Intro

Discover the 5 Ways W4v Form simplifies tax withholding, offering employee guidance on allowances, exemptions, and income adjustments, streamlining payroll processing and tax compliance.

The W-4V form is a crucial document for individuals who receive certain government payments, such as Social Security benefits, unemployment compensation, or railroad retirement benefits. It allows them to voluntarily withhold federal income tax from these payments. Understanding the W-4V form and its uses is essential for managing one's tax obligations efficiently. In this article, we will delve into the specifics of the W-4V form, its importance, and how it can be utilized effectively.

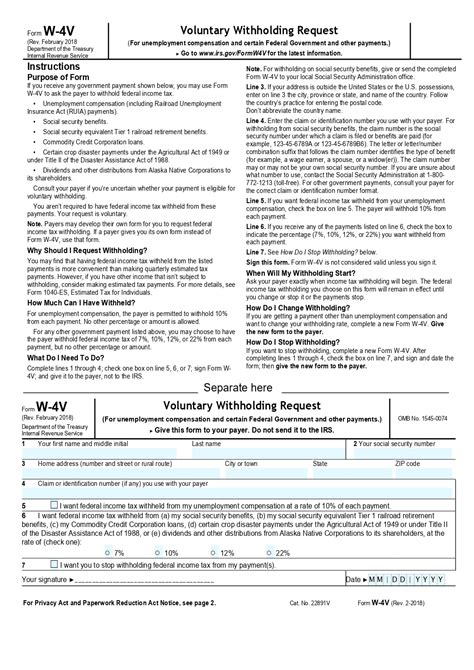

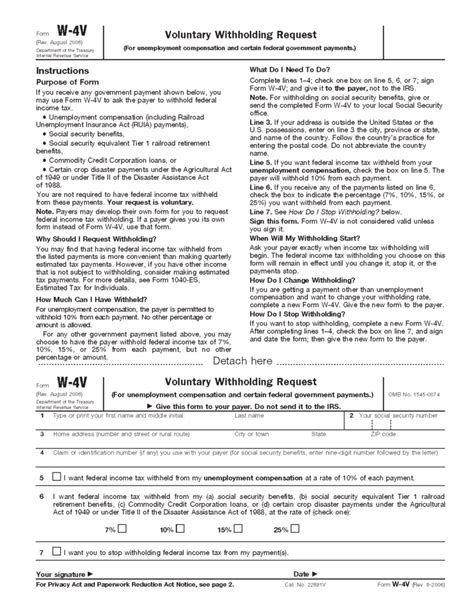

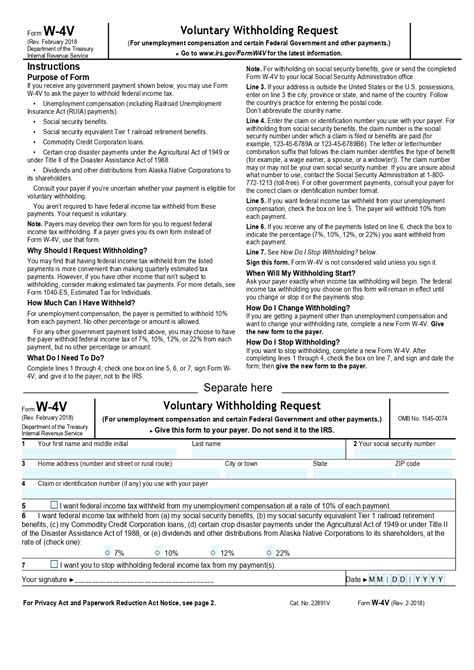

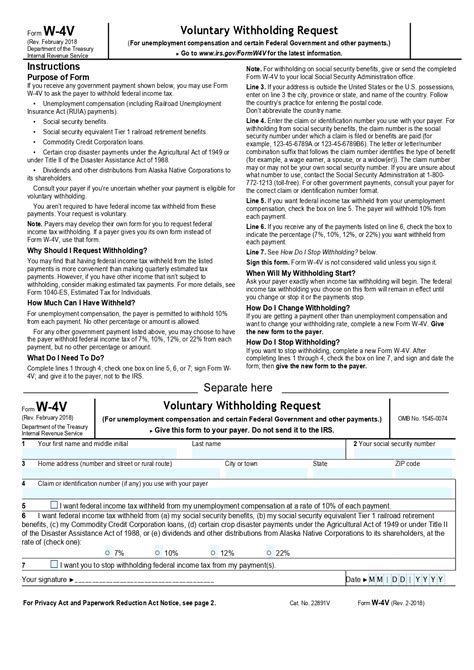

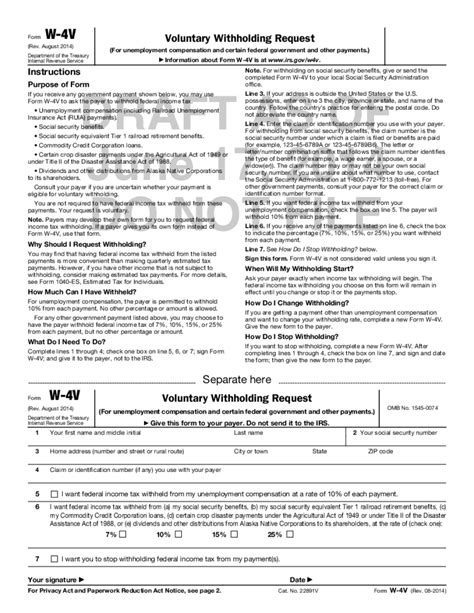

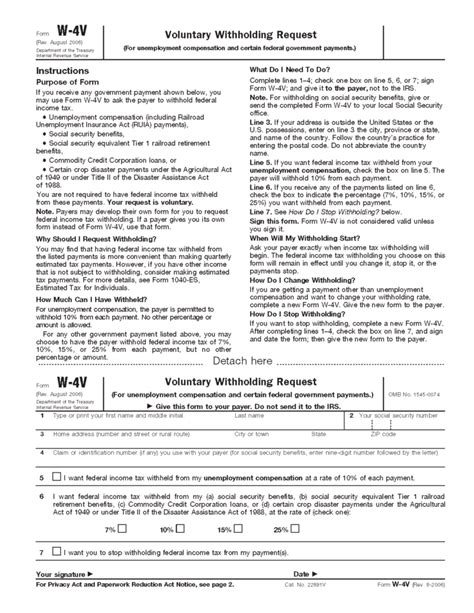

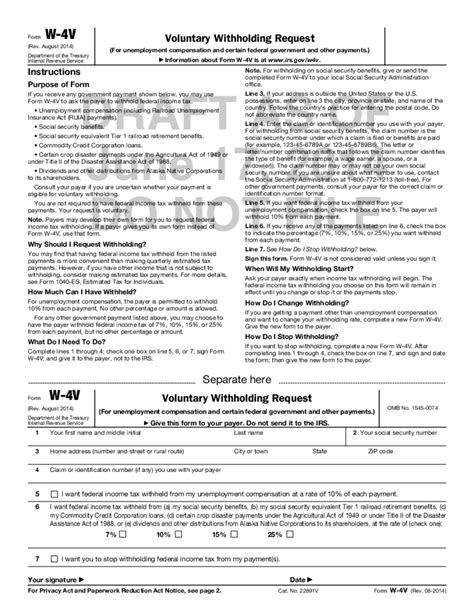

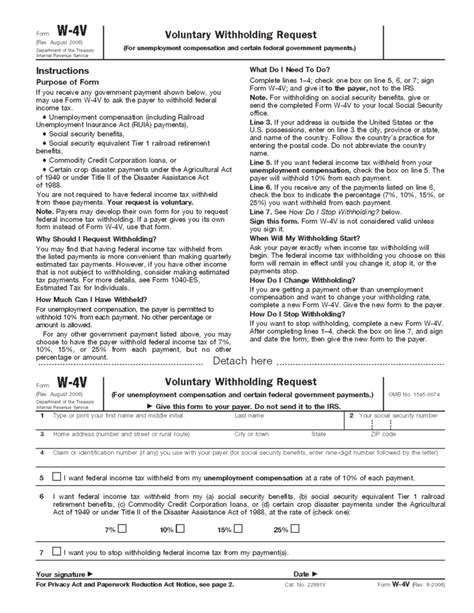

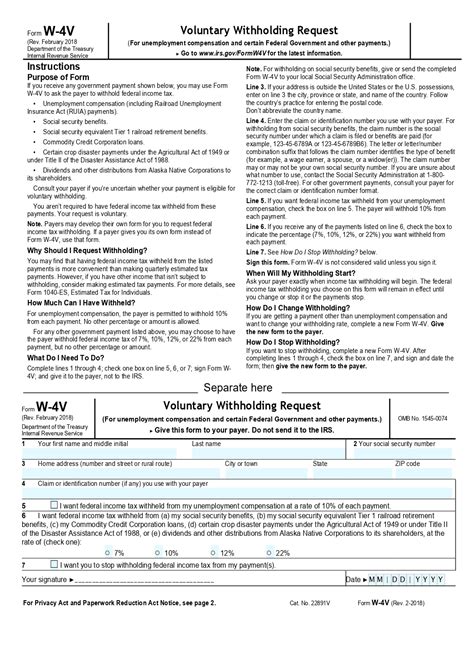

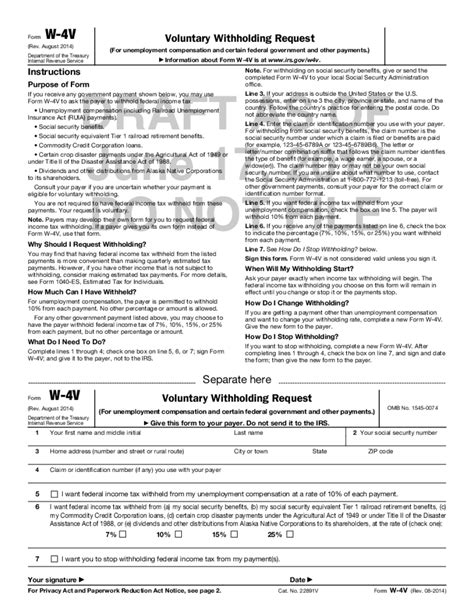

The W-4V form, also known as the Voluntary Withholding Request, is a form provided by the Internal Revenue Service (IRS) that enables recipients of certain government payments to request voluntary withholding of federal income tax. This can be particularly useful for individuals who wish to avoid a large tax bill at the end of the year or who prefer to have their taxes withheld incrementally throughout the year.

One of the primary reasons individuals choose to use the W-4V form is to manage their tax liability proactively. By having federal income tax withheld from their government payments, individuals can avoid the need to make estimated tax payments throughout the year. This can simplify their tax obligations and reduce the risk of incurring penalties for underpayment of taxes.

Another significant advantage of using the W-4V form is that it allows individuals to budget their taxes more effectively. By having a portion of their government payments withheld for taxes, individuals can better manage their cash flow and ensure they have sufficient funds available for their tax obligations when they file their tax return.

For individuals who receive Social Security benefits, the W-4V form can be especially beneficial. Social Security benefits are taxable, and recipients may need to pay federal income tax on their benefits. By using the W-4V form to request voluntary withholding, Social Security recipients can ensure that their tax obligations are met without having to make separate estimated tax payments.

In addition to its practical uses, the W-4V form also underscores the importance of tax planning and management. By taking proactive steps to manage their tax obligations, individuals can reduce their risk of incurring penalties and interest on underpaid taxes. Furthermore, the W-4V form highlights the need for individuals to stay informed about their tax obligations and to seek professional advice when necessary.

Understanding the W-4V Form

To understand the W-4V form fully, it's essential to grasp its components and how it is used. The form itself is relatively straightforward, requiring individuals to provide basic personal and payment information. This includes their name, address, and the type of government payment they receive. Individuals must also specify the amount of federal income tax they wish to have withheld from each payment.

The W-4V form can be completed and submitted to the payer of the government benefits, such as the Social Security Administration or the Railroad Retirement Board. Once the form is processed, the specified amount of federal income tax will be withheld from the individual's payments.

Benefits of Using the W-4V Form

The benefits of using the W-4V form are multifaceted. Not only does it allow individuals to manage their tax obligations more effectively, but it also provides a sense of security and peace of mind. By having federal income tax withheld from their government payments, individuals can avoid the stress and financial burden associated with making large tax payments at the end of the year.Moreover, the W-4V form can be particularly advantageous for individuals who have variable income or who experience fluctuations in their government payments. By adjusting the amount of federal income tax withheld, individuals can ensure that their tax obligations are met without incurring unnecessary penalties or interest.

How to Complete the W-4V Form

Completing the W-4V form is a relatively straightforward process. Individuals will need to provide their personal and payment information, as well as specify the amount of federal income tax they wish to have withheld. It's essential to ensure that the form is completed accurately and submitted to the correct payer.

To complete the W-4V form, individuals should follow these steps:

- Obtain the W-4V form from the IRS website or from the payer of their government benefits.

- Complete the form by providing the required personal and payment information.

- Specify the amount of federal income tax to be withheld from each payment.

- Submit the completed form to the payer of the government benefits.

Steps to Manage Tax Obligations Effectively

Managing tax obligations effectively requires a combination of planning, organization, and proactive steps. Here are some key steps individuals can take to manage their tax obligations: - Stay informed about tax laws and regulations. - Keep accurate and detailed records of income and expenses. - Consult with a tax professional or financial advisor. - Utilize tax planning tools and resources. - Review and adjust tax withholding as necessary.Importance of Tax Planning

Tax planning is a critical aspect of managing one's financial affairs. By taking proactive steps to plan and manage their tax obligations, individuals can reduce their risk of incurring penalties and interest, minimize their tax liability, and ensure they are in compliance with all tax laws and regulations.

Effective tax planning involves a range of strategies and techniques, including:

- Utilizing tax deductions and credits.

- Managing tax withholding and estimated tax payments.

- Investing in tax-advantaged accounts and investments.

- Consulting with a tax professional or financial advisor.

Tax Planning Strategies

There are numerous tax planning strategies that individuals can use to minimize their tax liability and manage their tax obligations effectively. Some of these strategies include: - Utilizing tax-deferred retirement accounts, such as 401(k) or IRA accounts. - Investing in tax-advantaged investments, such as municipal bonds or real estate investment trusts (REITs). - Claiming tax deductions and credits, such as the mortgage interest deduction or the earned income tax credit. - Managing tax withholding and estimated tax payments to avoid underpayment penalties.Conclusion and Next Steps

In conclusion, the W-4V form is a valuable tool for individuals who receive certain government payments and wish to manage their tax obligations proactively. By understanding the form and its uses, individuals can take control of their tax affairs and ensure they are in compliance with all tax laws and regulations.

To take the next steps in managing their tax obligations, individuals should:

- Consult with a tax professional or financial advisor.

- Review and adjust their tax withholding as necessary.

- Utilize tax planning tools and resources.

- Stay informed about tax laws and regulations.

Final Thoughts

The W-4V form is an essential document for individuals who wish to manage their tax obligations effectively. By completing and submitting the form, individuals can ensure that their tax obligations are met without incurring unnecessary penalties or interest. Remember, tax planning is an ongoing process that requires proactive steps and a commitment to staying informed.W4v Form Image Gallery

What is the W-4V form used for?

+The W-4V form is used to request voluntary withholding of federal income tax from certain government payments, such as Social Security benefits or unemployment compensation.

How do I complete the W-4V form?

+To complete the W-4V form, you will need to provide your personal and payment information, as well as specify the amount of federal income tax you wish to have withheld from each payment.

What are the benefits of using the W-4V form?

+The benefits of using the W-4V form include managing tax obligations proactively, avoiding large tax bills at the end of the year, and reducing the risk of incurring penalties and interest on underpaid taxes.

Can I change my withholding amount on the W-4V form?

+Yes, you can change your withholding amount on the W-4V form by completing a new form and submitting it to the payer of your government benefits.

Where can I get more information about the W-4V form?

+You can get more information about the W-4V form by visiting the IRS website or consulting with a tax professional or financial advisor.

Now that you have read this comprehensive guide to the W-4V form, we encourage you to share your thoughts and experiences with tax planning and management. Have you used the W-4V form to manage your tax obligations? What strategies have you found most effective for minimizing your tax liability? Share your comments and insights below, and don't forget to share this article with others who may benefit from this information. By working together and sharing our knowledge, we can all better navigate the complex world of taxes and ensure we are in compliance with all tax laws and regulations.