Intro

Get a free Walmart pay stub template to manage employee payroll, including salary, benefits, and deductions, with customizable formats for easy printing and digital access.

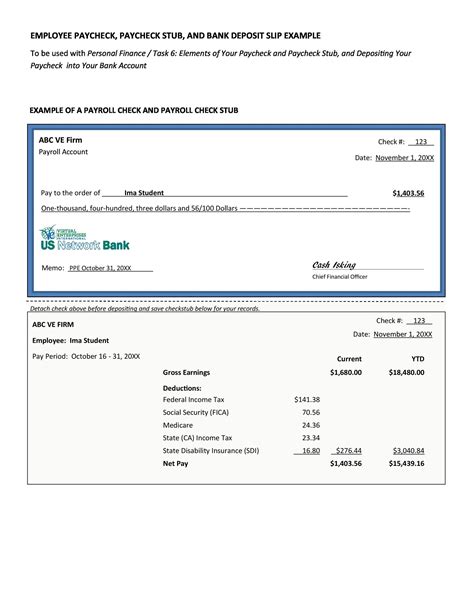

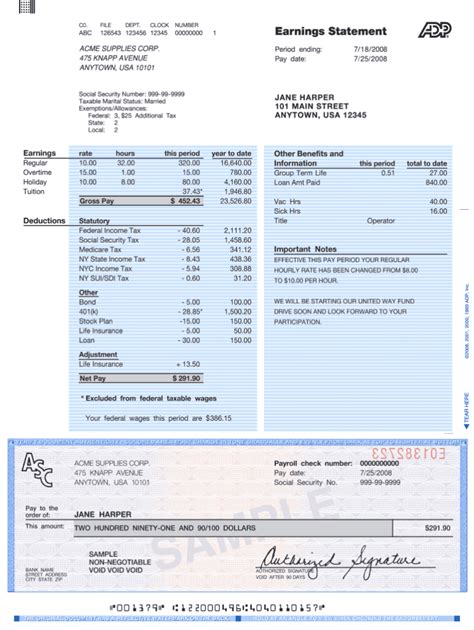

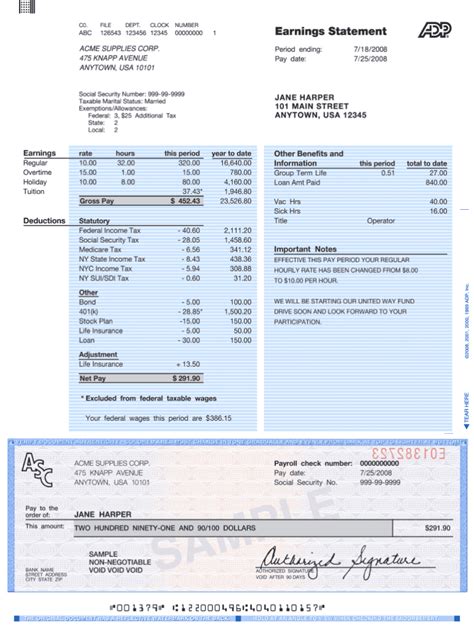

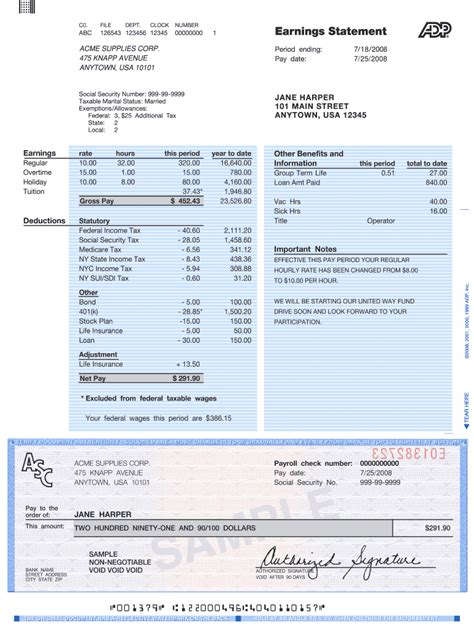

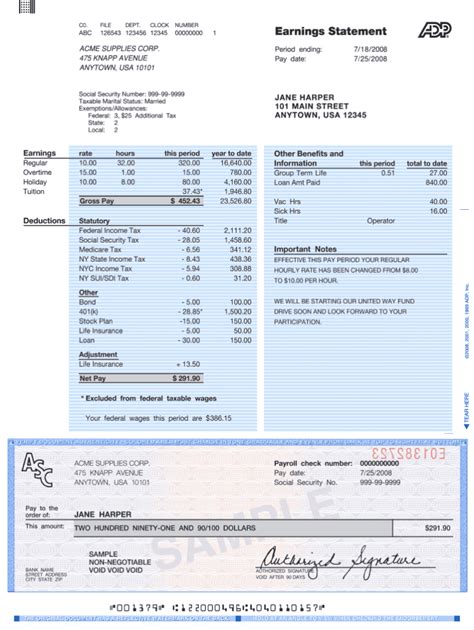

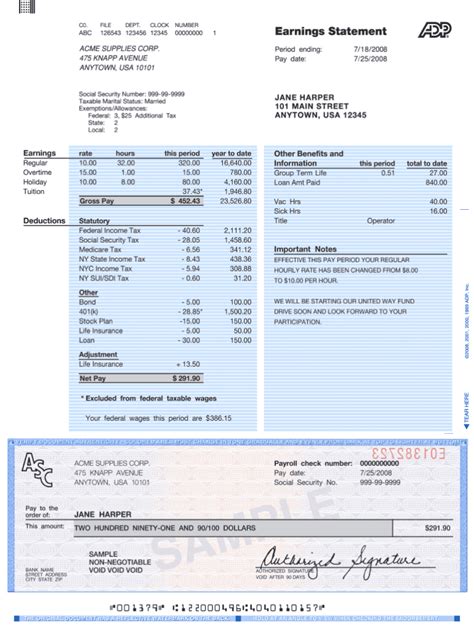

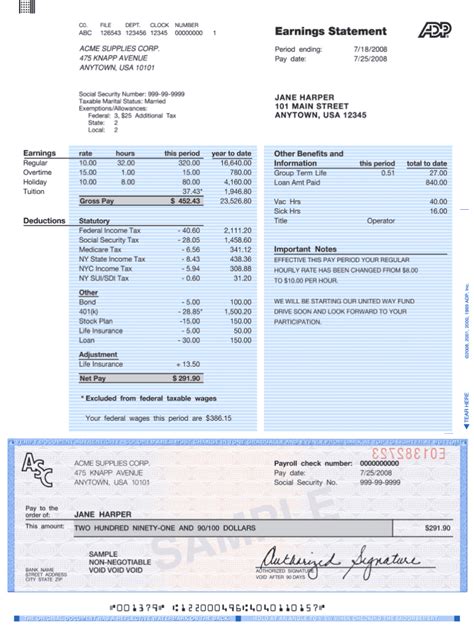

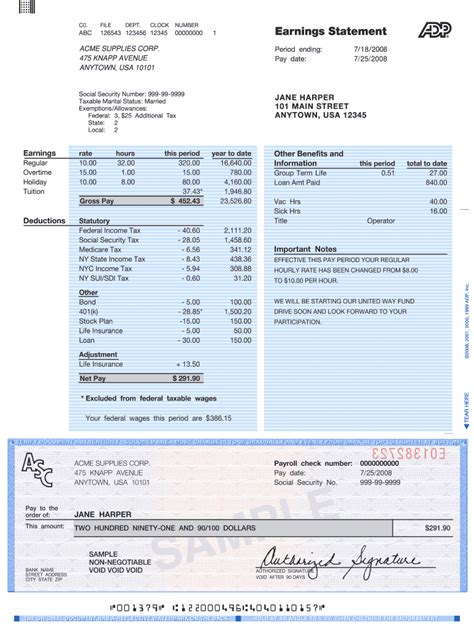

The world of payroll management can be complex, especially for large corporations like Walmart. As one of the biggest employers globally, Walmart needs an efficient system to manage its employees' pay stubs. A pay stub, also known as a paycheck stub, is a document that outlines an employee's payment details, including their gross pay, deductions, and net pay. In this article, we will delve into the world of Walmart pay stub templates, exploring their importance, benefits, and how they work.

Pay stubs are crucial for both employees and employers. For employees, they provide a clear breakdown of their earnings, helping them understand their financial situation. For employers, pay stubs serve as a record of payment, ensuring transparency and compliance with labor laws. Walmart, being a large corporation, requires a standardized pay stub template to streamline its payroll process. This template must include essential information such as employee details, payment dates, and deductions.

Understanding Walmart Pay Stub Templates

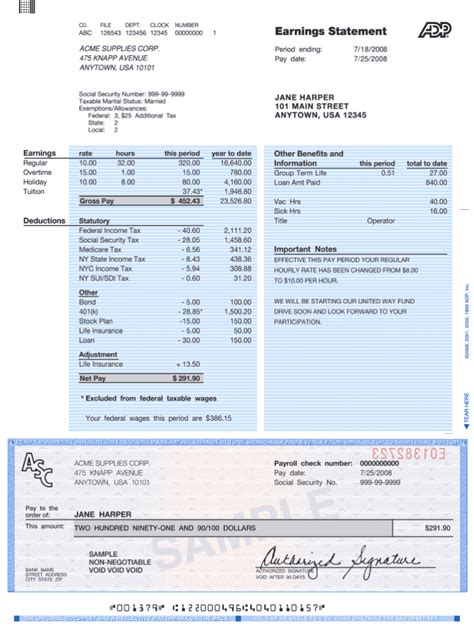

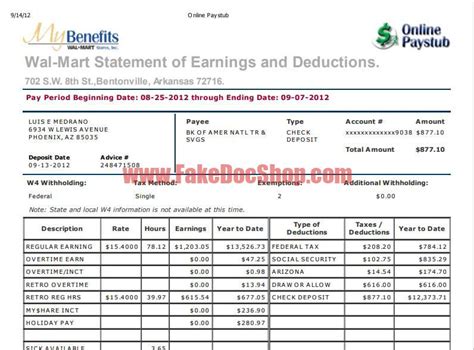

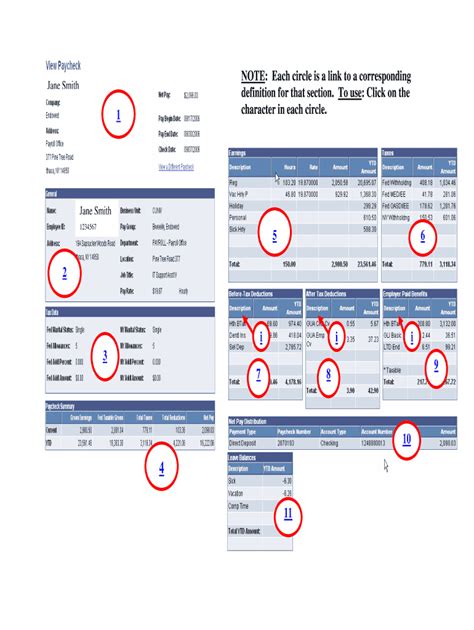

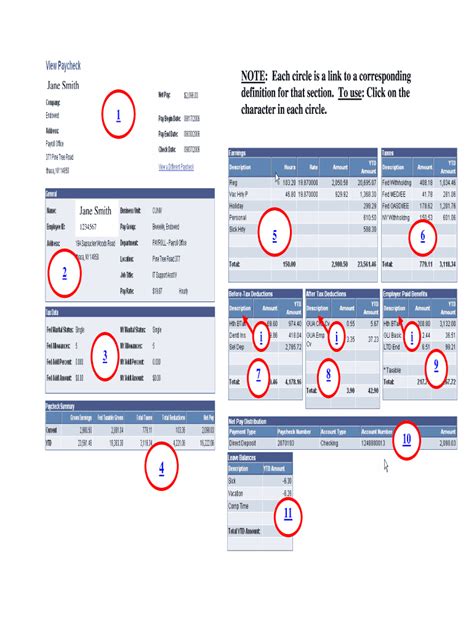

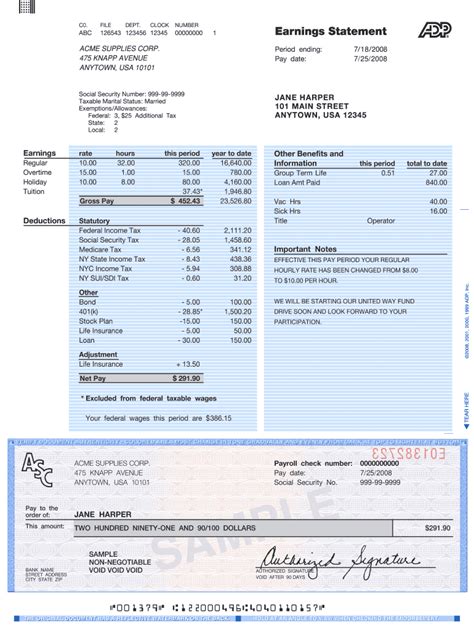

A Walmart pay stub template typically includes the following components:

- Employee information: name, employee ID, and address

- Payment details: pay date, pay period, and payment method

- Earnings: gross pay, net pay, and any additional income

- Deductions: taxes, health insurance, and other deductions

- Leave balances: available paid time off, sick leave, and vacation days

Having a standardized pay stub template helps Walmart ensure consistency across all its locations and departments. It also simplifies the payroll process, reducing errors and discrepancies.

Benefits of Using a Walmart Pay Stub Template

The benefits of using a Walmart pay stub template are numerous:

- Improved accuracy: reduces errors and discrepancies in payroll processing

- Increased efficiency: streamlines the payroll process, saving time and resources

- Enhanced transparency: provides employees with clear and detailed information about their pay

- Compliance: ensures adherence to labor laws and regulations

- Cost savings: reduces the need for manual processing and minimizes the risk of errors

By using a standardized pay stub template, Walmart can ensure that its payroll process is efficient, accurate, and transparent. This, in turn, can lead to increased employee satisfaction, reduced turnover rates, and improved overall productivity.

How to Create a Walmart Pay Stub Template

Creating a Walmart pay stub template involves several steps:

- Gather necessary information: collect employee data, payment details, and deduction information

- Choose a template format: select a suitable template format, such as Excel or PDF

- Design the template: include essential components, such as employee information, payment details, and deductions

- Test and review: test the template with sample data and review for accuracy and completeness

- Implement and maintain: implement the template and regularly update it to reflect changes in payroll policies or laws

It is essential to note that creating a pay stub template requires careful consideration of labor laws and regulations. Walmart must ensure that its template complies with federal and state laws, as well as company policies.

Walmart Pay Stub Template Examples

There are various examples of Walmart pay stub templates available online. These templates can be customized to suit specific needs and requirements. Some examples include:

- Basic pay stub template: includes essential information, such as employee details and payment dates

- Detailed pay stub template: provides a detailed breakdown of earnings and deductions

- Pay stub template with leave balances: includes available paid time off, sick leave, and vacation days

Using a Walmart pay stub template can help streamline the payroll process, reduce errors, and improve employee satisfaction. It is essential to choose a template that meets specific needs and requirements.

Best Practices for Using Walmart Pay Stub Templates

To get the most out of a Walmart pay stub template, follow these best practices:

- Regularly review and update the template to reflect changes in payroll policies or laws

- Ensure accuracy and completeness of employee data and payment information

- Use a standardized template format to simplify the payroll process

- Provide clear and detailed information about earnings and deductions

- Ensure compliance with labor laws and regulations

By following these best practices, Walmart can ensure that its pay stub template is effective, efficient, and compliant with relevant laws and regulations.

Common Mistakes to Avoid When Using Walmart Pay Stub Templates

When using a Walmart pay stub template, it is essential to avoid common mistakes, such as:

- Inaccurate or incomplete employee data

- Incorrect payment information or deductions

- Non-compliance with labor laws or regulations

- Failure to regularly review and update the template

- Inadequate security measures to protect employee data

By avoiding these common mistakes, Walmart can ensure that its pay stub template is effective, efficient, and compliant with relevant laws and regulations.

Gallery of Walmart Pay Stub Templates

Walmart Pay Stub Template Gallery

What is a Walmart pay stub template?

+A Walmart pay stub template is a document that outlines an employee's payment details, including their gross pay, deductions, and net pay.

Why is a Walmart pay stub template important?

+A Walmart pay stub template is important because it provides a clear breakdown of an employee's earnings, helping them understand their financial situation.

How do I create a Walmart pay stub template?

+To create a Walmart pay stub template, gather necessary information, choose a template format, design the template, test and review it, and implement and maintain it.

In conclusion, a Walmart pay stub template is a vital tool for managing employee payments. By understanding the importance of pay stubs, creating a standardized template, and following best practices, Walmart can ensure that its payroll process is efficient, accurate, and compliant with relevant laws and regulations. We invite you to share your thoughts and experiences with Walmart pay stub templates in the comments section below. If you found this article helpful, please share it with your friends and colleagues. Additionally, if you have any specific questions or topics you would like us to cover in future articles, please let us know. Your feedback is invaluable to us, and we look forward to hearing from you.