Intro

Discover 5 Excel salary templates to streamline payroll management, featuring automatic calculations, tax deductions, and benefits tracking, making salary processing efficient and error-free.

Managing employee salaries is a crucial aspect of running a business, as it directly affects the financial well-being and morale of the workforce. Effective salary management involves not only determining fair compensation but also maintaining accurate records, planning for future adjustments, and ensuring compliance with labor laws. One of the most efficient tools for managing salaries is Microsoft Excel, due to its versatility, calculation capabilities, and ease of use. Excel salary templates can streamline the process of tracking salaries, benefits, and deductions, making it easier for businesses to manage their payroll.

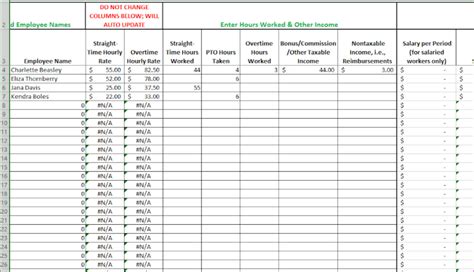

Excel offers a wide range of functionalities that can be leveraged to create comprehensive salary templates. From basic templates that calculate gross and net salary based on a fixed salary structure, to more complex ones that factor in variables such as overtime, bonuses, and tax deductions, the possibilities are vast. These templates can be customized to fit the specific needs of a business, including the size of the workforce, the industry, and the legal requirements of the region.

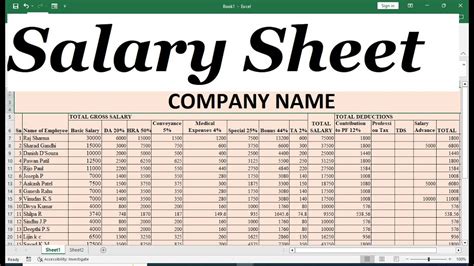

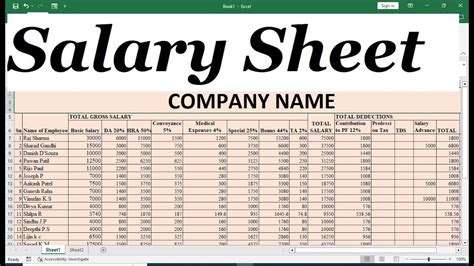

For small businesses or startups, a simple Excel salary template might suffice. This could include basic information such as employee names, positions, hourly or annual salaries, and any deductions. However, for larger corporations or businesses with complex payroll structures, more detailed templates are necessary. These might include separate sheets for different departments, detailed breakdowns of benefits and deductions, and automatic calculations for taxes and social security contributions.

One of the key benefits of using Excel salary templates is their ability to automate many of the tedious calculations involved in payroll management. By setting up formulas and macros, businesses can quickly and accurately calculate salaries, including all relevant adjustments, without the need for manual intervention. This not only saves time but also reduces the risk of human error, which can lead to costly mistakes and legal issues.

Moreover, Excel salary templates can be easily shared and accessed by authorized personnel, facilitating collaboration and transparency within the organization. They can also be securely stored, with access restricted to those who need it, ensuring confidentiality and compliance with data protection regulations.

In terms of customization, Excel templates can be tailored to include any specific requirements a business might have. For example, a template might include a section for tracking employee performance, with metrics that influence salary adjustments or bonuses. It could also incorporate a budgeting tool, allowing HR and finance departments to plan and forecast payroll expenses more effectively.

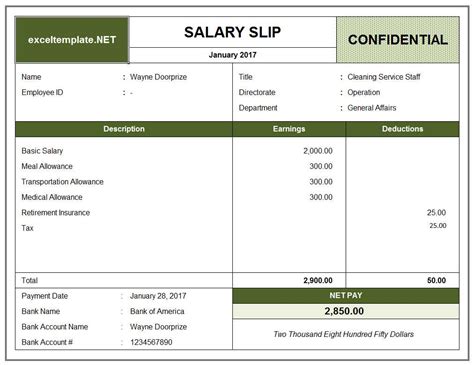

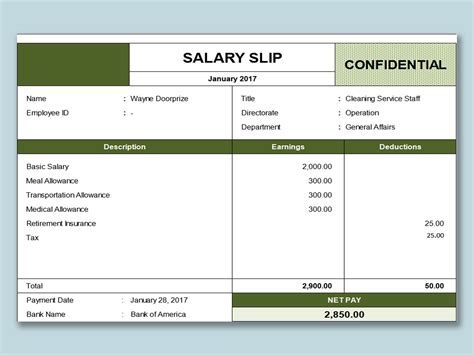

Given the importance of effective salary management and the versatility of Excel, it's no surprise that there are numerous Excel salary templates available, both free and paid. These templates cater to a wide range of needs and can be downloaded and customized as per the user's requirements. Some popular types of Excel salary templates include:

- Basic Salary Template: Suitable for small businesses or individuals, this template provides a straightforward way to calculate and track salaries.

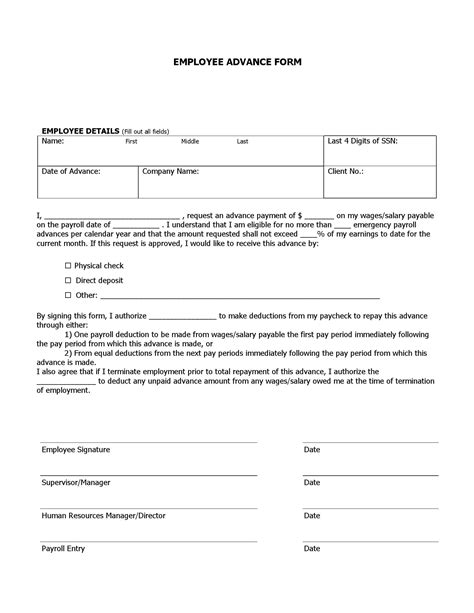

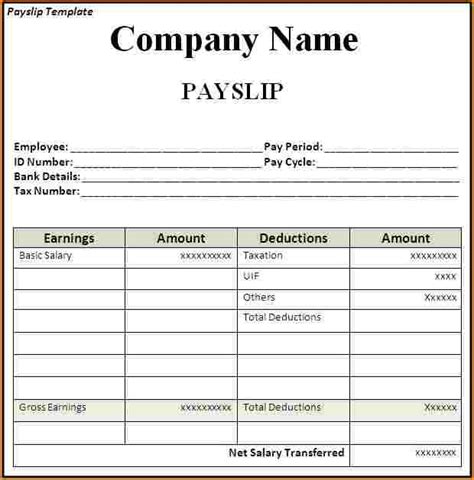

- Payroll Template: Designed for larger organizations, payroll templates include more detailed information such as benefits, deductions, and tax calculations.

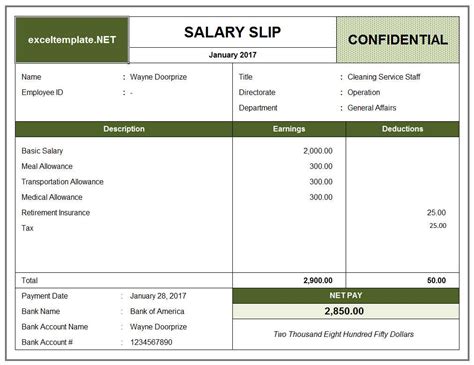

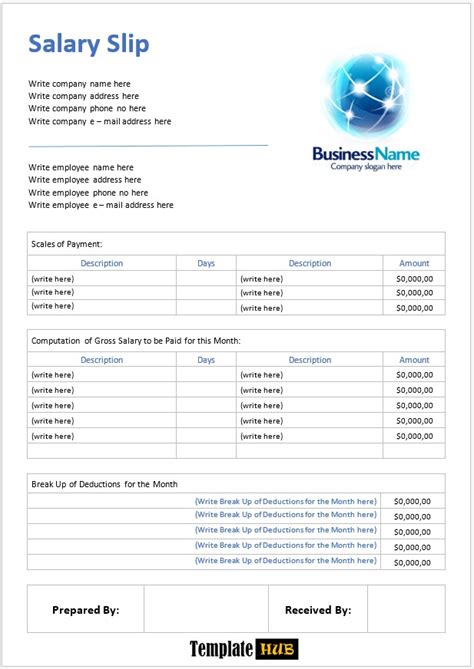

- Salary Slip Template: Used for generating salary slips for employees, this template can include details such as gross salary, deductions, and net salary.

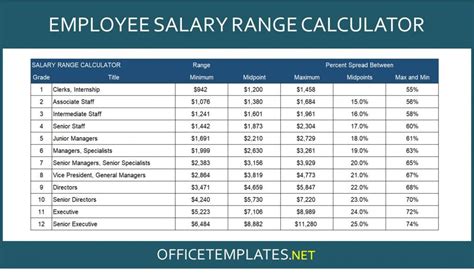

- Employee Salary Calculator: A more dynamic template that allows for the calculation of salaries based on various inputs such as hourly wage, working hours, and overtime.

Benefits of Using Excel Salary Templates

The use of Excel salary templates offers several benefits to businesses, including:

- Efficiency: Automates calculations and reduces the time spent on payroll management.

- Accuracy: Minimizes the risk of errors in salary calculations.

- Customization: Can be tailored to fit the specific needs of the business.

- Cost-Effective: Reduces the need for specialized payroll software or external services.

- Security: Allows for secure storage and access control.

Implementing Excel Salary Templates

Implementing an Excel salary template involves several steps:

- Download or Create a Template: Find a suitable template online or create one from scratch based on the business's requirements.

- Customize the Template: Modify the template to include all necessary fields and calculations specific to the business.

- Enter Employee Data: Populate the template with employee information, including salaries, benefits, and deductions.

- Test the Template: Ensure that all calculations are accurate and the template functions as expected.

- Regularly Update the Template: Keep the template up-to-date with any changes in employee data, laws, or business policies.

Common Features of Excel Salary Templates

While Excel salary templates can vary widely in their complexity and features, some common elements include:

- Employee Information: A section for entering basic employee details such as name, position, and contact information.

- Salary Details: Fields for gross salary, net salary, and any adjustments such as bonuses or deductions.

- Benefits and Deductions: Sections for calculating and tracking benefits like health insurance and deductions such as taxes or retirement contributions.

- Payroll Calendar: A calendar view of pay periods and payday schedules.

- Automatic Calculations: Formulas that automatically calculate salaries, taxes, and other payroll elements based on input data.

Best Practices for Using Excel Salary Templates

To get the most out of Excel salary templates, businesses should follow best practices such as:

- Regular Updates: Ensure that templates are updated regularly to reflect changes in laws, employee data, or business policies.

- Backup: Regularly backup templates and data to prevent loss in case of system failure or data corruption.

- Access Control: Limit access to authorized personnel to maintain confidentiality and security.

- Training: Provide training to staff on how to use and update the templates effectively.

Challenges and Limitations

While Excel salary templates are highly beneficial, they also come with some challenges and limitations, such as:

- Complexity: For very large or complex payroll structures, Excel might not be sufficient, requiring more specialized software.

- Security: Storing sensitive employee data in Excel templates requires robust security measures to protect against data breaches.

- Scalability: As a business grows, the need for more advanced payroll management systems may arise, potentially outgrowing the capabilities of Excel templates.

Future of Excel Salary Templates

The future of Excel salary templates looks promising, with ongoing advancements in technology expected to enhance their capabilities. Integration with other Microsoft tools, such as Microsoft 365, can provide additional features such as cloud storage, enhanced security, and collaborative functionalities. Moreover, the development of more sophisticated templates and add-ins can further automate payroll processes and improve accuracy.

Conclusion and Recommendations

In conclusion, Excel salary templates are a valuable tool for businesses of all sizes, offering a cost-effective, efficient, and customizable solution for managing payroll. By understanding the benefits, features, and best practices associated with these templates, businesses can leverage them to streamline their payroll processes, reduce errors, and improve compliance with legal requirements. As technology continues to evolve, it's essential for businesses to stay updated with the latest trends and tools in payroll management, ensuring they maximize the potential of Excel salary templates and other resources available to them.

Gallery of Excel Salary Templates

Excel Salary Templates Image Gallery

What are the benefits of using Excel salary templates?

+The benefits include efficiency, accuracy, customization, cost-effectiveness, and security in managing payroll.

How do I implement an Excel salary template?

+Implementing involves downloading or creating a template, customizing it, entering employee data, testing, and regularly updating the template.

What are some common features of Excel salary templates?

+Common features include employee information, salary details, benefits and deductions, payroll calendar, and automatic calculations.

What are the challenges and limitations of using Excel salary templates?

+Challenges include complexity for large payroll structures, security concerns, and potential scalability issues as the business grows.

How can I ensure the security of my Excel salary templates?

+Ensure security by limiting access, using strong passwords, regularly backing up data, and storing templates securely.

We hope this comprehensive guide to Excel salary templates has been informative and helpful. Whether you're managing a small team or a large workforce, leveraging the power of Excel can significantly streamline your payroll processes. Don't hesitate to reach out with any questions or to share your experiences with using Excel salary templates. Your feedback is invaluable in helping us provide the best possible resources for payroll management. Feel free to comment below, share this article with others who might find it useful, or explore more topics related to Excel and payroll management.