Intro

Discover 5 self employment letter templates, including freelance, independent contractor, and small business owner examples, to verify income and boost credibility with lenders, clients, and tax authorities, using proven self-employment verification letters and templates.

Self-employment is a dream for many, offering the freedom to pursue one's passion and work on one's own terms. However, when it comes to securing loans, mortgages, or other financial assistance, self-employed individuals often face unique challenges. One of the key documents required to overcome these hurdles is a self-employment letter, also known as a self-employment verification letter or an income verification letter for the self-employed. This document serves as proof of income and employment status, providing lenders and financial institutions with the necessary information to assess creditworthiness.

The importance of a self-employment letter cannot be overstated. It is a critical piece of documentation that helps self-employed individuals navigate the financial landscape with greater ease. Whether you're applying for a mortgage, a car loan, or seeking to lease a property, a self-employment letter can make all the difference. It provides a clear picture of your financial situation, giving lenders the confidence they need to approve your application. In this article, we will delve into the world of self-employment letters, exploring their significance, components, and providing templates to help you get started.

Understanding Self-Employment Letters

Components of a Self-Employment Letter

Templates for Self-Employment Letters

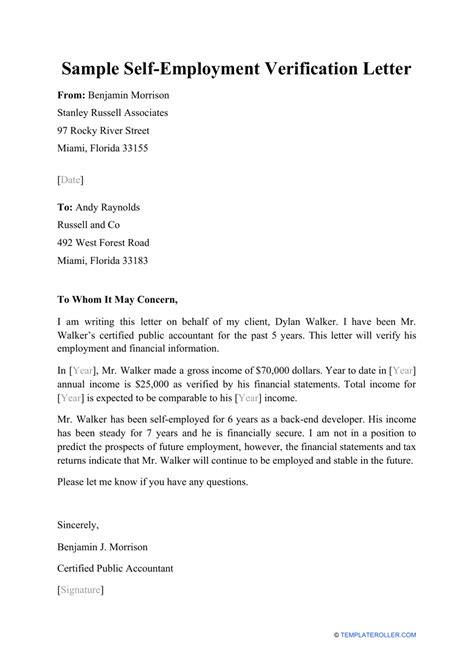

Template 1: Basic Self-Employment Verification Letter

[Your Accountant’s Letterhead] [Date] [Lender’s Name] [Lender’s Address]

Dear [Lender’s Name],

I am writing to confirm that [Self-Employed Individual’s Name] is self-employed and has been operating [Business Name], located at [Business Address], since [Date of Establishment]. As the accountant for [Business Name], I have reviewed the company’s financial records and can verify the following income details for [Self-Employed Individual’s Name] for the [Year/Period] ending [Date].

- Gross Income: $[Gross Income Amount]

- Business Expenses: $[Expenses Amount]

- Net Profit: $[Net Profit Amount]

Please feel free to contact me if you require any additional information.

Sincerely, [Your Name] [Your Title] [Contact Information]

Template 2: Detailed Self-Employment Letter for Mortgage Applications

[Your Accountant’s Letterhead] [Date] [Mortgage Lender’s Name] [Mortgage Lender’s Address]

Dear [Mortgage Lender’s Name],

Re: Verification of Income for Mortgage Application for [Self-Employed Individual’s Name]

I am pleased to provide this letter to verify the income of [Self-Employed Individual’s Name], who is self-employed and the [Position] of [Business Name], located at [Business Address]. The business has been in operation since [Date of Establishment] and engages in [Brief Description of Business Activities].

Below are the financial details for [Self-Employed Individual’s Name] for the past [Number] years, which demonstrate a stable and increasing income trend.

- Year [Year]: Gross Income $[Gross Income], Net Profit $[Net Profit]

- Year [Year]: Gross Income $[Gross Income], Net Profit $[Net Profit]

- Year [Year]: Gross Income $[Gross Income], Net Profit $[Net Profit]

These figures are based on the business’s audited financial statements, which are available upon request.

If you require any further information, please do not hesitate to contact me.

Sincerely, [Your Name] [Your Title] [Contact Information]

Using Self-Employment Letters for Financial Applications

Template 3: Self-Employment Letter for Loan Applications

[Your Accountant’s Letterhead] [Date] [Loan Officer’s Name] [Loan Institution’s Address]

Dear [Loan Officer’s Name],

I am writing to verify the employment and income status of [Self-Employed Individual’s Name], who is applying for a loan with your institution. [Self-Employed Individual’s Name] is the sole proprietor of [Business Name], a [Business Type] business located at [Business Address].

The business was established in [Year] and has consistently shown profitability. For the most recent fiscal year ending [Date], the business reported a gross income of $[Gross Income] and a net profit of $[Net Profit]. These figures are based on the business’s financial records, which I have reviewed and verified.

Please find attached the latest financial statements of the business for your reference. If you need any additional information, please contact me at [Your Contact Information].

Sincerely, [Your Name] [Your Title]

Template 4: Self-Employment Verification Letter for Rental Applications

[Your Accountant’s Letterhead] [Date] [Landlord’s Name] [Landlord’s Address]

Dear [Landlord’s Name],

Re: Income Verification for Rental Application of [Self-Employed Individual’s Name]

This letter is to confirm that [Self-Employed Individual’s Name] is self-employed and earns a stable income from [Business Name], located at [Business Address]. As the accountant for [Business Name], I have access to the company’s financial records and can verify the following income details for [Self-Employed Individual’s Name].

- Average Monthly Income: $[Average Monthly Income]

- Annual Net Profit: $[Annual Net Profit]

These figures are derived from the business’s latest financial statements, which are available for review upon request.

If you have any questions or require further verification, please do not hesitate to contact me.

Sincerely, [Your Name] [Your Title] [Contact Information]

Benefits of Self-Employment Letters

Template 5: Comprehensive Self-Employment Letter for Complex Financial Situations

[Your Accountant’s Letterhead] [Date] [Financial Institution’s Name] [Financial Institution’s Address]

Dear [Financial Institution’s Representative],

I am pleased to provide this comprehensive letter to verify the self-employment status and income of [Self-Employed Individual’s Name], who is the [Position] of [Business Name]. The business, located at [Business Address], has been in operation since [Date of Establishment] and is engaged in [Detailed Description of Business Activities].

The financial performance of the business over the past [Number] years is as follows:

- Year [Year]: Gross Income $[Gross Income], Business Expenses $[Business Expenses], Net Profit $[Net Profit]

- Year [Year]: Gross Income $[Gross Income], Business Expenses $[Business Expenses], Net Profit $[Net Profit]

- Year [Year]: Gross Income $[Gross Income], Business Expenses $[Business Expenses], Net Profit $[Net Profit]

These figures are based on the audited financial statements of the business, which have been prepared in accordance with [Accounting Standards]. I have reviewed these statements and can confirm their accuracy.

Additionally, I have attached a detailed breakdown of the business’s assets, liabilities, and equity as of [Date], which provides a comprehensive overview of its financial position.

If you require any further information or clarification, please do not hesitate to contact me.

Sincerely, [Your Name] [Your Title] [Contact Information]

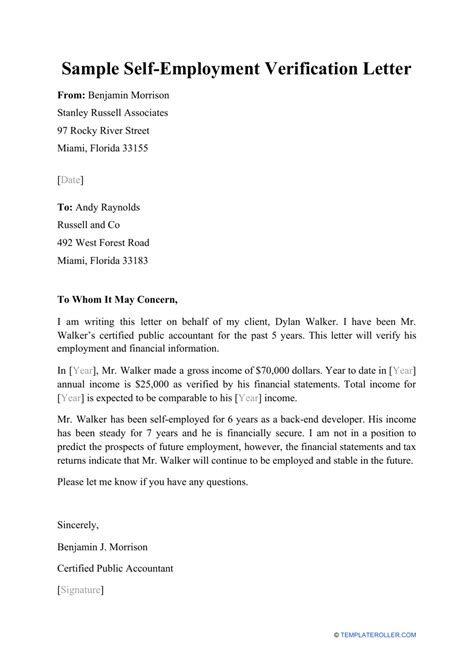

Gallery of Self Employment Letter Templates

Self Employment Letter Templates Image Gallery

What is a Self-Employment Letter?

+A self-employment letter is a document that verifies an individual's self-employment status and income, typically prepared by an accountant or professional.

Why is a Self-Employment Letter Important?

+A self-employment letter is crucial for self-employed individuals as it provides proof of income, which can be difficult to verify due to the variable nature of self-employment income.

What Information Should be Included in a Self-Employment Letter?

+A self-employment letter should include business information, self-employment status, income details, accountant’s information, and a verification statement.

How Do I Obtain a Self-Employment Letter?

+You can obtain a self-employment letter by contacting an accountant or professional who has access to your business’s financial records.

Can I Use a Self-Employment Letter for Multiple Financial Applications?

+Yes, a self-employment letter can be used for multiple financial applications, including mortgage applications, loan requests, and credit card applications.

In conclusion, self-employment letters are vital documents for self-employed individuals, providing a clear and concise way to verify income and employment status. By understanding the importance and components of these letters, and using the provided templates, self-employed individuals can navigate the financial landscape with greater ease. Whether you're applying for a mortgage, a loan, or seeking to lease a property, a self-employment letter can make all the difference. We invite you to share your experiences with self-employment letters, ask questions, and explore how these documents can help you achieve your financial goals.