Intro

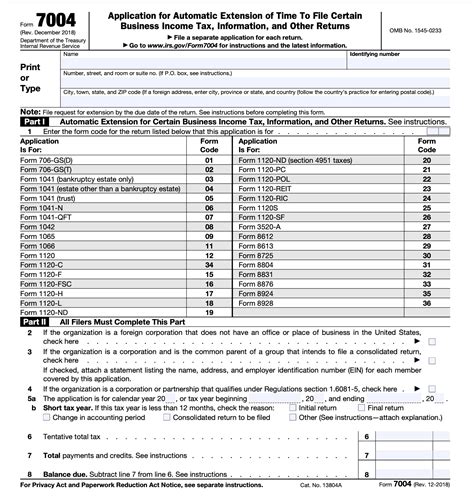

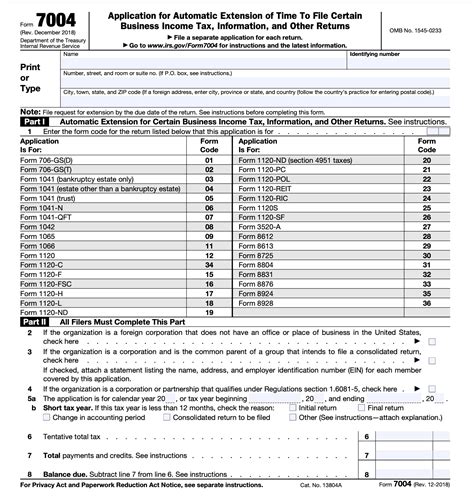

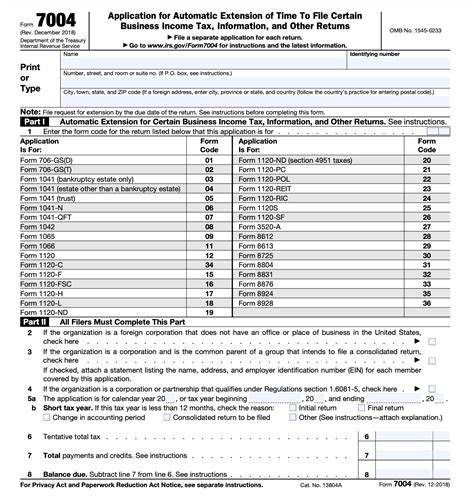

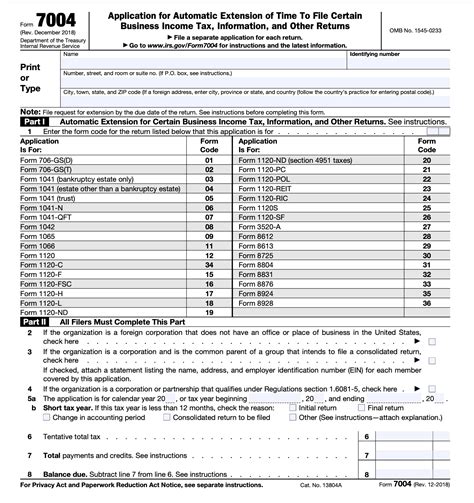

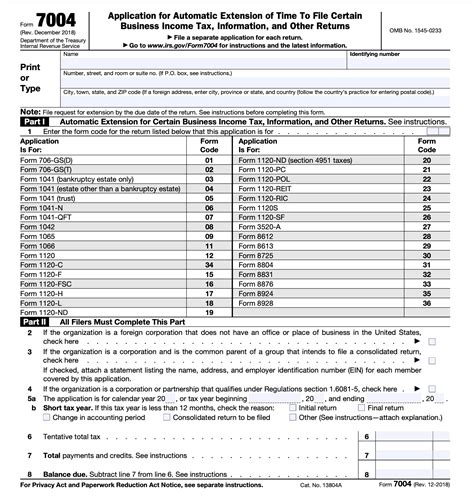

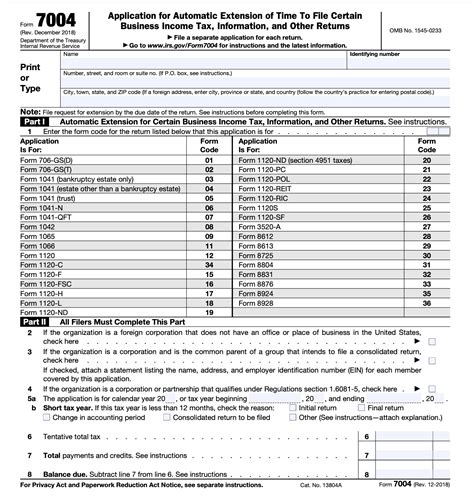

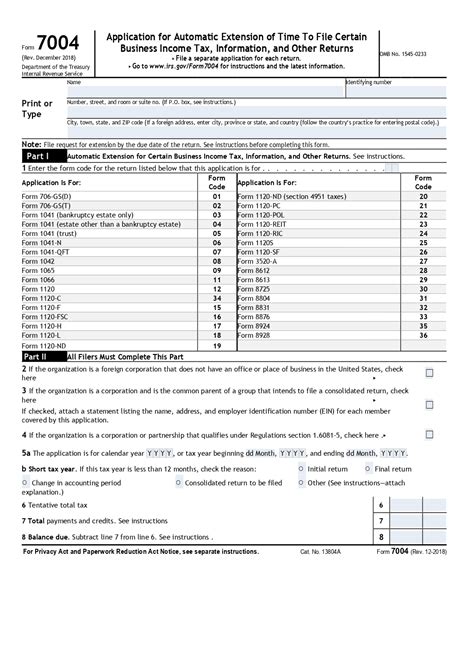

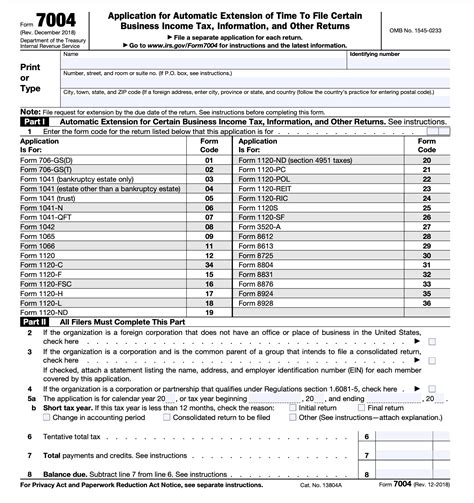

Discover Mail Form 7004 options for automatic extensions, including e-file and paper filing methods, to simplify tax return submissions and avoid penalties with timely IRS approvals and extensions.

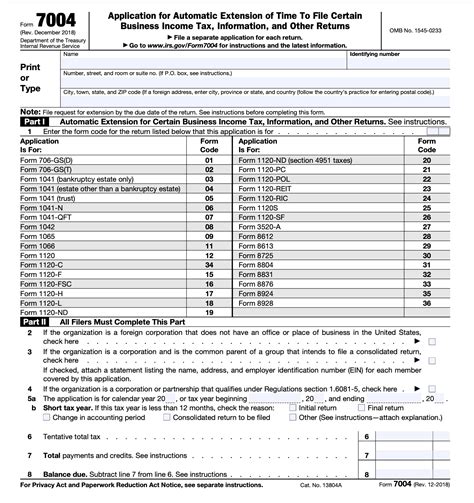

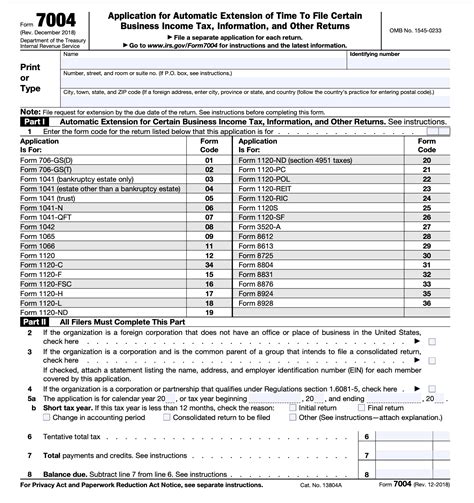

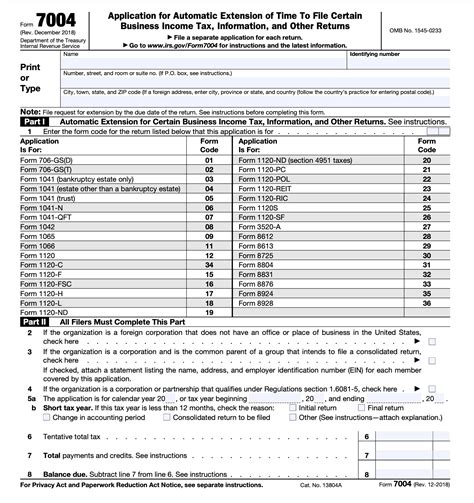

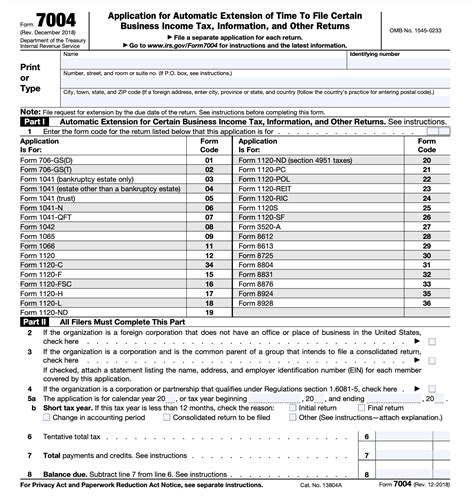

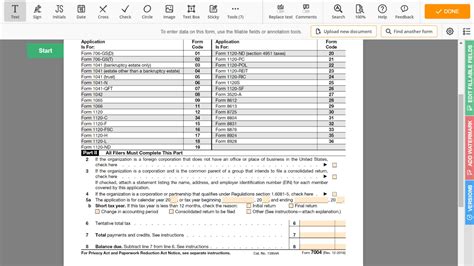

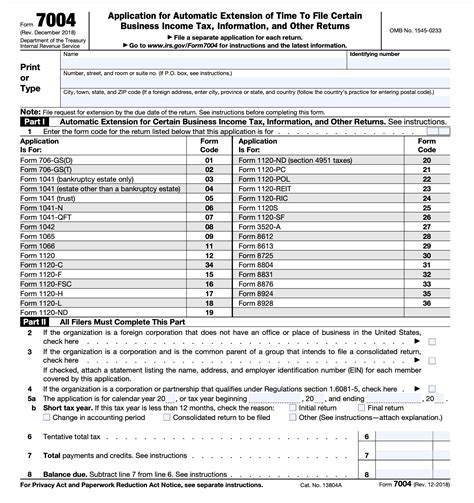

The IRS Form 7004 is an essential document for businesses and tax professionals, as it allows for an automatic extension of time to file certain business income tax returns. Understanding the options and implications of Form 7004 is crucial for ensuring compliance with tax regulations and avoiding potential penalties. In this article, we will delve into the details of Form 7004, its purpose, and the options available to filers.

The IRS Form 7004 is used to request an automatic extension of time to file business income tax returns, including partnership returns (Form 1065), corporate returns (Form 1120), and S corporation returns (Form 1120S). This form is typically filed by the original due date of the return, and it provides an additional six months to file the return. The extended due date for partnership and S corporation returns is September 15th, while the extended due date for corporate returns is October 15th.

Filers can submit Form 7004 electronically or by mail, and it is essential to ensure that the form is completed accurately and submitted on time. The form requires basic business information, including the business name, address, and employer identification number (EIN). Filers must also specify the type of return being extended and the reason for the extension. It is crucial to note that an extension of time to file is not an extension of time to pay, and any tax due must be paid by the original due date to avoid penalties and interest.

Eligibility for Form 7004

To be eligible for an automatic extension using Form 7004, the business must meet specific requirements. The business must have a valid EIN, and the return being extended must be a business income tax return. Additionally, the form must be filed by the original due date of the return, and the business must not have already filed the return. Filers can request an extension for multiple returns on a single Form 7004, but each return must meet the eligibility requirements.

Options for Filing Form 7004

There are several options available for filing Form 7004, including electronic filing and mail filing. Electronic filing is a convenient and efficient way to submit the form, and it provides an immediate confirmation of receipt. Mail filing, on the other hand, requires the form to be printed, signed, and mailed to the IRS. Regardless of the filing method, it is essential to ensure that the form is completed accurately and submitted on time.

Extension Period

The extension period for Form 7004 is typically six months from the original due date of the return. For partnership and S corporation returns, the extended due date is September 15th, while the extended due date for corporate returns is October 15th. It is essential to note that this extension is automatic, and the IRS will not notify the filer of the extension. However, the filer must still file the return and pay any tax due by the extended due date to avoid penalties and interest.

Penalties and Interest

Failure to file Form 7004 or pay tax due by the original due date can result in penalties and interest. The penalty for late filing is typically 5% of the unpaid tax for each month or part of a month, up to a maximum of 25%. The penalty for late payment is typically 0.5% of the unpaid tax for each month or part of a month, up to a maximum of 25%. Interest is also charged on unpaid tax, and it accrues from the original due date of the return.

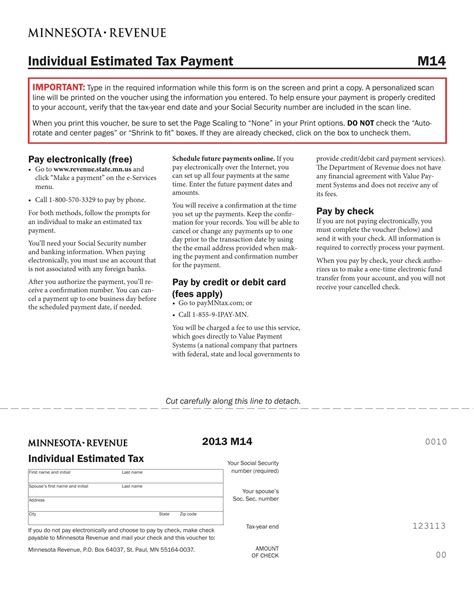

Form 7004 and Estimated Tax Payments

Filers who are required to make estimated tax payments must still make these payments by the original due date, even if they have filed Form 7004. Estimated tax payments are required for businesses that expect to owe $500 or more in tax for the year. The due dates for estimated tax payments are April 15th, June 15th, September 15th, and January 15th of the following year.

Common Errors on Form 7004

Common errors on Form 7004 include incorrect or missing business information, incorrect return type, and failure to sign the form. It is essential to review the form carefully before submitting it to ensure that all information is accurate and complete. Filers can also use tax software or consult with a tax professional to ensure that the form is completed correctly.

Gallery of Form 7004 Options

Form 7004 Options Image Gallery

What is the purpose of Form 7004?

+Form 7004 is used to request an automatic extension of time to file certain business income tax returns.

Who is eligible to file Form 7004?

+Businesses with a valid EIN that need to file a business income tax return can file Form 7004.

How long is the extension period for Form 7004?

+The extension period for Form 7004 is typically six months from the original due date of the return.

What are the penalties for late filing or payment of tax due?

+The penalty for late filing is typically 5% of the unpaid tax for each month or part of a month, up to a maximum of 25%. The penalty for late payment is typically 0.5% of the unpaid tax for each month or part of a month, up to a maximum of 25%.

Can I file Form 7004 electronically?

+Yes, Form 7004 can be filed electronically through the IRS website or through tax software.

In conclusion, Form 7004 is an essential document for businesses that need to request an automatic extension of time to file certain business income tax returns. By understanding the options and implications of Form 7004, businesses can ensure compliance with tax regulations and avoid potential penalties. We encourage readers to share their experiences and questions about Form 7004 in the comments below. Additionally, we invite readers to explore our other articles and resources on tax-related topics. By staying informed and up-to-date on tax regulations, businesses can navigate the complex world of taxation with confidence.