Intro

Streamline financial management with a Small Business Financial Statement Excel Template, featuring income statements, balance sheets, and cash flow forecasts for accurate accounting and informed decision-making.

As a small business owner, managing finances effectively is crucial for the success and sustainability of your enterprise. One of the essential tools for achieving this is a well-structured financial statement. Financial statements provide a snapshot of your business's financial health, helping you make informed decisions about investments, funding, and strategy. Among the various tools available for creating financial statements, Microsoft Excel stands out due to its versatility, ease of use, and widespread adoption. This article will delve into the importance of financial statements for small businesses, how to create a basic financial statement using an Excel template, and provide insights into the key components and benefits of using such templates.

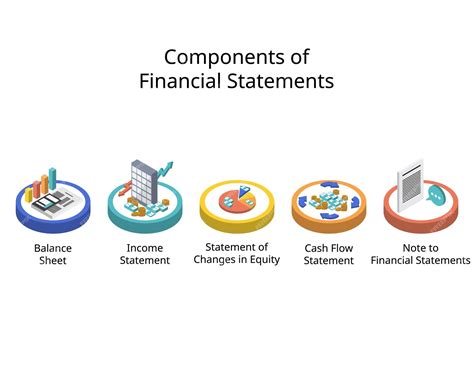

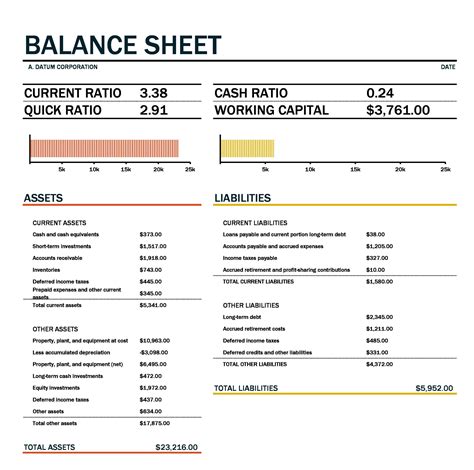

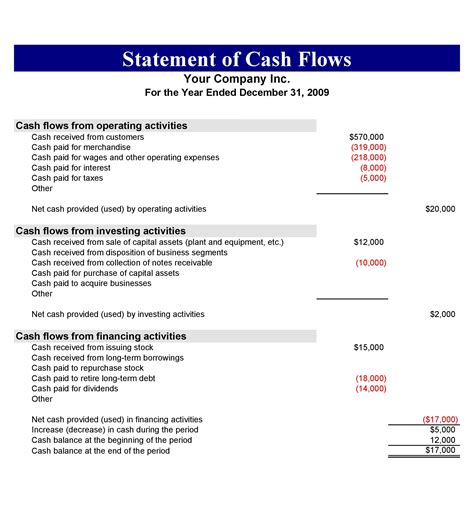

Financial statements are not just mandatory for tax purposes or for securing investments; they are vital for internal decision-making. They help small business owners understand their company's financial position, performance, and cash flows. The primary financial statements include the Balance Sheet, Income Statement (also known as the Profit & Loss Statement), and the Cash Flow Statement. Each of these documents serves a unique purpose: the Balance Sheet gives a snapshot of the business's financial situation at a specific point in time, the Income Statement shows the revenues and expenses over a period, and the Cash Flow Statement details the inflows and outflows of cash.

Creating these statements from scratch can be daunting, especially for those without an accounting background. This is where Excel templates come into play. Excel offers a range of built-in templates and formulas that can simplify the process of generating financial statements. Users can input their financial data into pre-designed sheets, and the template will automatically calculate totals, percentages, and other relevant figures. This not only saves time but also reduces the likelihood of errors that could lead to misleading financial insights.

Benefits of Using Excel for Financial Statements

The benefits of using Excel for financial statements are numerous. Firstly, Excel is widely available and familiar to many users, making it easier for small business owners to manage their finances without needing to learn new software. Secondly, Excel templates can be customized to fit the specific needs of a business, whether it's adding more detailed expense categories or creating separate sheets for different departments. Finally, Excel's analytical capabilities, including charts, graphs, and pivot tables, allow for deep dives into financial data, enabling more strategic decision-making.

Key Components of a Small Business Financial Statement Excel Template

A comprehensive small business financial statement Excel template should include several key components:

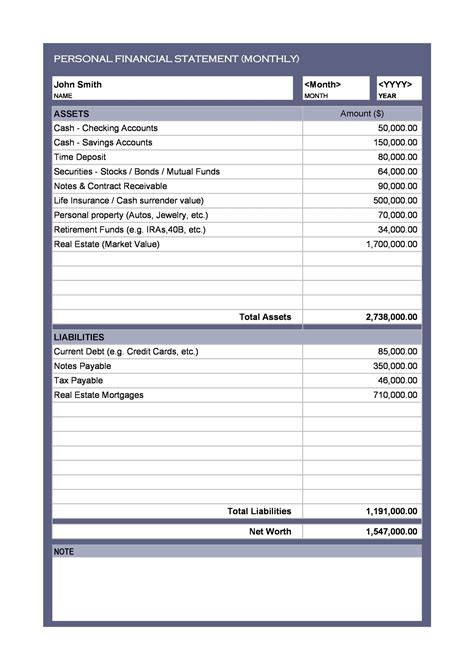

- Balance Sheet Template: This part of the template will have sections for assets (current and non-current), liabilities (current and non-current), and equity. It should automatically calculate totals and the business's net worth.

- Income Statement Template: This section will include revenue, cost of goods sold, gross profit, operating expenses, and net income. It should also calculate margins and provide a breakdown of expenses.

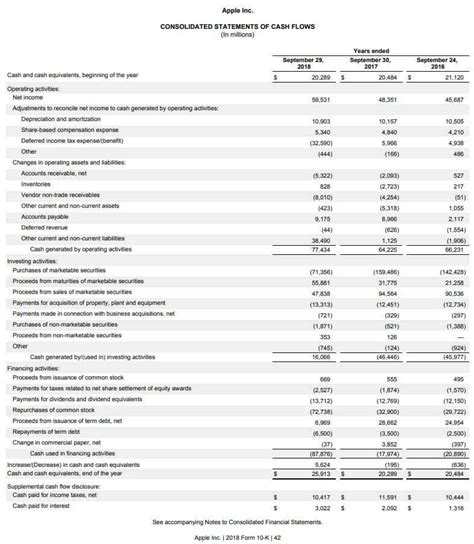

- Cash Flow Statement Template: This will detail the inflows and outflows of cash from operating, investing, and financing activities. It's crucial for understanding the business's liquidity and ability to meet its short-term obligations.

- Budget vs. Actual Variance Analysis: This component helps in comparing the planned budget with the actual financial performance, highlighting areas where the business is over or underperforming.

How to Create a Basic Financial Statement Using an Excel Template

Creating a basic financial statement using an Excel template involves several steps:

- Download or Open a Template: Start by downloading a financial statement template from Microsoft's template gallery or a reputable source online. Alternatively, you can open a blank Excel sheet and create your template from scratch.

- Input Financial Data: Fill in your business's financial data into the appropriate sections of the template. This includes listing assets, liabilities, revenues, expenses, and cash flows.

- Use Formulas for Calculations: Excel formulas can automatically calculate totals, percentages, and other figures. For example, you can use the SUM function to add up all expenses or the formula for calculating percentages to determine profit margins.

- Analyze and Review: Once your data is inputted and calculations are complete, review your financial statements for accuracy and to gain insights into your business's financial health.

- Customize as Needed: Depending on your business's specific needs, you may need to add or remove sections from the template. For instance, a retail business might need a detailed breakdown of inventory costs, while a service-based business might focus more on labor costs.

Practical Examples and Statistical Data

To illustrate the importance of financial statements, consider a small retail business that uses Excel templates to manage its finances. By closely monitoring its cash flow statement, the business identifies a period where its cash outflows exceed inflows, potentially leading to liquidity issues. Armed with this information, the business can take proactive measures such as reducing expenses, negotiating better payment terms with suppliers, or seeking short-term financing to mitigate the risk.

In terms of statistical data, studies have shown that businesses that regularly review and act upon their financial statements are more likely to experience growth and stability. For example, a survey by the National Federation of Independent Business found that small businesses that use financial planning tools, including Excel templates, have higher survival rates and are more likely to expand their operations.

Steps for Effective Financial Management

For effective financial management, small business owners should follow these steps:

- Regularly Update Financial Statements: Ensure that financial data is current and reflects the business's latest position and performance.

- Conduct Regular Financial Analysis: Use tools like ratio analysis, trend analysis, and variance analysis to derive meaningful insights from financial statements.

- Set Financial Goals and Budgets: Based on financial statement analysis, set realistic financial goals and create budgets that align with these objectives.

- Monitor and Control Expenses: Keep a close eye on expenses and take measures to control them, ensuring that the business operates within its means.

Gallery of Financial Statement Templates

Financial Statement Image Gallery

Frequently Asked Questions

What is the purpose of a financial statement in a small business?

+The primary purpose of a financial statement is to provide a clear picture of a company's financial health, including its assets, liabilities, revenues, and expenses. This information is crucial for making informed business decisions, securing investments, and ensuring compliance with legal and regulatory requirements.

How often should small businesses prepare financial statements?

+It is recommended that small businesses prepare financial statements at least quarterly, but ideally on a monthly basis. Regular financial statement preparation allows businesses to closely monitor their financial performance, identify areas for improvement, and make timely adjustments to their strategies.

What are the key components of a small business financial statement Excel template?

+A comprehensive small business financial statement Excel template should include a balance sheet, income statement, and cash flow statement. Additionally, it may include sections for budget vs. actual variance analysis, financial ratios, and forecasting.

In

Final Thoughts