Intro

Streamline finance with a Bank Reconciliation Template Excel, featuring automated statements, transaction matching, and error detection, for accurate accounting and financial analysis.

Reconciling bank statements is a crucial task for businesses and individuals to ensure the accuracy of their financial records. A bank reconciliation template in Excel can simplify this process by providing a structured format to compare the company's internal financial records with the bank's statement. This process helps identify any discrepancies, such as errors in transactions, missing deposits, or unauthorized withdrawals.

The importance of bank reconciliation cannot be overstated. It is a key control measure that helps in the detection of fraud, ensures the accuracy of financial statements, and aids in the preparation of tax returns. Moreover, it provides a clear picture of the company's cash position, which is vital for making informed financial decisions.

For individuals, reconciling bank statements can help manage personal finances more effectively. It assists in tracking expenses, identifying unnecessary expenditures, and ensuring that all transactions are legitimate. Given the significance of this task, utilizing a bank reconciliation template in Excel can streamline the process, making it more efficient and less prone to errors.

Understanding Bank Reconciliation

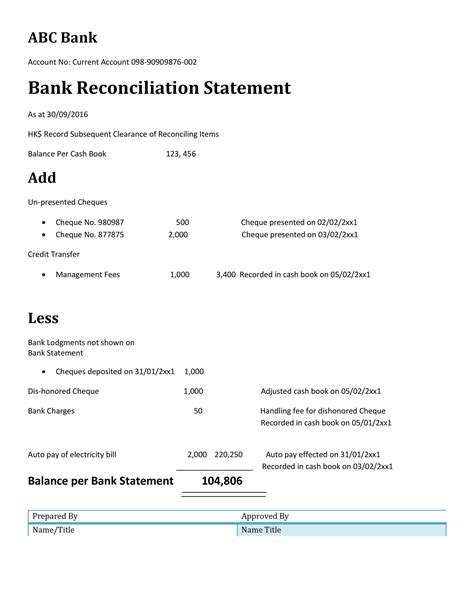

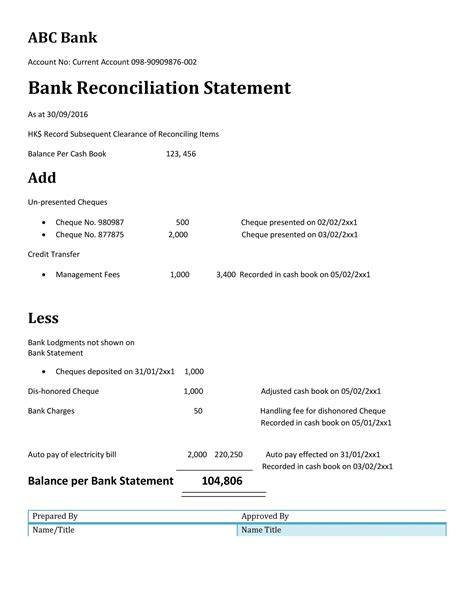

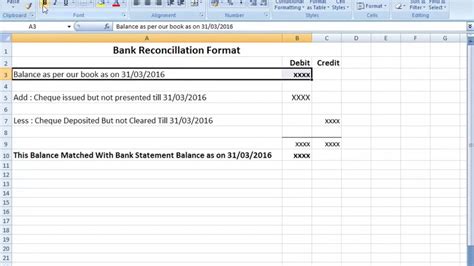

Bank reconciliation involves comparing the balance shown in the company's general ledger or cash book with the balance shown on the bank statement. This comparison is necessary because the two balances may not always match due to timing differences or errors in recording transactions. Common reasons for discrepancies include outstanding checks, deposits in transit, bank service charges, and errors made by either the company or the bank.

Benefits of Using a Bank Reconciliation Template in Excel

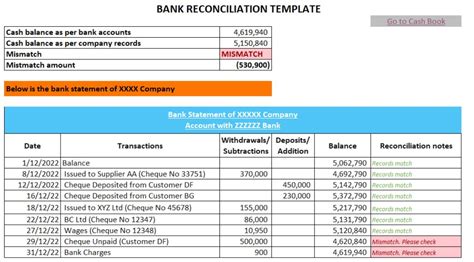

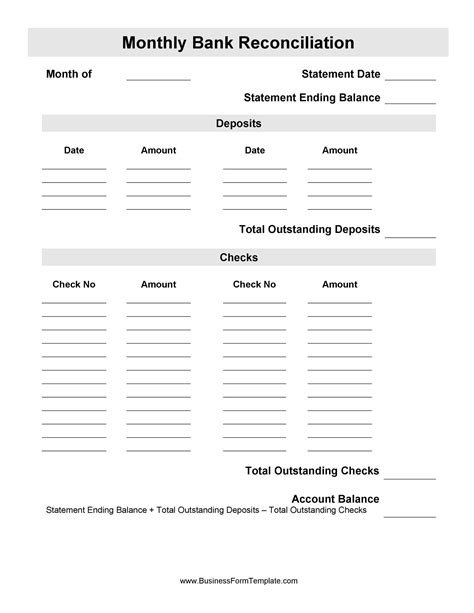

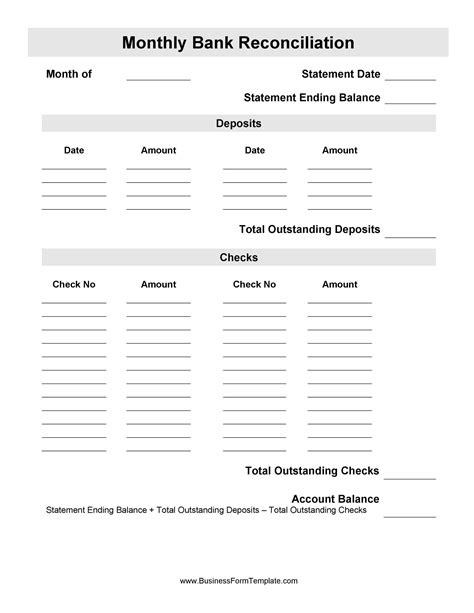

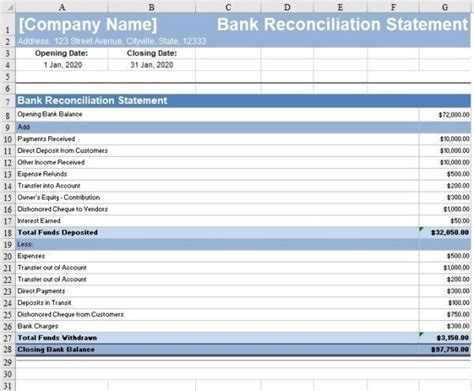

Utilizing a bank reconciliation template in Excel offers several benefits. It provides a systematic approach to reconciling bank statements, reducing the likelihood of errors. The template can be customized to fit the specific needs of the business or individual, including the ability to track multiple bank accounts. Excel's formulas and functions can automate parts of the reconciliation process, such as calculating the total of outstanding checks or deposits in transit.

Moreover, a bank reconciliation template in Excel can be easily shared among team members, facilitating collaboration and review. It also serves as a record-keeping tool, allowing for the archiving of past reconciliations for future reference or audit purposes.

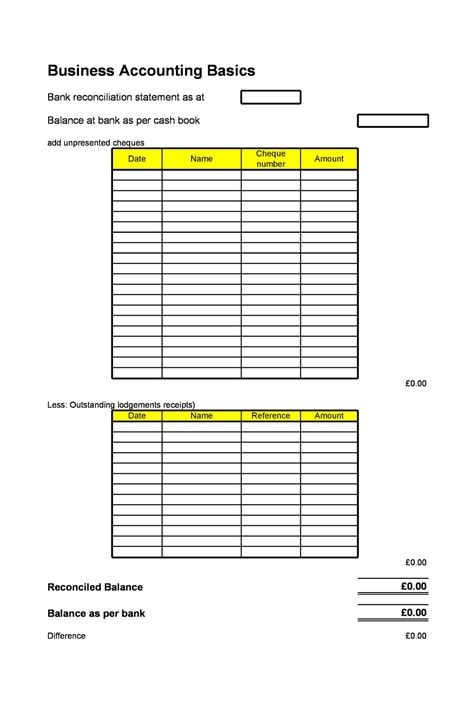

Steps to Create a Bank Reconciliation Template in Excel

Creating a bank reconciliation template in Excel involves several steps:

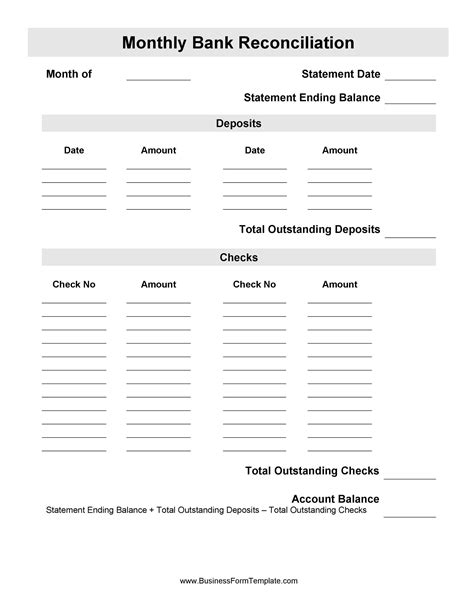

- Set up the template structure: Include sections for the company's cash book balance, bank statement balance, adjustments for outstanding items, and a summary of the reconciliation.

- Enter the beginning balances: Start with the current balance in the cash book and the bank statement.

- List all transactions: Include all deposits, withdrawals, and other transactions from both the cash book and the bank statement.

- Identify discrepancies: Use Excel formulas to calculate the difference between the cash book and bank statement balances.

- Adjust for outstanding items: Account for checks that have not cleared, deposits in transit, and any bank errors.

- Finalize the reconciliation: Ensure that the adjusted cash book balance matches the adjusted bank statement balance.

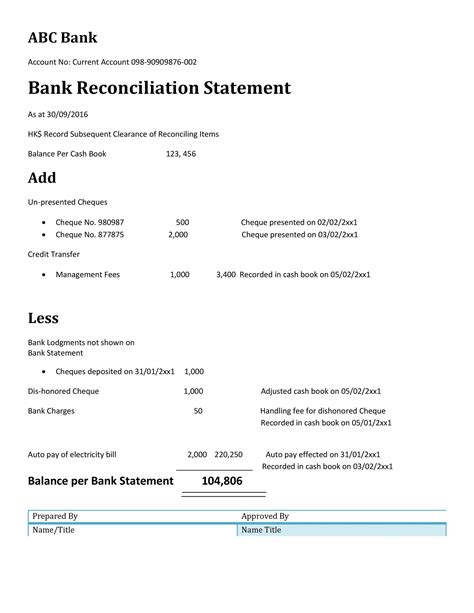

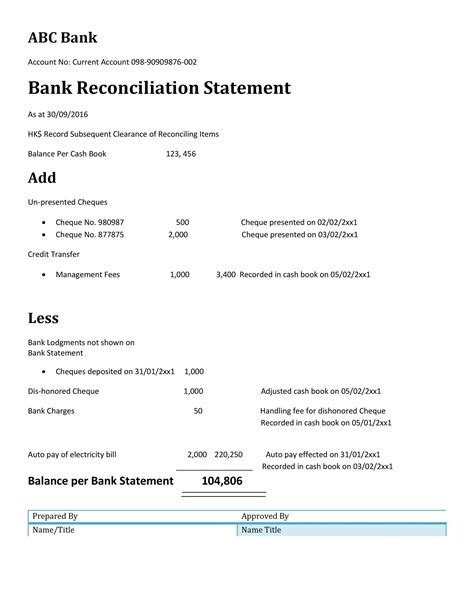

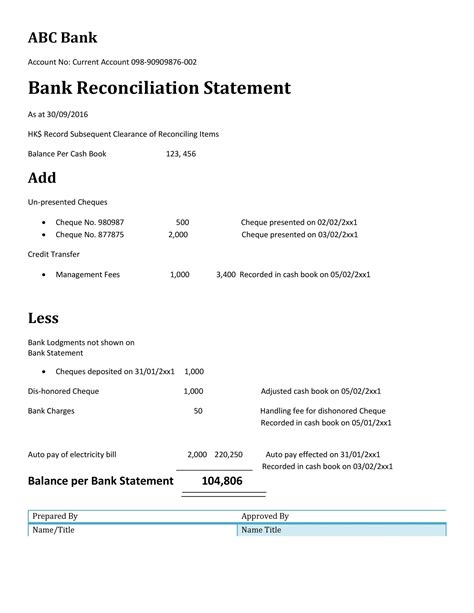

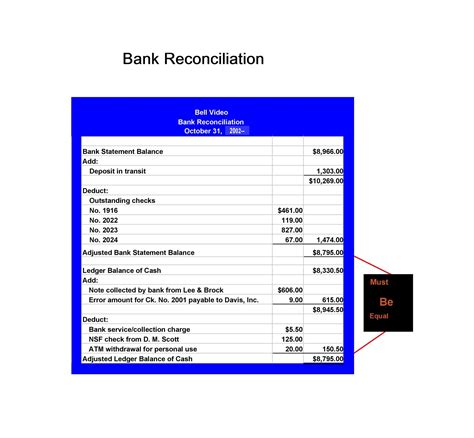

Practical Example of Bank Reconciliation

Consider a company with a cash book balance of $10,000 and a bank statement balance of $9,500. Upon reviewing the bank statement, it is noted that there are outstanding checks totaling $200 and a deposit in transit of $700. The bank has also deducted a service charge of $100.

- Cash Book Balance: $10,000

- Bank Statement Balance: $9,500

- Outstanding Checks: -$200

- Deposit in Transit: +$700

- Bank Service Charge: -$100

After adjustments, the cash book balance should be adjusted to $9,500 ($10,000 - $200 + $700 - $100), which matches the bank statement balance, thus reconciling the two.

Best Practices for Bank Reconciliation

Best practices for bank reconciliation include:

- Reconciling bank statements regularly, ideally monthly.

- Ensuring that reconciliations are performed by someone independent of the transaction process.

- Maintaining detailed records of reconciliations and any adjustments made.

- Investigating and resolving discrepancies promptly.

- Reviewing bank reconciliation statements for accuracy and completeness.

Common Challenges in Bank Reconciliation

Common challenges in bank reconciliation include missing or incomplete documentation, timing differences between the company's records and the bank's statement, and errors in transaction recording. Additionally, fraud and theft can pose significant challenges, as they may not be immediately apparent and can result in significant financial losses.

Technological Advances in Bank Reconciliation

Technological advances have significantly impacted the bank reconciliation process. Automated accounting systems can now directly import bank statements and match transactions, reducing the time and effort required for reconciliation. Moreover, cloud-based accounting solutions provide real-time access to financial data, enabling quicker identification and resolution of discrepancies.

Gallery of Bank Reconciliation Templates

Bank Reconciliation Templates Image Gallery

Frequently Asked Questions

What is bank reconciliation?

+Bank reconciliation is the process of comparing the balance in the company's general ledger or cash book with the balance shown on the bank statement to ensure they are accurate and match.

Why is bank reconciliation important?

+Bank reconciliation is important because it helps detect fraud, ensures the accuracy of financial statements, and aids in the preparation of tax returns. It also provides a clear picture of the company's cash position.

How often should bank reconciliation be performed?

+Bank reconciliation should be performed regularly, ideally monthly, to ensure that any discrepancies are identified and resolved promptly.

In conclusion, bank reconciliation is a vital process for maintaining accurate financial records and ensuring the integrity of a company's or individual's financial transactions. Utilizing a bank reconciliation template in Excel can simplify and streamline this process, making it more efficient and less prone to errors. By understanding the importance of bank reconciliation, creating an effective template, and following best practices, individuals and businesses can better manage their finances and make informed decisions. We encourage readers to share their experiences with bank reconciliation and suggest tips for improving the process. Your feedback is invaluable in helping others navigate the complexities of financial management.