Intro

Boost savings with 5 Money Savings Challenges, featuring budgeting tips, expense tracking, and financial discipline strategies to achieve frugal living and long-term wealth management goals.

Saving money can be a daunting task, especially when you're trying to make ends meet. However, with the right mindset and strategies, you can develop healthy financial habits that will help you achieve your long-term goals. One effective way to start saving is by taking on money savings challenges. These challenges are designed to help you save money, reduce expenses, and develop a more mindful approach to spending. In this article, we'll explore five money savings challenges that you can try to boost your savings and improve your financial well-being.

The importance of saving money cannot be overstated. Having a safety net in place can help you navigate unexpected expenses, avoid debt, and achieve financial stability. Moreover, saving money can also give you the freedom to pursue your passions and goals, whether that's traveling, starting a business, or buying a home. By taking on money savings challenges, you can develop the discipline and habits necessary to achieve financial success. Whether you're a seasoned saver or just starting out, these challenges are designed to be fun, engaging, and effective.

Money savings challenges come in all shapes and sizes, from simple techniques like cutting back on expenses to more complex strategies like investing in stocks or real estate. The key is to find a challenge that resonates with you and your financial goals. By committing to a money savings challenge, you can hold yourself accountable, track your progress, and celebrate your successes. So, if you're ready to take control of your finances and start building wealth, keep reading to learn more about the five money savings challenges that can help you achieve your goals.

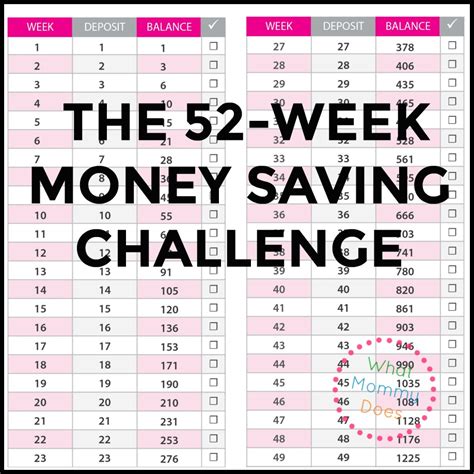

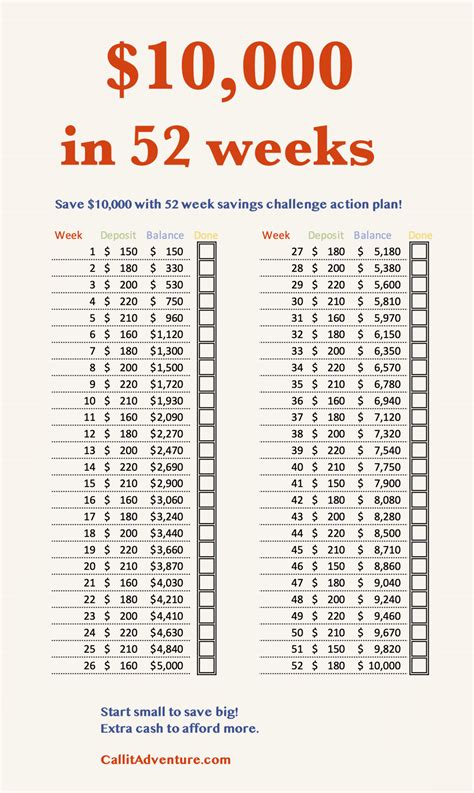

Understanding the 52-Week Savings Challenge

Taking on the No-Spend Challenge

Trying the Envelope System Challenge

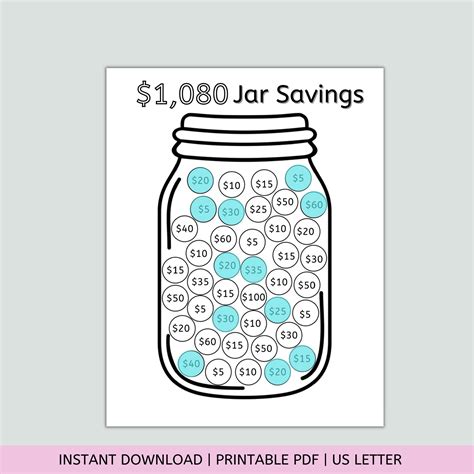

Embracing the Savings Jar Challenge

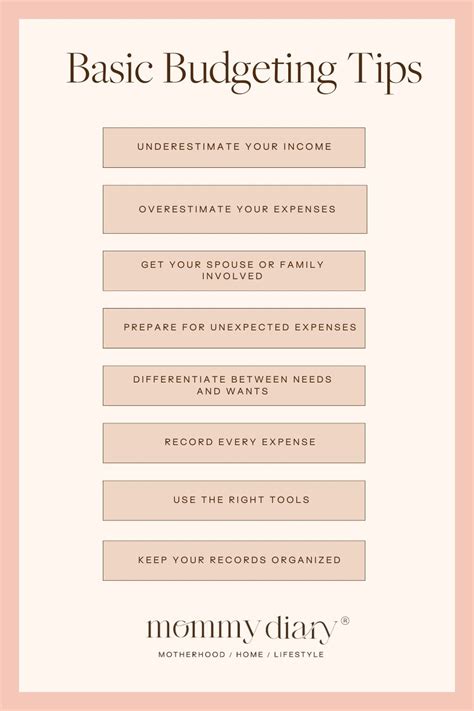

Exploring the Budgeting Challenge

Benefits of Money Savings Challenges

Money savings challenges offer numerous benefits, from developing healthy financial habits to achieving long-term goals. Some of the key benefits include: * Improved financial discipline and responsibility * Increased savings and emergency fund * Reduced debt and expenses * Enhanced financial awareness and literacy * Boosted confidence and motivation * Greater sense of control and securityTips for Success

To get the most out of money savings challenges, it's essential to approach them with the right mindset and strategies. Here are some tips for success: * Start small and be consistent * Set clear and achievable goals * Track your progress and celebrate milestones * Be patient and persistent * Stay accountable and motivated * Review and adjust your approach as neededMoney Savings Challenges Image Gallery

What is the best money savings challenge for beginners?

+The 52-week savings challenge is a great starting point for beginners. It's simple, easy to follow, and allows you to start small and gradually increase your savings over time.

How can I stay motivated during a money savings challenge?

+Staying motivated during a money savings challenge requires a combination of tracking your progress, celebrating milestones, and reminding yourself of your goals. You can also share your challenge with a friend or family member to increase accountability and support.

What are some common mistakes to avoid during a money savings challenge?

+Common mistakes to avoid during a money savings challenge include setting unrealistic goals, not tracking progress, and getting discouraged by setbacks. It's essential to be patient, persistent, and flexible when working towards your financial goals.

In