Intro

Master thinkorswim custom order template setup with ease, leveraging trading tools, conditional orders, and advanced strategies to streamline your investment workflow and maximize profits.

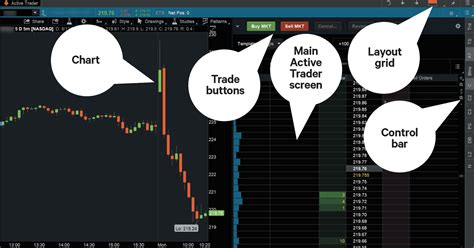

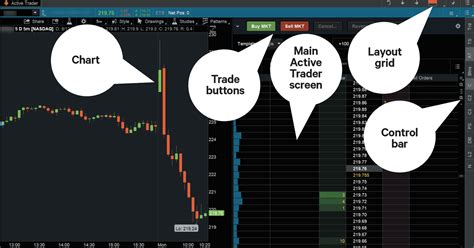

When it comes to trading and investing, having the right tools at your disposal can make all the difference. Thinkorswim, a popular trading platform, offers a wide range of features and customization options to help traders optimize their workflow. One of the most useful features of thinkorswim is the ability to create custom order templates. In this article, we will explore the importance of custom order templates, how to set them up, and how to use them to improve your trading experience.

The ability to create custom order templates is a game-changer for traders who want to streamline their workflow and reduce errors. By setting up custom templates, traders can quickly and easily place orders with their preferred settings, saving time and reducing the risk of mistakes. Whether you're a seasoned pro or just starting out, custom order templates can help you trade with confidence and precision.

To get started with custom order templates, you'll need to have a thinkorswim account and be familiar with the platform's basic features. If you're new to thinkorswim, don't worry – we'll walk you through the setup process step by step. With a little practice, you'll be creating custom order templates like a pro and taking your trading to the next level.

Setting Up Custom Order Templates

To set up a custom order template in thinkorswim, follow these steps:

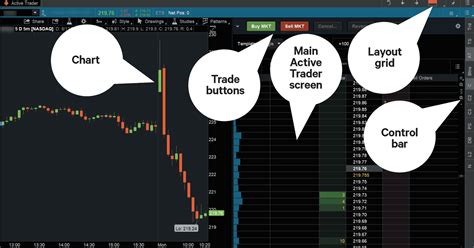

- Log in to your thinkorswim account and navigate to the "Trade" tab.

- Click on the "Order Template" button, located at the top of the screen.

- Select "Create New Template" from the drop-down menu.

- Give your template a name and description, and then start adding your preferred settings.

- Choose the order type, such as a market order or limit order, and set your preferred quantity and price.

- You can also add additional settings, such as stop-loss and take-profit levels, and choose your preferred routing and execution options.

Customizing Your Template

Once you've created your template, you can customize it to fit your specific trading needs. Some things to consider when customizing your template include:

- Order type: Do you want to use a market order, limit order, or stop order?

- Quantity: How many shares or contracts do you want to trade?

- Price: What price do you want to pay or receive for your trade?

- Stop-loss and take-profit levels: Do you want to set automatic stop-loss and take-profit levels to limit your risk and lock in profits?

- Routing and execution options: Do you want to use a specific exchange or routing option to execute your trade?

Using Your Custom Order Template

Once you've created and customized your template, you can use it to place orders with ease. To use your custom order template, follow these steps:

- Navigate to the "Trade" tab and select the security you want to trade.

- Click on the "Order Template" button and select your custom template from the drop-down menu.

- Review your template settings to make sure everything is correct.

- Click "Send" to place your order.

Tips and Tricks

Here are some tips and tricks to help you get the most out of your custom order templates:

- Use descriptive names for your templates to help you quickly identify them.

- Consider creating multiple templates for different trading scenarios or strategies.

- Use the "Save As" feature to create a new template based on an existing one.

- Experiment with different settings and options to find what works best for you.

Benefits of Custom Order Templates

Custom order templates offer a number of benefits for traders, including:

- Increased efficiency: With custom templates, you can place orders quickly and easily, saving time and reducing the risk of mistakes.

- Improved accuracy: By using a template, you can ensure that your orders are placed with the correct settings and options.

- Enhanced flexibility: Custom templates allow you to adapt to changing market conditions and trading scenarios.

- Better risk management: By setting automatic stop-loss and take-profit levels, you can limit your risk and lock in profits.

Common Mistakes to Avoid

When using custom order templates, there are several common mistakes to avoid, including:

- Failing to review template settings before placing an order.

- Using the wrong template for a particular trading scenario.

- Not updating templates to reflect changing market conditions or trading strategies.

- Not using automatic stop-loss and take-profit levels to manage risk.

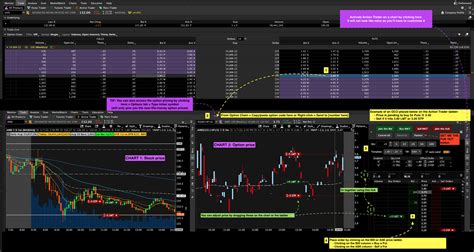

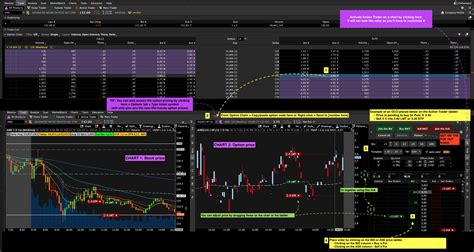

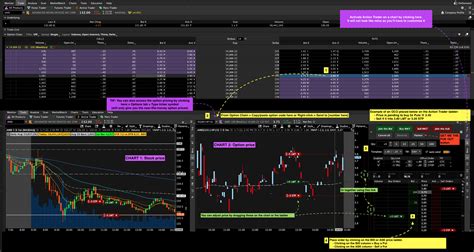

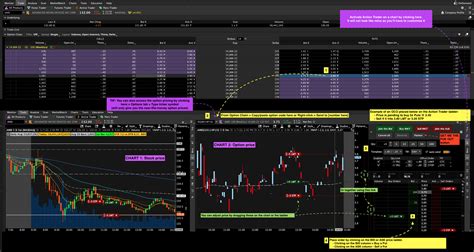

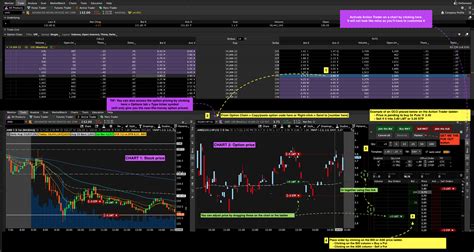

Advanced Custom Order Template Features

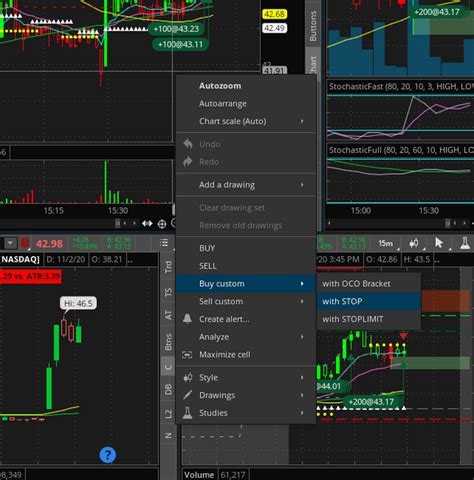

Thinkorswim offers a number of advanced features for custom order templates, including:

- Conditional orders: Allow you to place orders based on specific market conditions or events.

- Bracket orders: Allow you to set automatic stop-loss and take-profit levels for a trade.

- OCO (One Cancels the Other) orders: Allow you to place multiple orders that are contingent on each other.

- OSO (Order Sends Order) orders: Allow you to place an order that is contingent on the execution of another order.

Best Practices for Custom Order Templates

Here are some best practices to keep in mind when using custom order templates:

- Keep your templates organized and up to date.

- Use descriptive names for your templates to help you quickly identify them.

- Test your templates in a simulated environment before using them in live trading.

- Continuously monitor and evaluate your templates to ensure they are working as intended.

Thinkorswim Custom Order Template Gallery

What is a custom order template in thinkorswim?

+A custom order template is a pre-defined set of order settings that can be used to place orders quickly and efficiently.

How do I create a custom order template in thinkorswim?

+To create a custom order template, navigate to the "Trade" tab, click on the "Order Template" button, and select "Create New Template" from the drop-down menu.

What are the benefits of using custom order templates in thinkorswim?

+The benefits of using custom order templates include increased efficiency, improved accuracy, enhanced flexibility, and better risk management.

Can I use custom order templates for multiple trading scenarios?

+Yes, you can create multiple custom order templates for different trading scenarios or strategies.

How do I update my custom order templates in thinkorswim?

+To update your custom order templates, navigate to the "Trade" tab, click on the "Order Template" button, and select the template you want to update from the drop-down menu.

In conclusion, custom order templates are a powerful tool for thinkorswim users, allowing them to streamline their workflow, reduce errors, and improve their overall trading experience. By following the steps outlined in this article, you can create and customize your own templates to fit your specific trading needs. Whether you're a seasoned pro or just starting out, custom order templates can help you trade with confidence and precision. So why not give them a try? With a little practice, you'll be creating custom order templates like a pro and taking your trading to the next level. Share your thoughts and experiences with custom order templates in the comments below, and don't forget to share this article with your fellow traders!