Intro

Master QuickBooks journal entries with 5 expert tips, streamlining accounting, reconciliations, and financial reporting, ensuring accuracy and compliance.

QuickBooks is a powerful accounting software that helps businesses manage their financial transactions efficiently. One of the key features of QuickBooks is the journal entry, which allows users to record and track various financial transactions. In this article, we will discuss the importance of journal entries in QuickBooks and provide 5 QuickBooks journal entry tips to help users make the most out of this feature.

Journal entries are essential in QuickBooks as they enable users to record transactions that are not automatically recorded by the software. These transactions may include adjustments to accounts, corrections to previous entries, and accruals of expenses or revenues. By using journal entries, users can ensure that their financial records are accurate and up-to-date. Moreover, journal entries can help users to identify and correct errors in their financial statements, which is crucial for making informed business decisions.

The use of journal entries in QuickBooks can also help businesses to comply with accounting standards and regulations. For example, journal entries can be used to record depreciation, amortization, and other non-cash transactions that are required by accounting standards. Additionally, journal entries can be used to record transactions that are not supported by QuickBooks, such as transactions that involve multiple accounts or transactions that require complex calculations.

Understanding QuickBooks Journal Entries

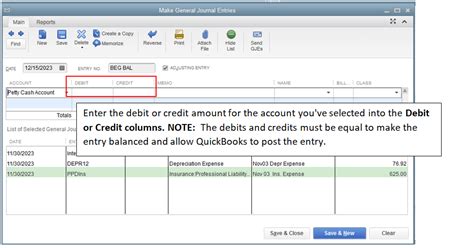

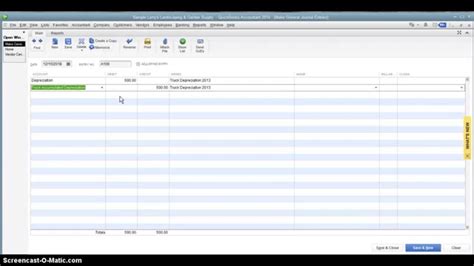

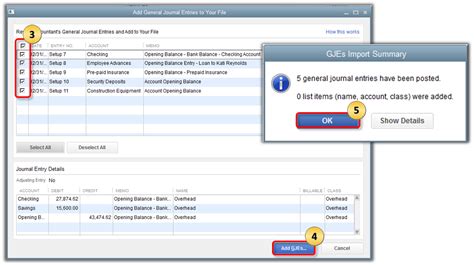

To use journal entries effectively in QuickBooks, users need to understand the basics of journal entry accounting. A journal entry is a record of a financial transaction that includes the date, account numbers, and amounts of the transaction. Journal entries can be used to record various types of transactions, including income, expenses, assets, liabilities, and equity. Users can create journal entries in QuickBooks by going to the "Company" menu and selecting "Make General Journal Entries."

Benefits of QuickBooks Journal Entries

The benefits of using journal entries in QuickBooks are numerous. Firstly, journal entries enable users to record transactions that are not automatically recorded by the software. This ensures that financial records are accurate and up-to-date. Secondly, journal entries can help users to identify and correct errors in their financial statements. This is crucial for making informed business decisions and ensuring compliance with accounting standards and regulations.Some other benefits of using journal entries in QuickBooks include the ability to record non-cash transactions, such as depreciation and amortization. Journal entries can also be used to record transactions that involve multiple accounts or complex calculations. Additionally, journal entries can help users to track and analyze financial data, which is essential for making informed business decisions.

5 QuickBooks Journal Entry Tips

Here are 5 QuickBooks journal entry tips to help users make the most out of this feature:

- Use journal entries to record non-cash transactions: Journal entries can be used to record non-cash transactions, such as depreciation, amortization, and accruals. These transactions are not automatically recorded by QuickBooks, but they are essential for accurate financial reporting.

- Use journal entries to correct errors: Journal entries can be used to correct errors in financial statements. For example, if a user discovers an error in a previous entry, they can use a journal entry to correct the error and ensure that their financial records are accurate.

- Use journal entries to record complex transactions: Journal entries can be used to record complex transactions that involve multiple accounts or complex calculations. For example, a user can use a journal entry to record a transaction that involves multiple accounts, such as a sale that involves both income and expense accounts.

- Use journal entries to track and analyze financial data: Journal entries can be used to track and analyze financial data. For example, a user can use journal entries to track expenses by department or to analyze sales by product.

- Use journal entries to comply with accounting standards: Journal entries can be used to comply with accounting standards and regulations. For example, journal entries can be used to record depreciation, amortization, and other non-cash transactions that are required by accounting standards.

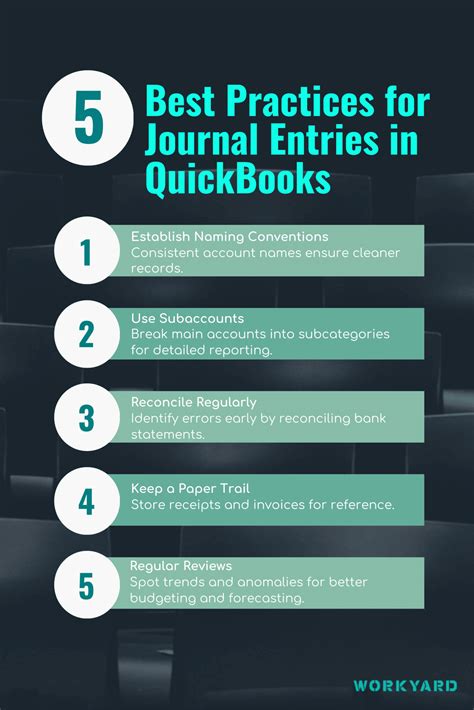

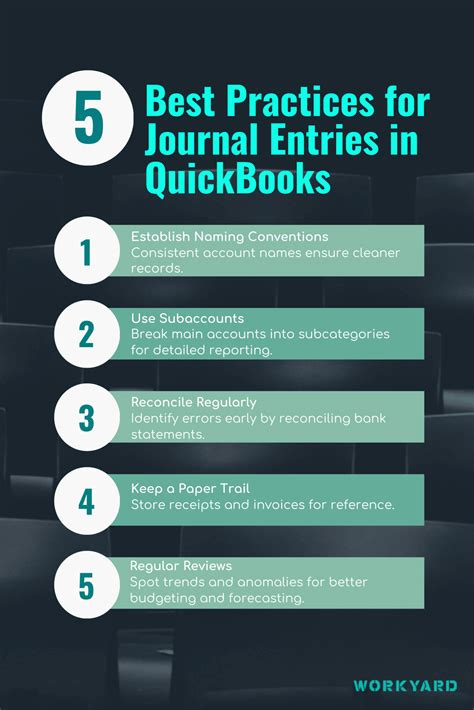

Best Practices for QuickBooks Journal Entries

To get the most out of QuickBooks journal entries, users should follow best practices. Here are some best practices to keep in mind:- Always use a clear and concise description of the transaction.

- Always use the correct accounts and amounts.

- Always date the journal entry correctly.

- Always review and approve journal entries before posting them.

- Always keep a record of journal entries for auditing purposes.

Common Mistakes to Avoid

When using journal entries in QuickBooks, there are several common mistakes to avoid. Here are some of the most common mistakes:

- Incorrect account numbers: Using incorrect account numbers can lead to errors in financial statements and make it difficult to track and analyze financial data.

- Incorrect amounts: Using incorrect amounts can lead to errors in financial statements and make it difficult to track and analyze financial data.

- Incorrect dates: Using incorrect dates can lead to errors in financial statements and make it difficult to track and analyze financial data.

- Lack of documentation: Failing to keep a record of journal entries can make it difficult to audit financial statements and track financial data.

Conclusion and Next Steps

In conclusion, QuickBooks journal entries are a powerful tool for managing financial transactions and ensuring accurate financial reporting. By following the 5 QuickBooks journal entry tips outlined in this article, users can make the most out of this feature and ensure that their financial records are accurate and up-to-date.To take your QuickBooks skills to the next level, we recommend practicing with sample journal entries and exploring the various features and functions of the software. Additionally, users can consult the QuickBooks user manual or online resources for more information on using journal entries and other features of the software.

QuickBooks Journal Entry Image Gallery

What is a QuickBooks journal entry?

+A QuickBooks journal entry is a record of a financial transaction that includes the date, account numbers, and amounts of the transaction.

How do I create a journal entry in QuickBooks?

+To create a journal entry in QuickBooks, go to the "Company" menu and select "Make General Journal Entries."

What are some common mistakes to avoid when using QuickBooks journal entries?

+Some common mistakes to avoid when using QuickBooks journal entries include using incorrect account numbers, incorrect amounts, and incorrect dates. Additionally, failing to keep a record of journal entries can make it difficult to audit financial statements and track financial data.

How can I use QuickBooks journal entries to track and analyze financial data?

+QuickBooks journal entries can be used to track and analyze financial data by recording transactions that involve multiple accounts or complex calculations. For example, a user can use a journal entry to track expenses by department or to analyze sales by product.

What are some best practices for using QuickBooks journal entries?

+Some best practices for using QuickBooks journal entries include always using a clear and concise description of the transaction, always using the correct accounts and amounts, and always dating the journal entry correctly. Additionally, users should always review and approve journal entries before posting them and keep a record of journal entries for auditing purposes.

We hope that this article has provided you with a comprehensive understanding of QuickBooks journal entries and how to use them effectively. If you have any further questions or would like to share your experiences with using QuickBooks journal entries, please feel free to comment below. Additionally, if you found this article helpful, please share it with others who may benefit from it.