Intro

Get the Printable Tax Form 8332 for child tax credits, exemptions, and dependent claims, including release of claim and revoke of release, with easy fillable templates and instructions.

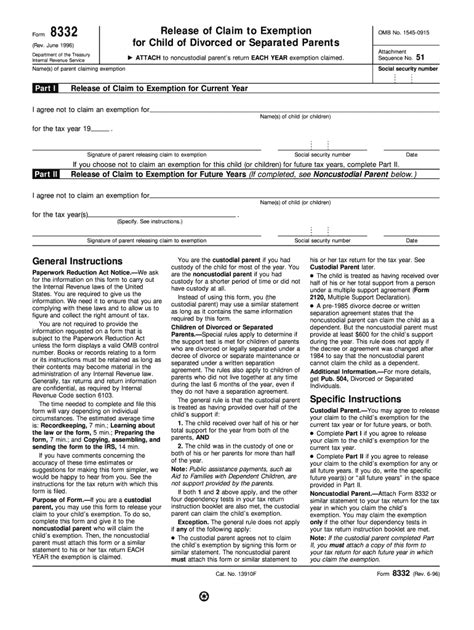

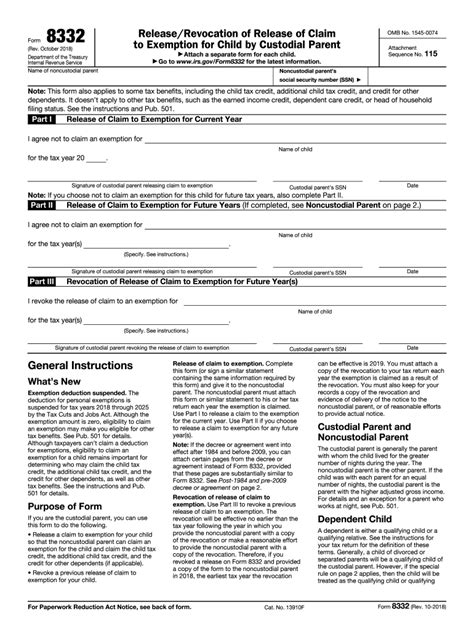

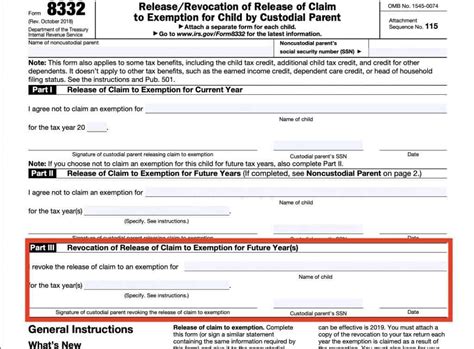

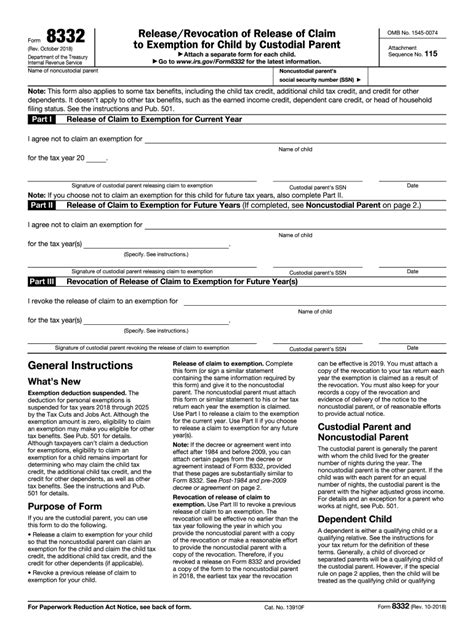

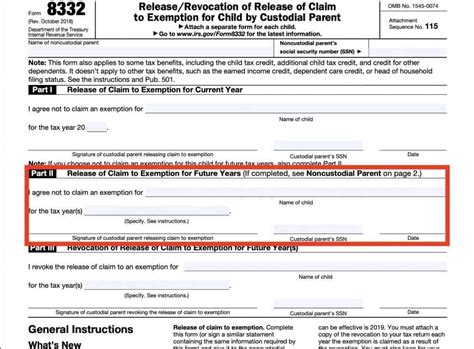

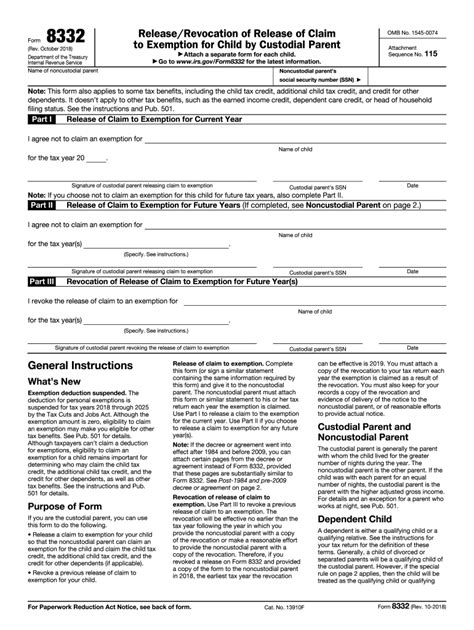

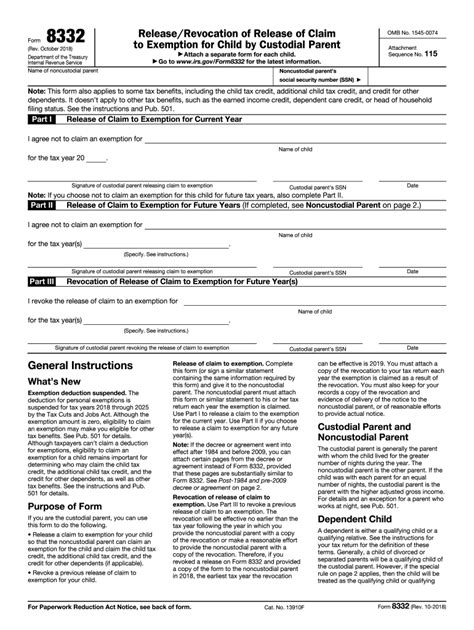

The importance of understanding and utilizing the correct tax forms cannot be overstated, especially when it comes to complex family situations such as divorce or separation. One form that plays a crucial role in these scenarios is the Printable Tax Form 8332, also known as the Release/Revocation of Release of Claim to Exemption for Child by Custodial Parent. This form is essential for parents who are divorced, separated, or living apart and need to determine which parent can claim the exemption for their child(ren) on their tax return.

In the United States, the Internal Revenue Service (IRS) allows taxpayers to claim exemptions for their dependents, which can significantly reduce their taxable income. However, when parents are no longer living together, it can become complicated to decide who gets to claim the exemption. This is where the Printable Tax Form 8332 comes into play. By completing and signing this form, the custodial parent (the parent with whom the child lives for the greater part of the year) can release their claim to the exemption, allowing the non-custodial parent to claim it instead.

The process of filling out the Printable Tax Form 8332 is relatively straightforward, but it requires careful consideration and understanding of the implications. The custodial parent must provide their name, address, and Social Security number, as well as the name and Social Security number of the child(ren) involved. They must also sign and date the form, indicating their intention to release their claim to the exemption. The non-custodial parent will then attach this form to their tax return to claim the exemption.

Benefits of Using the Printable Tax Form 8332

Eligibility Requirements

To be eligible to use the Printable Tax Form 8332, certain conditions must be met. The custodial parent must be the parent with whom the child lives for the greater part of the year, and the non-custodial parent must provide more than half of the child's support. The parents must also have a written agreement or a court decree that stipulates which parent can claim the exemption. If these conditions are not met, the form cannot be used, and the exemption will default to the custodial parent.How to Complete the Printable Tax Form 8332

Here are the steps to complete the Printable Tax Form 8332:

- Download and print the form from the IRS website or obtain it from a tax professional.

- Complete Part I of the form, providing the required information, including names, addresses, and Social Security numbers.

- Sign and date the form, indicating your intention to release your claim to the exemption.

- Give the completed form to the non-custodial parent, who will attach it to their tax return.

Tips and Considerations

When completing the Printable Tax Form 8332, there are several tips and considerations to keep in mind. First, it's essential to ensure that the form is completed accurately and signed by the custodial parent. Any errors or omissions can delay or prevent the non-custodial parent from claiming the exemption. Additionally, the form must be attached to the non-custodial parent's tax return, along with any other required documentation, such as a copy of the divorce decree or separation agreement.Common Mistakes to Avoid

Here are some common mistakes to avoid:

- Failing to sign and date the form

- Not providing the required information

- Not attaching the form to the non-custodial parent's tax return

- Not keeping a copy of the form for your records

Consequences of Not Using the Form

If the Printable Tax Form 8332 is not used, the custodial parent will automatically be entitled to claim the exemption, unless a court decree or written agreement stipulates otherwise. This can lead to a higher tax liability for the non-custodial parent, which can be a significant financial burden. Additionally, not using the form can lead to disputes or misunderstandings between the parents, which can be time-consuming and costly to resolve.Alternatives to the Printable Tax Form 8332

Here are some alternatives to the Printable Tax Form 8332:

- A court decree or written agreement that stipulates which parent can claim the exemption

- The non-custodial parent providing more than half of the child's support and the custodial parent not claiming the exemption

- The custodial parent signing a waiver or release, allowing the non-custodial parent to claim the exemption

Conclusion and Next Steps

In conclusion, the Printable Tax Form 8332 is a crucial document for parents who are divorced, separated, or living apart and need to determine which parent can claim the exemption for their child(ren) on their tax return. By understanding the benefits, eligibility requirements, and completion process, parents can make an informed decision about who claims the exemption and avoid common mistakes. If you are a parent who needs to use the Printable Tax Form 8332, it's essential to consult with a tax professional or the IRS to ensure you are completing the form correctly and meeting all the necessary requirements.Printable Tax Form 8332 Image Gallery

What is the purpose of the Printable Tax Form 8332?

+The purpose of the Printable Tax Form 8332 is to allow the custodial parent to release their claim to the exemption for their child(ren), allowing the non-custodial parent to claim it instead.

Who is eligible to use the Printable Tax Form 8332?

+The custodial parent must be the parent with whom the child lives for the greater part of the year, and the non-custodial parent must provide more than half of the child's support. The parents must also have a written agreement or a court decree that stipulates which parent can claim the exemption.

What are the benefits of using the Printable Tax Form 8332?

+The benefits of using the Printable Tax Form 8332 include allowing parents to make a mutual decision about who claims the exemption, providing a clear and official record of the agreement, and helping to prevent disputes or misunderstandings in the future.

What are the consequences of not using the Printable Tax Form 8332?

+If the Printable Tax Form 8332 is not used, the custodial parent will automatically be entitled to claim the exemption, unless a court decree or written agreement stipulates otherwise. This can lead to a higher tax liability for the non-custodial parent and disputes or misunderstandings between the parents.

How do I complete the Printable Tax Form 8332?

+To complete the Printable Tax Form 8332, download and print the form from the IRS website or obtain it from a tax professional. Complete Part I of the form, providing the required information, including names, addresses, and Social Security numbers. Sign and date the form, indicating your intention to release your claim to the exemption. Give the completed form to the non-custodial parent, who will attach it to their tax return.

We hope this article has provided you with a comprehensive understanding of the Printable Tax Form 8332 and its importance in determining which parent can claim the exemption for their child(ren) on their tax return. If you have any further questions or concerns, please do not hesitate to comment below or share this article with others who may find it helpful. Remember to consult with a tax professional or the IRS to ensure you are completing the form correctly and meeting all the necessary requirements.