Intro

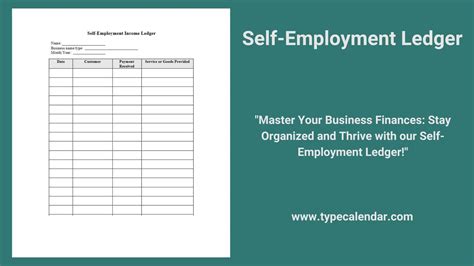

Create a self employment ledger with our template guide, featuring income tracking, expense management, and tax organization tools for freelancers and small business owners, simplifying financial record-keeping and accounting.

As a self-employed individual, managing finances and keeping track of expenses can be a daunting task. One essential tool to help with this is a self-employment ledger template. This template provides a clear and organized way to record income, expenses, and other financial transactions related to your business. In this article, we will delve into the importance of using a self-employment ledger template, its benefits, and provide a comprehensive guide on how to use it effectively.

A self-employment ledger template is a vital tool for any self-employed individual, as it helps to streamline financial management and ensure accuracy in financial reporting. With the increasing number of people opting for self-employment, the need for a reliable and efficient financial management system has become more pressing. By using a self-employment ledger template, individuals can easily track their income and expenses, identify areas of improvement, and make informed decisions about their business.

The benefits of using a self-employment ledger template are numerous. It helps to reduce errors in financial reporting, provides a clear picture of the business's financial health, and enables individuals to make informed decisions about investments and expansions. Moreover, a self-employment ledger template can be customized to suit the specific needs of the business, making it an indispensable tool for self-employed individuals.

Introduction to Self Employment Ledger Template

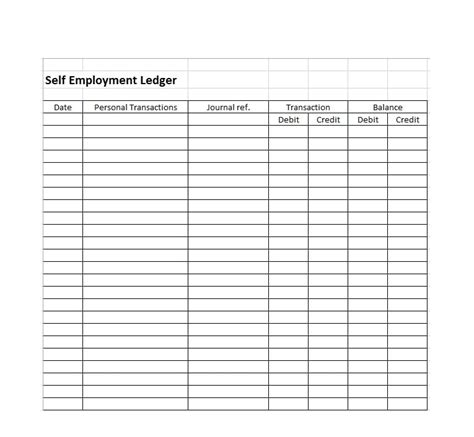

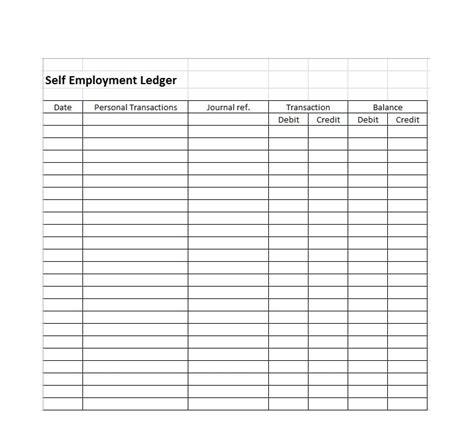

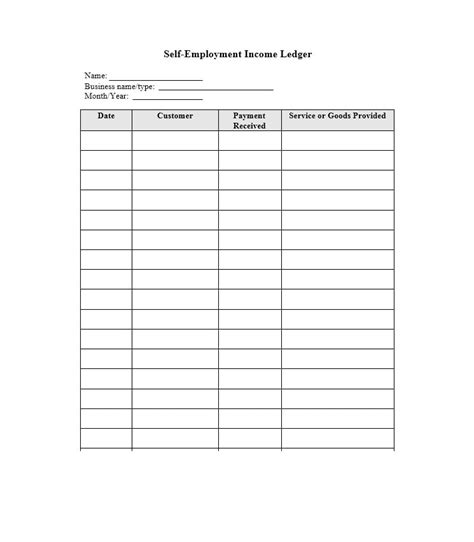

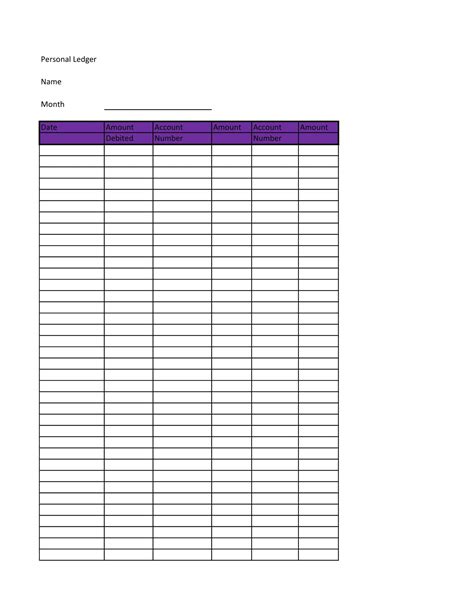

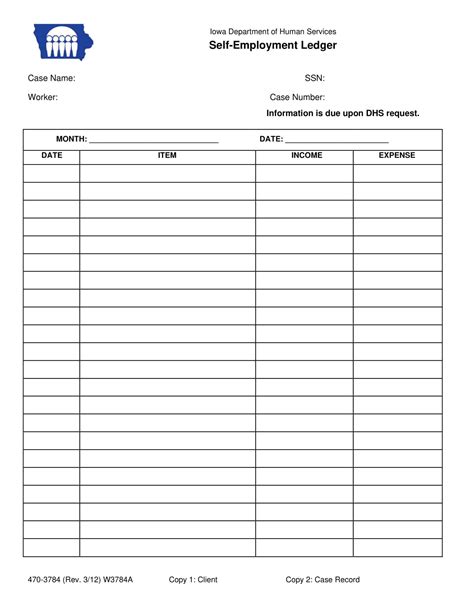

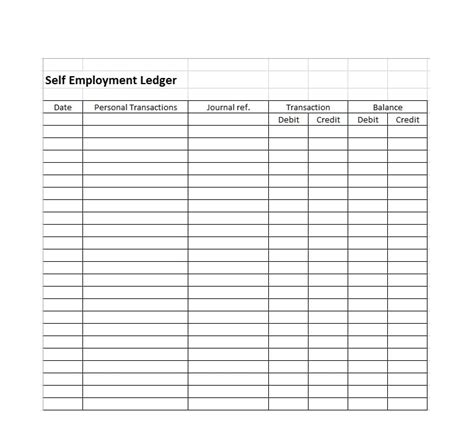

A self-employment ledger template is a document that provides a structured format for recording financial transactions related to a business. It typically includes columns for date, description, income, expenses, and balance, making it easy to track and manage finances. The template can be customized to include additional columns or sections, depending on the specific needs of the business.

Benefits of Using a Self Employment Ledger Template

The benefits of using a self-employment ledger template are numerous. Some of the key advantages include: * Improved financial management: A self-employment ledger template helps to streamline financial management by providing a clear and organized way to record income and expenses. * Reduced errors: The template reduces the risk of errors in financial reporting, ensuring accuracy and reliability. * Better decision-making: By providing a clear picture of the business's financial health, a self-employment ledger template enables individuals to make informed decisions about investments and expansions. * Customization: The template can be customized to suit the specific needs of the business, making it an indispensable tool for self-employed individuals.How to Use a Self Employment Ledger Template

Using a self-employment ledger template is straightforward. Here are the steps to follow:

- Download or create a self-employment ledger template: There are many free templates available online, or you can create your own using a spreadsheet program like Microsoft Excel.

- Set up the template: Customize the template to include the columns and sections that are relevant to your business.

- Record income and expenses: Enter all income and expenses related to your business into the template, including dates, descriptions, and amounts.

- Update the template regularly: Regularly update the template to ensure that it remains accurate and up-to-date.

- Review and analyze the data: Regularly review and analyze the data in the template to identify areas of improvement and make informed decisions about your business.

Steps to Create a Self Employment Ledger Template

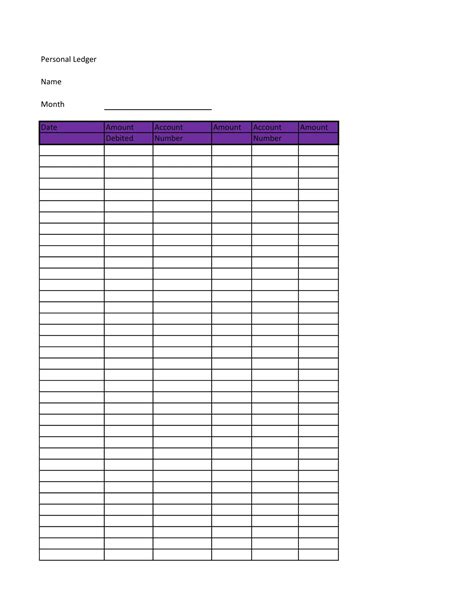

Creating a self-employment ledger template is a simple process. Here are the steps to follow: * Determine the columns and sections: Decide what columns and sections you need to include in the template, such as date, description, income, expenses, and balance. * Choose a format: Choose a format for the template, such as a spreadsheet or a table. * Set up the template: Set up the template using a spreadsheet program like Microsoft Excel or a table in a word processing program like Microsoft Word. * Customize the template: Customize the template to suit the specific needs of your business.Self Employment Ledger Template Examples

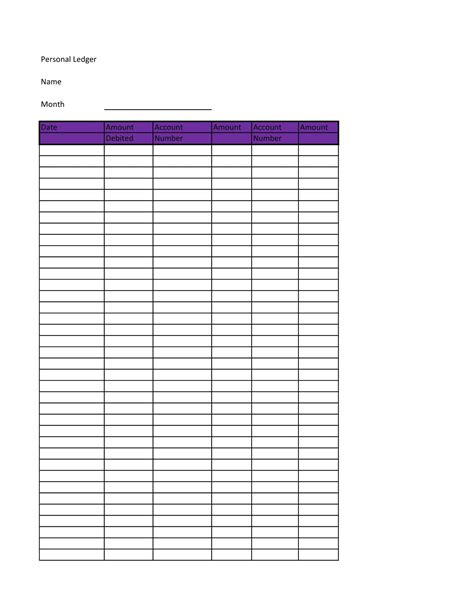

Here are some examples of self-employment ledger templates:

- Simple self-employment ledger template: This template includes columns for date, description, income, expenses, and balance.

- Detailed self-employment ledger template: This template includes additional columns for categories, such as rent, utilities, and supplies.

- Customized self-employment ledger template: This template is customized to suit the specific needs of the business, including columns for specific expenses and income.

Types of Self Employment Ledger Templates

There are several types of self-employment ledger templates available, including: * Basic template: This template includes the basic columns and sections needed to record income and expenses. * Advanced template: This template includes additional columns and sections, such as categories and subcategories. * Customized template: This template is customized to suit the specific needs of the business.Best Practices for Using a Self Employment Ledger Template

Here are some best practices for using a self-employment ledger template:

- Regularly update the template: Regularly update the template to ensure that it remains accurate and up-to-date.

- Review and analyze the data: Regularly review and analyze the data in the template to identify areas of improvement and make informed decisions about your business.

- Customize the template: Customize the template to suit the specific needs of your business.

- Use it consistently: Use the template consistently to ensure that all financial transactions are recorded accurately and efficiently.

Common Mistakes to Avoid When Using a Self Employment Ledger Template

Here are some common mistakes to avoid when using a self-employment ledger template: * Not regularly updating the template: Failing to regularly update the template can lead to inaccurate and outdated financial information. * Not reviewing and analyzing the data: Failing to review and analyze the data in the template can lead to missed opportunities for improvement and poor decision-making. * Not customizing the template: Failing to customize the template can lead to a lack of relevance and effectiveness.Gallery of Self Employment Ledger Templates

Self Employment Ledger Template Image Gallery

What is a self-employment ledger template?

+A self-employment ledger template is a document that provides a structured format for recording financial transactions related to a business.

Why do I need a self-employment ledger template?

+You need a self-employment ledger template to streamline financial management, reduce errors, and make informed decisions about your business.

How do I use a self-employment ledger template?

+To use a self-employment ledger template, simply download or create a template, set it up, record income and expenses, and regularly update and review the data.

Can I customize a self-employment ledger template?

+Yes, you can customize a self-employment ledger template to suit the specific needs of your business.

What are the benefits of using a self-employment ledger template?

+The benefits of using a self-employment ledger template include improved financial management, reduced errors, and better decision-making.

In conclusion, a self-employment ledger template is an essential tool for any self-employed individual. By using a template, you can streamline financial management, reduce errors, and make informed decisions about your business. Remember to regularly update and review the data, customize the template to suit your needs, and use it consistently to ensure accuracy and efficiency. With the right template and a little practice, you can take control of your finances and achieve success in your business. We invite you to share your experiences and tips on using self-employment ledger templates in the comments below.