Intro

Discover 5 retirement templates to plan your golden years, including budgeting worksheets, savings calculators, and investment trackers, to ensure a secure financial future and stress-free retirement planning strategy.

Planning for retirement is a crucial aspect of securing a comfortable and enjoyable post-work life. With numerous options and strategies available, it can be overwhelming to decide where to start. Retirement templates offer a structured approach to organizing your plans, goals, and financial resources. They help in creating a personalized roadmap tailored to your needs, ensuring a smooth transition into retirement. In this article, we will delve into the importance of retirement planning, explore different types of retirement templates, and discuss how to choose the most suitable one for your situation.

Retirement planning involves more than just saving money; it's about creating a lifestyle that aligns with your desires, health, and financial situation. A well-planned retirement can provide peace of mind, allowing you to focus on your passions and spend quality time with loved ones. However, without a clear plan, retirees may face uncertainty, financial strain, or unmet expectations. This is where retirement templates come into play, offering a guided framework to navigate the complexities of retirement planning.

Effective retirement planning requires consideration of various factors, including your current financial status, retirement goals, expected expenses, and potential income sources. It's essential to assess your financial readiness, understand your retirement aspirations, and develop strategies to achieve them. Retirement templates are designed to facilitate this process, providing a structured format to organize your thoughts, calculate your financial needs, and make informed decisions about your future.

Understanding Retirement Templates

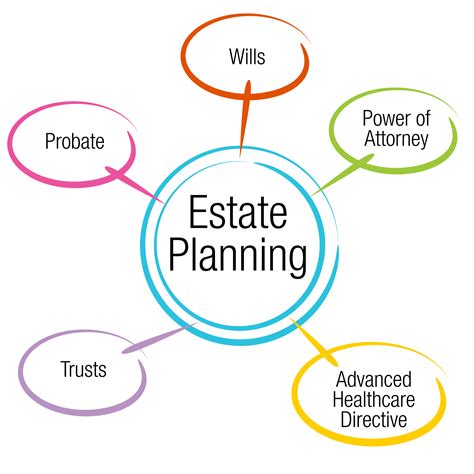

Retirement templates are pre-designed documents or tools that help individuals plan and organize their retirement. These templates can be found online or created with the assistance of a financial advisor. They typically include sections for budgeting, investment planning, healthcare considerations, and lifestyle preferences. By using a retirement template, you can systematically approach your retirement planning, ensuring that all critical aspects are addressed.

Benefits of Using Retirement Templates

The benefits of using retirement templates are multifaceted. They provide a clear and structured approach to retirement planning, helping individuals to: - Organize their financial information and goals. - Identify potential gaps in their retirement income. - Develop a comprehensive plan that aligns with their lifestyle aspirations. - Regularly review and adjust their plan as circumstances change.Types of Retirement Templates

There are various types of retirement templates available, catering to different needs and preferences. Some common types include:

- Financial Retirement Templates: These focus on the financial aspects of retirement, including budgeting, savings, investments, and potential income sources.

- Lifestyle Retirement Templates: These templates emphasize the non-financial aspects of retirement, such as travel plans, hobbies, health and wellness, and social engagement.

- Combined Retirement Templates: These offer a holistic approach, combining both financial and lifestyle planning aspects to provide a comprehensive retirement plan.

How to Choose a Retirement Template

Choosing the right retirement template depends on your individual circumstances, financial complexity, and personal preferences. Consider the following steps: - **Assess Your Needs:** Determine what aspects of retirement planning are most important to you. If you're primarily concerned with financial security, a financial retirement template might be suitable. For a more balanced approach, consider a combined template. - **Evaluate Complexity:** If you have complex financial situations, such as multiple investments or sources of income, you may benefit from a more detailed template that can accommodate these factors. - **Consider Professional Advice:** For personalized guidance, consult with a financial advisor who can help tailor a retirement template to your specific needs and goals.Creating Your Own Retirement Template

While pre-designed templates are readily available, some individuals may prefer to create their own tailored template. This approach allows for complete customization, ensuring that all unique aspects of your retirement plans are included. To create your own retirement template:

- Start with Basics: Begin with fundamental sections such as financial overview, retirement goals, and budget projections.

- Add Custom Sections: Incorporate areas that are specific to your situation, such as plans for starting a business, buying a vacation home, or pursuing hobbies.

- Regularly Review and Update: Treat your template as a living document, regularly reviewing and updating it to reflect changes in your life, finances, and goals.

Implementing Your Retirement Plan

After creating or selecting a retirement template and filling it out, the next step is implementation. This involves: - **Executing Financial Plans:** Start saving, investing, or adjusting your financial strategies according to your plan. - **Pursuing Lifestyle Goals:** Begin making arrangements for your desired lifestyle in retirement, whether that involves travel, education, or spending more time with family and friends. - **Monitoring Progress:** Regularly review your retirement template to track your progress, identify areas for improvement, and make necessary adjustments.Gallery of Retirement Planning Images

Retirement Planning Image Gallery

Frequently Asked Questions About Retirement Templates

What is a retirement template?

+A retirement template is a tool used to plan and organize retirement, covering financial, lifestyle, and other relevant aspects.

Why is it important to use a retirement template?

+Using a retirement template helps in creating a structured plan, ensuring that all critical aspects of retirement are considered, leading to a more secure and enjoyable post-work life.

How do I choose the right retirement template?

+Choose a template that aligns with your needs, whether financial, lifestyle, or a combination of both. Consider your financial complexity and personal preferences when selecting a template.

In conclusion, retirement templates are invaluable tools for planning a fulfilling and secure retirement. By understanding the different types of templates available and choosing one that suits your needs, you can create a personalized roadmap to your post-work life. Remember, retirement planning is a continuous process that requires regular review and adjustment. With the right template and a commitment to your goals, you can look forward to a retirement that is both enjoyable and financially stable. We invite you to share your thoughts on retirement planning and templates in the comments below, and consider sharing this article with others who may benefit from this information.