Intro

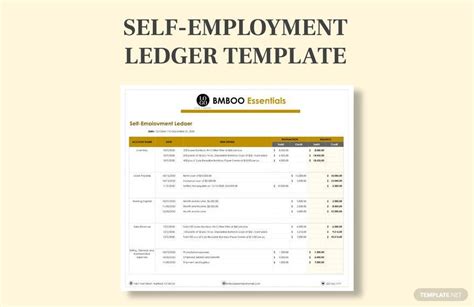

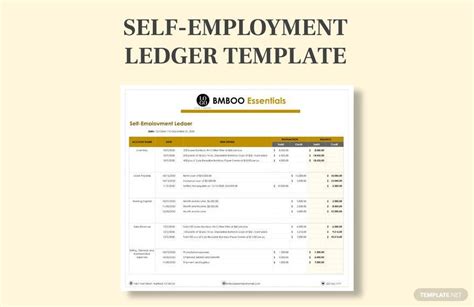

Track income and expenses with a Self Employment Ledger Template Excel, featuring invoicing, tax deductions, and financial reporting tools for freelancers and independent contractors to manage their business finances efficiently.

As a self-employed individual, managing finances and keeping track of expenses is crucial for the success of your business. One of the most effective ways to do this is by using a self-employment ledger template in Excel. This tool allows you to organize your income and expenses, making it easier to prepare for tax season and make informed financial decisions. In this article, we will explore the importance of using a self-employment ledger template, its benefits, and provide a step-by-step guide on how to create and use one.

The self-employment ledger template is a valuable tool for freelancers, independent contractors, and small business owners. It helps to streamline financial record-keeping, reducing the risk of errors and missed deductions. By using a self-employment ledger template, you can easily track your business income, expenses, and profits, making it easier to identify areas for improvement and make data-driven decisions.

Using a self-employment ledger template can also help you stay organized and focused on your financial goals. By having all your financial information in one place, you can quickly identify trends, spot potential issues, and make adjustments as needed. This can be especially helpful during tax season, when you need to provide accurate financial records to the IRS.

Benefits of Using a Self-Employment Ledger Template

The benefits of using a self-employment ledger template are numerous. Some of the most significant advantages include:

- Improved financial organization: By using a self-employment ledger template, you can keep all your financial records in one place, making it easier to track income, expenses, and profits.

- Increased accuracy: The template helps to reduce errors and ensure accuracy, which is essential for tax purposes and financial decision-making.

- Time-saving: The template saves time and effort, allowing you to focus on other aspects of your business.

- Enhanced financial visibility: The template provides a clear picture of your financial situation, making it easier to identify areas for improvement and make informed decisions.

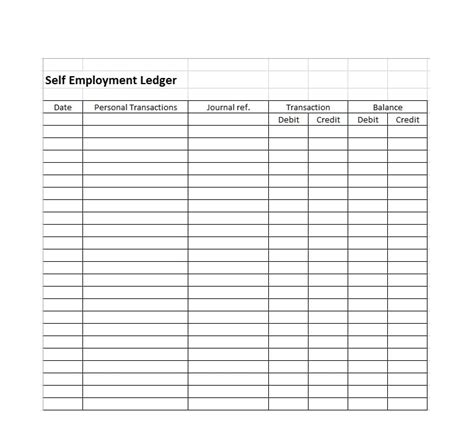

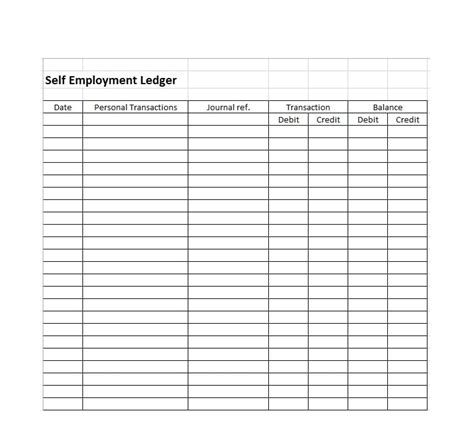

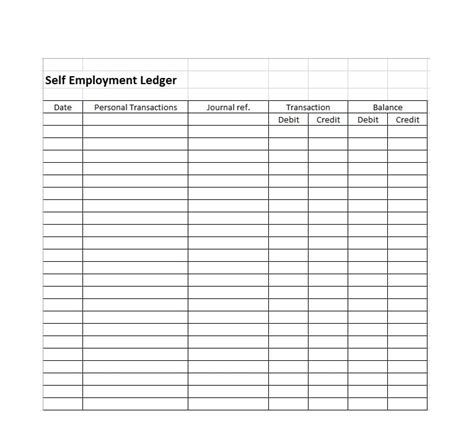

Creating a Self-Employment Ledger Template in Excel

Creating a self-employment ledger template in Excel is relatively straightforward. Here's a step-by-step guide to get you started:

- Open a new Excel spreadsheet and set up the following columns:

- Date

- Description

- Income

- Expenses

- Profit/Loss

- Set up the header row with the column names.

- Format the columns to fit your needs, such as adjusting the width and font size.

- Create a formula to calculate the profit/loss column by subtracting the expenses from the income.

- Add a summary section at the bottom of the spreadsheet to calculate the total income, expenses, and profit/loss.

Using the Self-Employment Ledger Template

Using the self-employment ledger template is easy. Here's how:

- Enter each transaction in the corresponding column, including the date, description, income, and expenses.

- Update the spreadsheet regularly to ensure accuracy and stay on top of your finances.

- Use the summary section to review your financial performance and make adjustments as needed.

- Use the template to prepare for tax season by identifying deductible expenses and calculating your net profit.

Tips for Getting the Most Out of Your Self-Employment Ledger Template

To get the most out of your self-employment ledger template, follow these tips:

- Update the spreadsheet regularly to ensure accuracy and stay on top of your finances.

- Use the template to identify areas for improvement and make informed financial decisions.

- Consider using additional templates, such as a budget template or a cash flow template, to further streamline your financial management.

- Review and revise the template regularly to ensure it continues to meet your needs and provide accurate financial information.

Common Mistakes to Avoid When Using a Self-Employment Ledger Template

When using a self-employment ledger template, there are several common mistakes to avoid:

- Failing to update the spreadsheet regularly, which can lead to inaccurate financial information.

- Not using the template to its full potential, such as not using formulas or not reviewing the summary section regularly.

- Not keeping backup copies of the spreadsheet, which can lead to data loss in case of a technical issue.

- Not seeking professional advice when needed, such as during tax season or when making significant financial decisions.

Conclusion and Next Steps

In conclusion, using a self-employment ledger template in Excel is an effective way to manage your finances and stay organized as a self-employed individual. By following the steps outlined in this article and avoiding common mistakes, you can get the most out of your template and make informed financial decisions. Remember to review and revise the template regularly to ensure it continues to meet your needs and provide accurate financial information.

Self-Employment Ledger Template Image Gallery

What is a self-employment ledger template?

+A self-employment ledger template is a tool used to track and manage finances for self-employed individuals. It helps to organize income, expenses, and profits, making it easier to prepare for tax season and make informed financial decisions.

Why do I need a self-employment ledger template?

+You need a self-employment ledger template to stay organized and focused on your financial goals. It helps to streamline financial record-keeping, reducing the risk of errors and missed deductions. By using a self-employment ledger template, you can easily track your business income, expenses, and profits, making it easier to identify areas for improvement and make data-driven decisions.

How do I create a self-employment ledger template in Excel?

+To create a self-employment ledger template in Excel, follow these steps: set up the columns for date, description, income, expenses, and profit/loss; format the columns to fit your needs; create a formula to calculate the profit/loss column; and add a summary section to calculate the total income, expenses, and profit/loss.

We hope this article has provided you with a comprehensive understanding of the importance of using a self-employment ledger template in Excel. By following the steps outlined in this article and avoiding common mistakes, you can get the most out of your template and make informed financial decisions. Remember to review and revise the template regularly to ensure it continues to meet your needs and provide accurate financial information. If you have any further questions or need additional guidance, please don't hesitate to reach out. Share this article with others who may benefit from using a self-employment ledger template, and leave a comment below with your thoughts and experiences.