Intro

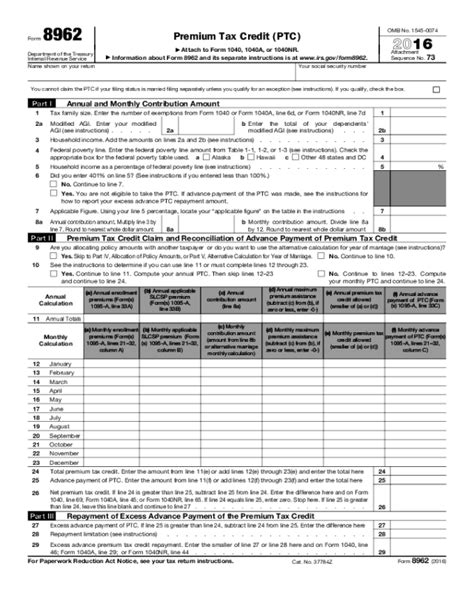

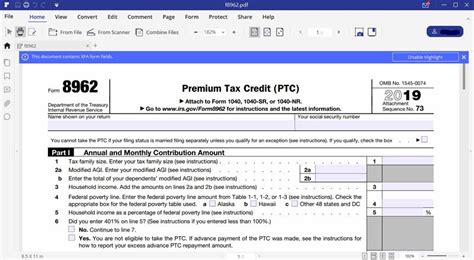

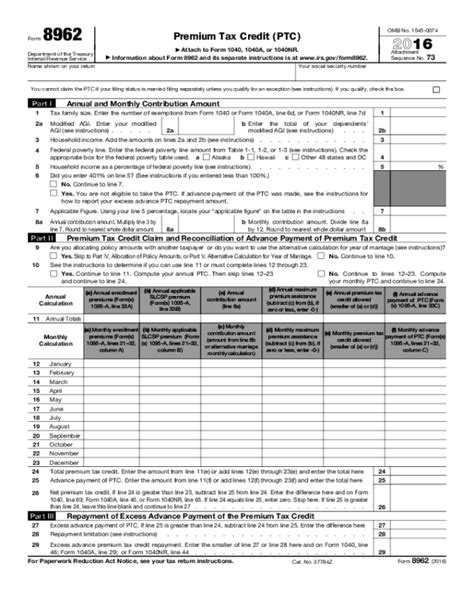

Get the latest Printable Tax Form 8962 for Premium Tax Credit claims, including instructions and calculations for net premium tax credits, advance payments, and reconciliation with IRS guidelines.

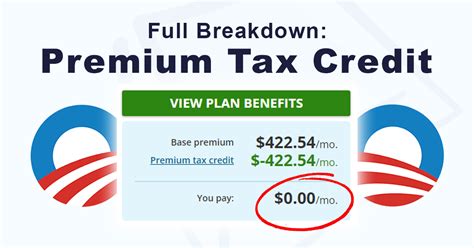

The importance of understanding and accurately completing tax forms cannot be overstated, especially when it comes to claiming credits that can significantly reduce your tax liability. One such form is the IRS Form 8962, which is used to claim the Premium Tax Credit (PTC). This credit is a refundable tax credit designed for eligible individuals and families with low to moderate income who purchase health insurance through the Health Insurance Marketplace. The process of claiming the PTC involves several steps, including calculating the credit, understanding eligibility criteria, and accurately reporting the information on your tax return.

For individuals and families who enrolled in a qualified health plan through the Marketplace, Form 8962 is a crucial document that helps reconcile the advance payments of the Premium Tax Credit with the actual credit amount you are eligible for based on your final income and family size. This reconciliation is necessary to ensure that you receive the correct amount of credit. If you received too much in advance payments, you might need to repay some or all of the excess, while if you received too little, you can claim the additional amount as a refund.

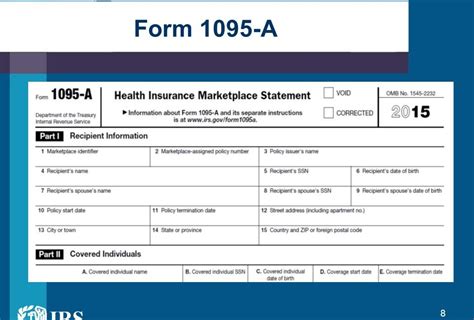

Given the complexity and the importance of accurately completing Form 8962, it is essential to understand the process step by step. This includes gathering all necessary documents, such as your health insurance premiums, your Form 1095-A, which provides information about your Marketplace coverage, and your tax return information. The form itself requires detailed calculations to determine the amount of the Premium Tax Credit you are eligible for, taking into account factors like your household income, family size, and the cost of the health insurance plan you chose.

Introduction to Form 8962

Understanding the basics of Form 8962 is the first step in navigating the process of claiming the Premium Tax Credit. The form is divided into several parts, each designed to collect specific information necessary for calculating the credit. Part I of the form deals with the annual and monthly contributions, which involve calculating your household income as a percentage of the federal poverty line and determining the applicable percentage of income you should contribute towards health insurance premiums. Part II is used to figure the total monthly enrollment premiums, which includes calculating the premiums for the applicable benchmark plan and the second lowest cost silver plan (SLCSP).

Eligibility Criteria for the Premium Tax Credit

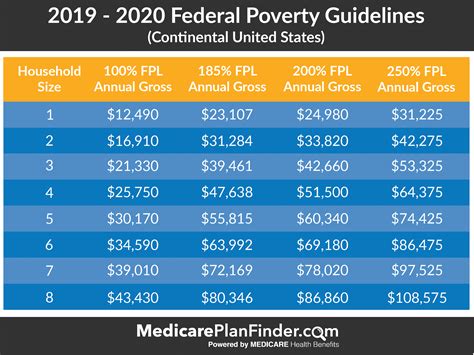

To be eligible for the Premium Tax Credit, you must meet certain criteria. These include having a household income that falls within a specific range (generally between 100% and 400% of the federal poverty line), not being eligible for minimum essential coverage through an employer or government program, and not being claimed as a dependent by another taxpayer. Additionally, you must have enrolled in a qualified health plan through the Health Insurance Marketplace and must file a joint return if you are married, unless certain exceptions apply.

Calculating the Premium Tax Credit

The calculation of the Premium Tax Credit involves several steps, including determining your applicable contribution percentage, calculating the monthly premium for the benchmark plan, and figuring the amount of the credit. The applicable contribution percentage is based on your household income as a percentage of the federal poverty line for your family size, ranging from 2% for those at 100% of the poverty line to 9.5% for those between 300% and 400% of the poverty line. The benchmark plan is the second lowest cost silver plan available in your area that covers the members of your tax family.Steps to Complete Form 8962

Completing Form 8962 accurately requires careful attention to detail and adherence to the instructions provided by the IRS. Here are the general steps:

- Gather all necessary documents, including Form 1095-A, proof of income, and information about your health insurance premiums.

- Determine your eligibility for the Premium Tax Credit based on income, family size, and health insurance coverage.

- Calculate your applicable contribution percentage and the monthly premium for the benchmark plan.

- Figure the amount of the Premium Tax Credit you are eligible for and compare it with the advance payments of the credit you received.

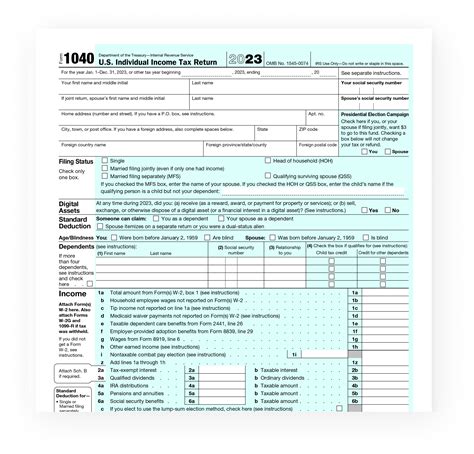

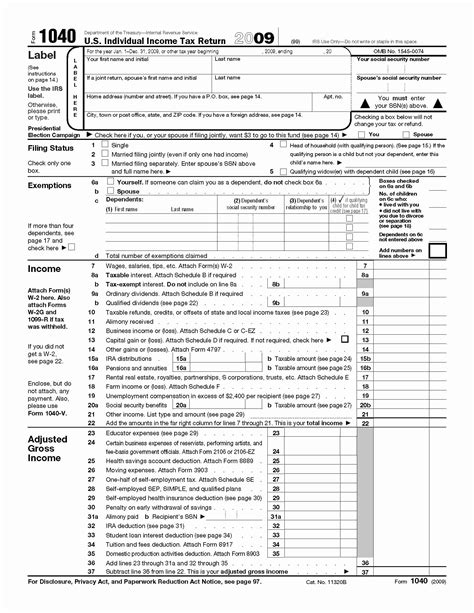

- Report the information on Form 8962 and attach it to your tax return (Form 1040).

Common Mistakes to Avoid

When completing Form 8962, it is crucial to avoid common mistakes that could delay your refund or result in an incorrect credit amount. These include: - Incorrectly calculating the applicable contribution percentage or the benchmark plan premium. - Failing to report all household members or incorrectly determining who is included in your tax family. - Not reconciling the advance payments of the Premium Tax Credit with the actual credit amount you are eligible for. - Failing to attach Form 8962 to your tax return or not signing the form.Gallery of Printable Tax Forms

Printable Tax Forms Gallery

Frequently Asked Questions

What is the Premium Tax Credit?

+The Premium Tax Credit is a refundable tax credit for eligible individuals and families with low to moderate income who purchase health insurance through the Health Insurance Marketplace.

How do I claim the Premium Tax Credit?

+You claim the Premium Tax Credit by completing Form 8962 and attaching it to your tax return (Form 1040). You will need to calculate the credit based on your household income, family size, and the cost of your health insurance premiums.

What documents do I need to complete Form 8962?

+To complete Form 8962, you will need Form 1095-A, which provides information about your Marketplace coverage, proof of income, and information about your health insurance premiums.

Can I get help with completing Form 8962?

+What if I received too much in advance payments of the Premium Tax Credit?

+If you received too much in advance payments, you may need to repay some or all of the excess when you file your tax return. This is done by reporting the difference on Form 8962.

In conclusion, navigating the process of claiming the Premium Tax Credit using Form 8962 requires careful attention to detail and a thorough understanding of the eligibility criteria and calculation process. By following the steps outlined and avoiding common mistakes, individuals and families can ensure they receive the correct amount of credit, which can significantly impact their tax liability and refund. If you have questions or need assistance, do not hesitate to reach out to a tax professional or utilize resources provided by the IRS. Share your experiences or tips for completing Form 8962 in the comments below, and consider sharing this article with others who may benefit from understanding how to claim the Premium Tax Credit.