Intro

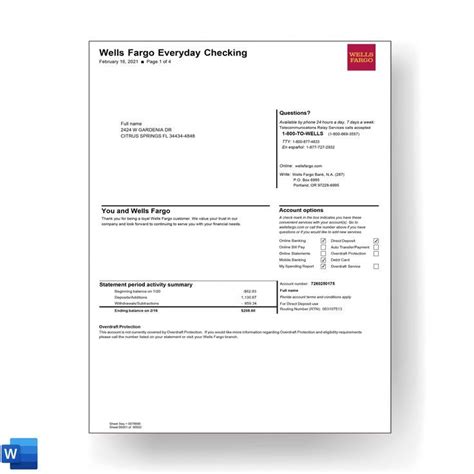

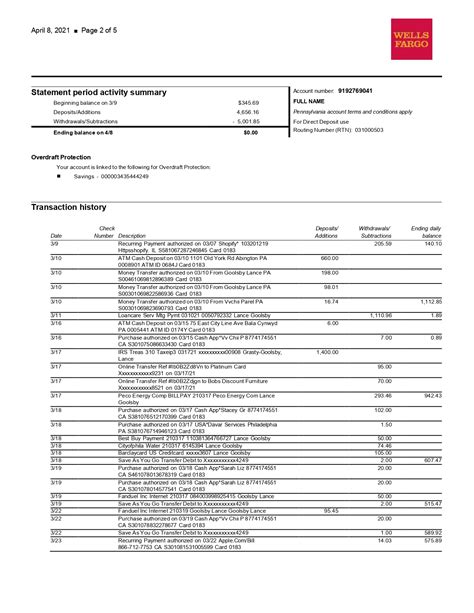

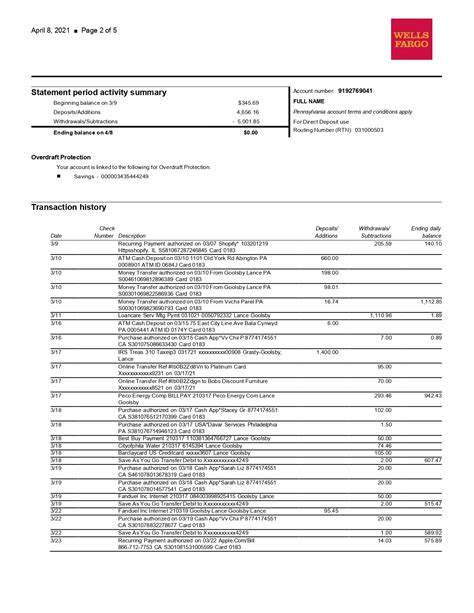

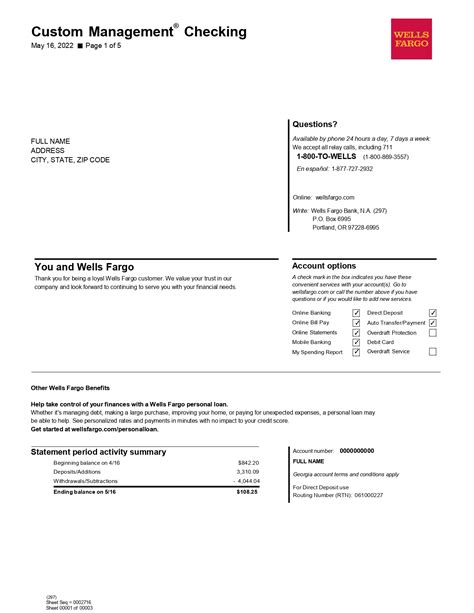

Create realistic bank documents with a Wells Fargo editable bank statement template, featuring customizable account details, transaction history, and balance updates for personal or business use, including PDF editing and printing capabilities.

The importance of having a reliable and editable bank statement template cannot be overstated, especially for individuals and businesses that need to manage their financial transactions efficiently. A Wells Fargo editable bank statement template is a valuable tool that can help users organize their financial data, track their expenses, and make informed decisions about their money. In this article, we will delve into the world of editable bank statement templates, exploring their benefits, features, and uses, with a focus on the Wells Fargo template.

Having a customizable bank statement template can be a game-changer for individuals and businesses alike. It allows users to easily edit and modify their bank statements to suit their specific needs, whether it's for personal or professional purposes. With an editable template, users can add or remove columns, rows, and sections as needed, making it easier to track their financial transactions and stay on top of their finances. Moreover, an editable template can help users identify areas where they can cut back on expenses, make adjustments to their budget, and optimize their financial performance.

The Wells Fargo editable bank statement template is a popular choice among individuals and businesses due to its user-friendly interface, flexibility, and customization options. This template allows users to easily edit and modify their bank statements, adding or removing sections as needed, and customizing the layout to suit their specific requirements. With this template, users can track their account balances, transaction history, and payment schedules, making it easier to manage their finances and stay on top of their accounts. Whether you're a personal user or a business owner, the Wells Fargo editable bank statement template is an essential tool that can help you streamline your financial management and make informed decisions about your money.

Benefits of Using a Wells Fargo Editable Bank Statement Template

Using a Wells Fargo editable bank statement template offers numerous benefits, including increased efficiency, improved accuracy, and enhanced customization. With this template, users can easily edit and modify their bank statements, adding or removing sections as needed, and customizing the layout to suit their specific requirements. This can help users save time and reduce errors, as they can quickly and easily update their bank statements to reflect changes in their financial transactions. Additionally, the template allows users to track their account balances, transaction history, and payment schedules, making it easier to manage their finances and stay on top of their accounts.

Some of the key benefits of using a Wells Fargo editable bank statement template include:

- Increased efficiency: The template allows users to quickly and easily edit and modify their bank statements, saving time and reducing errors.

- Improved accuracy: The template helps users ensure that their bank statements are accurate and up-to-date, reducing the risk of errors or discrepancies.

- Enhanced customization: The template allows users to customize the layout and content of their bank statements, making it easier to track their financial transactions and stay on top of their accounts.

- Better financial management: The template helps users manage their finances more effectively, by providing a clear and concise overview of their account balances, transaction history, and payment schedules.

Features of a Wells Fargo Editable Bank Statement Template

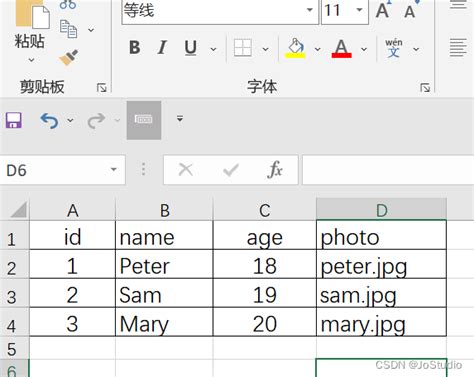

A Wells Fargo editable bank statement template typically includes a range of features that make it easy to use and customize. Some of the key features of this template include:

- Customizable layout: The template allows users to customize the layout and content of their bank statements, making it easier to track their financial transactions and stay on top of their accounts.

- Editable fields: The template includes editable fields that allow users to add or remove columns, rows, and sections as needed, making it easy to update their bank statements to reflect changes in their financial transactions.

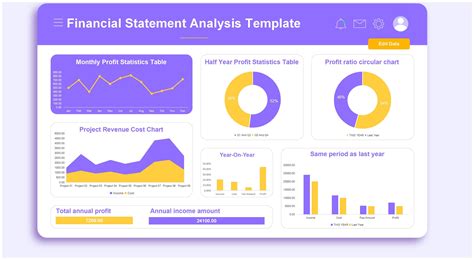

- Automatic calculations: The template includes automatic calculations that help users ensure that their bank statements are accurate and up-to-date, reducing the risk of errors or discrepancies.

- Data sorting and filtering: The template allows users to sort and filter their data, making it easier to track their financial transactions and identify trends or patterns.

Uses of a Wells Fargo Editable Bank Statement Template

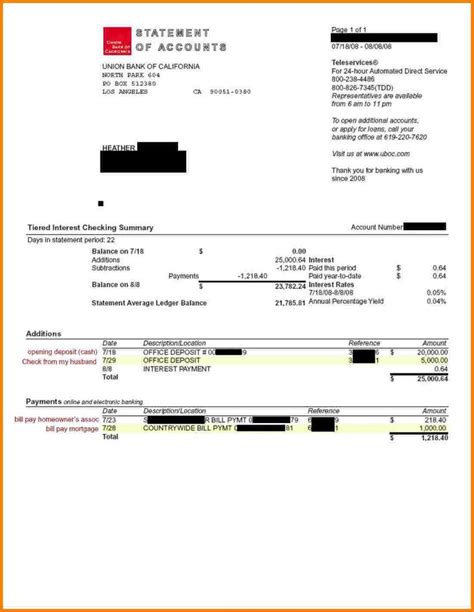

A Wells Fargo editable bank statement template can be used in a variety of ways, including:

- Personal finance management: The template can be used to track personal account balances, transaction history, and payment schedules, making it easier to manage personal finances and stay on top of accounts.

- Business finance management: The template can be used to track business account balances, transaction history, and payment schedules, making it easier to manage business finances and stay on top of accounts.

- Budgeting and forecasting: The template can be used to create budgets and forecasts, making it easier to plan and manage financial resources.

- Financial reporting: The template can be used to generate financial reports, making it easier to track financial performance and identify areas for improvement.

How to Create a Wells Fargo Editable Bank Statement Template

Creating a Wells Fargo editable bank statement template is a relatively straightforward process that can be completed in a few steps. Here's a step-by-step guide to creating a Wells Fargo editable bank statement template:

- Determine the template requirements: The first step is to determine the template requirements, including the type of account, the frequency of statements, and the level of detail required.

- Choose a template format: The next step is to choose a template format, such as Excel or Word, and select a template that meets the requirements.

- Customize the template: Once the template has been selected, it can be customized to meet the specific requirements, including adding or removing columns, rows, and sections.

- Add automatic calculations: The template can be enhanced with automatic calculations, such as formulas and macros, to help ensure that the bank statements are accurate and up-to-date.

- Test and refine the template: The final step is to test and refine the template, making sure that it meets the requirements and is easy to use.

Best Practices for Using a Wells Fargo Editable Bank Statement Template

Using a Wells Fargo editable bank statement template requires some best practices to ensure that it is used effectively and efficiently. Here are some best practices to keep in mind:

- Regularly update the template: The template should be regularly updated to reflect changes in financial transactions and account balances.

- Use automatic calculations: The template should be enhanced with automatic calculations, such as formulas and macros, to help ensure that the bank statements are accurate and up-to-date.

- Keep the template organized: The template should be kept organized, with clear and concise headings and sections, making it easier to track financial transactions and stay on top of accounts.

- Use data sorting and filtering: The template should be used with data sorting and filtering, making it easier to track financial transactions and identify trends or patterns.

Common Mistakes to Avoid When Using a Wells Fargo Editable Bank Statement Template

Using a Wells Fargo editable bank statement template requires some caution to avoid common mistakes that can lead to errors or inaccuracies. Here are some common mistakes to avoid:

- Not regularly updating the template: Failing to regularly update the template can lead to errors or inaccuracies in the bank statements.

- Not using automatic calculations: Not using automatic calculations, such as formulas and macros, can lead to errors or inaccuracies in the bank statements.

- Not keeping the template organized: Not keeping the template organized, with clear and concise headings and sections, can make it difficult to track financial transactions and stay on top of accounts.

- Not using data sorting and filtering: Not using data sorting and filtering can make it difficult to track financial transactions and identify trends or patterns.

Gallery of Wells Fargo Editable Bank Statement Templates

Wells Fargo Editable Bank Statement Templates Image Gallery

What is a Wells Fargo editable bank statement template?

+A Wells Fargo editable bank statement template is a customizable template that allows users to edit and modify their bank statements to suit their specific needs.

What are the benefits of using a Wells Fargo editable bank statement template?

+The benefits of using a Wells Fargo editable bank statement template include increased efficiency, improved accuracy, and enhanced customization.

How do I create a Wells Fargo editable bank statement template?

+To create a Wells Fargo editable bank statement template, determine the template requirements, choose a template format, customize the template, add automatic calculations, and test and refine the template.

In conclusion, a Wells Fargo editable bank statement template is a valuable tool that can help individuals and businesses manage their financial transactions more efficiently. By understanding the benefits, features, and uses of this template, users can create a customized template that meets their specific needs and helps them achieve their financial goals. Whether you're a personal user or a business owner, a Wells Fargo editable bank statement template is an essential tool that can help you streamline your financial management and make informed decisions about your money. We invite you to share your thoughts and experiences with using a Wells Fargo editable bank statement template, and to ask any questions you may have about this topic. By working together, we can help each other achieve financial success and stability.