Intro

Create professional pay stubs with an Independent Contractor Pay Stub Excel Template, featuring customizable fields for contractor pay, taxes, and deductions, streamlining freelance invoicing and payroll management.

As an independent contractor, managing finances and keeping track of payments is crucial for success. One essential tool for achieving this is a pay stub template. A pay stub, also known as a paycheck stub, is a document that details the wages earned by an employee or independent contractor, including deductions and taxes. In this article, we will explore the importance of using a pay stub template, particularly an Independent Contractor Pay Stub Excel Template, and provide guidance on how to create and use one effectively.

Managing finances as an independent contractor can be complex, with multiple income streams and expenses to track. A pay stub template helps simplify this process by providing a clear and organized record of earnings and deductions. This is particularly important for independent contractors, who are responsible for their own tax payments and benefits. By using a pay stub template, independent contractors can ensure accuracy and transparency in their financial records, making it easier to manage their finances and make informed decisions.

Using a pay stub template also helps independent contractors to professionalize their business operations. By providing a standardized and formal document to clients, independent contractors can demonstrate their professionalism and attention to detail. This can help to build trust and credibility with clients, which is essential for securing future contracts and growing a successful business. Furthermore, a pay stub template can help independent contractors to comply with regulatory requirements, such as tax laws and labor regulations, by providing a clear and accurate record of earnings and deductions.

Benefits of Using an Independent Contractor Pay Stub Excel Template

An Independent Contractor Pay Stub Excel Template offers several benefits, including ease of use, customization, and accuracy. Excel templates are widely available and can be easily downloaded and customized to meet the specific needs of an independent contractor. The template can be tailored to include relevant information, such as business name, address, and tax identification number, as well as the client's name and payment details. This ensures that the pay stub is accurate and complete, reducing the risk of errors or discrepancies.

Using an Excel template also allows independent contractors to automate calculations and reduce the risk of mathematical errors. The template can be set up to calculate totals, deductions, and taxes, making it easier to manage finances and ensure compliance with regulatory requirements. Additionally, an Excel template can be easily shared with clients and accounting professionals, making it a convenient and efficient way to communicate financial information.

Key Features of an Independent Contractor Pay Stub Excel Template

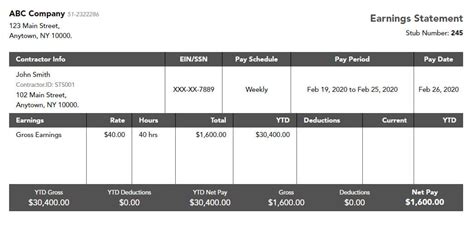

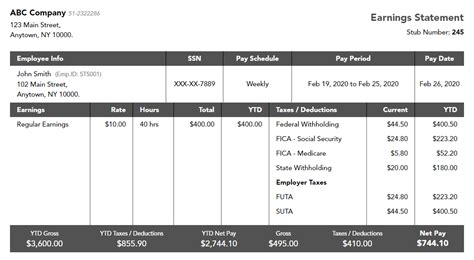

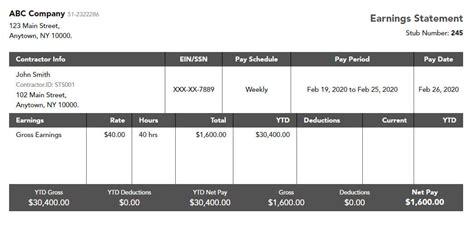

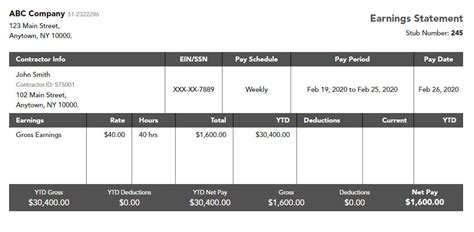

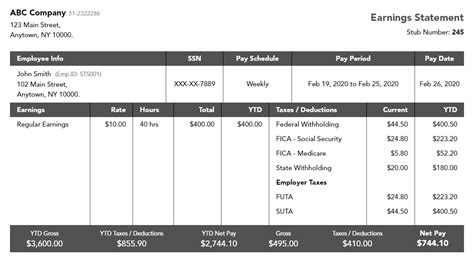

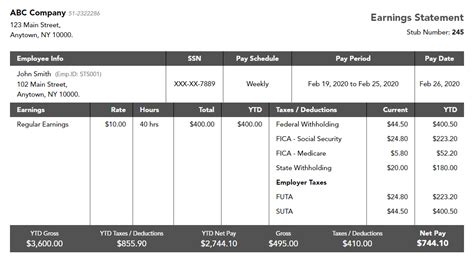

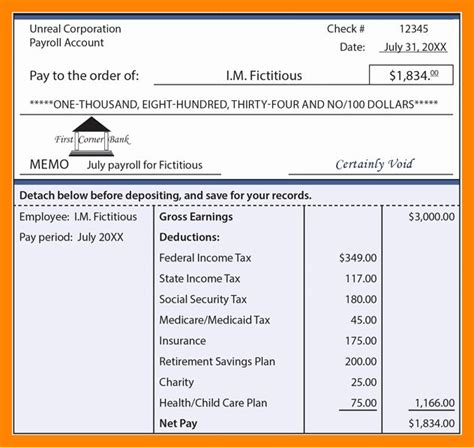

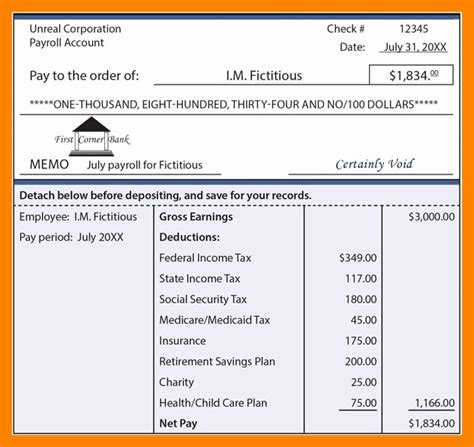

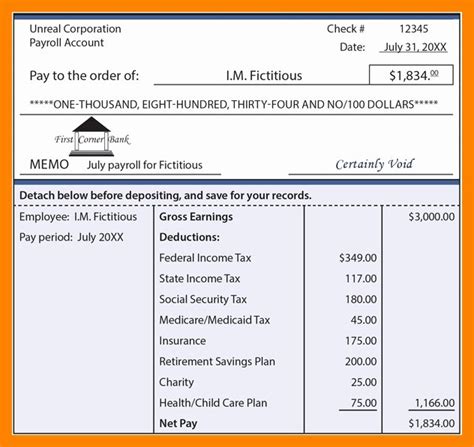

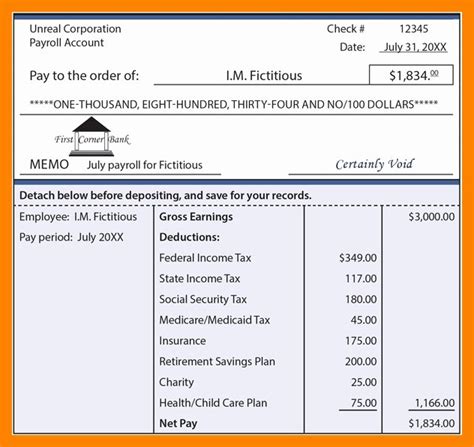

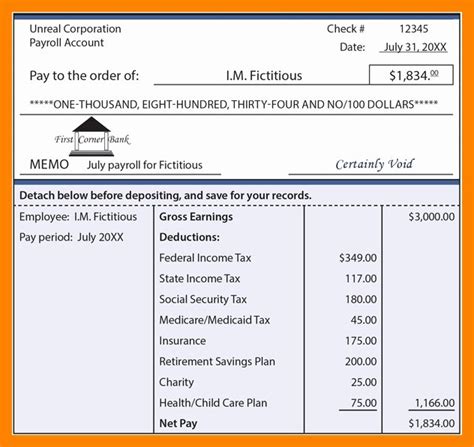

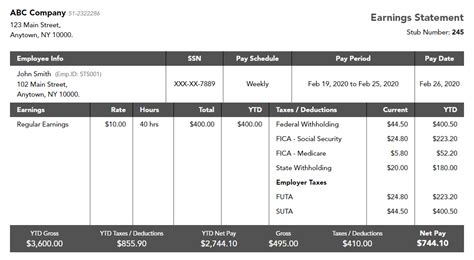

An Independent Contractor Pay Stub Excel Template typically includes the following key features: * Business name and address * Client name and address * Payment details, including date, amount, and method * Earnings and deductions, including taxes and benefits * Totals and calculations, including gross pay, net pay, and tax withholding * Space for notes and commentsThese features ensure that the pay stub is comprehensive and accurate, providing a clear record of earnings and deductions. By using an Independent Contractor Pay Stub Excel Template, independent contractors can streamline their financial management and reduce the risk of errors or discrepancies.

How to Create an Independent Contractor Pay Stub Excel Template

Creating an Independent Contractor Pay Stub Excel Template is a straightforward process that can be completed in a few steps. First, open a new Excel spreadsheet and set up the template with the relevant columns and rows. Include columns for business name, client name, payment details, earnings, and deductions, as well as rows for each payment period.

Next, format the template to make it easy to read and understand. Use clear headings and labels, and ensure that the template is well-organized and visually appealing. Finally, test the template to ensure that it is accurate and functional, making any necessary adjustments before using it for actual payments.

Steps to Create an Independent Contractor Pay Stub Excel Template

The following steps can be used to create an Independent Contractor Pay Stub Excel Template: 1. Open a new Excel spreadsheet and set up the template with the relevant columns and rows. 2. Include columns for business name, client name, payment details, earnings, and deductions. 3. Format the template to make it easy to read and understand. 4. Test the template to ensure that it is accurate and functional. 5. Make any necessary adjustments before using the template for actual payments.By following these steps, independent contractors can create a comprehensive and accurate pay stub template that meets their specific needs and helps them to manage their finances effectively.

Using an Independent Contractor Pay Stub Excel Template

Using an Independent Contractor Pay Stub Excel Template is a straightforward process that can help independent contractors to streamline their financial management and reduce the risk of errors or discrepancies. To use the template, simply enter the relevant information, including business name, client name, payment details, earnings, and deductions.

The template will automatically calculate totals and deductions, making it easy to manage finances and ensure compliance with regulatory requirements. Additionally, the template can be easily shared with clients and accounting professionals, making it a convenient and efficient way to communicate financial information.

Best Practices for Using an Independent Contractor Pay Stub Excel Template

The following best practices can be used to get the most out of an Independent Contractor Pay Stub Excel Template: * Enter accurate and complete information to ensure that the pay stub is accurate and reliable. * Use the template consistently to ensure that all payments are recorded and tracked. * Review and update the template regularly to ensure that it remains accurate and functional. * Share the template with clients and accounting professionals as needed to ensure that financial information is communicated effectively.By following these best practices, independent contractors can use an Independent Contractor Pay Stub Excel Template to streamline their financial management and reduce the risk of errors or discrepancies.

Gallery of Independent Contractor Pay Stub Templates

Independent Contractor Pay Stub Templates

Frequently Asked Questions

What is an Independent Contractor Pay Stub Excel Template?

+An Independent Contractor Pay Stub Excel Template is a document that details the wages earned by an independent contractor, including deductions and taxes.

Why do I need an Independent Contractor Pay Stub Excel Template?

+An Independent Contractor Pay Stub Excel Template helps independent contractors to manage their finances effectively, reduce the risk of errors or discrepancies, and comply with regulatory requirements.

How do I create an Independent Contractor Pay Stub Excel Template?

+To create an Independent Contractor Pay Stub Excel Template, open a new Excel spreadsheet and set up the template with the relevant columns and rows. Include columns for business name, client name, payment details, earnings, and deductions, and format the template to make it easy to read and understand.

Can I customize an Independent Contractor Pay Stub Excel Template?

+Yes, an Independent Contractor Pay Stub Excel Template can be customized to meet the specific needs of an independent contractor. The template can be tailored to include relevant information, such as business name, address, and tax identification number, as well as the client's name and payment details.

How do I use an Independent Contractor Pay Stub Excel Template?

+To use an Independent Contractor Pay Stub Excel Template, simply enter the relevant information, including business name, client name, payment details, earnings, and deductions. The template will automatically calculate totals and deductions, making it easy to manage finances and ensure compliance with regulatory requirements.

In conclusion, an Independent Contractor Pay Stub Excel Template is a valuable tool for managing finances and ensuring compliance with regulatory requirements. By using a template, independent contractors can streamline their financial management, reduce the risk of errors or discrepancies, and professionalize their business operations. We hope this article has provided you with the information and guidance you need to create and use an Independent Contractor Pay Stub Excel Template effectively. If you have any further questions or need additional assistance, please don't hesitate to contact us.