Intro

Submit Mail 941 X Form to the IRS address for amended employment tax returns, ensuring accurate filing and avoiding penalties with correct mailing addresses and procedures.

The importance of understanding and correctly completing tax forms cannot be overstated, especially for businesses and individuals who need to report various transactions to the Internal Revenue Service (IRS). One such form that holds significant relevance for certain entities is the 941 X form, which is used for adjusting employment taxes. This form is crucial for correcting errors or making adjustments to previously filed Form 941, Employer's Quarterly Federal Tax Return. The 941 X form allows employers to report corrections to employment taxes, such as Social Security and Medicare taxes, and to claim refunds or make payments for these corrections.

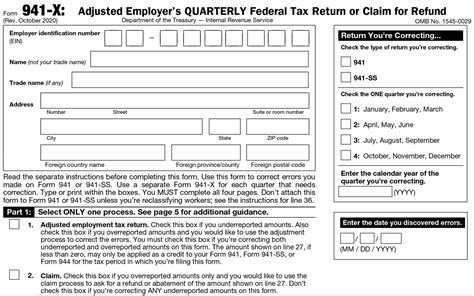

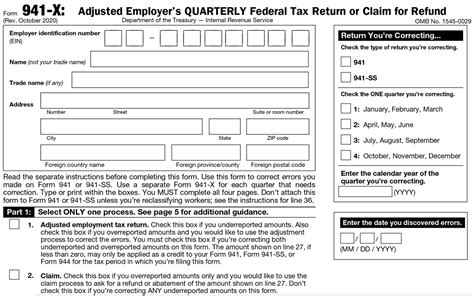

Understanding the purpose and the process of filling out the 941 X form is essential for maintaining compliance with IRS regulations and avoiding potential penalties. Employers who have made errors in reporting employment taxes, whether in underreporting or overreporting, must use this form to correct these mistakes. The form itself is quite detailed, requiring specific information about the corrections being made, including the quarter to which the corrections apply, the type of correction (either an error in reporting or a change in employment tax liability), and the amount of the correction.

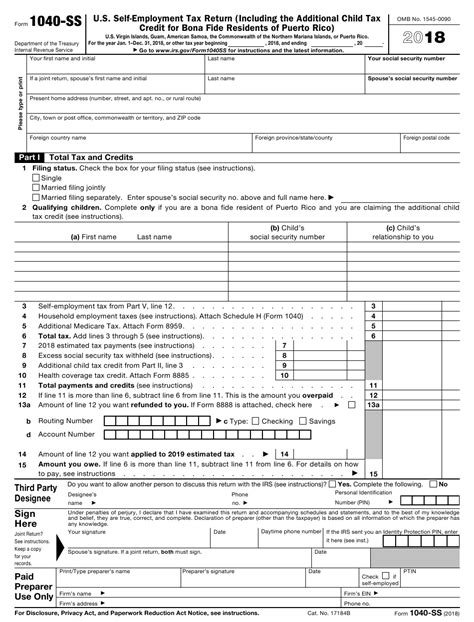

For those needing to file the 941 X form, it's vital to know where to send it. The address for mailing the 941 X form can depend on the location of the employer's business and whether the form is accompanied by a payment. Generally, the IRS provides specific mailing addresses for different regions and scenarios. Employers should consult the IRS instructions for Form 941-X or visit the IRS website to find the most current and applicable mailing address for their situation. It's also important to ensure that the form is properly completed and signed before mailing to avoid any delays or issues in processing.

Introduction to 941 X Form

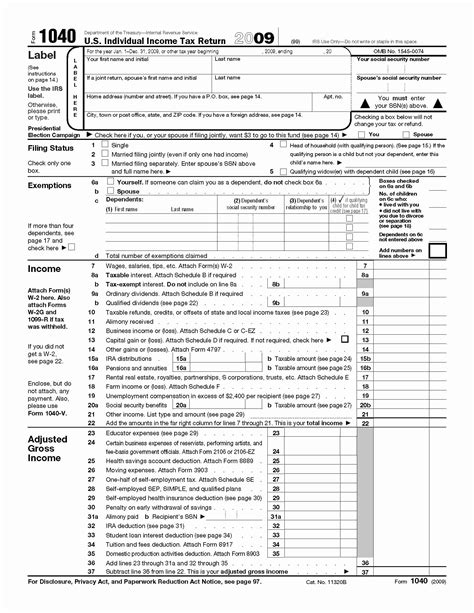

The 941 X form is designed to be a flexible tool for correcting employment tax errors. It can be used to correct a variety of mistakes, including errors in the amount of tax liability reported, the number of employees, or even the type of tax being reported. The form itself is divided into sections that guide the employer through the correction process, ensuring that all necessary information is provided to the IRS. Employers must be diligent in completing the form accurately, as incorrect or incomplete information can lead to further complications.

Benefits of Correctly Filing 941 X Form

Correctly filing the 941 X form offers several benefits to employers. Perhaps most importantly, it allows them to come into compliance with IRS regulations, thereby avoiding potential penalties and interest that can accrue on unpaid taxes or unreported tax liabilities. Additionally, for employers who have overpaid their employment taxes, the 941 X form provides a means to claim a refund. This can be particularly beneficial for small businesses or those operating on tight margins, as reclaiming overpaid taxes can help improve cash flow.Working Mechanism of 941 X Form

The working mechanism of the 941 X form involves several key steps. First, the employer must identify the need for a correction, which could arise from a variety of situations such as discovering an error in previously filed Form 941, receiving notification from the IRS of a discrepancy, or needing to adjust tax liability due to a change in business circumstances. Once the need for a correction is established, the employer must gather all relevant information and documentation to support the correction. This includes records of employment taxes paid, payroll records, and any correspondence with the IRS related to the issue.

Next, the employer completes the 941 X form, carefully following the instructions provided by the IRS. This involves specifying the quarter for which the correction is being made, detailing the nature of the correction (whether it's an error or a change in tax liability), and calculating the amount of the correction. If the correction results in an overpayment, the employer can choose to have the refund applied to their account or request a direct refund. Conversely, if the correction results in an underpayment, the employer must arrange to pay the additional amount due, which can be done by enclosing a check with the 941 X form or by using the Electronic Federal Tax Payment System (EFTPS).

Steps to Fill Out 941 X Form

To fill out the 941 X form correctly, employers should follow these steps: - Identify the specific quarter for which the correction is being made. - Determine the type of correction: either an error in reporting or a change in employment tax liability. - Calculate the amount of the correction, ensuring to account for any interest or penalties that may apply. - Complete all relevant sections of the form, including providing explanations for the corrections being made. - Ensure the form is properly signed and dated. - Submit the form to the IRS at the appropriate address, along with any required payment or supporting documentation.Practical Examples and Statistical Data

Understanding the practical implications of the 941 X form can be facilitated through examples. For instance, consider a small business that discovered it had underreported its employment taxes for the first quarter of the year. To correct this, the business would complete the 941 X form, specifying the quarter, the nature of the error, and the amount of the underpayment. The business would then need to pay the additional taxes due, plus any applicable interest and penalties.

Statistically, the importance of accurately filing employment tax returns and making timely corrections when necessary cannot be overstated. The IRS processes millions of employment tax returns each year, and while the majority are filed correctly, errors do occur. By using the 941 X form, employers can rectify these mistakes, ensuring compliance with tax laws and avoiding the financial and administrative burdens associated with unresolved tax discrepancies.

Benefits for Small Businesses

Small businesses, in particular, can benefit significantly from understanding how to use the 941 X form. Given their often limited resources, small businesses are more vulnerable to the financial impacts of tax errors or unresolved tax liabilities. By promptly correcting errors and adjusting tax liabilities as needed, small businesses can avoid accumulating unnecessary debt and focus on their core operations.SEO Optimization and Readability

To enhance the readability and SEO optimization of content related to the 941 X form, it's crucial to use clear, concise language and to incorporate relevant keywords. This includes terms like "employment taxes," "corrections," "IRS forms," and "tax compliance." By doing so, individuals and businesses seeking information on how to navigate the process of correcting employment tax errors can more easily find the resources they need.

Moreover, using bullet points, numbered lists, and short paragraphs can significantly improve the readability of the content, making it easier for readers to understand complex concepts and follow the steps required to complete the 941 X form. Statistical data and practical examples can also be invaluable in illustrating the importance and application of the form, providing readers with a more comprehensive understanding of its role in maintaining tax compliance.

Conclusion and Next Steps

In conclusion, the 941 X form is a vital tool for employers seeking to correct employment tax errors or adjust their tax liability. By understanding the purpose, benefits, and working mechanism of this form, businesses can ensure they are in compliance with IRS regulations, avoid potential penalties, and reclaim overpaid taxes. For those looking to delve deeper into the specifics of the 941 X form or seeking guidance on related tax matters, consulting the IRS website or contacting a tax professional can provide additional insights and support.941 X Form Image Gallery

What is the purpose of the 941 X form?

+The 941 X form is used to correct errors or make adjustments to previously filed Form 941, Employer's Quarterly Federal Tax Return.

How do I know if I need to file the 941 X form?

+You need to file the 941 X form if you have made an error in reporting employment taxes or if there has been a change in your employment tax liability.

Where do I mail the 941 X form?

+The mailing address for the 941 X form can depend on your location and whether you are including a payment. Check the IRS instructions for the most current information.

We invite readers to share their experiences or ask questions about the 941 X form in the comments below. For those seeking more detailed information or specific guidance on completing the form, we recommend consulting the official IRS website or reaching out to a tax professional. By engaging with this topic and exploring the resources available, individuals and businesses can better navigate the complexities of employment tax corrections and maintain compliance with IRS regulations. Whether you're looking to correct a past error, adjust your tax liability, or simply understand more about the process, the information provided here aims to serve as a comprehensive guide and starting point for your journey.