Intro

Learn how to report EBT on taxes, including EBT income, tax deductions, and credits, to maximize your refund and minimize tax liabilities with accurate tax reporting and government benefits.

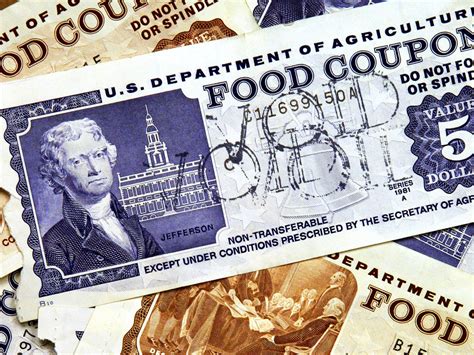

The Supplemental Nutrition Assistance Program (SNAP), also known as food stamps, is a vital resource for many low-income individuals and families in the United States. One of the key benefits of SNAP is the Electronic Benefits Transfer (EBT) system, which allows recipients to purchase food and other eligible items using a debit card-like system. However, there are often questions and misconceptions about how EBT benefits are reported on taxes. In this article, we will delve into the importance of understanding EBT and taxes, and explore the various aspects of this topic.

The EBT system is designed to provide a convenient and secure way for SNAP recipients to access their benefits. The system uses a magnetic stripe card, similar to a credit or debit card, to track and manage benefits. Recipients can use their EBT card to purchase eligible food items at participating retailers, and the benefits are automatically deducted from their account. This system has been shown to be highly effective in reducing food insecurity and improving nutrition among low-income households.

As the number of people relying on SNAP benefits continues to grow, it is essential to understand the tax implications of these benefits. The tax treatment of EBT benefits can be complex, and there are often misconceptions about how these benefits are reported on taxes. In general, SNAP benefits are not considered taxable income, and recipients do not need to report their benefits on their tax return. However, there are some exceptions and nuances to this rule, which we will explore in more detail later.

Introduction to EBT and Taxes

The EBT system is a vital component of the SNAP program, and it plays a critical role in providing food assistance to low-income households. The system is designed to be efficient and secure, and it has been shown to be highly effective in reducing food insecurity. However, the tax treatment of EBT benefits can be complex, and there are often questions and misconceptions about how these benefits are reported on taxes.

How EBT Benefits Are Reported on Taxes

The tax treatment of EBT benefits is governed by federal law, which states that SNAP benefits are not considered taxable income. This means that recipients do not need to report their benefits on their tax return, and they are not subject to federal income tax. However, there are some exceptions to this rule, which we will explore in more detail later.Benefits of EBT

The EBT system provides numerous benefits to SNAP recipients, including convenience, security, and flexibility. The system allows recipients to purchase eligible food items at participating retailers, and the benefits are automatically deducted from their account. This system has been shown to be highly effective in reducing food insecurity and improving nutrition among low-income households.

Some of the key benefits of EBT include:

- Convenience: The EBT system provides a convenient way for recipients to access their benefits, eliminating the need for paper coupons or other forms of payment.

- Security: The EBT system is designed to be secure, with multiple layers of protection to prevent fraud and abuse.

- Flexibility: The EBT system allows recipients to purchase eligible food items at participating retailers, providing them with greater flexibility and choice.

How to Report EBT Benefits on Taxes

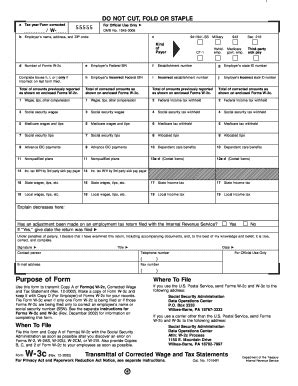

In general, SNAP benefits are not considered taxable income, and recipients do not need to report their benefits on their tax return. However, there are some exceptions to this rule, which we will explore in more detail later. For example, if a recipient receives cash benefits, such as Temporary Assistance for Needy Families (TANF) benefits, they may need to report these benefits on their tax return.Tax Implications of EBT Benefits

The tax implications of EBT benefits can be complex, and there are often misconceptions about how these benefits are reported on taxes. In general, SNAP benefits are not considered taxable income, and recipients do not need to report their benefits on their tax return. However, there are some exceptions to this rule, which we will explore in more detail later.

Some of the key tax implications of EBT benefits include:

- Tax-free benefits: SNAP benefits are not considered taxable income, and recipients do not need to report their benefits on their tax return.

- Exceptions: There are some exceptions to this rule, such as cash benefits, which may be subject to federal income tax.

- Reporting requirements: Recipients may need to report their benefits on their tax return if they receive cash benefits or other forms of assistance.

Common Mistakes to Avoid

There are several common mistakes that recipients can avoid when reporting EBT benefits on their taxes. These include: * Failing to report cash benefits: Recipients who receive cash benefits, such as TANF benefits, may need to report these benefits on their tax return. * Failing to keep accurate records: Recipients should keep accurate records of their benefits, including the amount and type of benefits received. * Failing to understand tax implications: Recipients should understand the tax implications of their benefits, including any exceptions or nuances to the rule.FAQs and Resources

There are several resources available to help recipients understand the tax implications of EBT benefits. These include:

- The IRS website: The IRS website provides information and resources on the tax treatment of SNAP benefits.

- The USDA website: The USDA website provides information and resources on the SNAP program, including the tax implications of benefits.

- Local assistance offices: Recipients can contact their local assistance office for information and guidance on the tax implications of EBT benefits.

Some frequently asked questions about EBT and taxes include:

- Are SNAP benefits taxable?

- Do I need to report my EBT benefits on my tax return?

- What are the tax implications of cash benefits?

Gallery of EBT-Related Images

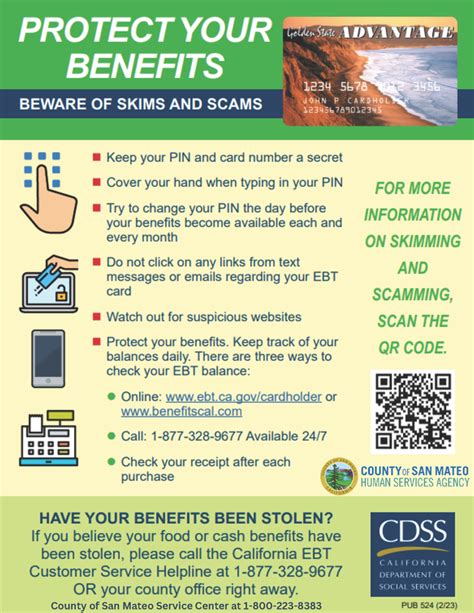

EBT Image Gallery

Conclusion and Next Steps

In conclusion, the tax implications of EBT benefits can be complex, and there are often misconceptions about how these benefits are reported on taxes. However, by understanding the basics of EBT and taxes, recipients can avoid common mistakes and ensure that they are in compliance with federal tax laws. If you have any questions or concerns about EBT and taxes, we encourage you to reach out to your local assistance office or consult with a tax professional.

We hope that this article has provided you with a comprehensive understanding of EBT and taxes. If you have any further questions or would like to learn more about this topic, please do not hesitate to contact us. We are always here to help.

Are SNAP benefits taxable?

+No, SNAP benefits are not considered taxable income.

Do I need to report my EBT benefits on my tax return?

+No, you do not need to report your EBT benefits on your tax return, unless you receive cash benefits.

What are the tax implications of cash benefits?

+Cash benefits, such as TANF benefits, may be subject to federal income tax.

We encourage you to share this article with others who may be interested in learning more about EBT and taxes. You can also comment below with any questions or concerns you may have. Thank you for reading, and we look forward to hearing from you.