Intro

Discover 5 Texas insurance tips for navigating auto, home, and health coverage, including policy comparisons, claims guidance, and risk management strategies to save money and ensure protection.

The vast and diverse state of Texas, known for its rich history, vibrant culture, and thriving economy. When it comes to insurance, Texans have a wide range of options to choose from, but navigating the complex world of insurance can be overwhelming. Whether you're a native Texan or a newcomer to the Lone Star State, it's essential to have the right insurance coverage to protect yourself, your loved ones, and your assets. In this article, we'll delve into the world of Texas insurance, providing you with valuable tips and insights to help you make informed decisions about your insurance needs.

From the sun-kissed beaches of South Padre Island to the bustling streets of Houston, Texas is a state that's full of life and energy. However, with great beauty comes great risk, and Texans face a unique set of challenges when it comes to insurance. From hurricanes and wildfires to car accidents and health emergencies, there are many potential risks that can have a significant impact on your life and finances. By understanding the insurance landscape in Texas and taking proactive steps to protect yourself, you can enjoy peace of mind and financial security, no matter what life throws your way.

As you explore the world of Texas insurance, you'll encounter a wide range of options and providers, each with their own strengths and weaknesses. With so many choices available, it can be difficult to know where to start or how to make sense of the complex terminology and policies. That's why we've put together this comprehensive guide, designed to provide you with the knowledge and expertise you need to navigate the Texas insurance market with confidence. Whether you're looking for auto insurance, health insurance, home insurance, or something else, we've got you covered with expert advice and insider tips to help you get the best coverage at the best price.

Understanding Texas Insurance Laws and Regulations

Some key aspects of Texas insurance laws and regulations include:

- The Texas Insurance Code, which outlines the rules and guidelines for insurance providers in the state

- The Texas Department of Insurance, which regulates and oversees the insurance industry in Texas

- The Texas Windstorm Insurance Association, which provides windstorm and hail insurance to homeowners in coastal areas

- The Texas Fair Plan, which provides basic property insurance to homeowners who are unable to obtain coverage through traditional means

By understanding these laws and regulations, you can better navigate the Texas insurance market and make informed decisions about your coverage.

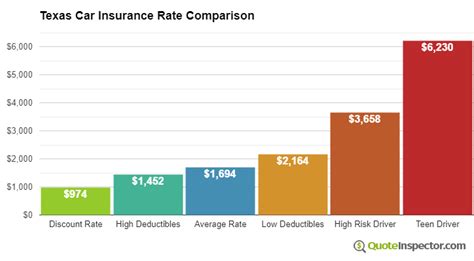

Tip #1: Shop Around for the Best Rates

Some tips for shopping around for Texas insurance rates include:

- Using online comparison tools to get quotes from multiple providers

- Contacting local insurance agents to discuss your options and get personalized quotes

- Reviewing your policy regularly to ensure you're getting the best rates

- Considering bundling multiple policies with the same provider to save money

By shopping around for the best rates, you can save money on your Texas insurance premiums and enjoy greater financial security.

Tip #2: Understand Your Policy

Some key aspects of your Texas insurance policy to understand include:

- The types of coverage included, such as liability, collision, and comprehensive

- The policy limits, which determine the maximum amount your provider will pay out in the event of a claim

- The deductible, which is the amount you must pay out of pocket before your coverage kicks in

- The exclusions, which are the types of losses or damages that are not covered by your policy

By understanding your policy, you can make informed decisions about your coverage and avoid costly mistakes.

Tip #3: Consider Bundling Multiple Policies

Some benefits of bundling multiple policies include:

- Discounts on your premiums, which can help you save money

- Simplified billing and payment, which can make it easier to manage your coverage

- Enhanced customer service, which can provide you with greater support and guidance

- Increased convenience, which can make it easier to manage your insurance needs

By considering bundling multiple policies, you can save money and enjoy greater convenience and flexibility.

Tip #4: Take Advantage of Discounts

Some common discounts available to Texas insurance policyholders include:

- Good student discounts, which reward students for their academic achievements

- Military discounts, which provide lower rates for military personnel and their families

- Multi-car discounts, which offer lower rates for policyholders who insure multiple vehicles

- Home security discounts, which reward homeowners for installing security systems and other safety features

By taking advantage of these discounts, you can save money on your Texas insurance premiums and enjoy greater financial security.

Tip #5: Review Your Policy Regularly

Some tips for reviewing your Texas insurance policy include:

- Scheduling regular reviews with your insurance agent or provider

- Updating your policy to reflect changes in your life, such as a new home or a new vehicle

- Comparing rates and coverage options to ensure you're getting the best deal

- Considering new types of coverage, such as umbrella insurance or flood insurance

By reviewing your policy regularly, you can ensure you're getting the best coverage at the best price and enjoy greater peace of mind.

Texas Insurance Image Gallery

What types of insurance are available in Texas?

+Texas offers a wide range of insurance types, including auto insurance, health insurance, home insurance, life insurance, and more.

How do I choose the right insurance provider in Texas?

+When choosing an insurance provider in Texas, consider factors such as policy options, rates, customer service, and financial stability.

What are the benefits of bundling multiple policies in Texas?

+Bundling multiple policies in Texas can help you save money on your premiums, simplify your billing and payment, and enjoy enhanced customer service.

How often should I review my Texas insurance policy?

+It's a good idea to review your Texas insurance policy regularly, ideally every 6-12 months, to ensure you're getting the best coverage at the best price.

What are the most common discounts available to Texas insurance policyholders?

+Some common discounts available to Texas insurance policyholders include good student discounts, military discounts, multi-car discounts, and home security discounts.

As you navigate the complex world of Texas insurance, it's essential to stay informed and up-to-date on the latest developments and trends. By following our top 5 Texas insurance tips, you can save money, simplify your coverage, and enjoy greater peace of mind. Whether you're a seasoned insurance expert or just starting out, our guide is designed to provide you with the knowledge and expertise you need to make informed decisions about your insurance needs. So why wait? Start exploring your Texas insurance options today and discover the benefits of having the right coverage at the right price. Share your thoughts and experiences with us in the comments below, and don't forget to share this article with your friends and family to help them navigate the world of Texas insurance.