Intro

Streamline church finances with 5 essential accounting templates, including budgeting, expense tracking, and donation management, for efficient financial reporting and transparency.

Church accounting is a critical aspect of managing the financial resources of a church, ensuring transparency, accountability, and compliance with regulatory requirements. Effective church accounting involves tracking income, expenses, assets, and liabilities, as well as preparing financial statements and reports. In this article, we will explore the importance of church accounting, its benefits, and provide five essential church accounting templates to help churches manage their finances efficiently.

Church accounting is vital for several reasons. Firstly, it helps churches to manage their financial resources effectively, ensuring that they have sufficient funds to support their mission and activities. Secondly, it provides transparency and accountability, enabling church leaders to make informed decisions about financial matters. Thirdly, it helps churches to comply with regulatory requirements, such as tax laws and financial reporting standards. Finally, it enables churches to prepare accurate financial statements and reports, which are essential for stakeholders, including members, donors, and regulatory authorities.

The benefits of church accounting are numerous. It helps churches to identify areas of inefficiency and make adjustments to optimize their financial performance. It also enables churches to track their income and expenses, ensuring that they are operating within their means. Additionally, church accounting helps churches to prepare for the future, by identifying trends and patterns in their financial data. This enables them to make informed decisions about budgeting, forecasting, and planning.

Introduction to Church Accounting Templates

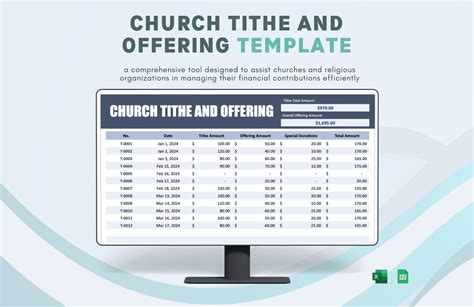

Church accounting templates are essential tools for churches to manage their finances effectively. These templates provide a framework for tracking income, expenses, assets, and liabilities, as well as preparing financial statements and reports. They help churches to streamline their accounting processes, reduce errors, and improve financial transparency. In this article, we will provide five essential church accounting templates, including a budget template, expense report template, income statement template, balance sheet template, and cash flow statement template.

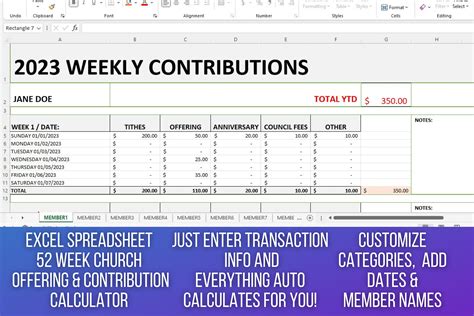

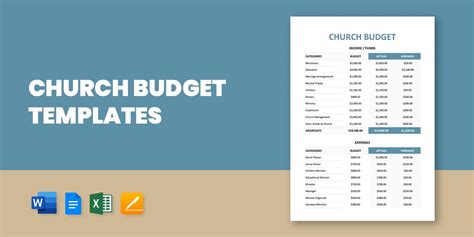

Template 1: Church Budget Template

A church budget template is a critical tool for churches to manage their finances effectively. It helps churches to track their income and expenses, ensuring that they are operating within their means. The template should include columns for income, expenses, and budget variance, as well as rows for different categories of income and expenses, such as tithes, offerings, and salaries. Here is an example of a church budget template:

- Income:

- Tithes: $10,000

- Offerings: $5,000

- Donations: $2,000

- Expenses:

- Salaries: $8,000

- Utilities: $1,500

- Maintenance: $1,000

- Budget Variance:

- Income: $2,000

- Expenses: ($1,000)

Template 2: Church Expense Report Template

A church expense report template is essential for tracking and managing expenses. It helps churches to identify areas of inefficiency and make adjustments to optimize their financial performance. The template should include columns for date, description, amount, and category, as well as rows for different types of expenses, such as salaries, utilities, and maintenance. Here is an example of a church expense report template:

- Date: 2022-01-01

- Description: Salary payment

- Amount: $8,000

- Category: Salaries

- Date: 2022-01-05

- Description: Utility payment

- Amount: $1,500

- Category: Utilities

Template 3: Church Income Statement Template

A church income statement template is a critical tool for churches to track their income and expenses over a specific period. It helps churches to identify trends and patterns in their financial data, enabling them to make informed decisions about budgeting, forecasting, and planning. The template should include columns for income, expenses, and net income, as well as rows for different categories of income and expenses, such as tithes, offerings, and salaries. Here is an example of a church income statement template:

- Income:

- Tithes: $10,000

- Offerings: $5,000

- Donations: $2,000

- Expenses:

- Salaries: $8,000

- Utilities: $1,500

- Maintenance: $1,000

- Net Income: $2,000

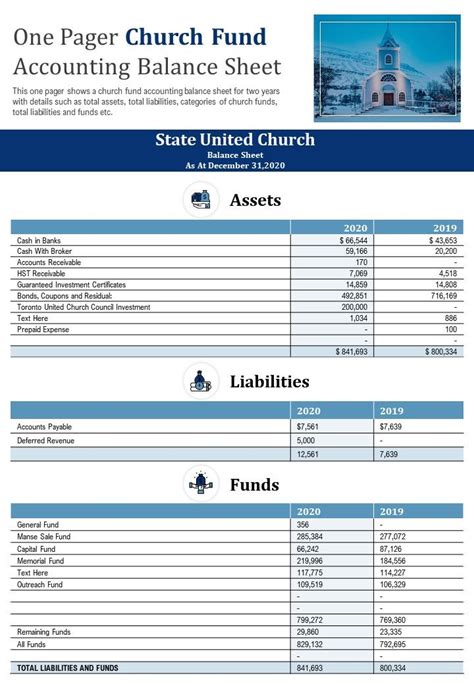

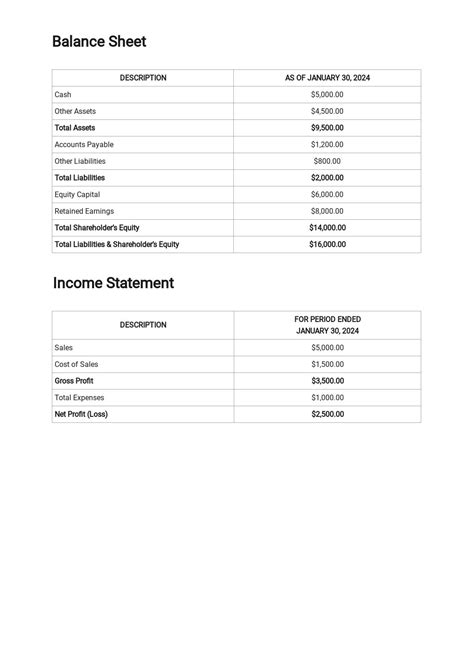

Template 4: Church Balance Sheet Template

A church balance sheet template is essential for tracking and managing assets, liabilities, and equity. It helps churches to identify their financial position at a specific point in time, enabling them to make informed decisions about financial matters. The template should include columns for assets, liabilities, and equity, as well as rows for different categories of assets, liabilities, and equity, such as cash, accounts payable, and net assets. Here is an example of a church balance sheet template:

- Assets:

- Cash: $10,000

- Accounts receivable: $5,000

- Property: $20,000

- Liabilities:

- Accounts payable: $2,000

- Loans payable: $10,000

- Equity:

- Net assets: $20,000

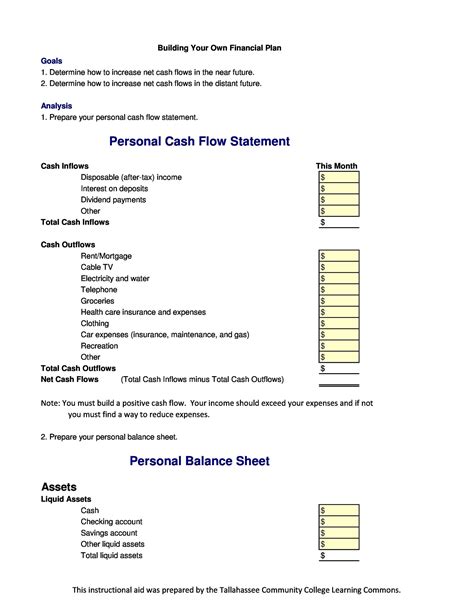

Template 5: Church Cash Flow Statement Template

A church cash flow statement template is critical for tracking and managing cash inflows and outflows. It helps churches to identify their cash position at a specific point in time, enabling them to make informed decisions about financial matters. The template should include columns for cash inflows, cash outflows, and net cash flow, as well as rows for different categories of cash inflows and outflows, such as cash received from tithes, offerings, and donations, and cash paid for salaries, utilities, and maintenance. Here is an example of a church cash flow statement template:

- Cash Inflows:

- Cash received from tithes: $10,000

- Cash received from offerings: $5,000

- Cash received from donations: $2,000

- Cash Outflows:

- Cash paid for salaries: $8,000

- Cash paid for utilities: $1,500

- Cash paid for maintenance: $1,000

- Net Cash Flow: $2,000

Gallery of Church Accounting Templates

Church Accounting Templates Image Gallery

What is church accounting?

+Church accounting refers to the process of managing and tracking the financial resources of a church, including income, expenses, assets, and liabilities.

Why is church accounting important?

+Church accounting is important because it helps churches to manage their financial resources effectively, provides transparency and accountability, and enables them to comply with regulatory requirements.

What are the benefits of using church accounting templates?

+The benefits of using church accounting templates include streamlining accounting processes, reducing errors, and improving financial transparency.

How can I create a church budget template?

+To create a church budget template, you can start by identifying the different categories of income and expenses, and then create columns and rows to track and manage these categories.

What is the difference between a church income statement and a church balance sheet?

+A church income statement shows the income and expenses of a church over a specific period, while a church balance sheet shows the assets, liabilities, and equity of a church at a specific point in time.

In conclusion, church accounting is a critical aspect of managing the financial resources of a church. By using church accounting templates, churches can streamline their accounting processes, reduce errors, and improve financial transparency. The five church accounting templates provided in this article, including a budget template, expense report template, income statement template, balance sheet template, and cash flow statement template, can help churches to manage their finances effectively. We encourage readers to share this article with others, and to provide feedback and suggestions on how to improve church accounting practices. Additionally, we invite readers to explore other resources and templates that can help them to manage their church's finances effectively.