Intro

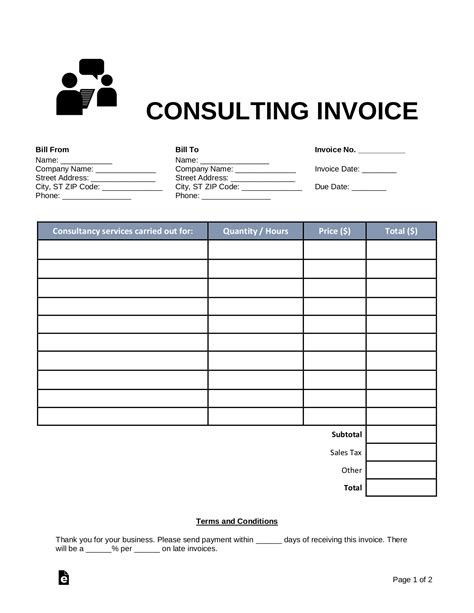

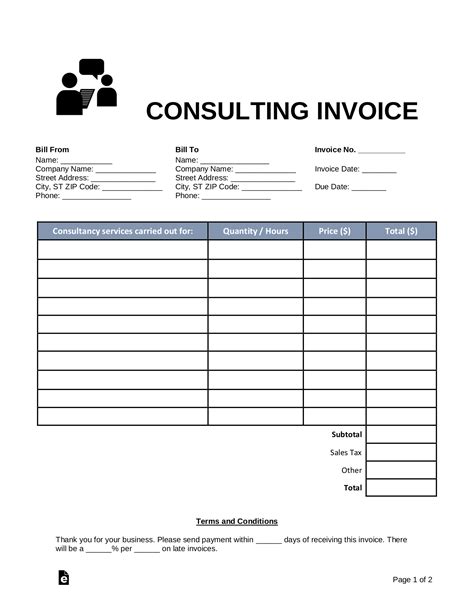

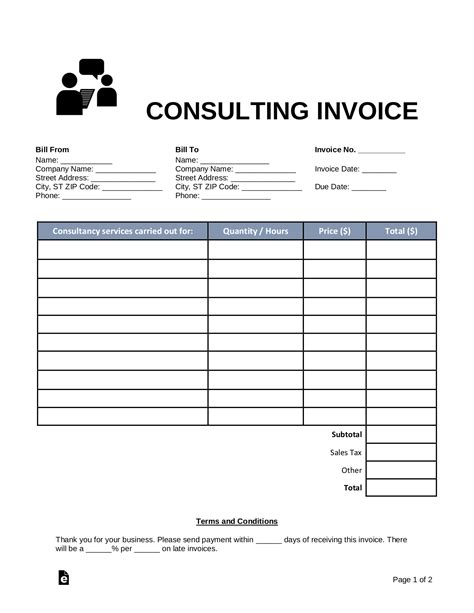

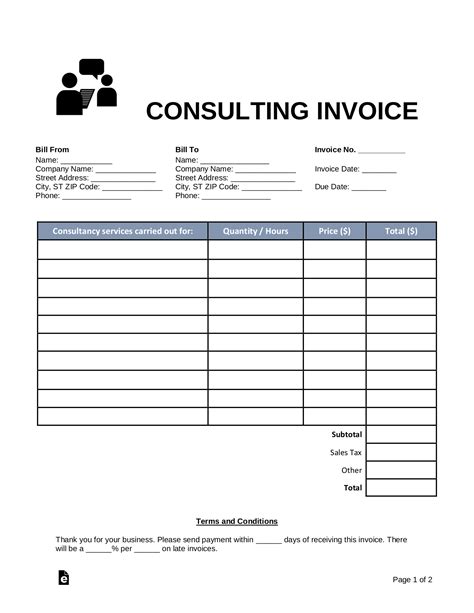

Streamline billing with a Consulting Services Invoice Template, featuring customizable fields for hourly rates, project costs, and payment terms, making invoicing efficient and professional for consultants and freelancers.

As a consulting service provider, creating an invoice that accurately reflects the services provided and the costs incurred is crucial for maintaining a professional relationship with clients and ensuring timely payment. A well-structured consulting services invoice template can help streamline the billing process, reduce errors, and improve cash flow. In this article, we will delve into the importance of having a comprehensive invoice template, its key components, and provide guidance on how to create one that meets your business needs.

The importance of a consulting services invoice template cannot be overstated. It serves as a formal request for payment from clients, outlining the services rendered, the associated costs, and the payment terms. A clear and detailed invoice helps prevent misunderstandings, ensures that clients understand what they are being charged for, and facilitates prompt payment. Moreover, a standardized invoice template helps consulting service providers to maintain a professional image, which is essential for building trust and credibility with clients.

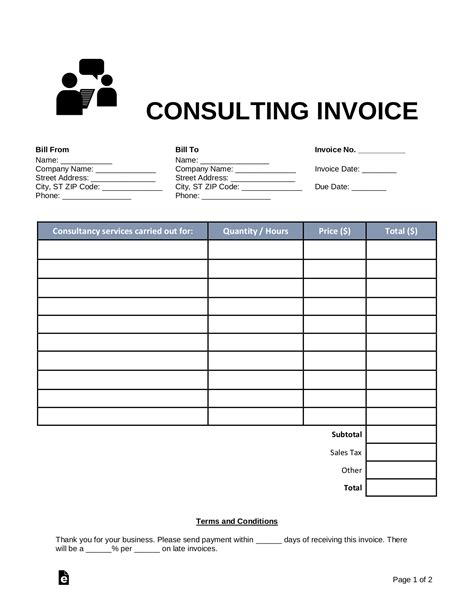

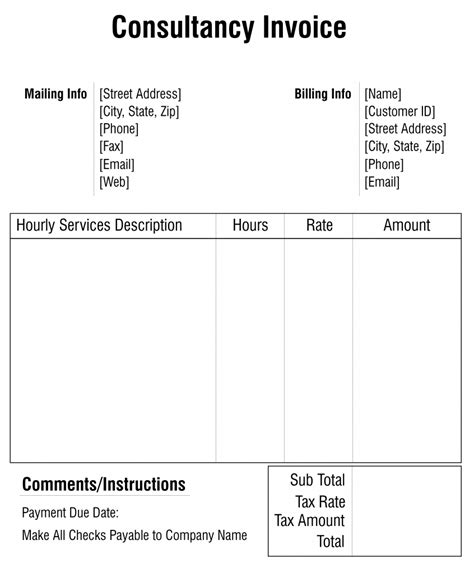

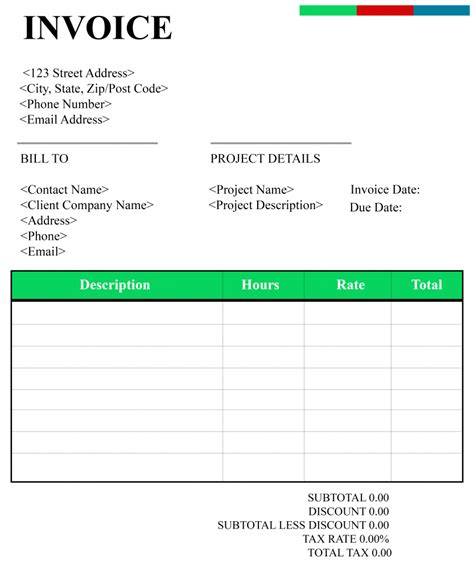

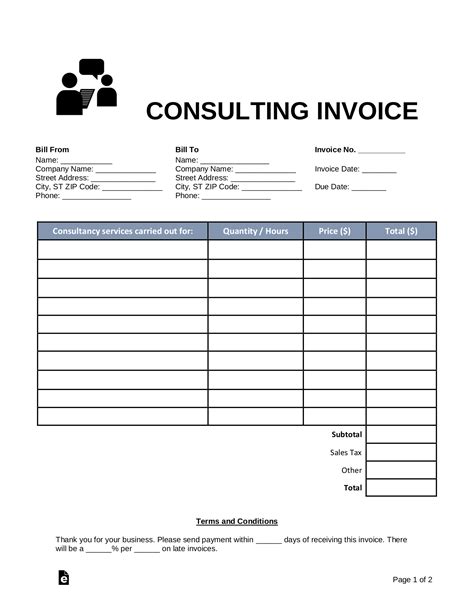

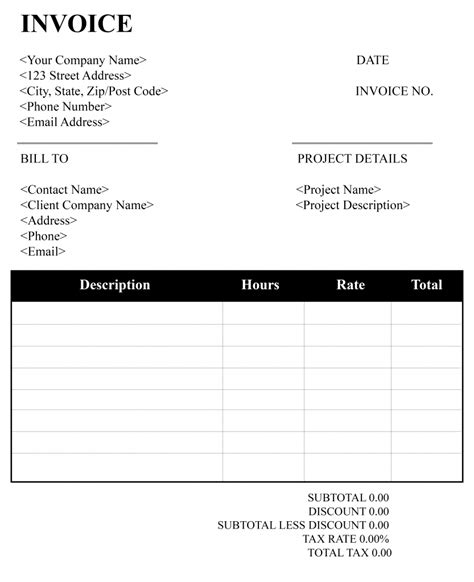

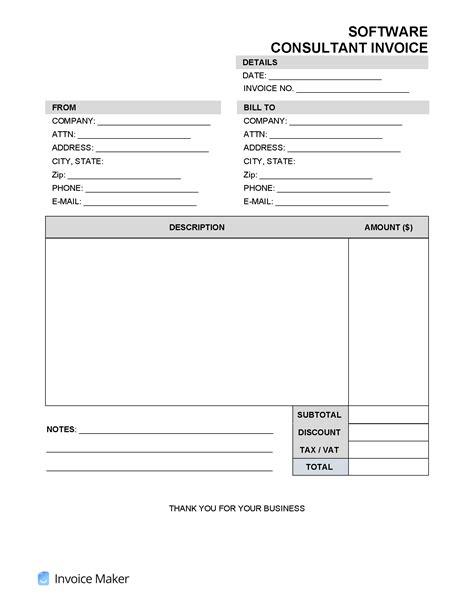

To create an effective consulting services invoice template, it is essential to consider the key components that should be included. These components typically comprise the service provider's information, client details, invoice number and date, billing details, services provided, rates and charges, subtotal, taxes, and total amount due. Each of these components plays a vital role in ensuring that the invoice is comprehensive, accurate, and easy to understand.

Understanding the Key Components of a Consulting Services Invoice Template

When creating a consulting services invoice template, it is crucial to include the following key components:

- Service provider's information: This includes the company name, address, phone number, and email address.

- Client details: The client's name, address, and contact information should be clearly stated.

- Invoice number and date: A unique invoice number and the date of issuance help in tracking and organizing invoices.

- Billing details: This section should outline the services provided, including descriptions, quantities, rates, and charges.

- Services provided: A detailed list of the consulting services rendered, including any additional work or expenses.

- Rates and charges: The hourly or project-based rates, as well as any additional charges, should be clearly specified.

- Subtotal: The total amount due before taxes.

- Taxes: Any applicable taxes, such as sales tax or VAT, should be calculated and added to the subtotal.

- Total amount due: The final amount that the client needs to pay, including all taxes and charges.

Benefits of Using a Consulting Services Invoice Template

The benefits of using a consulting services invoice template are numerous. It helps to: - Streamline the billing process: By having a standardized template, you can quickly generate invoices and reduce the time spent on billing. - Reduce errors: A template ensures that all necessary information is included, minimizing the risk of errors or omissions. - Improve cash flow: Clear and detailed invoices facilitate prompt payment from clients, which is essential for maintaining a healthy cash flow. - Enhance professionalism: A well-structured invoice template presents a professional image, which is vital for building trust and credibility with clients.Creating a Consulting Services Invoice Template

To create a consulting services invoice template, follow these steps:

- Determine the template format: Decide whether you want to use a Word document, Excel spreadsheet, or an online invoicing tool.

- Include the service provider's information: Add your company's name, address, phone number, and email address.

- Add client details: Include spaces for the client's name, address, and contact information.

- Insert invoice number and date: Create a system for generating unique invoice numbers and include the date of issuance.

- Outline billing details: Create a table or list to outline the services provided, including descriptions, quantities, rates, and charges.

- Specify payment terms: Clearly state the payment terms, including the due date, accepted payment methods, and any late payment fees.

- Calculate subtotal, taxes, and total amount due: Use formulas to calculate the subtotal, taxes, and total amount due.

Best Practices for Using a Consulting Services Invoice Template

To get the most out of your consulting services invoice template, follow these best practices: - **Customize the template**: Tailor the template to your business needs and branding. - **Use clear and concise language**: Ensure that the language used is easy to understand and avoids ambiguity. - **Include a payment stub**: Provide a payment stub or a tear-off section to make it easy for clients to send payment. - **Send invoices promptly**: Send invoices to clients as soon as possible after the services have been rendered. - **Follow up on overdue invoices**: Regularly follow up on overdue invoices to ensure timely payment.Common Mistakes to Avoid When Creating a Consulting Services Invoice Template

When creating a consulting services invoice template, avoid the following common mistakes:

- Omitting essential information: Ensure that all necessary information, such as client details and payment terms, is included.

- Using ambiguous language: Use clear and concise language to avoid confusion or misunderstandings.

- Not including a unique invoice number: Generate a unique invoice number for each invoice to facilitate tracking and organization.

- Not specifying payment terms: Clearly state the payment terms, including the due date and accepted payment methods.

- Not calculating taxes correctly: Ensure that taxes are calculated correctly and added to the subtotal.

Conclusion and Next Steps

In conclusion, a well-structured consulting services invoice template is essential for streamlining the billing process, reducing errors, and improving cash flow. By including the key components, following best practices, and avoiding common mistakes, you can create an effective invoice template that meets your business needs. To take your invoicing to the next level, consider implementing an online invoicing tool that automates the billing process and provides real-time tracking and reporting.Consulting Services Invoice Template Gallery

What is a consulting services invoice template?

+A consulting services invoice template is a pre-designed document that outlines the services provided, rates, and payment terms for consulting services.

Why is a consulting services invoice template important?

+A consulting services invoice template is important because it streamlines the billing process, reduces errors, and improves cash flow.

What are the key components of a consulting services invoice template?

+The key components of a consulting services invoice template include the service provider's information, client details, invoice number and date, billing details, services provided, rates and charges, subtotal, taxes, and total amount due.

How can I create a consulting services invoice template?

+You can create a consulting services invoice template by determining the template format, including the service provider's information, adding client details, inserting invoice number and date, outlining billing details, specifying payment terms, and calculating subtotal, taxes, and total amount due.

What are the best practices for using a consulting services invoice template?

+The best practices for using a consulting services invoice template include customizing the template, using clear and concise language, including a payment stub, sending invoices promptly, and following up on overdue invoices.

We hope this article has provided you with a comprehensive understanding of the importance of a consulting services invoice template and how to create one that meets your business needs. If you have any further questions or would like to share your experiences with consulting services invoicing, please feel free to comment below. Additionally, if you found this article helpful, please share it with your colleagues and friends who may benefit from it. By working together, we can improve our invoicing processes and maintain a professional image in the consulting industry.