Intro

Streamline mail deposit processes with ease, using secure and efficient aspiration methods, including automated check deposit and remote deposit capture, for a hassle-free banking experience.

The concept of mail deposit aspiration has been around for decades, but it has gained significant traction in recent years due to the rise of digital banking and online financial services. As more people turn to online banking and mobile banking apps, the need for convenient and secure deposit methods has become increasingly important. Mail deposit aspiration is one such method that allows individuals to deposit checks and other funds into their accounts remotely, without having to physically visit a bank branch. In this article, we will explore the importance of mail deposit aspiration, its benefits, and how it works.

The traditional banking system has been slow to adapt to the changing needs of consumers, who are increasingly expecting faster, more convenient, and more secure banking services. Mail deposit aspiration is one way that banks and financial institutions are responding to these demands. By allowing customers to deposit funds remotely, banks can reduce the need for physical branch visits, which can be time-consuming and inconvenient for many people. Additionally, mail deposit aspiration can help to reduce the risk of fraud and identity theft, as customers do not have to physically handle cash or sensitive financial information.

The benefits of mail deposit aspiration are numerous. For one, it provides customers with greater flexibility and convenience, as they can deposit funds at any time and from any location. This is particularly useful for individuals who live in rural areas or have limited access to banking services. Mail deposit aspiration also reduces the need for physical branch visits, which can be time-consuming and inconvenient. Furthermore, it can help to reduce the risk of fraud and identity theft, as customers do not have to physically handle cash or sensitive financial information. Overall, mail deposit aspiration is a secure, convenient, and efficient way to deposit funds into a bank account.

How Mail Deposit Aspiration Works

Mail deposit aspiration works by allowing customers to deposit checks and other funds into their accounts remotely, using a mobile banking app or online banking platform. The process typically involves the following steps:

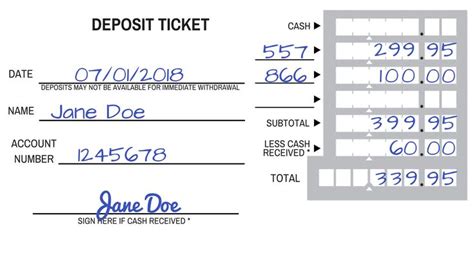

- Customers endorse the check and fill out a deposit slip, which includes their account information and the amount of the deposit.

- Customers then take a photo of the check and deposit slip using their mobile banking app, or scan the documents using a scanner.

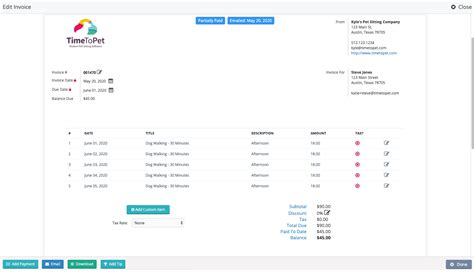

- The images are then uploaded to the bank's online platform, where they are verified and processed.

- Once the deposit has been processed, the funds are credited to the customer's account, and they can access the money immediately.

Benefits of Mail Deposit Aspiration

The benefits of mail deposit aspiration are numerous. Some of the key advantages include: * Convenience: Mail deposit aspiration allows customers to deposit funds remotely, without having to physically visit a bank branch. * Flexibility: Customers can deposit funds at any time and from any location, using a mobile banking app or online banking platform. * Security: Mail deposit aspiration reduces the risk of fraud and identity theft, as customers do not have to physically handle cash or sensitive financial information. * Efficiency: Mail deposit aspiration can help to reduce the time and effort required to deposit funds, as customers do not have to wait in line or fill out paperwork.Types of Mail Deposit Aspiration

There are several types of mail deposit aspiration, including:

- Mobile deposit: This involves using a mobile banking app to deposit checks and other funds into a bank account.

- Online deposit: This involves using an online banking platform to deposit checks and other funds into a bank account.

- Remote deposit: This involves using a scanner or other device to deposit checks and other funds into a bank account remotely.

Security Features of Mail Deposit Aspiration

Mail deposit aspiration includes several security features to protect customers' financial information and prevent fraud. Some of the key security features include: * Encryption: Mail deposit aspiration uses encryption to protect customers' financial information and prevent unauthorized access. * Authentication: Mail deposit aspiration requires customers to authenticate their identity before depositing funds, using a password, PIN, or other secure method. * Verification: Mail deposit aspiration verifies the deposit information and checks for any suspicious activity before processing the deposit.Best Practices for Mail Deposit Aspiration

To get the most out of mail deposit aspiration, customers should follow best practices, including:

- Using a secure internet connection and device to deposit funds.

- Keeping their account information and financial data up to date.

- Monitoring their account activity regularly to detect any suspicious activity.

- Using strong passwords and authentication methods to protect their account.

Common Mistakes to Avoid

When using mail deposit aspiration, customers should avoid common mistakes, including: * Using an unsecured internet connection or device to deposit funds. * Failing to endorse the check or fill out the deposit slip correctly. * Depositing funds into the wrong account or using incorrect account information. * Failing to monitor their account activity regularly to detect any suspicious activity.Mail Deposit Aspiration and Fraud Prevention

Mail deposit aspiration includes several features to prevent fraud and protect customers' financial information. Some of the key features include:

- Real-time monitoring: Mail deposit aspiration monitors account activity in real-time to detect any suspicious activity.

- Alert systems: Mail deposit aspiration sends alerts to customers when suspicious activity is detected, allowing them to take action quickly.

- Verification: Mail deposit aspiration verifies the deposit information and checks for any suspicious activity before processing the deposit.

Mail Deposit Aspiration and Customer Support

Mail deposit aspiration typically includes customer support to help customers with any issues or questions they may have. Some of the key features include: * Online support: Mail deposit aspiration provides online support, including FAQs and troubleshooting guides. * Phone support: Mail deposit aspiration provides phone support, allowing customers to speak with a representative directly. * Email support: Mail deposit aspiration provides email support, allowing customers to send questions or concerns to a representative.Gallery of Mail Deposit Aspiration

Mail Deposit Aspiration Image Gallery

Frequently Asked Questions

What is mail deposit aspiration?

+Mail deposit aspiration is a method of depositing checks and other funds into a bank account remotely, using a mobile banking app or online banking platform.

How does mail deposit aspiration work?

+Mail deposit aspiration works by allowing customers to deposit checks and other funds into their accounts remotely, using a mobile banking app or online banking platform. The process typically involves endorsing the check, filling out a deposit slip, and uploading the images to the bank's online platform.

What are the benefits of mail deposit aspiration?

+The benefits of mail deposit aspiration include convenience, flexibility, security, and efficiency. It allows customers to deposit funds remotely, without having to physically visit a bank branch, and reduces the risk of fraud and identity theft.

Is mail deposit aspiration secure?

+Yes, mail deposit aspiration is a secure method of depositing funds into a bank account. It uses encryption to protect customers' financial information and prevent unauthorized access, and includes features such as real-time monitoring and alert systems to detect and prevent fraud.

What are the best practices for using mail deposit aspiration?

+The best practices for using mail deposit aspiration include using a secure internet connection and device, keeping account information and financial data up to date, monitoring account activity regularly, and using strong passwords and authentication methods to protect the account.

In conclusion, mail deposit aspiration is a convenient, secure, and efficient way to deposit funds into a bank account remotely. It provides customers with greater flexibility and reduces the risk of fraud and identity theft. By following best practices and using the features included in mail deposit aspiration, customers can ensure a safe and successful deposit experience. We invite you to share your thoughts and experiences with mail deposit aspiration in the comments below, and to explore our other articles on banking and finance for more information on how to manage your finances effectively.