Intro

Master the Stock Day Span Excel Formula to track stock performance, calculate trading days, and analyze market trends with ease, using Excel functions and financial modeling techniques.

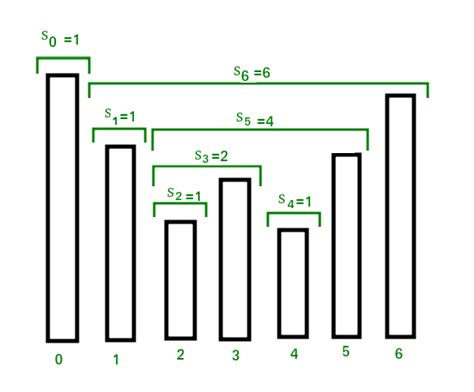

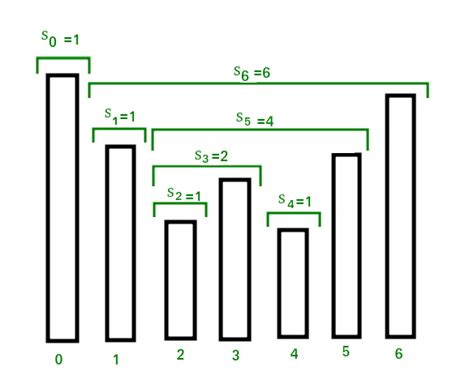

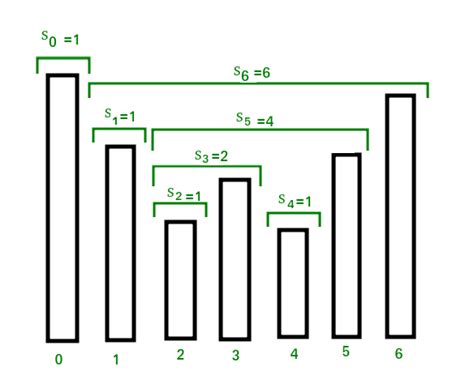

The stock day span Excel formula is a useful tool for investors and financial analysts to calculate the number of trading days between two specific dates. This can be particularly helpful in analyzing stock performance, calculating returns, and making informed investment decisions. In this article, we will delve into the importance of calculating the stock day span, explain how to use the Excel formula, and provide practical examples to illustrate its application.

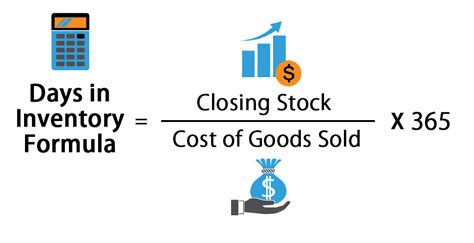

Calculating the stock day span is crucial because it allows investors to assess the performance of their stocks over a specific period. By knowing the exact number of trading days, investors can calculate the daily returns of their stocks and make comparisons with other investment opportunities. Furthermore, the stock day span formula can be used to calculate the average daily trading volume, which is an essential metric in technical analysis.

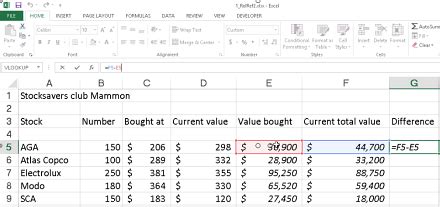

The stock day span Excel formula is relatively straightforward to use. The formula is =NETWORKDAYS(start_date, end_date), where start_date and end_date are the two dates between which you want to calculate the number of trading days. This formula automatically excludes weekends and holidays, providing an accurate count of trading days.

For instance, if you want to calculate the number of trading days between January 1, 2022, and December 31, 2022, you can use the formula =NETWORKDAYS(A1, B1), assuming the start date is in cell A1 and the end date is in cell B1. The formula will return the number of trading days between these two dates, excluding weekends and holidays.

Understanding the NETWORKDAYS Formula

The NETWORKDAYS formula is a built-in Excel function that calculates the number of working days between two dates. It is commonly used in financial modeling, project management, and human resources to calculate the number of working days between two dates. The formula takes two arguments: the start date and the end date.

To use the NETWORKDAYS formula, simply enter the start date and end date in two separate cells, and then use the formula =NETWORKDAYS(start_date, end_date) to calculate the number of working days. The formula will automatically exclude weekends and holidays, providing an accurate count of working days.

Examples of Using the NETWORKDAYS Formula

The NETWORKDAYS formula can be used in a variety of scenarios, including calculating the number of trading days between two dates, calculating the average daily trading volume, and calculating the daily returns of a stock. Here are a few examples:- Calculating the number of trading days between January 1, 2022, and December 31, 2022: =NETWORKDAYS(A1, B1)

- Calculating the average daily trading volume of a stock over a specific period: =AVERAGEIFS(volume_range, date_range, ">="&start_date, date_range, "<="&end_date) / NETWORKDAYS(start_date, end_date)

- Calculating the daily returns of a stock over a specific period: =(END_PRICE / START_PRICE) ^ (1 / NETWORKDAYS(start_date, end_date)) - 1

Benefits of Using the Stock Day Span Formula

The stock day span formula offers several benefits to investors and financial analysts. Some of the key benefits include:

- Accurate calculation of trading days: The formula automatically excludes weekends and holidays, providing an accurate count of trading days.

- Easy to use: The formula is relatively straightforward to use, and can be applied to a variety of scenarios.

- Flexibility: The formula can be used to calculate the number of trading days between any two dates, making it a versatile tool for investors and financial analysts.

- Improved analysis: By calculating the number of trading days, investors and financial analysts can perform more accurate analysis of stock performance and make informed investment decisions.

Common Applications of the Stock Day Span Formula

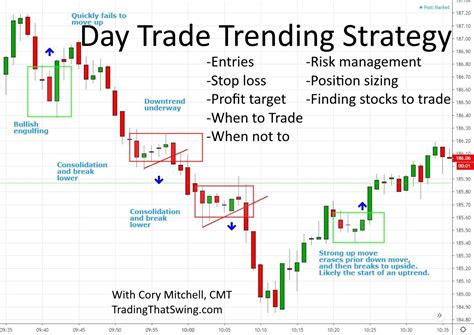

The stock day span formula has a variety of applications in finance and investing. Some common applications include:- Calculating the daily returns of a stock: By calculating the number of trading days, investors can calculate the daily returns of a stock and compare it to other investment opportunities.

- Calculating the average daily trading volume: By calculating the number of trading days, investors can calculate the average daily trading volume of a stock and use it to make informed investment decisions.

- Analyzing stock performance: By calculating the number of trading days, investors can analyze the performance of a stock over a specific period and make informed investment decisions.

Best Practices for Using the Stock Day Span Formula

To get the most out of the stock day span formula, it's essential to follow best practices. Some best practices include:

- Using the correct dates: Make sure to use the correct start and end dates when using the formula.

- Excluding weekends and holidays: The formula automatically excludes weekends and holidays, but it's essential to double-check the results to ensure accuracy.

- Using the formula in conjunction with other analysis tools: The stock day span formula should be used in conjunction with other analysis tools, such as technical indicators and fundamental analysis, to make informed investment decisions.

Tips for Troubleshooting Common Errors

When using the stock day span formula, it's not uncommon to encounter errors. Some common errors include:- Incorrect dates: Make sure to use the correct start and end dates when using the formula.

- Formula errors: Double-check the formula to ensure it's correct and properly formatted.

- Data errors: Make sure the data is accurate and up-to-date before using the formula.

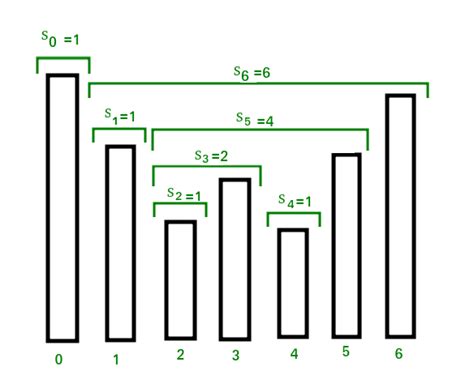

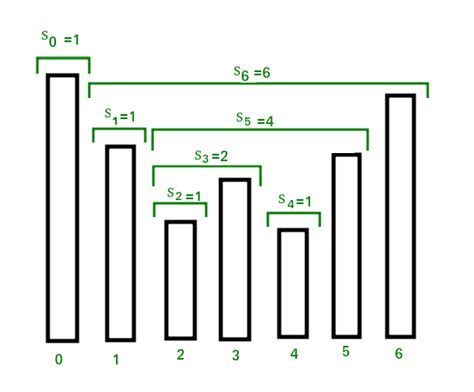

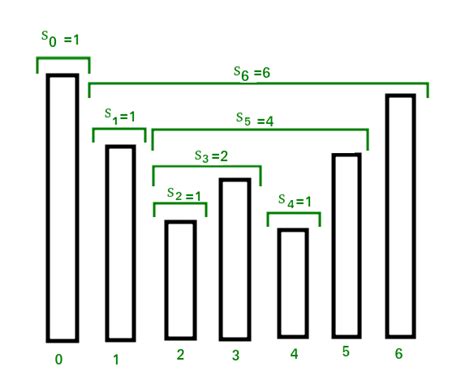

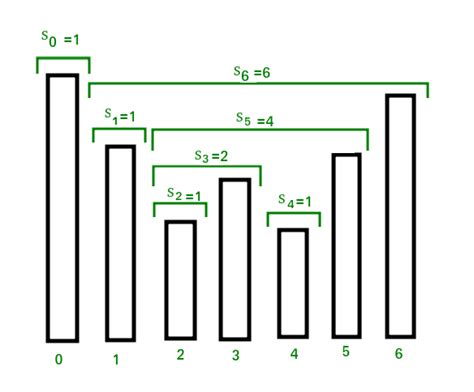

Stock Day Span Formula Image Gallery

What is the stock day span formula?

+The stock day span formula is a formula used to calculate the number of trading days between two specific dates.

How do I use the stock day span formula?

+To use the stock day span formula, simply enter the start date and end date in two separate cells, and then use the formula =NETWORKDAYS(start_date, end_date) to calculate the number of trading days.

What are the benefits of using the stock day span formula?

+The stock day span formula offers several benefits, including accurate calculation of trading days, ease of use, flexibility, and improved analysis.

In