Intro

Boost your banking experience with 5 essential Santander Bank tips, including account management, online banking, and mobile banking, to enhance your financial control and security.

Santander Bank is one of the largest banks in the world, with operations in numerous countries across Europe, North and South America, and other regions. As a customer of Santander Bank, it's essential to understand how to get the most out of your banking experience. Whether you're looking to manage your finances more effectively, save money, or take advantage of the bank's various services, there are several tips and tricks that can help. In this article, we'll explore five Santander Bank tips that can help you make the most of your banking experience.

The banking industry has undergone significant changes in recent years, with the rise of digital banking and mobile payments. As a result, banks like Santander have had to adapt to these changes, offering their customers a range of new services and features. From mobile banking apps to online account management, there are many ways to manage your finances with Santander Bank. However, with so many options available, it can be difficult to know where to start. That's why we've put together these five tips, to help you navigate the world of Santander Bank and get the most out of your banking experience.

As a Santander Bank customer, you have access to a wide range of services and features, from current and savings accounts to credit cards, loans, and investment products. Whether you're looking to manage your day-to-day finances, save for the future, or invest in your retirement, Santander Bank has a range of products and services that can help. However, with so many options available, it's essential to understand how to use these services effectively. By following these five tips, you can make the most of your Santander Bank experience and achieve your financial goals.

Understanding Your Account Options

Some of the key account options available from Santander Bank include:

- Current accounts: These are ideal for managing your day-to-day finances, with features such as debit cards, online banking, and mobile banking apps.

- Savings accounts: These are designed to help you save for the future, with features such as interest rates, withdrawal limits, and savings goals.

- Credit cards: These can be used to make purchases, pay bills, and earn rewards, with features such as interest rates, credit limits, and rewards programs.

- Loans: These can be used to finance large purchases, pay off debt, or cover unexpected expenses, with features such as interest rates, repayment terms, and loan amounts.

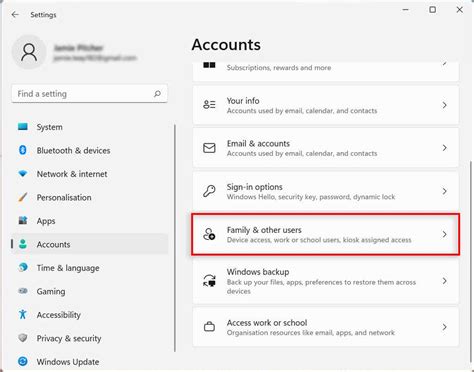

Managing Your Finances Online

Some of the key features of Santander Bank's online banking platform include:

- Account management: You can view your account balances, transaction history, and statements, as well as manage your account settings and preferences.

- Bill pay: You can pay bills online, either as a one-time payment or as a recurring payment.

- Money transfer: You can transfer money between your accounts, or to other people's accounts, either domestically or internationally.

- Budgeting tools: You can use the platform's budgeting tools to track your spending, create a budget, and set financial goals.

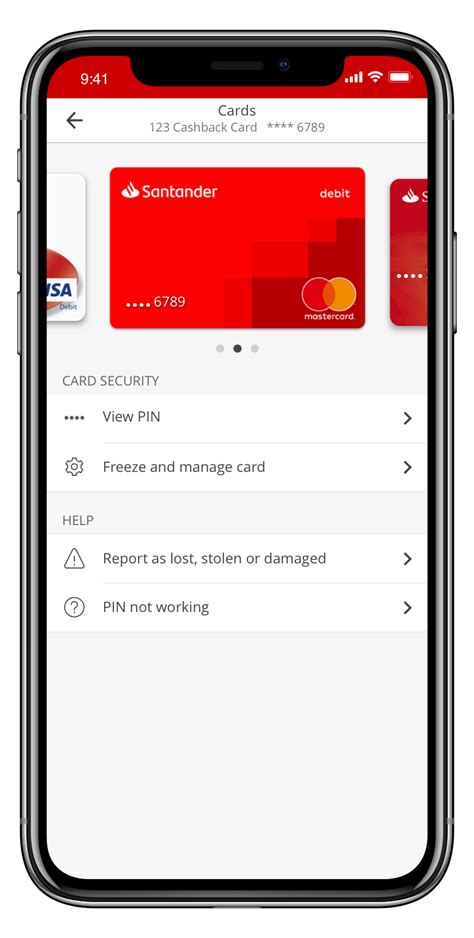

Using Mobile Banking Apps

Some of the key features of Santander Bank's mobile banking apps include:

- Account management: You can view your account balances, transaction history, and statements, as well as manage your account settings and preferences.

- Mobile deposit: You can deposit checks remotely, using the app's mobile deposit feature.

- Mobile payment: You can make payments using your mobile device, either in-store or online.

- Alerts: You can set up alerts to notify you of account activity, such as low balances, large transactions, or suspicious activity.

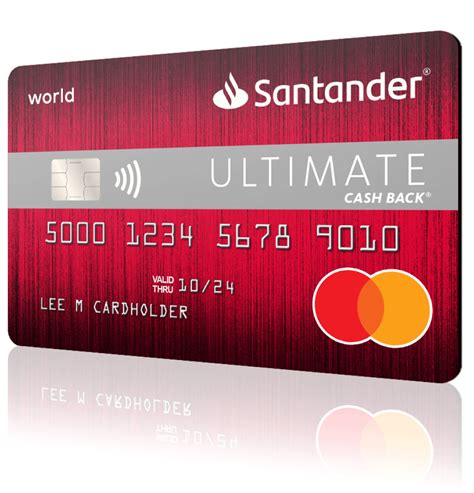

Taking Advantage of Rewards and Benefits

Some of the key rewards and benefits available from Santander Bank include:

- Cashback: You can earn cashback on your purchases, either as a percentage of the purchase amount or as a fixed amount.

- Points: You can earn points on your purchases, which can be redeemed for rewards such as gift cards, travel, or merchandise.

- Travel miles: You can earn travel miles on your purchases, which can be redeemed for flights, hotels, or other travel-related expenses.

- Interest rates: You can earn interest on your savings, either as a fixed rate or as a variable rate.

- Bonuses: You can earn bonuses on your savings, either as a one-time payment or as a recurring payment.

Getting Help and Support

Some of the key ways to get help and support from Santander Bank include:

- Phone: You can contact the bank's customer service team by phone, either during business hours or outside of business hours.

- Email: You can contact the bank's customer service team by email, either through the bank's website or through your email provider.

- Online chat: You can contact the bank's customer service team through online chat, either through the bank's website or through a mobile banking app.

- Branch: You can visit a branch in person, either during business hours or outside of business hours.

Santander Bank Image Gallery

What types of accounts does Santander Bank offer?

+Santander Bank offers a range of accounts, including current accounts, savings accounts, credit cards, loans, and investment products.

How do I manage my finances online with Santander Bank?

+You can manage your finances online with Santander Bank by using the bank's online banking platform, which allows you to view your account balances, pay bills, transfer money, and more.

What are the benefits of using Santander Bank's mobile banking apps?

+The benefits of using Santander Bank's mobile banking apps include being able to manage your finances on the go, deposit checks remotely, make mobile payments, and receive alerts about account activity.

How do I get help and support from Santander Bank?

+You can get help and support from Santander Bank by contacting the bank's customer service team by phone, email, or online chat, or by visiting a branch in person.

What types of rewards and benefits does Santander Bank offer?

+Santander Bank offers a range of rewards and benefits, including cashback, points, travel miles, interest rates, and bonuses, depending on the type of account or product you have.

We hope that these five Santander Bank tips have been helpful in understanding how to get the most out of your banking experience. Whether you're looking to manage your finances more effectively, save money, or take advantage of the bank's various services, there are many ways to make the most of your Santander Bank experience. By following these tips and taking advantage of the bank's range of products and services, you can achieve your financial goals and enjoy a more secure and prosperous future. So why not start today and see how Santander Bank can help you achieve your financial aspirations? Share your thoughts and experiences with us in the comments below, and don't forget to share this article with your friends and family who may be interested in learning more about Santander Bank.