Intro

Maximize tax deductions with accurate mileage tracking using these 5 IRS mileage log tips, including record-keeping, vehicle expenses, and business use percentage calculations.

The importance of maintaining an accurate and detailed IRS mileage log cannot be overstated, especially for individuals who use their personal vehicles for business purposes. The Internal Revenue Service (IRS) allows taxpayers to deduct business-related mileage expenses on their tax returns, which can result in significant savings. However, to take advantage of this deduction, it is crucial to keep a meticulous record of all business-related trips. In this article, we will delve into the world of IRS mileage logs, exploring their significance, benefits, and providing valuable tips on how to maintain an accurate and compliant log.

For many individuals, particularly those who are self-employed or work as independent contractors, keeping an IRS mileage log is a necessary task. The IRS requires taxpayers to substantiate their business mileage expenses, and a well-maintained log is the best way to do so. By keeping a detailed record of all business-related trips, individuals can ensure that they are taking advantage of all eligible deductions, which can result in a lower tax liability. Furthermore, an accurate IRS mileage log can also help to reduce the risk of an audit, as it provides a clear and transparent record of all business-related expenses.

In addition to the financial benefits, maintaining an IRS mileage log can also help individuals to better manage their time and expenses. By tracking all business-related trips, individuals can identify areas where they can improve their efficiency and reduce their costs. For example, an individual may notice that they are spending a significant amount of time and money on commuting to client meetings, and as a result, they may decide to explore alternative transportation options or adjust their meeting schedule. Overall, keeping an IRS mileage log is an essential task for anyone who uses their personal vehicle for business purposes, and by following a few simple tips, individuals can ensure that their log is accurate, compliant, and effective.

Understanding IRS Mileage Log Requirements

Benefits of Using a Mileage Log App

Using a mileage log app can be a convenient and efficient way to track business-related mileage expenses. These apps can automatically track an individual's mileage, eliminating the need for manual recording. Additionally, many mileage log apps also provide features such as GPS tracking, automatic expense reporting, and integration with popular accounting software. Some popular mileage log apps include MileIQ, TripLog, and Hurdlr.5 IRS Mileage Log Tips

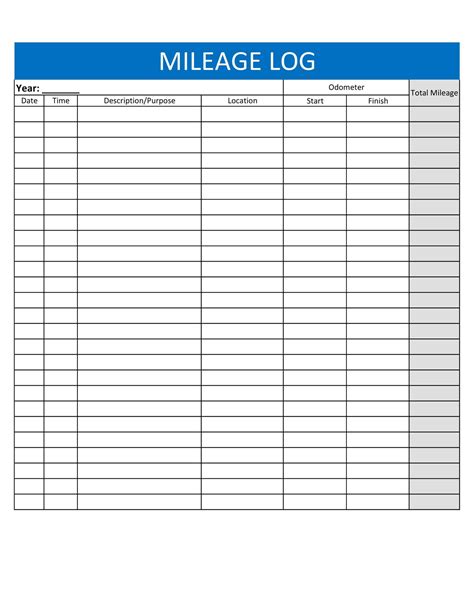

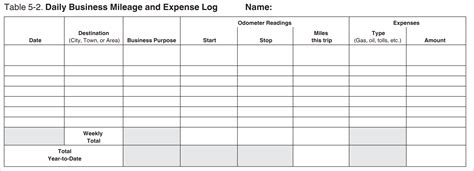

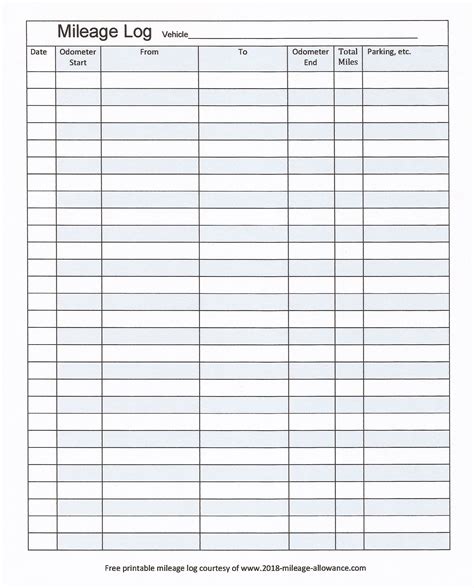

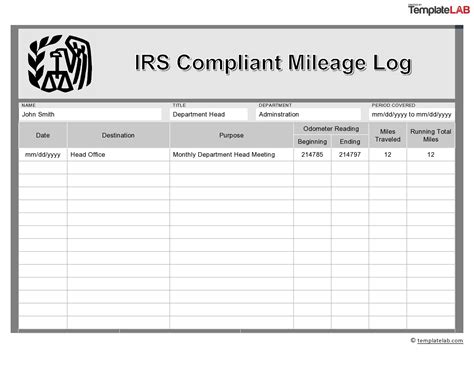

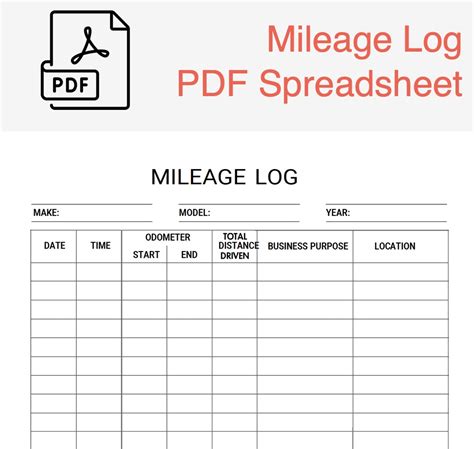

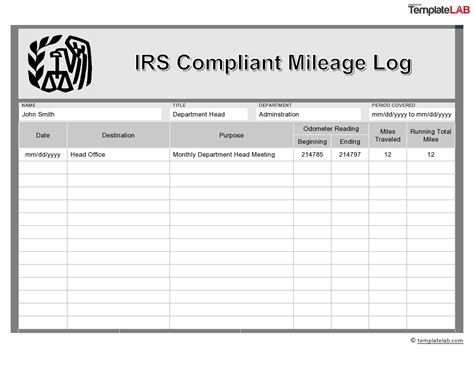

- Keep a consistent record: It is essential to keep a consistent record of all business-related trips, including the date, destination, and purpose of each trip. This information can be recorded in a variety of ways, including using a paper logbook, a mobile app, or a spreadsheet.

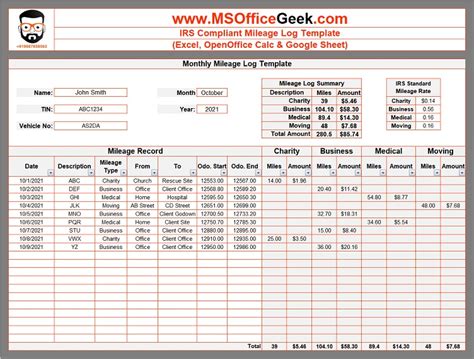

- Track all business-related mileage: In addition to tracking miles driven for business purposes, individuals should also track miles driven for personal purposes. This information is necessary to calculate the business use percentage of the vehicle.

- Use a mileage log app: Using a mileage log app can be a convenient and efficient way to track business-related mileage expenses. These apps can automatically track an individual's mileage, eliminating the need for manual recording.

- Keep receipts and records: In addition to keeping a mileage log, individuals should also keep receipts and records for all business-related expenses, including fuel, maintenance, and repairs.

- Review and update the log regularly: It is essential to review and update the mileage log regularly to ensure that it is accurate and complete. This can help to identify any errors or discrepancies and ensure that the log is compliant with IRS requirements.

Common Mistakes to Avoid

When maintaining an IRS mileage log, there are several common mistakes that individuals should avoid. These include:- Failing to keep a consistent record: It is essential to keep a consistent record of all business-related trips, including the date, destination, and purpose of each trip.

- Not tracking all business-related mileage: In addition to tracking miles driven for business purposes, individuals should also track miles driven for personal purposes.

- Not keeping receipts and records: In addition to keeping a mileage log, individuals should also keep receipts and records for all business-related expenses, including fuel, maintenance, and repairs.

- Not reviewing and updating the log regularly: It is essential to review and update the mileage log regularly to ensure that it is accurate and complete.

IRS Mileage Log Best Practices

- Use a dedicated logbook or app: It is essential to use a dedicated logbook or app to track business-related mileage expenses. This can help to keep the log organized and ensure that all necessary information is recorded.

- Keep the log in a safe place: It is essential to keep the mileage log in a safe place, such as a file cabinet or a secure online storage service. This can help to protect the log from damage or loss.

- Make regular backups: It is essential to make regular backups of the mileage log, either manually or automatically. This can help to ensure that the log is not lost in the event of a technical issue or other disaster.

- Review and update the log regularly: It is essential to review and update the mileage log regularly to ensure that it is accurate and complete.

IRS Mileage Log FAQs

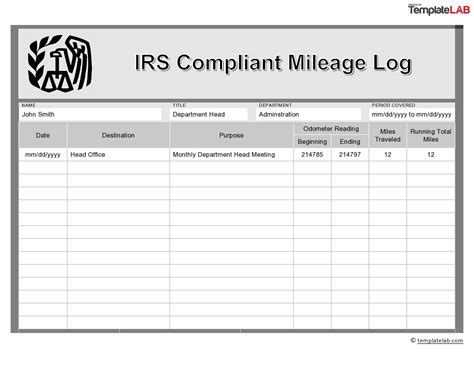

Here are some frequently asked questions about IRS mileage logs:- What is the IRS mileage log requirement?: The IRS requires taxpayers to keep a record of all business-related trips, including the date, destination, and purpose of each trip.

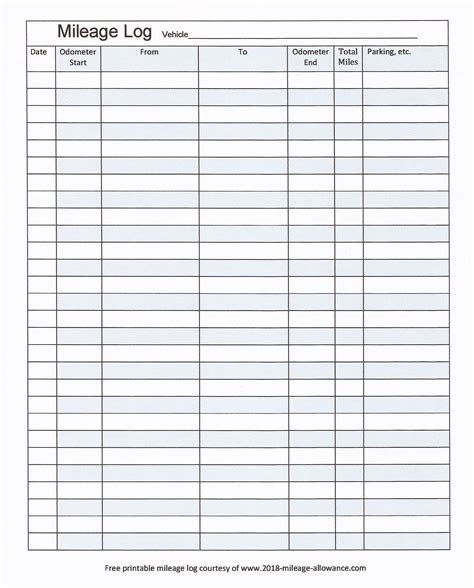

- How do I keep an IRS mileage log?: There are several ways to keep an IRS mileage log, including using a paper logbook, a mobile app, or a spreadsheet.

- What information should I include in my IRS mileage log?: The IRS mileage log should include the date, destination, and purpose of each trip, as well as the total miles driven for business purposes and the total miles driven for personal purposes.

Gallery of IRS Mileage Log Images

IRS Mileage Log FAQs

What is the purpose of an IRS mileage log?

+The purpose of an IRS mileage log is to track business-related mileage expenses and provide a record of these expenses for tax purposes.

How do I keep an IRS mileage log?

+There are several ways to keep an IRS mileage log, including using a paper logbook, a mobile app, or a spreadsheet.

What information should I include in my IRS mileage log?

+The IRS mileage log should include the date, destination, and purpose of each trip, as well as the total miles driven for business purposes and the total miles driven for personal purposes.

In

Final Thoughts