Intro

Learn about IRS certified mail with our comprehensive guide, covering mailing requirements, tax returns, and audit notifications, to ensure compliance and avoid penalties.

The importance of understanding and utilizing certified mail cannot be overstated, particularly when dealing with sensitive or critical communications such as those involving the Internal Revenue Service (IRS). Certified mail provides a secure and reliable method for sending important documents, ensuring that both the sender and recipient have proof of mailing and delivery. This is especially crucial when dealing with tax-related matters, as it helps protect individuals and businesses from potential disputes or penalties arising from undelivered or lost documents.

In the context of IRS communications, certified mail is often the recommended, if not required, method for submitting certain types of documents or notifications. This includes responses to IRS notices, tax returns, and other critical communications where proof of delivery is essential. The use of certified mail in these situations helps ensure that documents are handled with the care and priority they deserve, reducing the risk of lost or misplaced documents and the associated consequences.

For individuals and businesses looking to navigate the complexities of IRS communications effectively, understanding the process and benefits of certified mail is indispensable. It not only provides a secure means of sending sensitive documents but also offers a layer of protection against potential issues that may arise from the mailing process. By leveraging certified mail, taxpayers can ensure that their communications with the IRS are handled efficiently and securely, minimizing the risk of errors or disputes that could lead to unnecessary penalties or delays.

Introduction to Certified Mail

Certified mail is a type of mail service offered by postal services that provides the sender with a receipt as proof of mailing, as well as a record of the delivery. This service is particularly useful for sending important documents where proof of delivery is required. When using certified mail, the sender can choose to have the recipient sign for the document upon delivery, providing an additional layer of verification.

Key Benefits of Certified Mail

The key benefits of certified mail include: - **Proof of Mailing**: The sender receives a receipt as proof that the document was mailed. - **Proof of Delivery**: The sender can request a return receipt, which provides proof that the document was delivered to the recipient. - **Security**: Certified mail is handled with more care than regular mail, reducing the risk of loss or theft. - **Priority Handling**: Certified mail often receives priority handling, ensuring faster delivery.Using Certified Mail for IRS Communications

When communicating with the IRS, it is crucial to follow the recommended guidelines for submitting documents and responses. Certified mail is often the preferred method for these communications due to the importance of having proof of mailing and delivery. This is particularly relevant for documents such as tax returns, responses to IRS notices, and appeals, where timely and secure delivery is paramount.

Steps for Using Certified Mail with the IRS

To use certified mail for IRS communications, follow these steps: 1. **Prepare Your Document**: Ensure your document is complete and accurate. 2. **Choose Certified Mail**: Select the certified mail service at your post office. 3. **Request Return Receipt**: Ask for a return receipt to prove delivery. 4. **Keep Records**: Keep a copy of your document and the certified mail receipt.Understanding IRS Notices and Responses

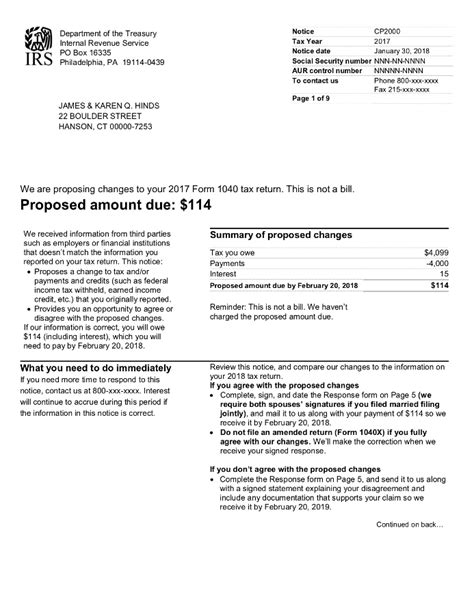

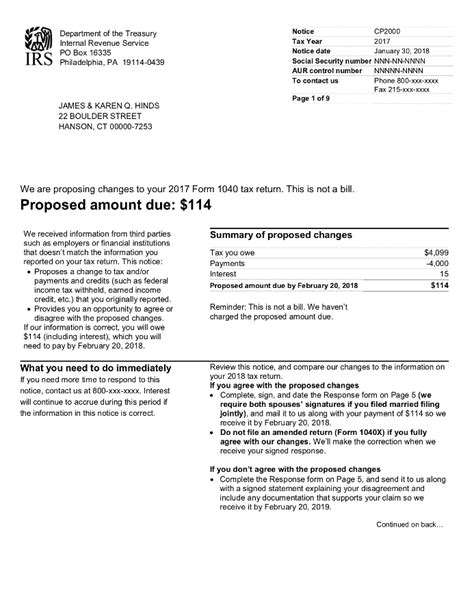

The IRS sends various types of notices to taxpayers, each requiring a specific response. Understanding these notices and how to respond appropriately is vital for resolving issues efficiently and avoiding additional penalties. From notices of audit to notices of deficiency, each type of communication from the IRS requires careful attention and a timely, appropriate response.

Types of IRS Notices

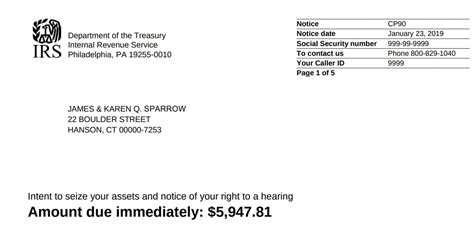

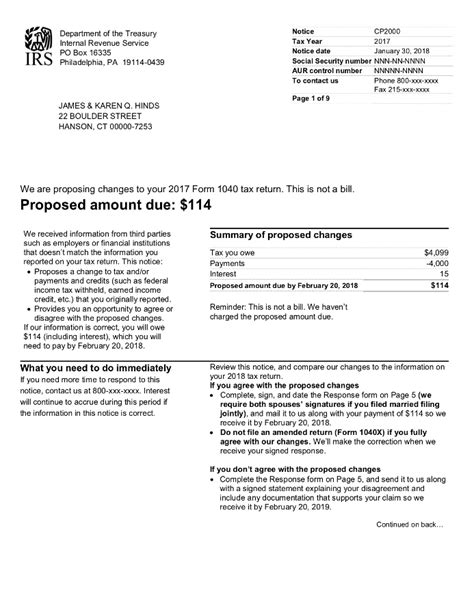

- **Notice of Audit**: The IRS intends to audit your tax return. - **Notice of Deficiency**: The IRS has determined you owe additional taxes. - **Notice of Intent to Levy**: The IRS intends to levy your assets to satisfy a tax debt.Best Practices for IRS Certified Mail

To ensure effective and secure communication with the IRS via certified mail, several best practices should be observed. These include using the correct address for the IRS, ensuring timely mailing to meet deadlines, and keeping detailed records of all communications.

Record Keeping

- **Keep a Copy**: Of the document sent and the certified mail receipt. - **Track Delivery**: Use the return receipt to confirm delivery. - **Organize Records**: Keep all IRS-related documents and communications organized.Common Mistakes to Avoid

When using certified mail for IRS communications, there are several common mistakes that should be avoided. These include using an incorrect IRS address, failing to request a return receipt, and not keeping accurate records of the mailing.

Avoiding Delays

- **Use Correct Addresses**: Ensure the IRS address is correct. - **Meet Deadlines**: Send documents early to avoid missing deadlines. - **Follow Instructions**: Carefully follow any instructions provided by the IRS.Gallery of IRS Certified Mail Examples

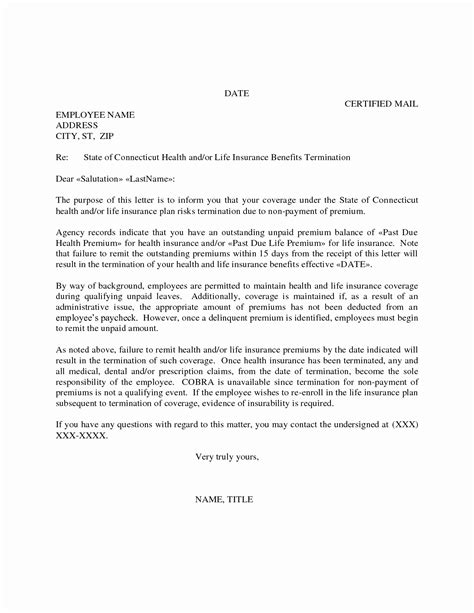

IRS Certified Mail Image Gallery

Frequently Asked Questions

What is the purpose of using certified mail with the IRS?

+The purpose of using certified mail with the IRS is to provide proof of mailing and delivery for important tax-related documents, ensuring a secure and traceable method of communication.

How do I ensure my certified mail reaches the IRS on time?

+To ensure your certified mail reaches the IRS on time, use the correct IRS address, send your document well in advance of the deadline, and consider using a tracked shipping method for added security.

What should I do if my certified mail to the IRS is lost or not delivered?

+If your certified mail to the IRS is lost or not delivered, contact the USPS to report the issue and potentially initiate a trace. You may also need to resend the document via certified mail to meet any looming deadlines.

In conclusion, understanding and effectively utilizing certified mail for IRS communications is a critical aspect of managing tax-related matters. By following the guidelines and best practices outlined, individuals and businesses can ensure secure, timely, and traceable communication with the IRS, minimizing the risk of disputes, penalties, or delays. Whether you're responding to an IRS notice, submitting a tax return, or appealing a decision, certified mail provides the peace of mind and legal protection that comes with knowing your important documents are handled with care and priority. We invite you to share your experiences or ask questions about using certified mail for IRS communications in the comments below, and don't forget to share this article with anyone who might benefit from this valuable information.