Intro

Boost trucking finances with 5 essential pay stub tips, including accurate logging, mileage tracking, and expense reporting to maximize driver earnings and minimize errors, ensuring seamless trucking payroll management and compliance.

The trucking industry is a vital part of the global economy, with millions of truckers working hard to deliver goods and products to businesses and consumers. As a trucker, receiving an accurate and timely pay stub is crucial to managing your finances and ensuring you're fairly compensated for your work. In this article, we'll provide 5 trucking pay stub tips to help you navigate the complex world of trucking payroll.

Trucking pay stubs can be confusing, especially for new drivers who are unfamiliar with the various deductions and calculations involved. However, understanding your pay stub is essential to avoiding potential errors and discrepancies. By following these tips, you'll be better equipped to manage your finances, plan for the future, and avoid any potential issues with your employer.

The importance of accurate pay stubs cannot be overstated. Not only do they provide a clear record of your earnings and deductions, but they also help you track your hours worked, miles driven, and other key metrics. With this information, you can make informed decisions about your career, negotiate with your employer, and plan for retirement or other long-term goals. In the following sections, we'll delve deeper into the world of trucking pay stubs, exploring the key elements, common mistakes, and best practices for drivers.

Understanding Your Pay Stub

Key Elements of a Trucking Pay Stub

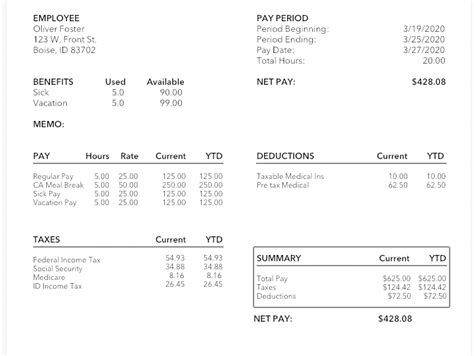

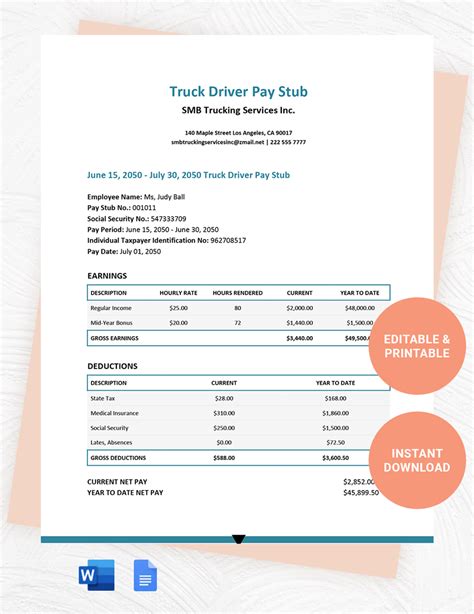

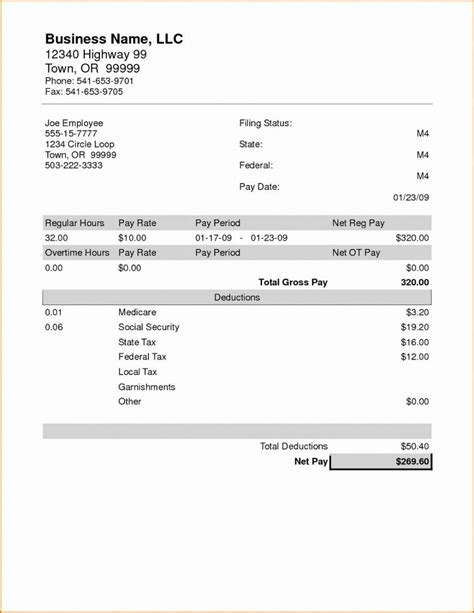

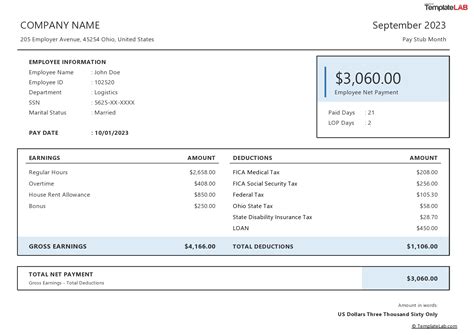

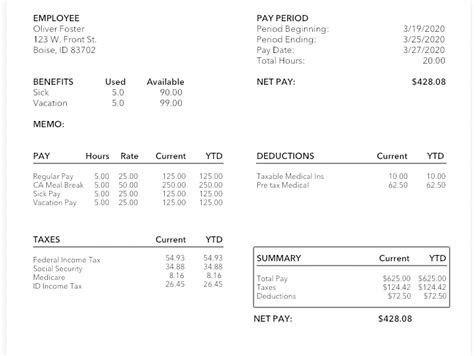

When reviewing your pay stub, look for the following key elements: * Gross pay: Your total earnings before deductions * Net pay: Your take-home pay after deductions * Deductions: Taxes, insurance, fuel costs, and other expenses * Hours worked: The number of hours you've worked during the pay period * Miles driven: The total miles you've driven during the pay period * Additional compensation: Any extra pay or benefits, such as bonuses or overtimeCommon Mistakes to Watch Out For

How to Avoid Pay Stub Mistakes

To avoid these mistakes, follow these best practices: * Review your pay stub carefully each pay period * Verify your hours worked and miles driven against your logs or records * Check for any discrepancies or errors in your deductions or benefits * Contact your employer or payroll department immediately if you notice any issuesTrucking Pay Stub Tips

Additional Tips for Truckers

In addition to these tips, consider the following best practices: * Stay organized: Keep all your pay stubs and financial records in a safe and accessible place. * Seek professional advice: If you're unsure about any aspect of your pay stub or finances, consider consulting a financial advisor or accountant. * Take advantage of benefits: Make the most of any benefits or perks offered by your employer, such as health insurance, retirement plans, or paid time off.Gallery of Trucking Pay Stub Examples

Trucking Pay Stub Image Gallery

Frequently Asked Questions

What is a trucking pay stub?

+A trucking pay stub is a document that outlines a truck driver's earnings, deductions, and other compensation for a given pay period.

How do I read my trucking pay stub?

+To read your trucking pay stub, look for the key elements such as gross pay, net pay, deductions, hours worked, and miles driven.

What are some common mistakes to watch out for on my trucking pay stub?

+Common mistakes to watch out for include incorrect hours worked or miles driven, miscalculated deductions or benefits, and missing or delayed payments.

How can I avoid pay stub mistakes?

+To avoid pay stub mistakes, review your pay stub carefully each pay period, verify your hours worked and miles driven, and contact your employer or payroll department if you notice any issues.

What are some tips for managing my trucking pay stub?

+Tips for managing your trucking pay stub include keeping accurate records, reviewing your pay stub carefully, understanding your deductions, negotiating with your employer, and planning for the future.

In

Final Thoughts