missed out on their payments in 2021 have until the end of 2023 to file a claim. After this date, the opportunity to recover these funds will be lost permanently.

Read also:Viviana Macouzet Unveiling The Life And Achievements Of A Rising Star

What Happens After the Deadline?

Once the deadline passes, the IRS will no longer process claims for the $1,400 stimulus check. This means that eligible individuals who fail to act will forfeit their right to receive this financial assistance. It's essential to prioritize filing your claim before the deadline to avoid missing out.

Steps to Claim Your Stimulus Check

Claiming your $1,400 stimulus check involves a straightforward process, but attention to detail is critical. Follow these steps to ensure your claim is processed efficiently:

Gather Necessary Documents

- Most recent tax return (2019 or 2020).

- Proof of income and dependent status.

- Bank account information for direct deposit.

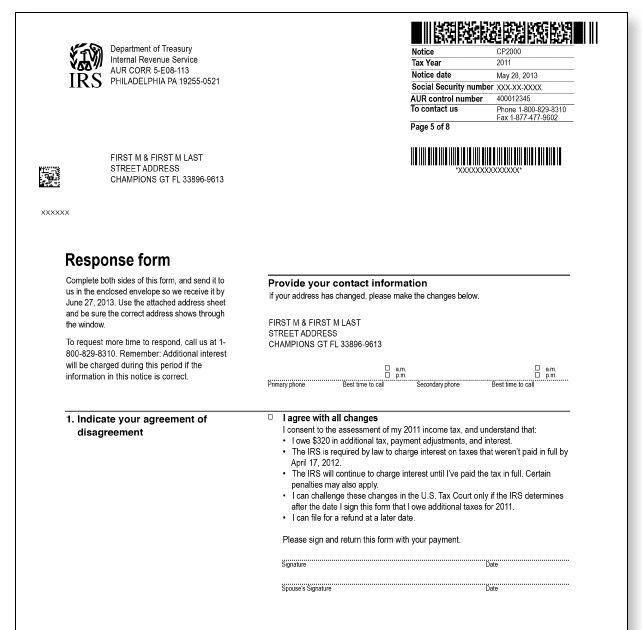

File an Amended Tax Return

If you did not receive your stimulus payment or believe you qualify for additional funds, you may need to file an amended tax return using IRS Form 1040-X. This form allows you to update your tax information and claim any missing payments.

Common Issues and How to Resolve Them

Many individuals encounter challenges when claiming their stimulus checks. Here are some common issues and solutions:

Issue: Incorrect Payment Amount

If you received a smaller payment than expected, verify your eligibility and ensure your tax information is accurate. File an amended return if necessary.

Issue: Missing Payment

If you never received your stimulus check, contact the IRS using their "Get My Payment" tool to track your payment status. If unresolved, submit a claim for the missing funds.

Tax Implications of the Stimulus Check

It's important to understand the tax implications of the $1,400 stimulus check. These payments are not considered taxable income, meaning you won't owe taxes on them. However, if you failed to claim your payment in 2021, you may need to file an amended return to recover the funds.

How to Report Stimulus Payments on Your Tax Return

Stimulus payments are reported as part of the Recovery Rebate Credit on your tax return. Use IRS Form 1040 or 1040-SR to claim any missing payments or adjust your credit amount.

Resources for Further Assistance

Several resources are available to assist individuals in claiming their $1,400 stimulus check:

IRS Official Website

Visit the IRS website for detailed information on stimulus payments, eligibility, and the claim process. The "Get My Payment" tool can help you track your payment status.

Tax Professional Assistance

Consult a certified tax professional for guidance on filing amended returns or resolving payment issues. Their expertise can ensure your claim is processed correctly.

Key Statistics on Stimulus Check Claims

Data from the IRS and other sources highlight the importance of claiming your $1,400 stimulus check:

- Over 160 million payments were issued in 2021.

- Approximately 10 million eligible individuals have yet to claim their payments.

- Unclaimed funds total an estimated $20 billion.

These statistics underscore the urgency of acting before the deadline.

Expert Advice on Maximizing Your Payment

Financial experts recommend taking proactive steps to maximize your stimulus payment:

Tips for Ensuring Full Payment

- Verify your eligibility and income information.

- File an amended return if necessary.

- Track your payment status using IRS tools.

Seeking professional advice can also help ensure you receive the full amount you're entitled to.

Conclusion and Call to Action

As the deadline approaches for claiming the $1,400 stimulus check from 2021, it's critical for eligible individuals to take immediate action. By understanding the eligibility criteria, gathering necessary documents, and following the claim process, you can secure the financial support you deserve. Don't let this opportunity slip away—act now to claim your rightful payment.

We encourage you to share this article with friends and family who may benefit from this information. For more updates on financial matters, explore our other articles and resources. Together, we can ensure everyone receives the support they need during these challenging times.