Intro

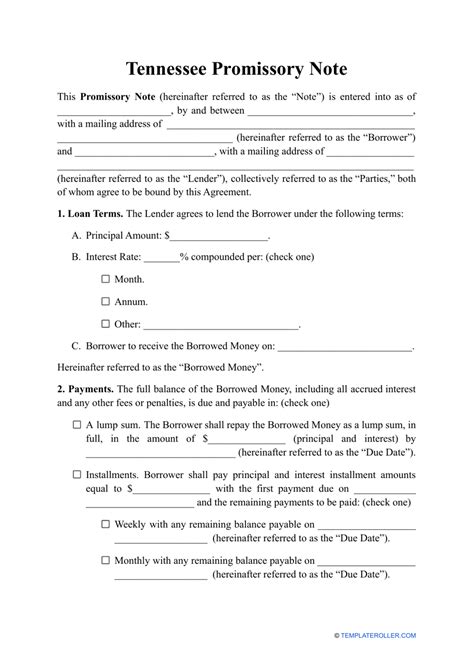

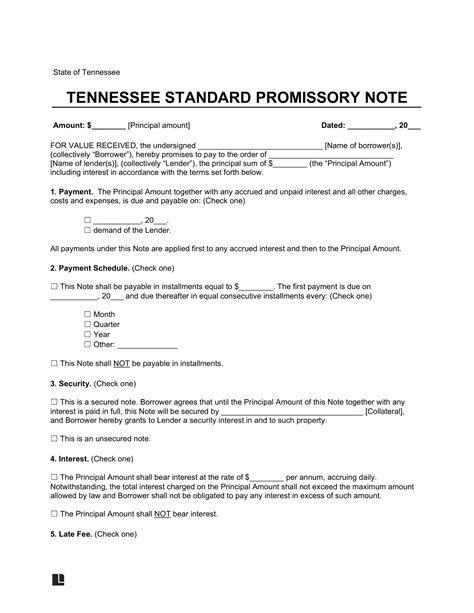

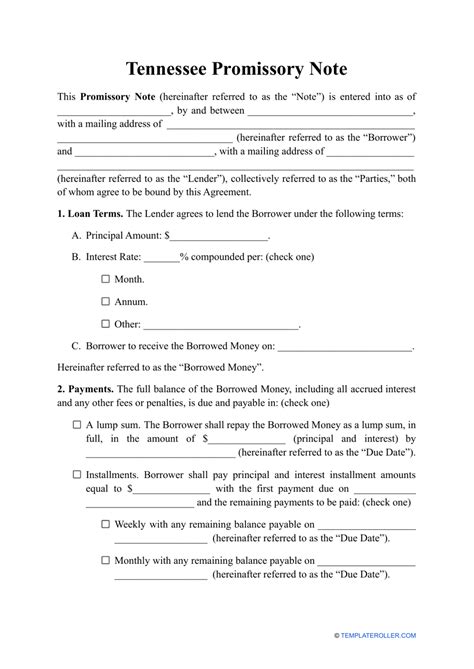

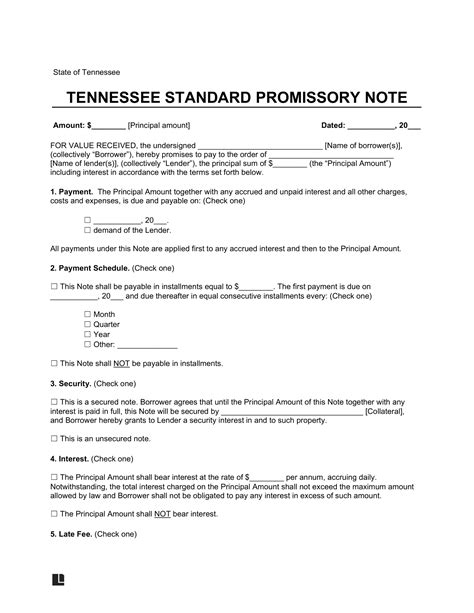

Download a free Tennessee Promissory Note Template to create a legally binding loan agreement, outlining repayment terms, interest rates, and borrower obligations, ensuring secure lending transactions in Tennessee.

The Tennessee promissory note template is a crucial document used in lending transactions within the state. It serves as a written promise from the borrower to repay a loan to the lender, outlining the terms and conditions of the loan, including the principal amount, interest rate, repayment schedule, and any applicable fees. Understanding the components and legal implications of a Tennessee promissory note is essential for both lenders and borrowers to ensure a clear and enforceable agreement.

The importance of using a Tennessee promissory note template cannot be overstated. It provides a structured format that helps in avoiding misunderstandings and disputes that might arise from verbal agreements. Furthermore, it is a legally binding document that can be used in court if the borrower defaults on the loan. This makes it an indispensable tool for lenders seeking to protect their investments and for borrowers who want to demonstrate their commitment to repaying the loan.

For individuals and businesses in Tennessee, having access to a reliable and compliant promissory note template is key to facilitating lending transactions efficiently. It ensures that all necessary details are included, such as the identities of the parties involved, the loan amount, the interest rate, the repayment terms, and the consequences of default. This not only helps in preventing potential legal issues but also in maintaining healthy financial relationships between lenders and borrowers.

Understanding Tennessee Promissory Notes

Tennessee promissory notes are governed by state laws, which dictate the requirements for creating and enforcing these documents. The Uniform Commercial Code (UCC) also plays a significant role in regulating promissory notes, especially in commercial transactions. It's crucial for parties involved in lending transactions to be aware of these laws to ensure their promissory notes are legally binding and enforceable.

Key Components of a Tennessee Promissory Note

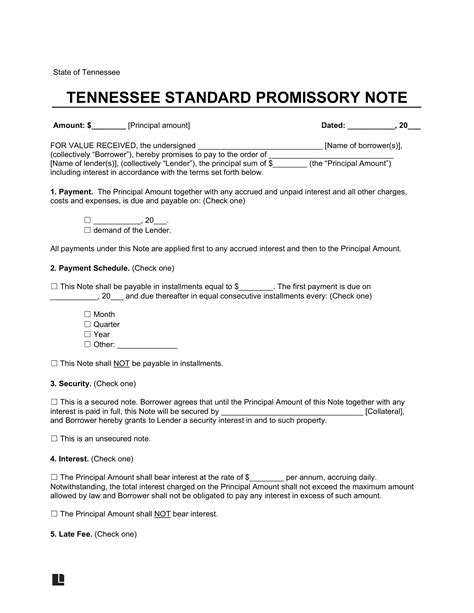

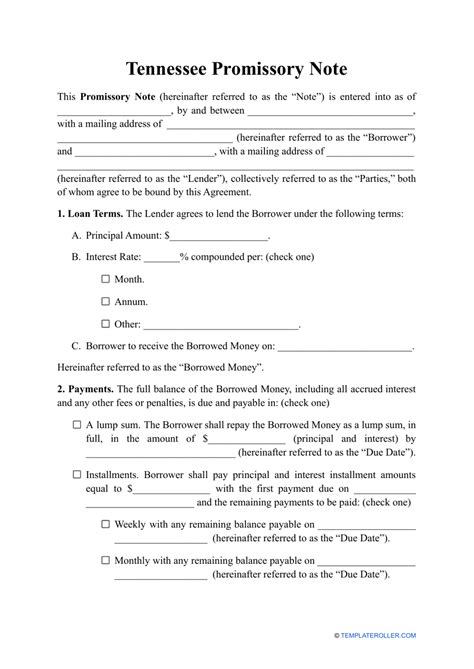

A comprehensive Tennessee promissory note template should include several key components: - **Identification of Parties:** The full names and addresses of both the borrower and the lender. - **Loan Amount:** The total amount borrowed, also known as the principal. - **Interest Rate:** The rate at which interest accrues on the loan, expressed as a percentage. - **Repayment Terms:** The schedule outlining when and how the loan is to be repaid, including the payment amount and frequency. - **Default and Late Payment Provisions:** The actions that will be taken if the borrower fails to make payments on time, including any late fees or penalties. - **Security:** If the loan is secured, a description of the collateral pledged by the borrower. - **Governing Law:** A statement indicating that the note is governed by Tennessee law.Benefits of Using a Tennessee Promissory Note Template

Utilizing a Tennessee promissory note template offers several benefits to both lenders and borrowers. For lenders, it provides a clear and legally enforceable agreement that protects their investment. For borrowers, it outlines the terms of the loan in a transparent manner, helping them understand their obligations and plan their finances accordingly. Additionally, having a written agreement can help prevent disputes and facilitate smoother loan repayment processes.

Steps to Create a Tennessee Promissory Note

Creating a Tennessee promissory note involves several steps: 1. **Determine the Loan Terms:** Agree on the loan amount, interest rate, repayment schedule, and any other conditions with the borrower. 2. **Choose a Template:** Select a Tennessee promissory note template that meets your needs. Ensure it is compliant with Tennessee laws and includes all necessary components. 3. **Fill Out the Template:** Insert the agreed-upon loan terms, the identities of the parties, and any other required information into the template. 4. **Review and Sign:** Both the lender and the borrower should review the document carefully before signing it. This ensures that all parties understand and agree to the terms. 5. **Keep a Record:** Maintain a copy of the signed promissory note for your records. This is crucial for reference and in case of any future disputes.Legal Considerations and Enforcement

Tennessee promissory notes are subject to state and federal laws. The enforcement of these notes, especially in cases of default, must comply with these laws. Lenders have several options for enforcing a promissory note, including filing a lawsuit against the borrower. However, the specific steps and legal requirements can vary, making it advisable for lenders to consult with a legal professional before taking any action.

Default and Collection

In the event of default, the lender may pursue various collection methods, such as sending demand letters, making phone calls, or hiring a collection agency. However, all collection activities must adhere to the Fair Debt Collection Practices Act (FDCPA) and other applicable laws to avoid legal repercussions.Customizing Your Tennessee Promissory Note Template

While templates provide a useful starting point, lending situations can vary widely. Therefore, it may be necessary to customize your Tennessee promissory note template to fit the specific needs of your transaction. This could involve adding or modifying clauses related to security interests, default remedies, or dispute resolution mechanisms. It's essential to ensure that any customizations comply with Tennessee laws and do not inadvertently void the note or make it unenforceable.

Seeking Professional Advice

Given the legal complexities involved, it's often beneficial for both lenders and borrowers to seek advice from a legal professional. An attorney can review the promissory note, ensure it meets all legal requirements, and provide guidance on enforcement and collection should the need arise.Tennessee Promissory Note Templates Image Gallery

What is a Tennessee promissory note?

+A Tennessee promissory note is a written agreement where a borrower promises to repay a loan to a lender, outlining the terms and conditions of the loan.

Why is it important to use a Tennessee promissory note template?

+Using a Tennessee promissory note template ensures that the agreement is clear, comprehensive, and compliant with Tennessee laws, protecting both lenders and borrowers.

What are the key components of a Tennessee promissory note?

+The key components include the identification of parties, loan amount, interest rate, repayment terms, default provisions, and security, if applicable.

In conclusion, a Tennessee promissory note template is a vital tool for facilitating lending transactions within the state. By understanding the importance, benefits, and legal considerations of these documents, lenders and borrowers can navigate loan agreements with confidence. Whether you're lending or borrowing, ensuring that your promissory note is comprehensive, legally binding, and compliant with Tennessee laws is crucial for a successful and stress-free transaction. We invite you to share your experiences or ask questions about Tennessee promissory notes in the comments below, and don't forget to share this article with anyone who might benefit from this information.