You Could Be Eligible For A $1,400 IRS Stimulus Check: How To Check If You Qualify

Mar 18 2025

Millions of Americans are eligible for a $1,400 IRS stimulus check as part of the government's efforts to support individuals and families during the ongoing economic challenges. If you're wondering whether you qualify, this article will provide comprehensive guidance on how to determine your eligibility and what steps you need to take.

The American Rescue Plan Act, passed in March 2021, included a third round of stimulus checks aimed at providing financial relief to those affected by the pandemic. This initiative is part of the broader effort by the federal government to stabilize the economy and assist households in need. Understanding the details of this stimulus package is crucial for ensuring you receive the support you deserve.

Whether you're an individual, a family, or a small business owner, it's important to stay informed about the latest developments in stimulus payments. This article will break down everything you need to know, from eligibility criteria to the application process, ensuring you're well-prepared to claim your benefits.

Read also:Agmaal Web Series The Ultimate Guide To This Gripping Show

Table of Contents

- Eligibility Criteria for the $1,400 Stimulus Check

- Income Limits and Phase-Out Rules

- Dependent Rules and Who Qualifies

- The Application Process: What You Need to Know

- How Tax Returns Impact Your Eligibility

- Direct Deposit vs. Paper Checks

- Non-Filers: How to Claim Your Stimulus Check

- Stay Updated: Latest News on Stimulus Checks

- Frequently Asked Questions About Stimulus Checks

- Conclusion and Next Steps

Eligibility Criteria for the $1,400 Stimulus Check

To qualify for the $1,400 IRS stimulus check, individuals must meet specific criteria set by the Internal Revenue Service (IRS). These criteria are designed to ensure that the funds reach those who need them most. Here are the key factors to consider:

Key Factors for Eligibility

- Adjusted Gross Income (AGI) must fall within the specified limits.

- You must have a valid Social Security Number (SSN).

- U.S. citizenship or qualifying resident alien status is required.

- Eligible dependents can also receive payments, depending on the household's AGI.

For example, single filers with an AGI of $75,000 or less, and married couples filing jointly with an AGI of $150,000 or less, are eligible for the full amount. Payments phase out for higher incomes.

Income Limits and Phase-Out Rules

The income limits for the $1,400 stimulus check are structured to prioritize those most affected by economic challenges. Here's a breakdown:

Income Thresholds

- Single filers: Full payment for AGI up to $75,000; payments phase out above this threshold.

- Married couples filing jointly: Full payment for AGI up to $150,000; phase-out begins above this amount.

- Head of household filers: Full payment for AGI up to $112,500; phase-out starts beyond this level.

According to the IRS, the phase-out reduces the payment by $5 for every $100 of income above the threshold. For example, a single filer with an AGI of $80,000 would receive a reduced payment.

Dependent Rules and Who Qualifies

The American Rescue Plan expanded the definition of dependents eligible for stimulus payments. Unlike previous rounds, the new rules include:

Eligible Dependents

- Children under 17 years old.

- Adult dependents, including college students and disabled individuals.

- Dependents claimed on your 2020 tax return.

This expansion means more families can benefit from the stimulus checks. For instance, a family with three children under 17 could receive an additional $4,200 in total.

Read also:Discover The Best Of Mb Of West Chester A Comprehensive Guide To The Community

The Application Process: What You Need to Know

Most eligible individuals do not need to take additional steps to receive their stimulus check. The IRS uses information from your 2019 or 2020 tax returns to determine eligibility and payment amounts.

Steps to Ensure You Receive Your Payment

- File your 2020 tax return if you haven't already.

- Update your direct deposit information with the IRS.

- Check the IRS Get My Payment tool for updates on your status.

For those who do not typically file taxes, such as low-income individuals or Social Security recipients, specific steps may be required. We'll cover this in more detail later.

How Tax Returns Impact Your Eligibility

Your tax return is the primary source of information for the IRS to determine your eligibility for the stimulus check. Here's how it works:

Key Points About Tax Returns

- The IRS uses your most recent tax return to calculate your AGI and dependent status.

- If you haven't filed your 2020 return, the IRS will use your 2019 return instead.

- Ensure your tax return accurately reflects your current financial situation to avoid delays or errors in payment.

For example, if your financial situation has changed significantly since your last tax return, filing an updated return may improve your chances of receiving the full stimulus amount.

Direct Deposit vs. Paper Checks

Receiving your stimulus check via direct deposit is faster and more secure than a paper check. Here's what you need to know:

Choosing Your Payment Method

- Direct deposit: Automatically set up if you provided bank account details on your tax return.

- Paper check: Sent by mail if direct deposit information is unavailable.

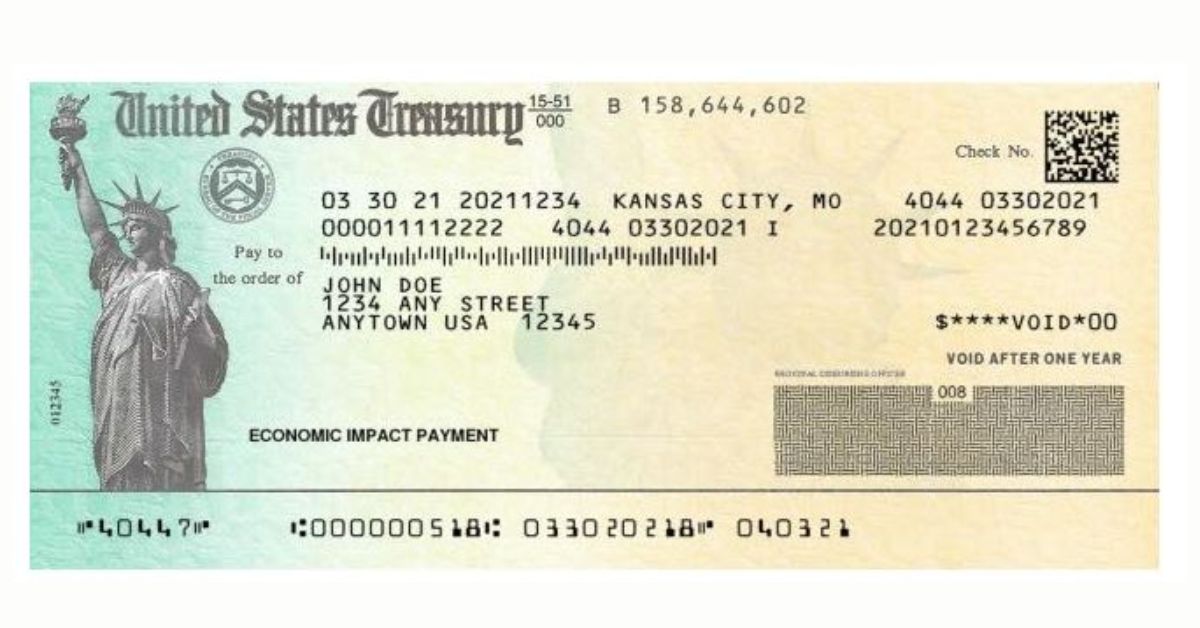

- Debit card: In some cases, the IRS issues payments via Economic Impact Payment (EIP) cards.

According to the IRS, approximately 90% of payments are distributed via direct deposit. Ensure your bank account information is up-to-date to avoid delays.

Non-Filers: How to Claim Your Stimulus Check

Some individuals, such as low-income earners or Social Security recipients, may not typically file tax returns. Here's how they can claim their stimulus check:

Steps for Non-Filers

- Use the IRS Non-Filers tool to provide necessary information.

- Ensure your details are accurate, including SSN and mailing address.

- Monitor the IRS Get My Payment tool for updates.

Non-filers who follow these steps can still receive their stimulus payment, even without filing a traditional tax return.

Stay Updated: Latest News on Stimulus Checks

The IRS regularly updates its website with the latest information on stimulus payments. Here are some recent developments:

Key Updates

- The IRS has processed millions of payments since the program's launch.

- Ongoing efforts to reach non-filers and ensure no one is left out.

- Future plans for additional payments, depending on economic conditions.

Stay informed by visiting the IRS website or subscribing to official updates. This ensures you're aware of any changes or extensions to the program.

Frequently Asked Questions About Stimulus Checks

Here are answers to some common questions about the $1,400 IRS stimulus check:

FAQ

- Q: When will I receive my payment? A: Most payments are issued within weeks of eligibility confirmation, depending on your method of receipt.

- Q: Can I check my payment status? A: Yes, use the IRS Get My Payment tool for real-time updates.

- Q: What if I didn't receive my payment? A: Contact the IRS or consult their troubleshooting guide for assistance.

For more detailed information, refer to the IRS official resources or consult a tax professional.

Conclusion and Next Steps

The $1,400 IRS stimulus check is a vital resource for millions of Americans navigating economic challenges. By understanding the eligibility criteria, income limits, and application process, you can ensure you receive the support you deserve.

We encourage you to take action by:

- Filing your 2020 tax return if you haven't already.

- Updating your direct deposit information with the IRS.

- Checking the IRS Get My Payment tool regularly for updates.

Share this article with friends and family to help them stay informed. For more insights on financial support programs, explore our other articles or consult official IRS resources.