Intro

Simplify tax season with a customizable Tax Preparation Client Intake Form Template, streamlining taxpayer data collection, IRS compliance, and financial documentation, making client onboarding efficient and secure.

Tax preparation is a crucial service that helps individuals and businesses manage their financial obligations to the government. To provide accurate and efficient tax preparation services, it's essential to gather all the necessary information from clients. A tax preparation client intake form template is a valuable tool that helps tax professionals collect relevant data, ensuring compliance with tax laws and regulations. In this article, we will delve into the importance of tax preparation, the benefits of using a client intake form template, and provide a comprehensive guide on how to create an effective template.

Tax preparation involves a range of activities, including data collection, tax planning, and compliance. Tax professionals must stay up-to-date with changing tax laws and regulations to provide accurate and reliable services. A client intake form template helps tax professionals gather all the necessary information, reducing errors and ensuring that clients receive the best possible service. By using a template, tax professionals can streamline their workflow, increase efficiency, and provide better customer service.

Benefits of Using a Tax Preparation Client Intake Form Template

Some of the key benefits of using a tax preparation client intake form template include:

- Improved accuracy and compliance

- Increased efficiency and productivity

- Enhanced customer service

- Better data management and analysis

- Reduced errors and risks

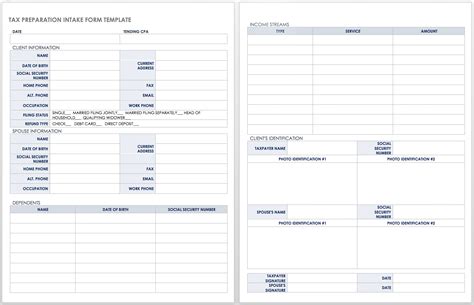

Creating an Effective Tax Preparation Client Intake Form Template

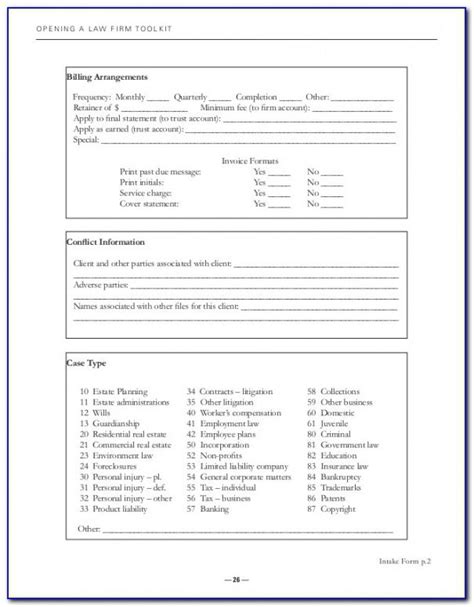

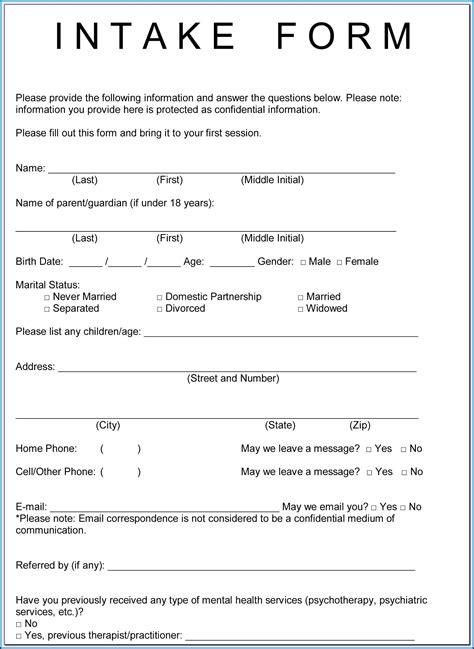

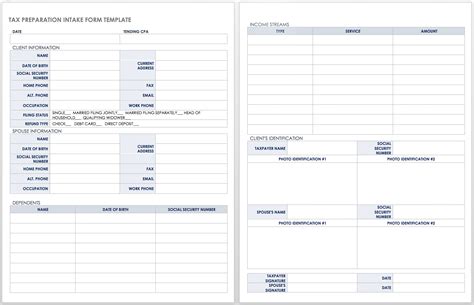

Some of the key sections to include in a tax preparation client intake form template are:

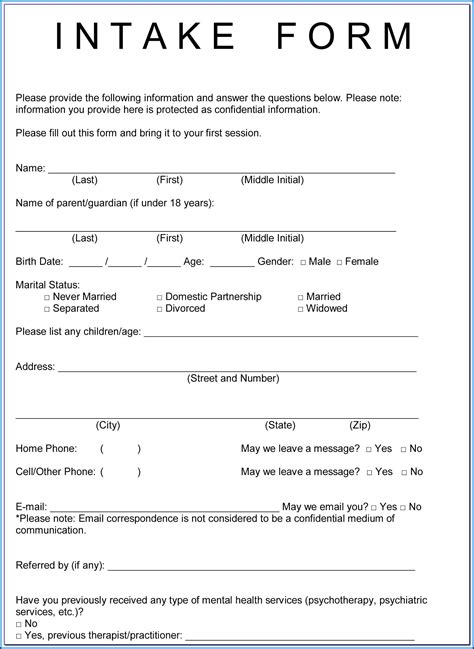

- Client information: Name, address, phone number, email, and other contact information.

- Income: Employment income, self-employment income, investments, and other sources of income.

- Deductions: Charitable donations, medical expenses, mortgage interest, and other deductible expenses.

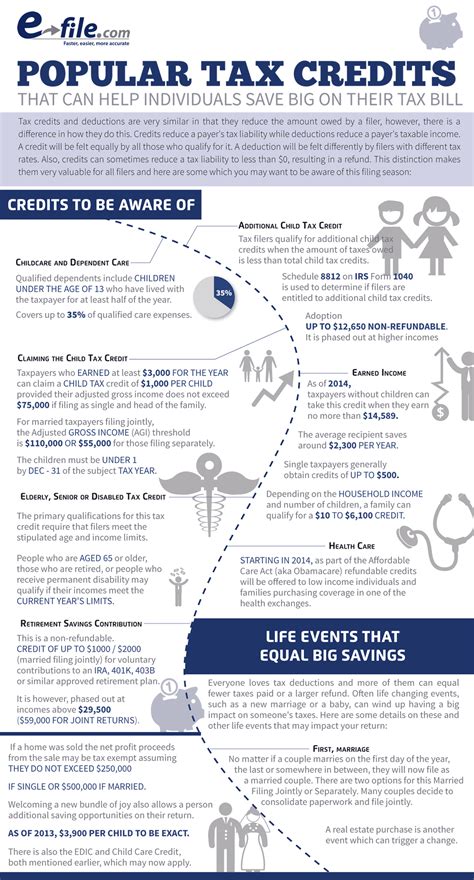

- Credits: Earned income tax credit, child tax credit, and other tax credits.

- Other tax-related information: Dependents, filing status, and other relevant tax-related information.

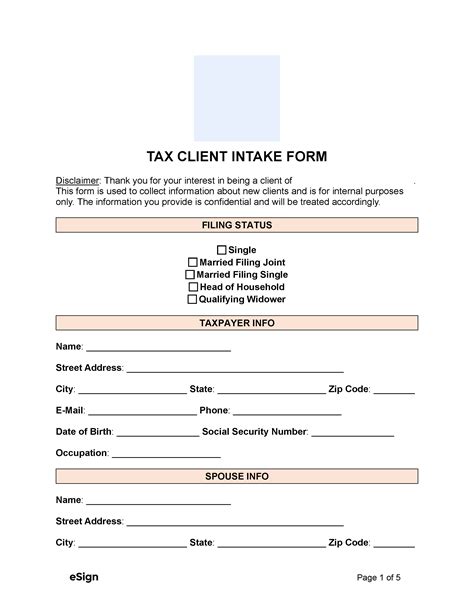

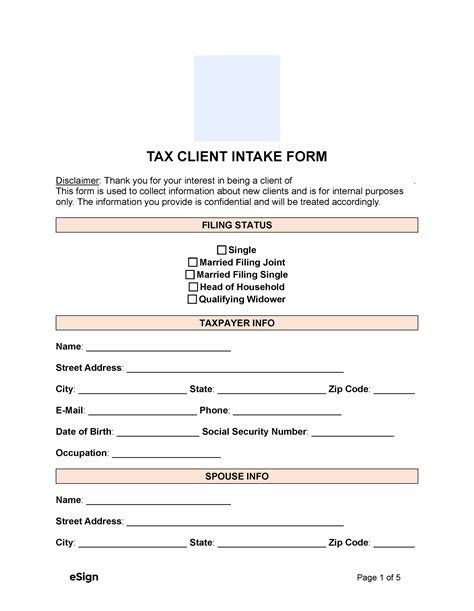

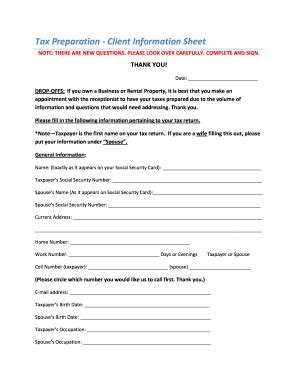

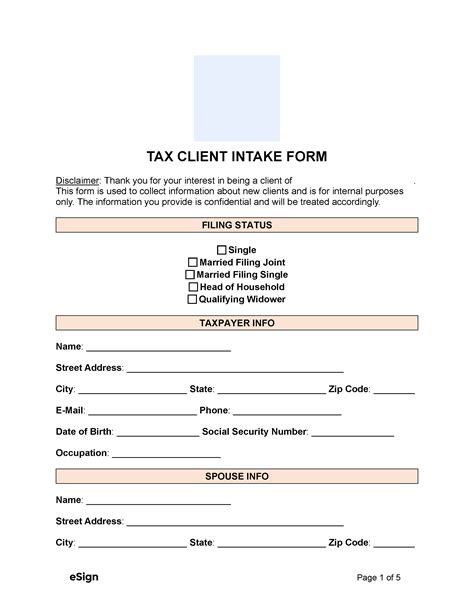

Client Information Section

The client information section is a critical part of the tax preparation client intake form template. This section should include: * Name and address * Phone number and email * Social Security number or tax identification number * Filing status (single, married, head of household, etc.) * Number of dependentsIncome Section

The income section should include: * Employment income: W-2 forms, pay stubs, and other documentation of employment income. * Self-employment income: Business income, expenses, and other documentation of self-employment income. * Investments: Interest, dividends, capital gains, and other investment income. * Other sources of income: Rental income, royalties, and other sources of income.Deductions Section

The deductions section should include: * Charitable donations: Cash, goods, and other charitable donations. * Medical expenses: Medical bills, prescriptions, and other medical expenses. * Mortgage interest: Mortgage statements, interest paid, and other mortgage-related expenses. * Other deductible expenses: Business expenses, education expenses, and other deductible expenses.Best Practices for Using a Tax Preparation Client Intake Form Template

Some of the key benefits of using a tax preparation client intake form template include:

- Improved accuracy and compliance

- Increased efficiency and productivity

- Enhanced customer service

- Better data management and analysis

- Reduced errors and risks

Gallery of Tax Preparation Client Intake Form Templates

Tax Preparation Client Intake Form Template Gallery

Frequently Asked Questions

What is a tax preparation client intake form template?

+A tax preparation client intake form template is a document used to collect information from clients for tax preparation purposes.

Why is it important to use a tax preparation client intake form template?

+Using a tax preparation client intake form template helps to improve accuracy, increase efficiency, and enhance customer service.

What information should be included in a tax preparation client intake form template?

+A tax preparation client intake form template should include client information, income, deductions, credits, and other relevant tax-related information.

How can I create an effective tax preparation client intake form template?

+To create an effective tax preparation client intake form template, identify the necessary information, keep it simple and concise, use a standardized format, and include relevant sections.

What are the benefits of using a tax preparation client intake form template?

+The benefits of using a tax preparation client intake form template include improved accuracy, increased efficiency, enhanced customer service, better data management and analysis, and reduced errors and risks.

In conclusion, a tax preparation client intake form template is a valuable tool for tax professionals, helping to streamline the tax preparation process, improve accuracy, and enhance customer service. By using a template, tax professionals can gather all the necessary information from clients, reduce errors, and provide better service. We hope this article has provided you with a comprehensive guide on how to create an effective tax preparation client intake form template and the benefits of using one. If you have any further questions or would like to share your experiences with using a template, please don't hesitate to comment below.