Intro

Track income and expenses with Blank Self Employment Ledger Sheets Printable, ideal for freelancers and small businesses, featuring customizable templates for tax deductions, expense tracking, and financial record-keeping.

As a self-employed individual, keeping track of income and expenses is crucial for tax purposes and financial management. One essential tool for achieving this is a self-employment ledger sheet. These sheets provide a structured format for recording transactions, making it easier to calculate net earnings and stay organized throughout the year. In this article, we will delve into the importance of using blank self-employment ledger sheets, their benefits, and how to effectively utilize them for your business.

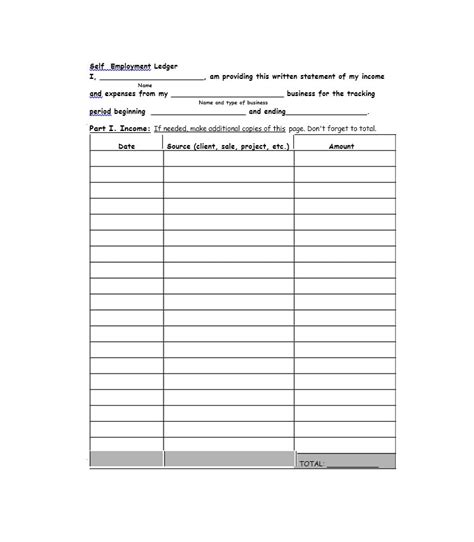

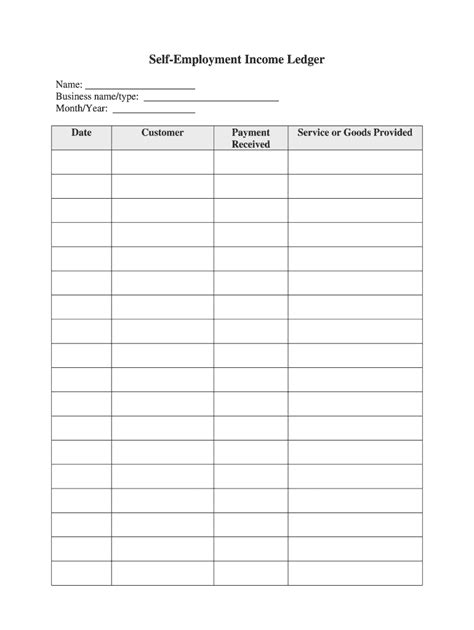

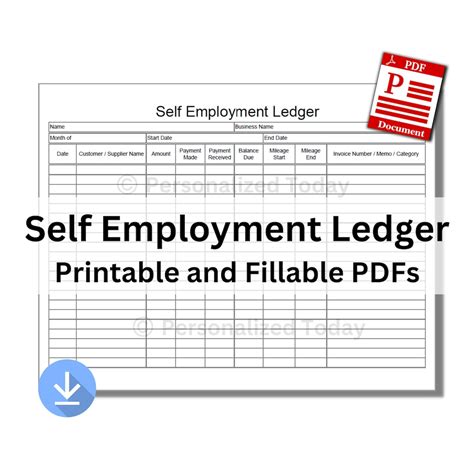

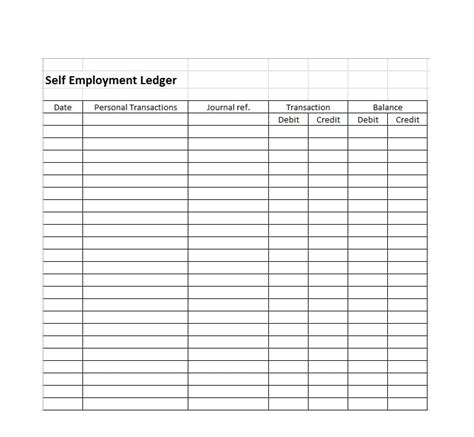

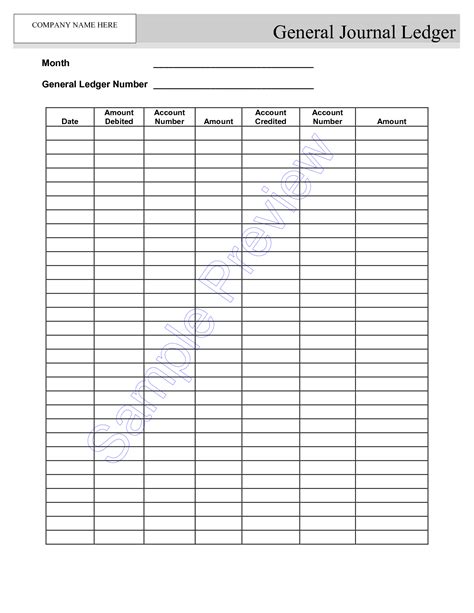

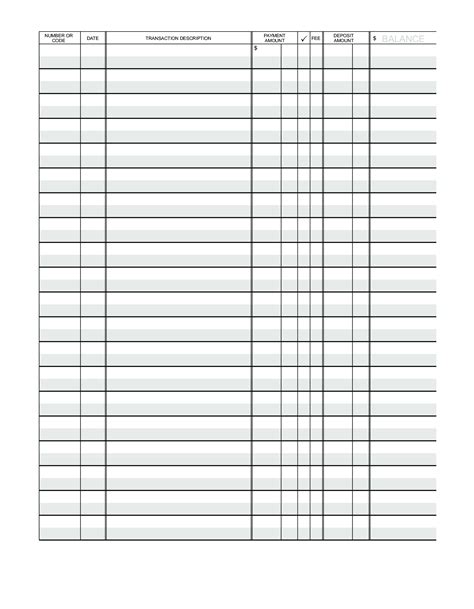

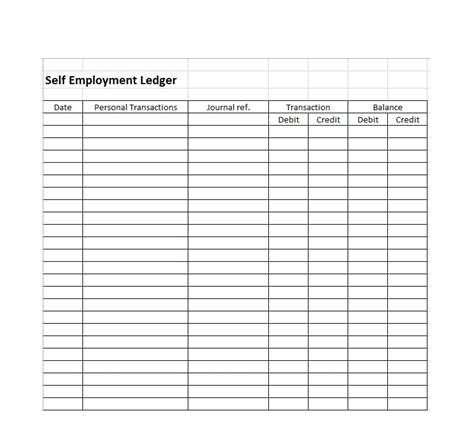

Self-employment ledger sheets are designed to help freelancers, independent contractors, and small business owners manage their finances efficiently. These sheets typically include columns for date, description, income, and expenses, allowing users to log their transactions in a clear and systematic manner. By using these sheets, self-employed individuals can ensure accuracy in their financial records, which is vital for filing taxes and making informed business decisions.

The benefits of using self-employment ledger sheets are numerous. For one, they provide a centralized location for all financial transactions, making it easier to track income and expenses over time. This information can be used to identify trends, create budgets, and forecast future financial performance. Additionally, having a comprehensive record of transactions can help self-employed individuals prepare for audits and ensure compliance with tax regulations.

Another significant advantage of self-employment ledger sheets is their ability to help users categorize expenses. By separating business expenses into different categories, such as supplies, travel, and equipment, self-employed individuals can better understand where their money is being spent and make adjustments as needed. This level of detail also facilitates the process of claiming deductions on tax returns, which can result in significant savings.

Benefits of Using Blank Self Employment Ledger Sheets

Customization and Flexibility

One of the primary advantages of blank self-employment ledger sheets is their customizability. Unlike pre-formatted sheets, which may not cater to the unique needs of every business, blank sheets can be tailored to include the specific categories and columns required by the user. This flexibility ensures that self-employed individuals can create a system that accurately reflects their financial situation and meets their record-keeping needs.How to Use Blank Self Employment Ledger Sheets

Here are the steps to follow:

- Set up the ledger sheet with the necessary columns, such as date, description, income, and expenses.

- Log each transaction in the corresponding column, ensuring that all income and expenses are accounted for.

- Regularly review and update the ledger sheet to ensure accuracy and completeness.

- Use the information in the ledger sheet to create financial statements, such as balance sheets and income statements.

Best Practices for Maintaining Accurate Records

To get the most out of blank self-employment ledger sheets, it's essential to maintain accurate and up-to-date records. Here are some best practices to follow: * Log transactions regularly, ideally on a daily or weekly basis. * Ensure that all income and expenses are accounted for, including small transactions like coffee or transportation costs. * Use a consistent format for logging transactions, making it easier to review and analyze the data. * Review and reconcile the ledger sheet regularly to catch any errors or discrepancies.Types of Blank Self Employment Ledger Sheets

Choosing the Right Type of Ledger Sheet

When selecting a blank self-employment ledger sheet, it's essential to consider the specific needs of your business. Here are some factors to consider: * The complexity of your financial situation: If you have a simple business structure, a basic ledger sheet may suffice. However, if you have multiple income streams or complex expenses, a more detailed sheet may be necessary. * Your level of accounting knowledge: If you're familiar with accounting principles, you may prefer a more advanced ledger sheet. However, if you're new to accounting, a simpler sheet may be more suitable. * Your personal preferences: Consider whether you prefer a digital or physical ledger sheet, and whether you need any additional features, such as budgeting tools or financial forecasting.Common Mistakes to Avoid When Using Blank Self Employment Ledger Sheets

Tips for Avoiding Common Mistakes

To avoid common mistakes when using blank self-employment ledger sheets, follow these tips: * Set a regular schedule for logging transactions, such as daily or weekly. * Use a consistent format for logging transactions, making it easier to review and analyze the data. * Regularly review and reconcile the ledger sheet to catch any errors or discrepancies. * Consider using accounting software or consulting with an accountant to ensure accuracy and compliance with tax regulations.Conclusion and Next Steps

To take your financial management to the next level, consider the following next steps:

- Download and print blank self-employment ledger sheets, or create your own template using a spreadsheet program.

- Set up a regular schedule for logging transactions and reviewing the ledger sheet.

- Consult with an accountant or use accounting software to ensure accuracy and compliance with tax regulations.

Blank Self Employment Ledger Sheets Image Gallery

What is a self-employment ledger sheet?

+A self-employment ledger sheet is a tool used to track income and expenses for self-employed individuals. It provides a structured format for logging transactions, making it easier to manage finances and prepare for tax season.

Why do I need a self-employment ledger sheet?

+You need a self-employment ledger sheet to accurately track your income and expenses, categorize your transactions, and prepare for tax season. It helps you stay organized, ensures compliance with tax regulations, and provides valuable insights into your business's financial performance.

How do I use a self-employment ledger sheet?

+To use a self-employment ledger sheet, simply log each transaction in the corresponding column, including the date, description, income, and expenses. Regularly review and update the sheet to ensure accuracy and completeness.

Can I customize my self-employment ledger sheet?

+Yes, you can customize your self-employment ledger sheet to meet your specific needs. You can add or remove columns, create custom categories, and tailor the sheet to your business's unique requirements.

Where can I find blank self-employment ledger sheets?

+You can find blank self-employment ledger sheets online, or create your own template using a spreadsheet program. Many websites offer free downloadable templates, or you can purchase accounting software that includes ledger sheet templates.

We hope this article has provided you with valuable insights into the importance of using blank self-employment ledger sheets. By implementing these tools into your financial management system, you can streamline your record-keeping, improve your business's financial performance, and ensure compliance with tax regulations. If you have any further questions or would like to share your experiences with using self-employment ledger sheets, please don't hesitate to comment below. Additionally, feel free to share this article with others who may benefit from this information, and subscribe to our newsletter for more tips and resources on managing your finances as a self-employed individual.