Intro

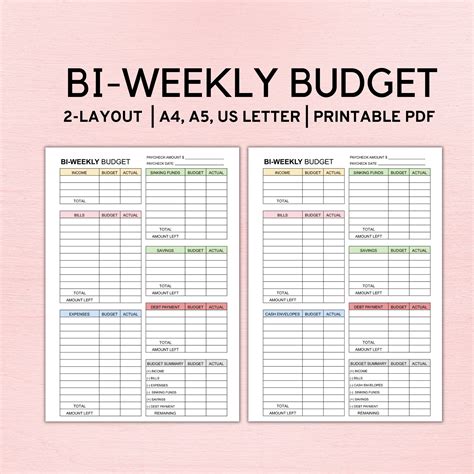

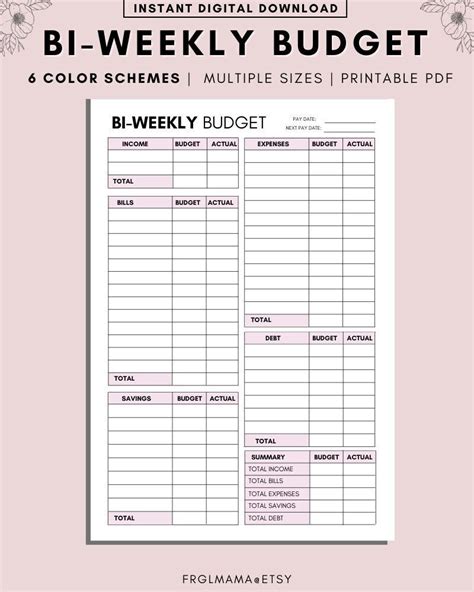

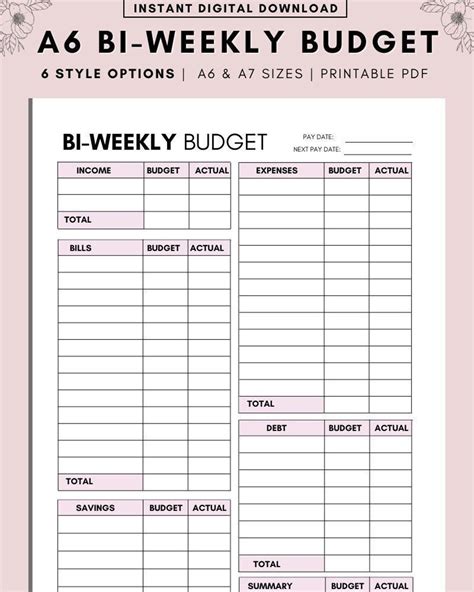

Manage finances with a free biweekly budget template, featuring expense tracking, income planning, and savings goals, to achieve financial stability and control.

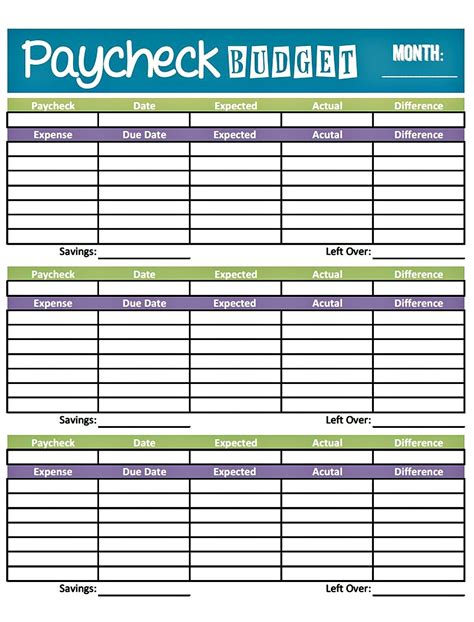

Creating a budget is an essential step in managing personal finances effectively. It helps individuals track their income and expenses, make informed financial decisions, and achieve long-term financial goals. One of the most effective ways to manage finances is by using a biweekly budget template. This template allows individuals to plan their expenses based on their biweekly paychecks, ensuring that they stay on top of their financial obligations.

A biweekly budget template is particularly useful for individuals who receive their paychecks every other week. It helps them allocate their income into different categories, such as savings, rent, utilities, and entertainment, and make adjustments as needed. By using a biweekly budget template, individuals can avoid overspending, reduce debt, and build wealth over time.

Importance of Budgeting

Budgeting is essential for achieving financial stability and security. It helps individuals prioritize their spending, make smart financial decisions, and avoid debt. By creating a budget, individuals can identify areas where they can cut back on unnecessary expenses and allocate that money towards more important goals, such as saving for retirement or paying off debt.

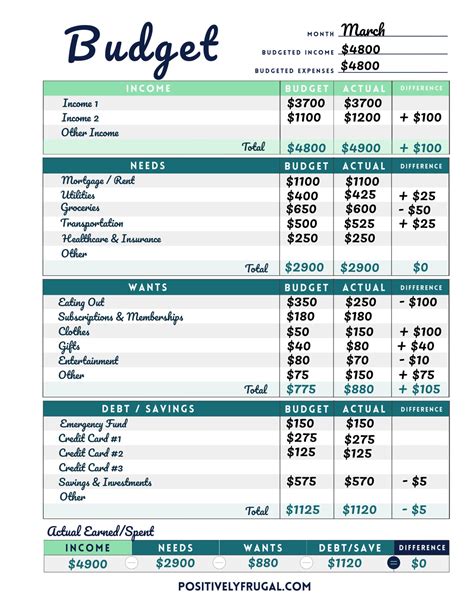

A biweekly budget template can be customized to fit individual needs and financial goals. It typically includes categories for income, fixed expenses, variable expenses, and savings. By tracking income and expenses on a biweekly basis, individuals can make adjustments as needed to stay on track with their financial goals.

Benefits of Using a Biweekly Budget Template

Using a biweekly budget template offers several benefits, including:

- Improved financial management: A biweekly budget template helps individuals track their income and expenses, making it easier to manage their finances effectively.

- Increased savings: By allocating a portion of their income towards savings, individuals can build wealth over time and achieve long-term financial goals.

- Reduced debt: A biweekly budget template helps individuals prioritize their expenses and make smart financial decisions, reducing the likelihood of debt.

- Enhanced financial discipline: By tracking income and expenses on a biweekly basis, individuals can develop financial discipline and make adjustments as needed to stay on track with their financial goals.

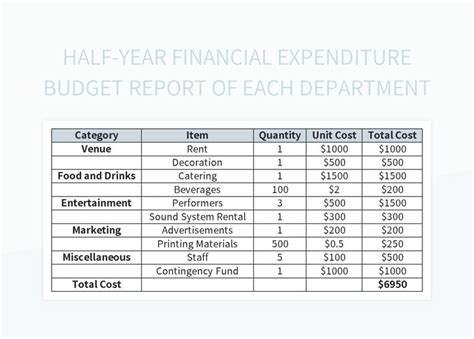

Key Components of a Biweekly Budget Template

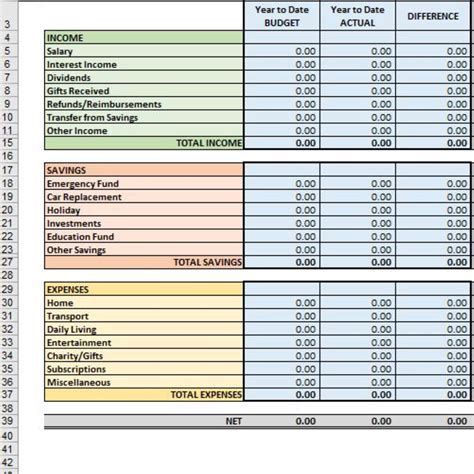

A biweekly budget template typically includes the following components:- Income: This section includes all sources of income, such as salary, investments, and freelance work.

- Fixed expenses: This section includes expenses that remain the same each month, such as rent, utilities, and car payments.

- Variable expenses: This section includes expenses that vary from month to month, such as groceries, entertainment, and travel.

- Savings: This section includes allocations for short-term and long-term savings goals, such as emergency funds, retirement savings, and down payments on a house.

How to Create a Biweekly Budget Template

Creating a biweekly budget template is a straightforward process that involves the following steps:

- Identify income and expenses: Start by tracking income and expenses over a period of one month to get an accurate picture of financial inflows and outflows.

- Categorize expenses: Divide expenses into fixed, variable, and savings categories.

- Allocate income: Allocate income towards each category, ensuring that essential expenses are covered first.

- Review and adjust: Review the budget regularly and make adjustments as needed to stay on track with financial goals.

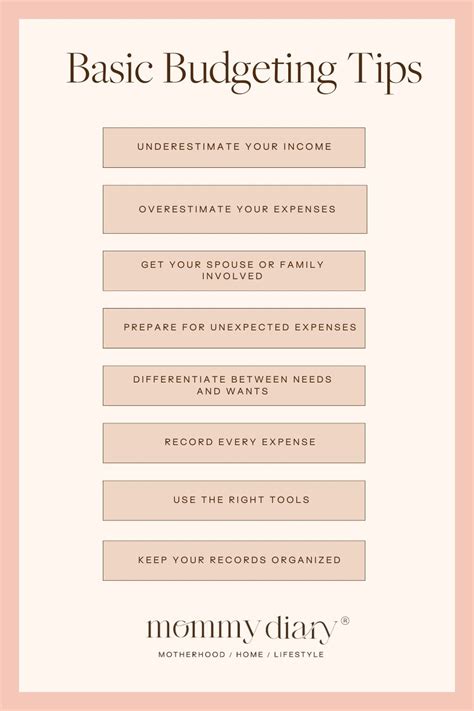

Tips for Using a Biweekly Budget Template Effectively

To get the most out of a biweekly budget template, individuals should:- Track income and expenses regularly: Regular tracking helps individuals stay on top of their finances and make adjustments as needed.

- Prioritize needs over wants: Essential expenses, such as rent and utilities, should be prioritized over discretionary expenses, such as entertainment and travel.

- Review and adjust regularly: Regular review and adjustment help individuals stay on track with their financial goals and make changes as needed.

Common Mistakes to Avoid When Using a Biweekly Budget Template

When using a biweekly budget template, individuals should avoid the following common mistakes:

- Failing to track income and expenses: Regular tracking is essential for staying on top of finances and making adjustments as needed.

- Not prioritizing needs over wants: Essential expenses should be prioritized over discretionary expenses to ensure financial stability.

- Not reviewing and adjusting regularly: Regular review and adjustment help individuals stay on track with their financial goals and make changes as needed.

Best Practices for Implementing a Biweekly Budget Template

To implement a biweekly budget template effectively, individuals should:- Start small: Begin with a simple budget template and gradually add complexity as needed.

- Be consistent: Regular tracking and review are essential for staying on top of finances and making adjustments as needed.

- Seek support: Share financial goals and progress with a trusted friend or family member to increase accountability and motivation.

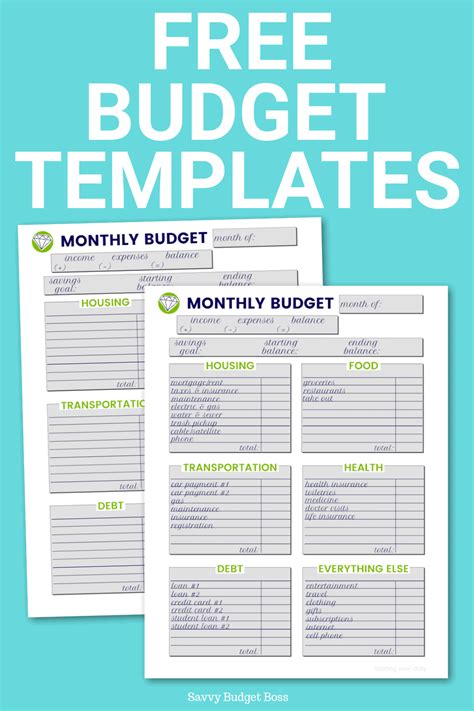

Free Biweekly Budget Template Resources

There are many free biweekly budget template resources available online, including:

- Microsoft Excel templates: Microsoft offers a range of free budget templates that can be customized to fit individual needs.

- Google Sheets templates: Google Sheets offers a range of free budget templates that can be accessed and edited online.

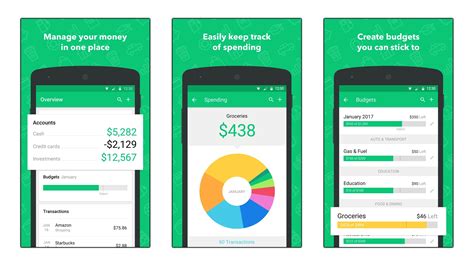

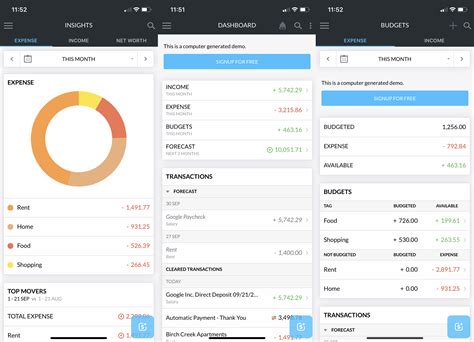

- Budgeting apps: Apps like Mint and You Need a Budget (YNAB) offer free budgeting tools and templates that can be accessed on desktop and mobile devices.

Conclusion and Next Steps

In conclusion, a biweekly budget template is a powerful tool for managing personal finances effectively. By tracking income and expenses on a biweekly basis, individuals can make informed financial decisions, reduce debt, and build wealth over time. To get started with a biweekly budget template, individuals can download free resources online or create their own template using a spreadsheet or budgeting app.Biweekly Budget Template Image Gallery

What is a biweekly budget template?

+A biweekly budget template is a tool used to manage personal finances by tracking income and expenses on a biweekly basis.

How do I create a biweekly budget template?

+To create a biweekly budget template, start by tracking income and expenses over a period of one month, then categorize expenses and allocate income towards each category.

What are the benefits of using a biweekly budget template?

+The benefits of using a biweekly budget template include improved financial management, increased savings, reduced debt, and enhanced financial discipline.

Where can I find free biweekly budget template resources?

+Free biweekly budget template resources can be found online, including Microsoft Excel templates, Google Sheets templates, and budgeting apps like Mint and YNAB.

How often should I review and adjust my biweekly budget template?

+It's recommended to review and adjust your biweekly budget template regularly, ideally every few months, to ensure you're on track with your financial goals and make changes as needed.

We hope this article has provided you with a comprehensive understanding of biweekly budget templates and how to use them effectively. If you have any further questions or would like to share your experiences with biweekly budgeting, please don't hesitate to comment below. Additionally, feel free to share this article with friends and family who may benefit from learning about biweekly budget templates. By taking control of your finances and using a biweekly budget template, you can achieve financial stability and security, and make progress towards your long-term financial goals.