Intro

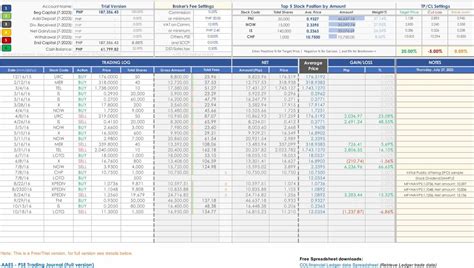

Boost trading performance with 5 expert-approved trading journal templates, featuring technical analysis, risk management, and market insights to refine your strategy and optimize trades.

Trading journals are essential tools for traders to track their progress, identify patterns, and refine their strategies. A well-structured trading journal template can help traders to organize their thoughts, analyze their performance, and make data-driven decisions. In this article, we will explore five trading journal templates that can help traders to improve their trading skills and achieve their financial goals.

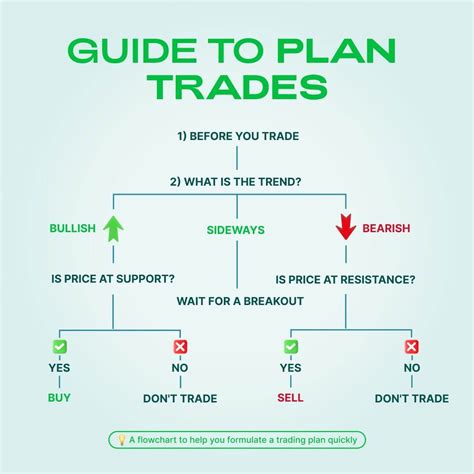

The importance of trading journals cannot be overstated. By keeping a record of their trades, traders can identify areas of strength and weakness, develop a trading plan, and stay accountable for their actions. A trading journal can also help traders to manage their emotions, avoid impulsive decisions, and stay focused on their long-term objectives. With a trading journal template, traders can streamline their workflow, save time, and concentrate on what matters most - making profitable trades.

Trading journals are not just for experienced traders; they are also essential for beginners who want to learn the ropes and develop good trading habits. By using a trading journal template, new traders can learn from their mistakes, develop a trading strategy, and build confidence in their abilities. Whether you are a seasoned trader or just starting out, a trading journal template can help you to achieve your trading goals and become a more successful trader.

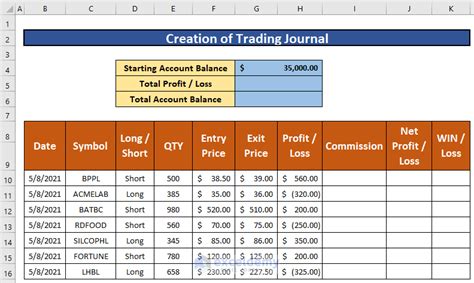

Template 1: Basic Trading Journal

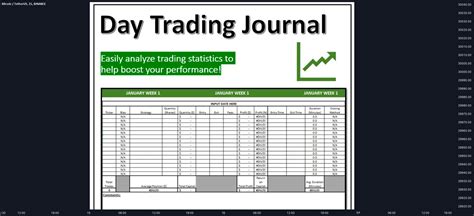

Template 2: Advanced Trading Journal

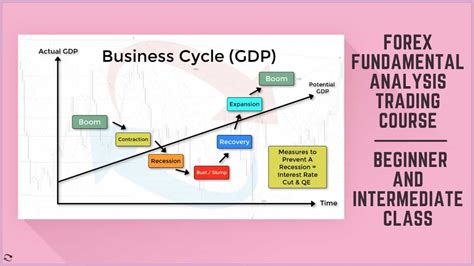

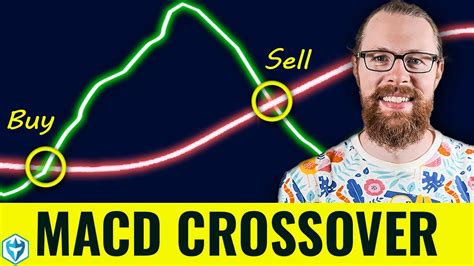

Template 3: Technical Analysis Trading Journal

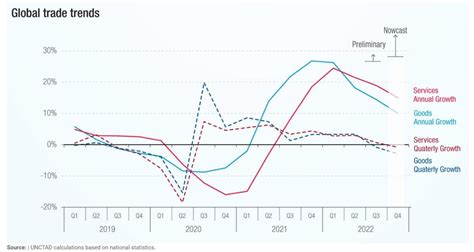

Template 4: Fundamental Analysis Trading Journal

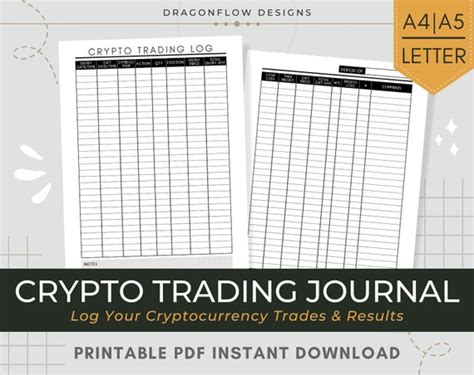

Template 5: Cryptocurrency Trading Journal

Benefits of Using a Trading Journal Template

Using a trading journal template can have numerous benefits for traders. Some of the benefits include: * Improved trading performance: By tracking their trades, traders can identify areas of strength and weakness and make adjustments to their strategy. * Increased accountability: A trading journal template can help traders to stay accountable for their actions and avoid impulsive decisions. * Enhanced risk management: By tracking their risk/reward ratio and maximum drawdown, traders can manage their risk more effectively. * Better trade planning: A trading journal template can help traders to plan their trades more effectively and set realistic goals.How to Choose the Right Trading Journal Template

Choosing the right trading journal template depends on several factors, including the trader's experience level, trading strategy, and personal preferences. Here are some tips for choosing the right template: * Consider your trading strategy: If you are a technical analyst, you may want to choose a template that focuses on technical indicators. If you are a fundamental analyst, you may want to choose a template that focuses on fundamental indicators. * Consider your experience level: If you are a beginner, you may want to choose a simple template that is easy to use. If you are an experienced trader, you may want to choose a more comprehensive template that includes advanced features. * Consider your personal preferences: Some traders may prefer a template that is highly customizable, while others may prefer a template that is easy to use and requires minimal setup.Trading Journal Templates Image Gallery

What is a trading journal template?

+A trading journal template is a pre-designed spreadsheet or document that helps traders to track and record their trades, including the date, time, symbol, entry price, exit price, position size, profit/loss, and notes.

Why do I need a trading journal template?

+A trading journal template can help you to improve your trading performance, increase accountability, and enhance risk management. It can also help you to identify areas of strength and weakness, develop a trading plan, and stay focused on your long-term objectives.

How do I choose the right trading journal template?

+Choosing the right trading journal template depends on several factors, including your trading strategy, experience level, and personal preferences. Consider what features are important to you, such as technical indicators, fundamental analysis, or risk management tools.

Can I customize a trading journal template?

+Yes, many trading journal templates can be customized to fit your specific needs. You can add or remove columns, change the layout, and add your own formulas and calculations.

What are the benefits of using a trading journal template?

+The benefits of using a trading journal template include improved trading performance, increased accountability, enhanced risk management, and better trade planning. It can also help you to identify areas of strength and weakness, develop a trading plan, and stay focused on your long-term objectives.

In