Intro

Boost financial clarity with 5 essential financial report templates, featuring income statements, balance sheets, and cash flow analysis to streamline accounting and budgeting processes.

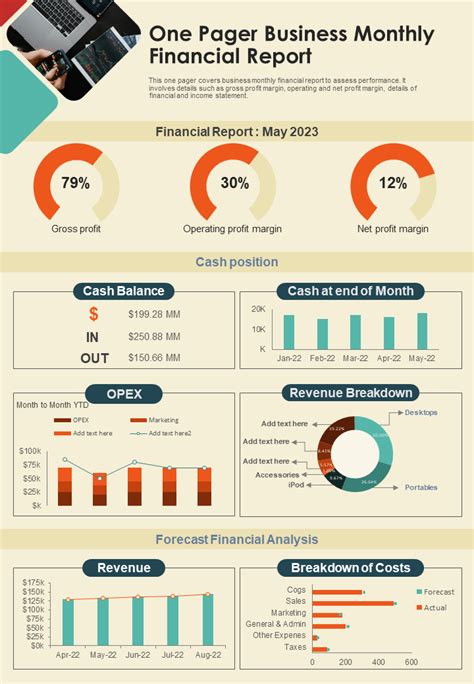

Financial reports are a crucial aspect of any business, providing stakeholders with a clear picture of the company's financial health and performance. These reports help in making informed decisions, identifying areas of improvement, and ensuring compliance with regulatory requirements. With the increasing complexity of financial data, having the right financial report templates can simplify the process of creating and presenting these reports. In this article, we will delve into the importance of financial reports, the benefits of using templates, and explore five essential financial report templates that every business should consider.

The importance of financial reports cannot be overstated. They provide a snapshot of a company's financial position at a given point in time, helping stakeholders understand its strengths, weaknesses, and potential areas for growth. Financial reports are not just about presenting numbers; they are about telling a story of where the company has been, where it is now, and where it is headed. This narrative is crucial for investors, lenders, and management alike, as it informs strategic decisions and ensures that the company remains on a path towards sustainability and profitability.

Using financial report templates can significantly streamline the reporting process. Templates provide a structured format that ensures consistency and completeness, reducing the time and effort required to compile and present financial data. Moreover, templates can help in maintaining compliance with financial reporting standards and regulations, which is essential for avoiding legal and reputational risks. By leveraging financial report templates, businesses can focus more on analysis and decision-making, rather than on the mechanics of report preparation.

Introduction to Financial Report Templates

Financial report templates are designed to cater to various aspects of financial reporting, from basic income statements to comprehensive financial analysis reports. These templates are adaptable to different business sizes and types, making them a versatile tool for financial management. By understanding the different types of financial report templates available, businesses can better navigate their financial reporting needs and make more informed decisions.

Benefits of Financial Report Templates

The benefits of using financial report templates are multifaceted. They include: - Enhanced efficiency in report preparation - Improved accuracy and consistency in financial reporting - Better compliance with financial reporting standards - Enhanced decision-making through clear and concise financial data presentation - Cost savings by reducing the need for external financial reporting services1. Income Statement Template

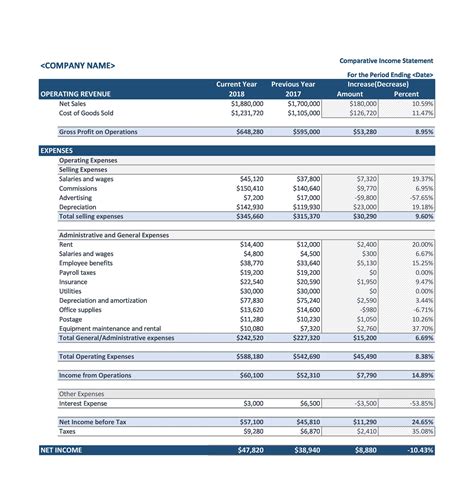

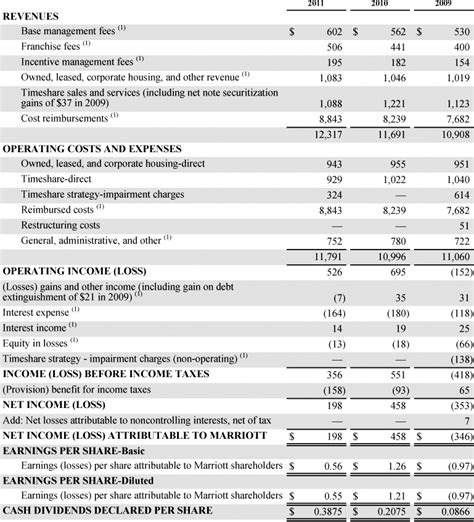

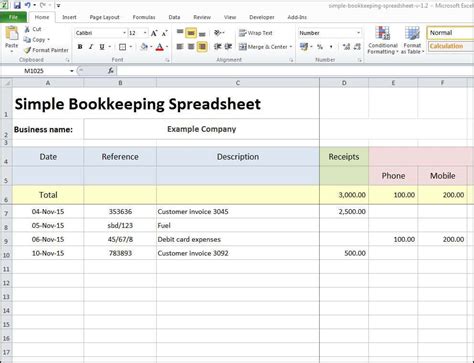

An income statement, also known as a profit and loss statement, is a critical financial report that summarizes a company's revenues and expenses over a specific period. The income statement template is designed to help businesses easily calculate their net income, which is a key indicator of profitability. This template typically includes sections for revenues, cost of goods sold, operating expenses, and net income. By using an income statement template, businesses can quickly identify profitable areas and areas where costs can be optimized.

Components of an Income Statement

- Revenues: The total income generated from sales and other business activities. - Cost of Goods Sold (COGS): The direct costs associated with producing the goods or services sold. - Gross Profit: The difference between revenues and COGS. - Operating Expenses: The indirect costs of operating the business, such as salaries, rent, and marketing expenses. - Net Income: The profit after deducting all expenses from revenues.2. Balance Sheet Template

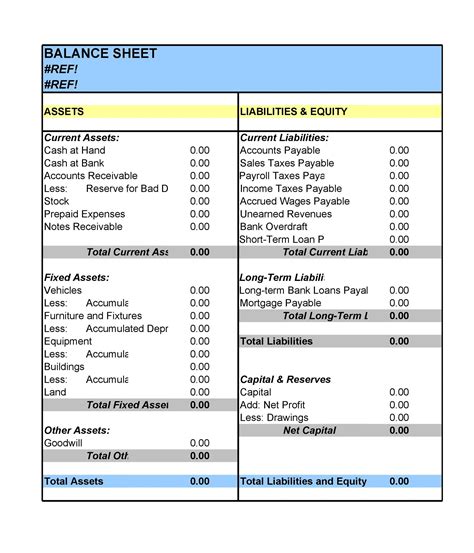

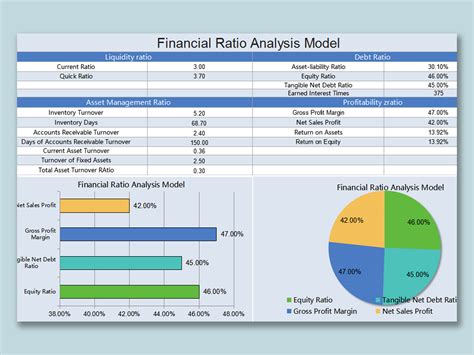

A balance sheet provides a snapshot of a company's financial position at a specific point in time, listing its assets, liabilities, and equity. The balance sheet template is essential for understanding a company's liquidity, solvency, and financial flexibility. This template is divided into three main sections: assets, liabilities, and equity. By analyzing these components, stakeholders can assess the company's ability to meet its short-term and long-term obligations.

Understanding Balance Sheet Components

- Assets: Resources owned or controlled by the business, such as cash, inventory, and property. - Liabilities: Debts or obligations that the business is expected to settle, such as accounts payable and loans. - Equity: The residual interest in the assets of the business after deducting liabilities, representing the ownership interest.3. Cash Flow Statement Template

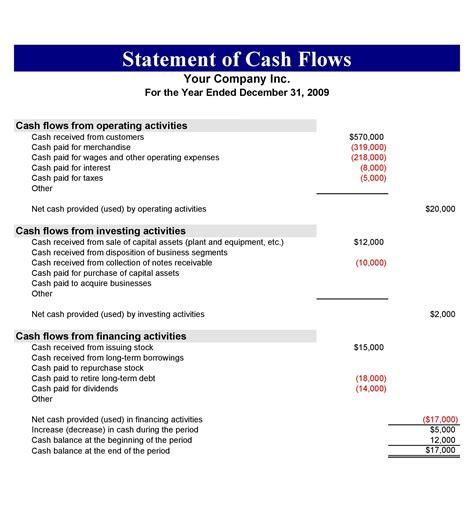

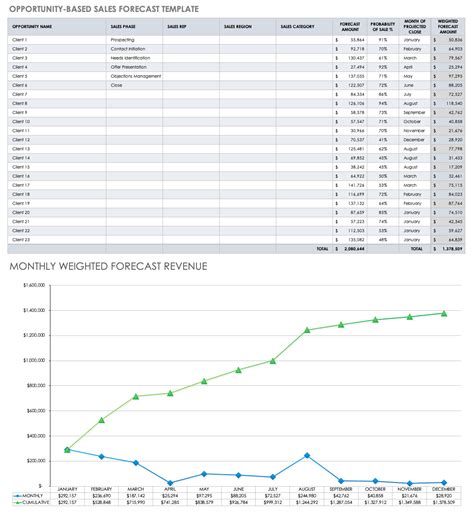

The cash flow statement template is used to report the inflows and outflows of cash and cash equivalents over a specified period. This template is vital for assessing a company's liquidity, its ability to pay bills, and its capacity to invest in new opportunities. The cash flow statement is typically divided into three main categories: operating, investing, and financing activities.

Cash Flow Statement Categories

- Operating Activities: Inflows and outflows from the company's core operations, such as cash received from customers and cash paid to suppliers. - Investing Activities: Cash flows related to the acquisition or disposal of assets, such as purchasing equipment or selling investments. - Financing Activities: Cash flows related to the company's funding, such as issuing debt or equity, and dividend payments.4. Break-Even Analysis Template

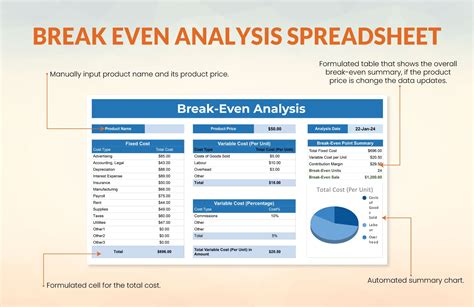

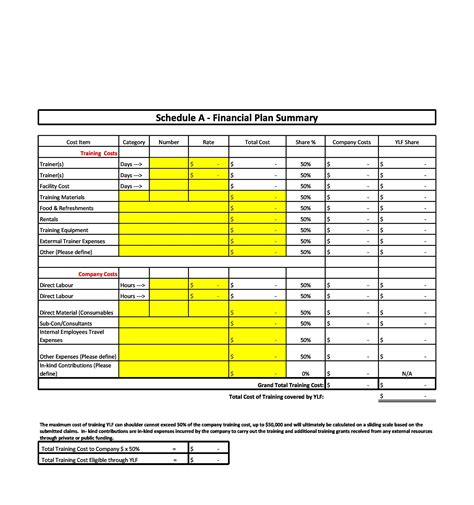

The break-even analysis template is a financial tool used to determine the point at which a business will neither make a profit nor incur a loss. This template is essential for startups and existing businesses looking to launch new products or services, as it helps in understanding the volume of sales required to cover fixed and variable costs. By using a break-even analysis template, businesses can set realistic sales targets and make informed decisions about pricing and cost management.

Calculating the Break-Even Point

- Fixed Costs: Costs that remain the same even if the business produces more or less, such as rent and salaries. - Variable Costs: Costs that vary with the level of production or sales, such as raw materials and direct labor. - Contribution Margin: The difference between sales revenue and variable costs. - Break-Even Point: The point at which total revenue equals total fixed and variable costs.5. Budget Template

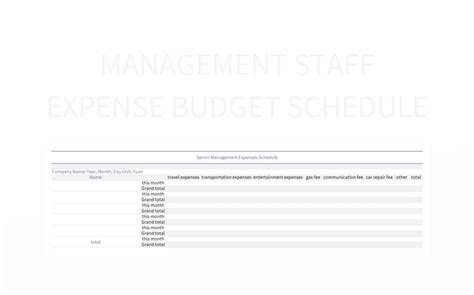

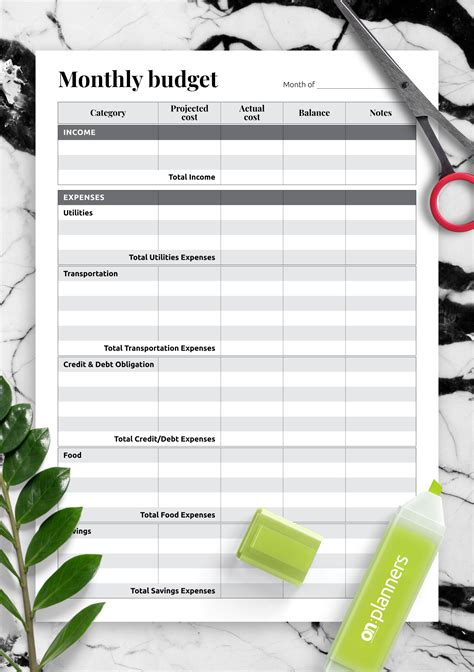

A budget template is a financial plan that outlines projected income and expenses over a specific period. This template is crucial for managing a company's finances effectively, ensuring that resources are allocated efficiently, and achieving business objectives. By using a budget template, businesses can forecast their financial performance, identify potential financial risks, and make adjustments to stay on track with their strategic plans.

Components of a Budget

- Revenue Projections: Estimated income from sales and other sources. - Expense Projections: Estimated costs, including both fixed and variable expenses. - Capital Expenditure Budget: Plan for investments in assets, such as equipment or property. - Cash Flow Budget: Projection of the inflows and outflows of cash.Financial Report Templates Image Gallery

What is the purpose of financial report templates?

+Financial report templates are designed to simplify the process of creating financial reports, ensuring consistency, accuracy, and compliance with financial reporting standards.

How do I choose the right financial report template for my business?

+The choice of financial report template depends on the specific needs of your business. Consider the type of report you need (e.g., income statement, balance sheet), the complexity of your financial data, and the regulatory requirements you must comply with.

Can financial report templates be customized?

+Yes, most financial report templates can be customized to fit the specific needs of your business. This may involve adding or removing sections, adjusting formulas, or changing the format to better suit your reporting requirements.

In conclusion, financial report templates are indispensable tools for businesses seeking to enhance their financial reporting processes. By leveraging these templates, companies can improve the efficiency, accuracy, and compliance of their financial reports, ultimately leading to better decision-making and strategic planning. Whether you are a small startup or a large corporation, understanding and utilizing financial report templates can be a significant step towards achieving your business objectives. We invite you to share your experiences with financial report templates, ask questions, or explore how these tools can be tailored to meet the unique needs of your organization.