Intro

Boost trading performance with 5 expert-approved trading journal templates, featuring technical analysis, risk management, and market insights to refine your strategy and optimize trades.

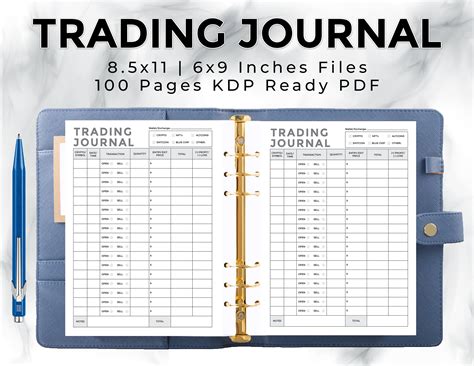

Trading journals are essential tools for traders to track their progress, identify patterns, and refine their strategies. A well-structured trading journal template can help traders to stay organized, focused, and disciplined. In this article, we will explore five different trading journal templates that can be used by traders to improve their performance.

The importance of keeping a trading journal cannot be overstated. It allows traders to reflect on their decisions, analyze their mistakes, and make data-driven improvements to their trading strategies. By using a trading journal template, traders can ensure that they are capturing all the relevant information about their trades, including the date, time, asset, entry and exit points, and profit or loss. This information can be used to identify areas for improvement, develop new strategies, and optimize existing ones.

A trading journal template can also help traders to stay accountable and motivated. By regularly reviewing their journal entries, traders can identify patterns and trends in their trading behavior, such as over-trading or under-trading, and make adjustments accordingly. Additionally, a trading journal template can provide a sense of structure and discipline, which is essential for traders to achieve their goals.

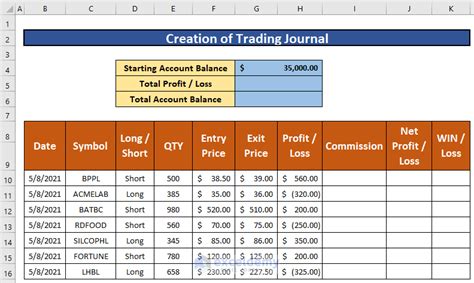

Template 1: Basic Trading Journal

Here is an example of what the basic trading journal template might look like:

- Date: 2022-01-01

- Time: 09:00

- Asset: EUR/USD

- Entry Point: 1.2000

- Exit Point: 1.2100

- Profit/Loss: $100

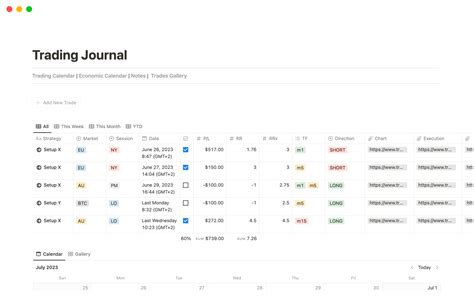

Template 2: Advanced Trading Journal

Here is an example of what the advanced trading journal template might look like:

- Date: 2022-01-01

- Time: 09:00

- Asset: EUR/USD

- Entry Point: 1.2000

- Exit Point: 1.2100

- Profit/Loss: $100

- Trading Strategy: Trend Following

- Risk Management: Stop-Loss Order

- Market Analysis: Technical Analysis

Template 3: Trading Performance Journal

Here is an example of what the trading performance journal template might look like:

- Date: 2022-01-01

- Profit/Loss: $100

- Percentage Return: 2%

- Running Total: $1,000

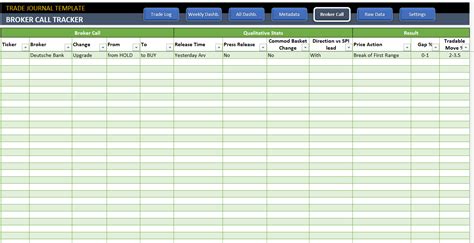

Template 4: Trade Review Journal

Here is an example of what the trade review journal template might look like:

- Trade Details:

- Date: 2022-01-01

- Time: 09:00

- Asset: EUR/USD

- Entry Point: 1.2000

- Exit Point: 1.2100

- Notes and Comments: The trade was based on a technical analysis of the market. The entry point was determined by a trend line, and the exit point was determined by a profit target.

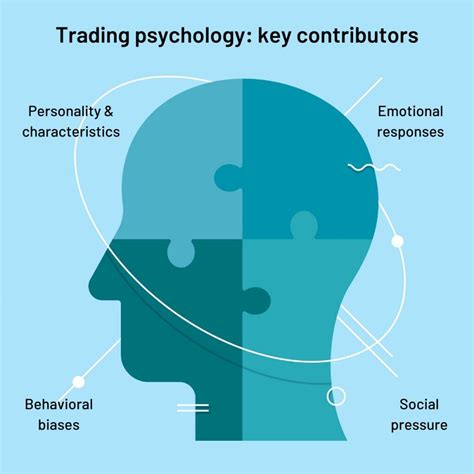

Template 5: Psychological Trading Journal

Here is an example of what the psychological trading journal template might look like:

- Date: 2022-01-01

- Mood: Confident

- Confidence Level: 8/10

- Risk Tolerance: High

- Notes and Comments: I felt confident in my trading decisions today, but I also felt a sense of anxiety when the market moved against me.

Benefits of Using a Trading Journal Template

Using a trading journal template can have numerous benefits for traders, including: * Improved discipline and accountability * Enhanced trading performance * Increased self-awareness and emotional intelligence * Better risk management and trade planning * More effective trade analysis and reviewBest Practices for Using a Trading Journal Template

To get the most out of a trading journal template, traders should follow these best practices: * Use the template consistently and regularly * Be honest and accurate when recording trades and emotions * Review and analyze the journal entries regularly * Use the insights and lessons learned to adjust trading strategies and improve performanceTrading Journal Templates Image Gallery

What is a trading journal template?

+A trading journal template is a tool used by traders to track and record their trades, including the date, time, asset, entry and exit points, and profit or loss.

Why is it important to use a trading journal template?

+Using a trading journal template can help traders to improve their discipline and accountability, enhance their trading performance, and increase their self-awareness and emotional intelligence.

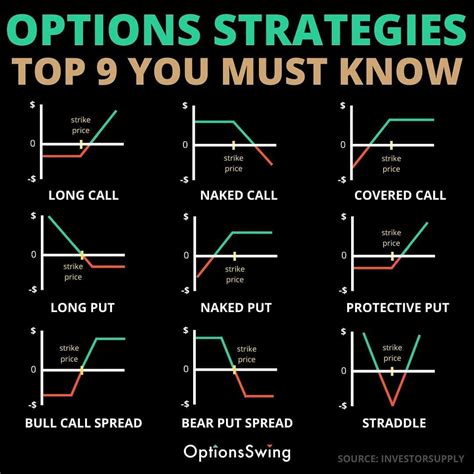

What are the different types of trading journal templates?

+There are several types of trading journal templates, including basic trading journals, advanced trading journals, trading performance journals, trade review journals, and psychological trading journals.

How can I use a trading journal template to improve my trading performance?

+Using a trading journal template can help you to identify patterns and trends in your trading behavior, develop new strategies, and optimize existing ones. By regularly reviewing your journal entries, you can gain insights and lessons that can be used to adjust your trading strategies and improve your performance.

Can I customize a trading journal template to suit my needs?

+Yes, you can customize a trading journal template to suit your needs. You can add or remove columns, change the layout, and modify the template to fit your specific trading style and goals.

In