Intro

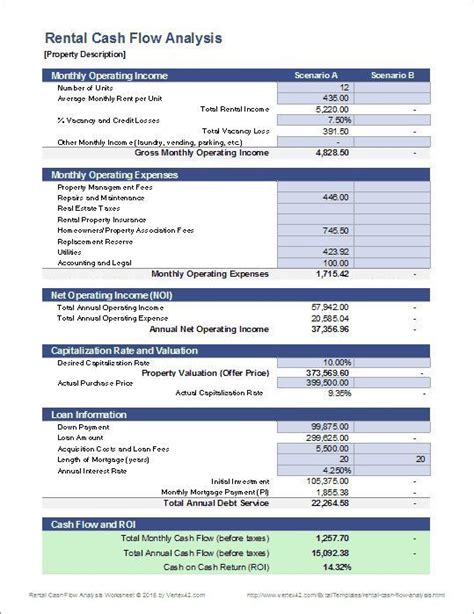

Streamline rental property management with a balance sheet Excel template, tracking income, expenses, and cash flow to optimize investment returns and tax deductions, ensuring accurate financial reporting and analysis.

As a real estate investor, managing your rental properties effectively is crucial for maximizing profits and minimizing losses. One essential tool for achieving this is a well-structured balance sheet, which provides a snapshot of your rental property's financial health at a given point in time. In this article, we will delve into the importance of a rental property balance sheet, its components, and how to create one using an Excel template.

A balance sheet for a rental property is a vital financial statement that outlines the property's assets, liabilities, and equity. It helps investors and property managers make informed decisions about their investments, identify areas for improvement, and ensure compliance with accounting standards. By regularly reviewing and updating the balance sheet, you can track changes in your property's financial situation, respond to potential issues, and optimize your investment strategy.

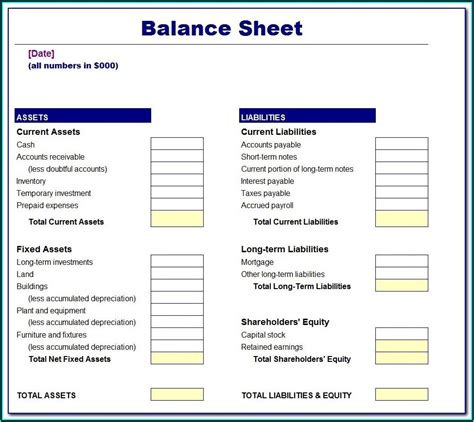

The balance sheet is typically divided into three main categories: assets, liabilities, and equity. Assets represent the property's resources, such as the property itself, cash, and accounts receivable. Liabilities, on the other hand, include debts, taxes, and other obligations. Equity represents the owner's stake in the property, including their initial investment and any accumulated profits. By understanding these components and how they interact, you can gain valuable insights into your rental property's financial performance and make data-driven decisions.

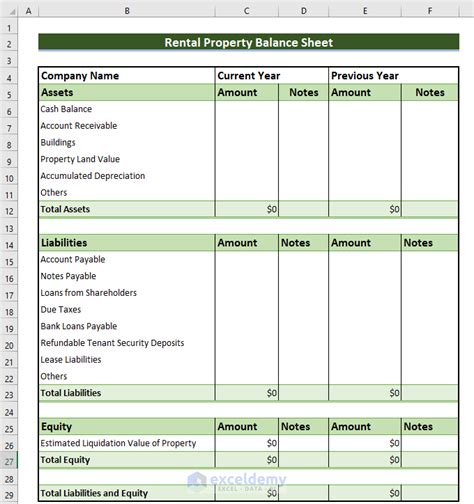

Rental Property Balance Sheet Components

To create a comprehensive balance sheet for your rental property, you need to include the following components:

- Assets:

- Property value

- Cash and cash equivalents

- Accounts receivable

- Other assets (e.g., equipment, vehicles)

- Liabilities:

- Mortgages and loans

- Accounts payable

- Taxes owed

- Other liabilities (e.g., credit card debt)

- Equity:

- Owner's capital

- Retained earnings

- Accumulated depreciation

Benefits of Using a Rental Property Balance Sheet Excel Template

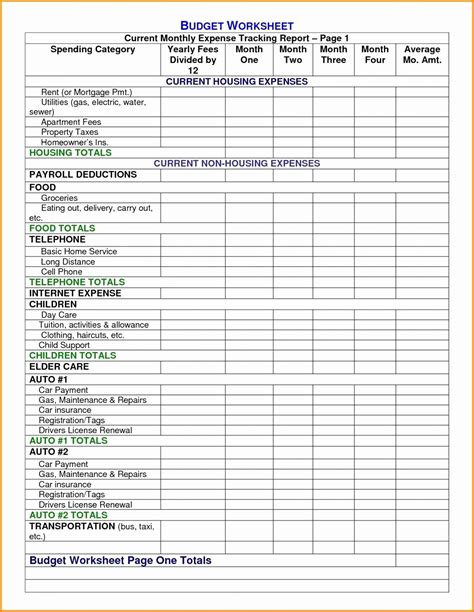

Using a rental property balance sheet Excel template offers several benefits, including:

- Streamlined data entry: The template provides a pre-designed format for entering your financial data, making it easier to organize and update your balance sheet.

- Automated calculations: Excel formulas can be used to perform calculations, such as totaling assets and liabilities, and calculating equity.

- Customization: You can tailor the template to fit your specific needs, adding or removing sections as necessary.

- Easy analysis: The template allows you to quickly identify trends and patterns in your financial data, facilitating analysis and decision-making.

Creating a Rental Property Balance Sheet Excel Template

To create a rental property balance sheet Excel template, follow these steps:

- Open a new Excel spreadsheet and set up the following columns:

- Asset/Liability/Equity

- Description

- Value

- Enter your assets, liabilities, and equity items in the respective columns.

- Use Excel formulas to calculate totals and subtotals.

- Format the template to make it easy to read and understand.

- Save the template for future use and updates.

Rental Property Balance Sheet Example

Here's an example of a rental property balance sheet:

- Assets:

- Property value: $200,000

- Cash: $10,000

- Accounts receivable: $5,000

- Liabilities:

- Mortgage: $150,000

- Accounts payable: $2,000

- Equity:

- Owner's capital: $50,000

- Retained earnings: $10,000

Tips for Managing Your Rental Property Balance Sheet

To effectively manage your rental property balance sheet, consider the following tips:

- Regularly review and update your balance sheet to ensure accuracy and completeness.

- Monitor your cash flow and adjust your expenses accordingly.

- Keep track of your accounts receivable and payable to avoid late payments and penalties.

- Consider hiring a property manager or accountant to help with financial management.

Common Mistakes to Avoid When Creating a Rental Property Balance Sheet

When creating a rental property balance sheet, avoid the following common mistakes:

- Inaccurate or incomplete data entry

- Failure to account for depreciation and amortization

- Incorrect classification of assets, liabilities, and equity

- Not regularly reviewing and updating the balance sheet

Best Practices for Rental Property Accounting

To ensure accurate and effective rental property accounting, follow these best practices:

- Use a separate bank account for your rental property income and expenses.

- Keep detailed records of income and expenses, including receipts and invoices.

- Use accounting software or a spreadsheet to track and manage your financial data.

- Regularly review and reconcile your financial statements to ensure accuracy.

Rental Property Balance Sheet Gallery

Rental Property Balance Sheet Image Gallery

What is a rental property balance sheet?

+A rental property balance sheet is a financial statement that outlines the property's assets, liabilities, and equity at a given point in time.

Why is a rental property balance sheet important?

+A rental property balance sheet is important because it provides a snapshot of the property's financial health, helping investors and property managers make informed decisions and identify areas for improvement.

How do I create a rental property balance sheet?

+To create a rental property balance sheet, you can use an Excel template or accounting software, entering your assets, liabilities, and equity items, and using formulas to calculate totals and subtotals.

In conclusion, a rental property balance sheet is a vital tool for managing your investment and ensuring its long-term success. By understanding the components of a balance sheet, using a template, and following best practices for rental property accounting, you can make informed decisions, optimize your investment strategy, and achieve your financial goals. We encourage you to share your experiences with rental property balance sheets, ask questions, and provide feedback in the comments section below. Additionally, feel free to share this article with others who may benefit from this information, and explore our other resources on rental property management and investing.