Intro

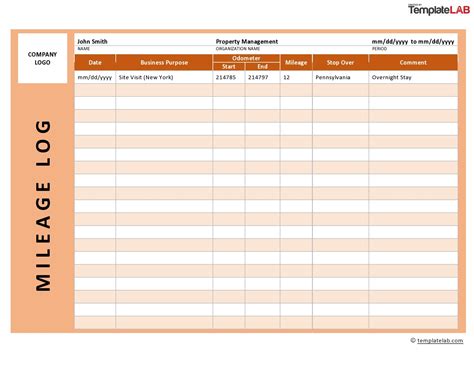

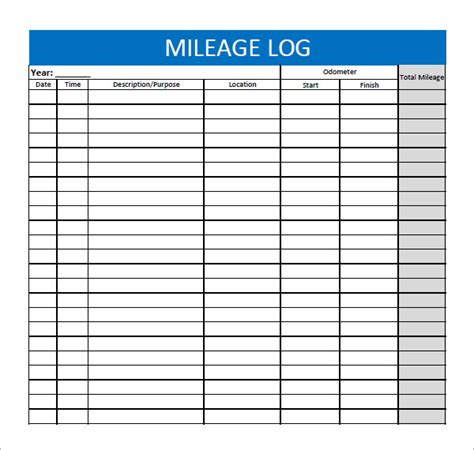

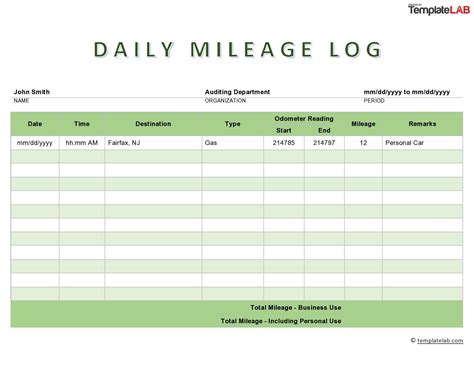

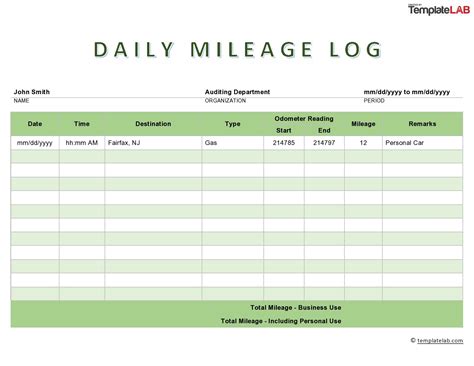

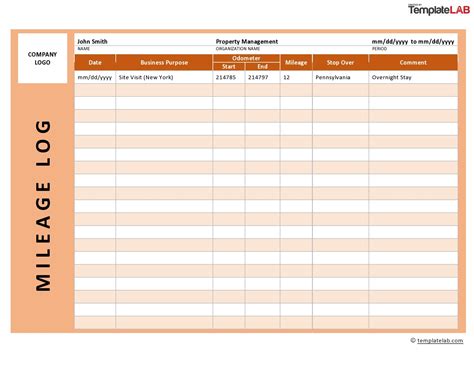

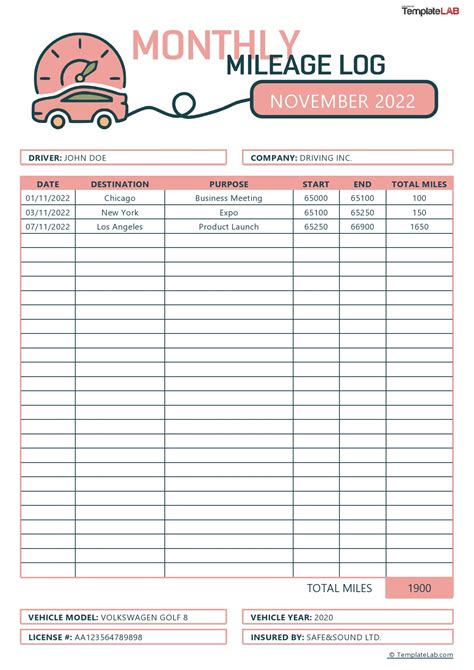

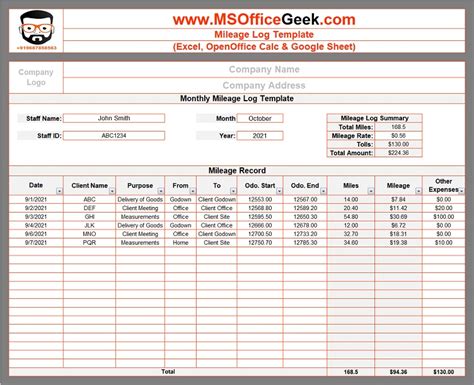

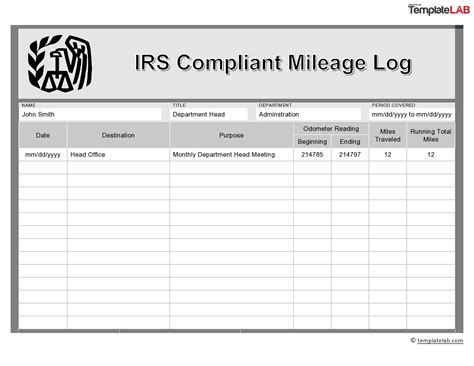

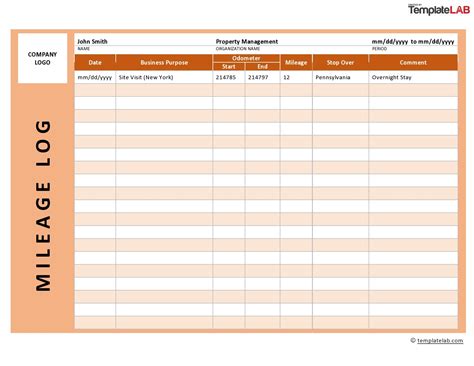

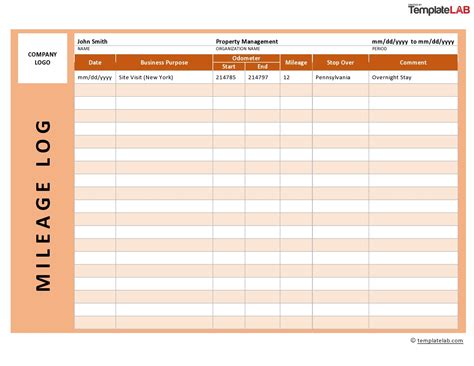

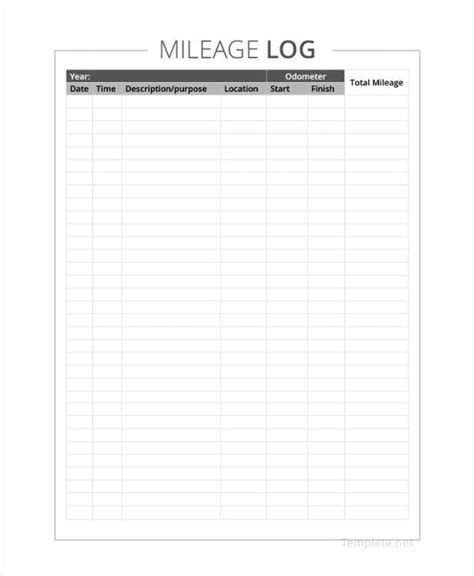

Track vehicle expenses with a printable mileage log template, featuring odometer readings, date, and purpose of trip, ideal for business expense reports, tax deductions, and fuel efficiency tracking.

Keeping track of mileage is essential for individuals and businesses, especially for tax purposes, reimbursement, and vehicle maintenance. A printable mileage log template is a useful tool to help you record and manage your mileage accurately. In this article, we will explore the importance of mileage logs, the benefits of using a printable template, and provide guidance on how to use and customize a mileage log to suit your needs.

Mileage logs are crucial for tracking the distance traveled for business, medical, or charitable purposes. The Internal Revenue Service (IRS) requires accurate records of mileage to claim deductions or reimbursements. A mileage log helps you keep a detailed record of your trips, including dates, destinations, mileage, and purposes. This information is vital for tax returns, audits, and compliance with company policies.

Using a printable mileage log template offers several benefits. It saves time and effort by providing a pre-designed format that you can easily fill out. The template helps you stay organized and ensures that you capture all the necessary information for each trip. Additionally, a printable template allows you to keep a physical record of your mileage, which can be useful for audits or when electronic devices fail.

Benefits of Using a Printable Mileage Log Template

The benefits of using a printable mileage log template include:

- Accuracy: A template helps you record mileage accurately, reducing errors and discrepancies.

- Organization: A mileage log keeps all your trip information in one place, making it easy to access and review.

- Time-saving: A pre-designed template saves time and effort, allowing you to focus on other tasks.

- Compliance: A mileage log ensures compliance with IRS regulations and company policies.

- Customization: You can customize a printable template to suit your specific needs, including adding or removing columns, and modifying the layout.

How to Use a Printable Mileage Log Template

Using a printable mileage log template is straightforward. Here's a step-by-step guide: 1. Download and print the template: Find a suitable mileage log template online, download it, and print it out. 2. Fill out the template: Record your trip information, including dates, destinations, mileage, and purposes. 3. Keep it in your vehicle: Store the mileage log in your vehicle, so it's easily accessible when you need to record a trip. 4. Update regularly: Regularly update your mileage log to ensure accuracy and completeness. 5. Review and reconcile: Periodically review your mileage log to ensure accuracy and reconcile any discrepancies.Customizing a Printable Mileage Log Template

Customizing a printable mileage log template is essential to suit your specific needs. Here are some tips:

- Add or remove columns: Modify the template to include or exclude columns, such as trip purpose, vehicle information, or notes.

- Modify the layout: Adjust the layout to make it more readable or to fit your preferred format.

- Include additional information: Add space for notes, comments, or other relevant information.

- Use different colors: Use different colors to differentiate between personal and business trips or to highlight important information.

Types of Mileage Logs

There are various types of mileage logs available, including: * Daily mileage logs: Record trips on a daily basis, including dates, destinations, and mileage. * Weekly mileage logs: Record trips on a weekly basis, including totals and summaries. * Monthly mileage logs: Record trips on a monthly basis, including totals and summaries. * Annual mileage logs: Record trips on an annual basis, including totals and summaries.Best Practices for Maintaining a Mileage Log

Maintaining a mileage log requires discipline and attention to detail. Here are some best practices:

- Record trips immediately: Record trips as soon as possible to ensure accuracy and completeness.

- Keep it accurate: Ensure that your mileage log is accurate and up-to-date.

- Keep it organized: Keep your mileage log organized, including using tabs, folders, or digital tools.

- Review regularly: Regularly review your mileage log to ensure accuracy and reconcile any discrepancies.

Common Mistakes to Avoid

When maintaining a mileage log, there are common mistakes to avoid: * Inaccurate recording: Failing to record trips accurately, including dates, destinations, and mileage. * Incomplete information: Failing to capture all necessary information, including trip purpose and vehicle information. * Lack of organization: Failing to keep the mileage log organized, making it difficult to access and review.Digital Mileage Logs

Digital mileage logs offer an alternative to traditional paper-based logs. Here are some benefits:

- Convenience: Digital mileage logs are easily accessible and can be updated from anywhere.

- Accuracy: Digital mileage logs can automatically calculate mileage and reduce errors.

- Organization: Digital mileage logs can be easily organized and searched, making it simple to access and review information.

Choosing the Right Digital Mileage Log

When choosing a digital mileage log, consider the following factors: * Ease of use: Choose a digital mileage log that is easy to use and navigate. * Features: Consider the features you need, including automatic mileage calculation, GPS tracking, and reporting. * Compatibility: Ensure that the digital mileage log is compatible with your devices and operating systems.IRS Guidelines for Mileage Logs

The IRS provides guidelines for mileage logs, including:

- Accurate recording: The IRS requires accurate recording of mileage, including dates, destinations, and mileage.

- Complete information: The IRS requires complete information, including trip purpose and vehicle information.

- Retention: The IRS requires retention of mileage logs for a certain period, typically three years.

Penalties for Non-Compliance

Failure to comply with IRS guidelines for mileage logs can result in penalties, including: * Fines: The IRS can impose fines for non-compliance, including failure to maintain accurate records. * Audits: The IRS can conduct audits to verify mileage logs and ensure compliance. * Loss of deductions: Failure to comply with IRS guidelines can result in the loss of deductions or reimbursements.Printable Mileage Log Template Image Gallery

What is a mileage log?

+A mileage log is a record of the distance traveled for business, medical, or charitable purposes.

Why is it important to keep a mileage log?

+Keeping a mileage log is essential for tax purposes, reimbursement, and vehicle maintenance.

How do I choose the right mileage log template?

+Choose a mileage log template that is easy to use, customizable, and meets your specific needs.

Can I use a digital mileage log?

+Yes, digital mileage logs offer an alternative to traditional paper-based logs and can be easily accessible and updated.

What are the IRS guidelines for mileage logs?

+The IRS requires accurate recording of mileage, complete information, and retention of mileage logs for a certain period.

In conclusion, a printable mileage log template is a valuable tool for individuals and businesses to track and manage mileage accurately. By understanding the importance of mileage logs, the benefits of using a printable template, and how to customize and maintain a mileage log, you can ensure compliance with IRS guidelines and make the most of your mileage log. Remember to choose the right mileage log template, keep it accurate and up-to-date, and review it regularly to ensure accuracy and completeness. Share your thoughts and experiences with mileage logs in the comments below, and don't forget to share this article with others who may benefit from using a printable mileage log template.