Intro

Discover expert 5 Missouri note tips, including note buying, selling, and investing strategies, to maximize returns on private mortgage notes, promissory notes, and real estate notes in Missouri.

The state of Missouri is known for its rich history, vibrant cities, and stunning natural beauty. From the iconic Gateway Arch in St. Louis to the scenic Ozark Mountains, Missouri has something to offer for every kind of traveler. However, navigating the state's financial landscape can be complex, especially when it comes to notes and debt instruments. In this article, we will delve into the world of Missouri notes, providing valuable tips and insights for individuals and businesses looking to navigate this often-confusing territory.

Missouri notes are essentially debt instruments that represent a loan from one party to another. They can be used for a variety of purposes, including financing real estate purchases, funding business ventures, or simply providing a personal loan between individuals. Understanding the intricacies of Missouri notes is crucial for anyone looking to borrow or lend money in the state. With the right knowledge and strategies, individuals and businesses can avoid common pitfalls and ensure a smooth transaction.

The importance of Missouri notes cannot be overstated. They provide a vital source of funding for many individuals and businesses, allowing them to achieve their financial goals and pursue new opportunities. However, the process of creating and managing Missouri notes can be complex and time-consuming, requiring a deep understanding of state laws and regulations. By following the right tips and guidelines, individuals and businesses can navigate this process with confidence, avoiding costly mistakes and ensuring a successful outcome.

Understanding Missouri Notes

To effectively navigate the world of Missouri notes, it's essential to understand the basics. A Missouri note is a written promise to pay a certain amount of money to a lender, typically with interest. The note will outline the terms of the loan, including the principal amount, interest rate, and repayment schedule. Missouri notes can be secured or unsecured, with secured notes requiring collateral to guarantee repayment. Understanding the different types of Missouri notes and their characteristics is crucial for making informed decisions.

Types of Missouri Notes

Missouri notes come in various forms, each with its own unique characteristics and advantages. Some common types of Missouri notes include: * Promissory notes: These are the most basic type of Missouri note, representing a promise to pay a certain amount of money to a lender. * Mortgage notes: These notes are secured by real estate, providing a lender with a level of security in case the borrower defaults. * Commercial notes: These notes are used for business purposes, often to finance large purchases or investments. * Personal notes: These notes are used for personal purposes, such as financing a wedding or paying for education expenses.Creating a Missouri Note

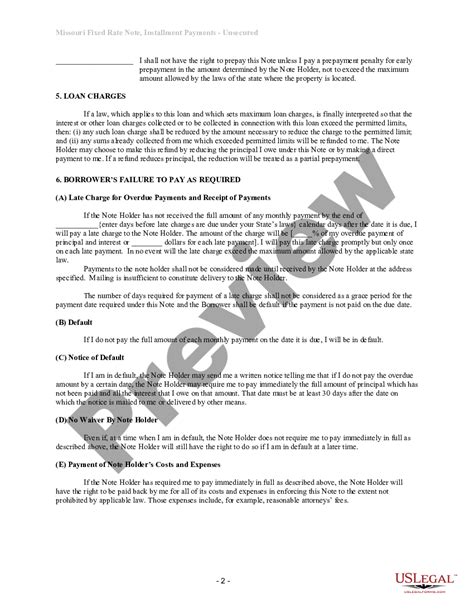

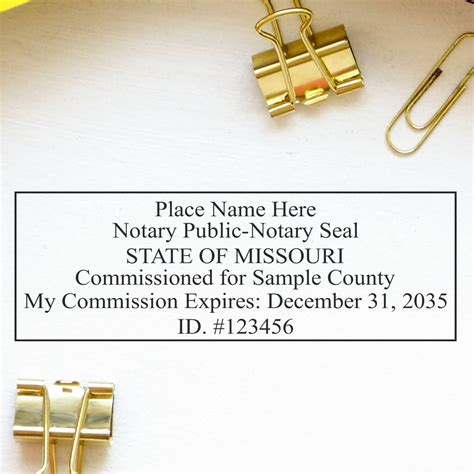

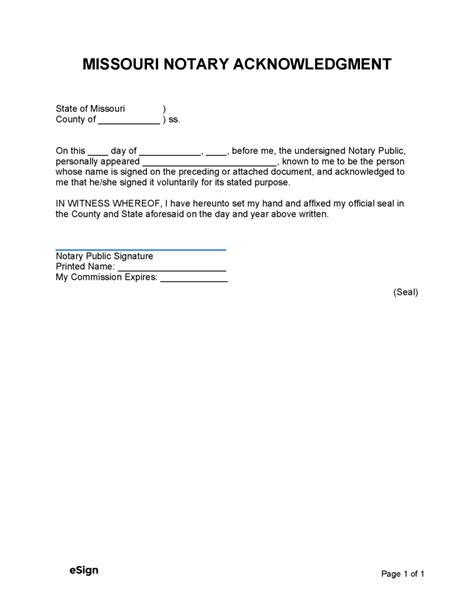

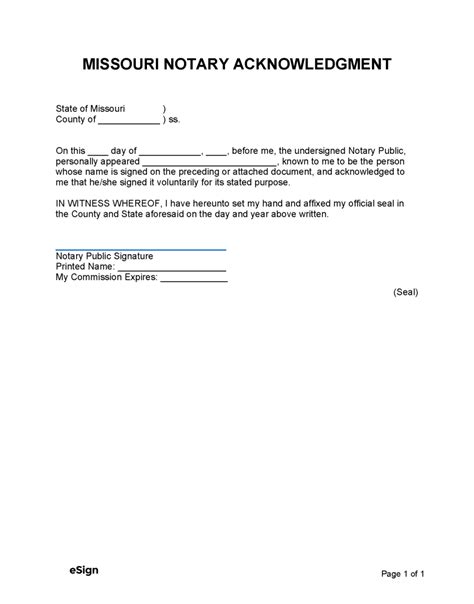

Creating a Missouri note requires careful consideration and attention to detail. The note should clearly outline the terms of the loan, including the principal amount, interest rate, and repayment schedule. It's essential to include all relevant details, such as the names and addresses of the parties involved, the date of the note, and any collateral or security agreements. A well-crafted Missouri note will provide clarity and protection for both the lender and borrower, reducing the risk of disputes or misunderstandings.

Key Components of a Missouri Note

A Missouri note should include the following key components: * The names and addresses of the parties involved * The date of the note * The principal amount of the loan * The interest rate and repayment schedule * Any collateral or security agreements * The terms of repayment, including the payment amount and frequencyManaging Missouri Notes

Managing Missouri notes requires ongoing attention and care. The lender should keep accurate records of payments and balances, ensuring that the borrower is meeting their obligations. The borrower should also keep track of their payments, verifying that they are being applied correctly to the principal and interest. Regular communication between the parties can help prevent misunderstandings and ensure a smooth repayment process.

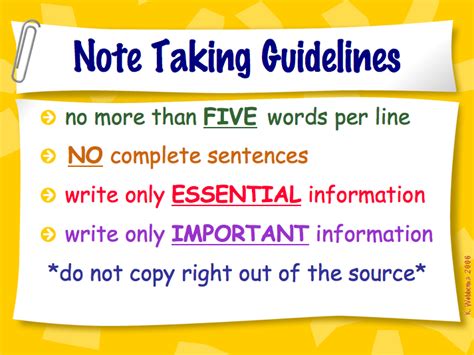

Best Practices for Managing Missouri Notes

To effectively manage Missouri notes, consider the following best practices: * Keep accurate and detailed records of payments and balances * Verify payment amounts and frequencies * Communicate regularly with the other party * Review and update the note as necessary * Consider using a third-party service to manage the note and facilitate paymentsMissouri Note Tips and Strategies

When working with Missouri notes, it's essential to have a solid understanding of the tips and strategies that can help you succeed. From negotiating the terms of the note to managing the repayment process, there are many ways to optimize your experience with Missouri notes. By following these tips and strategies, individuals and businesses can reduce their risk, increase their returns, and achieve their financial goals.

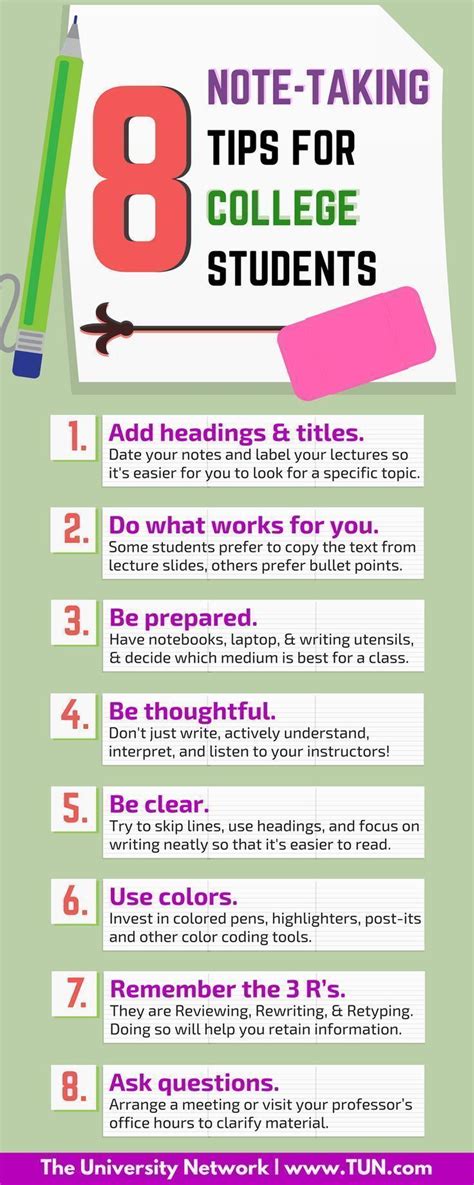

Top 5 Missouri Note Tips

Here are the top 5 Missouri note tips to keep in mind: * Clearly outline the terms of the loan, including the principal amount, interest rate, and repayment schedule * Use collateral or security agreements to guarantee repayment * Keep accurate and detailed records of payments and balances * Communicate regularly with the other party to prevent misunderstandings * Consider using a third-party service to manage the note and facilitate paymentsCommon Mistakes to Avoid

When working with Missouri notes, there are several common mistakes to avoid. From failing to clearly outline the terms of the loan to neglecting to keep accurate records, these mistakes can have serious consequences, including disputes, defaults, and financial losses. By understanding these common mistakes and taking steps to avoid them, individuals and businesses can reduce their risk and achieve a successful outcome.

Missouri Note Mistakes to Watch Out For

Here are some common Missouri note mistakes to watch out for: * Failing to clearly outline the terms of the loan * Neglecting to keep accurate and detailed records of payments and balances * Failing to communicate regularly with the other party * Using unclear or ambiguous language in the note * Failing to consider the tax implications of the noteGallery of Missouri Notes

Missouri Notes Image Gallery

Frequently Asked Questions

What is a Missouri note?

+A Missouri note is a written promise to pay a certain amount of money to a lender, typically with interest.

What are the different types of Missouri notes?

+Missouri notes come in various forms, including promissory notes, mortgage notes, commercial notes, and personal notes.

How do I create a Missouri note?

+To create a Missouri note, clearly outline the terms of the loan, including the principal amount, interest rate, and repayment schedule. Include all relevant details, such as the names and addresses of the parties involved, the date of the note, and any collateral or security agreements.

What are some common mistakes to avoid when working with Missouri notes?

+Common mistakes to avoid include failing to clearly outline the terms of the loan, neglecting to keep accurate records, and using unclear or ambiguous language in the note.

How do I manage a Missouri note?

+To manage a Missouri note, keep accurate and detailed records of payments and balances, verify payment amounts and frequencies, and communicate regularly with the other party.

In conclusion, Missouri notes are a vital source of funding for many individuals and businesses, providing a flexible and efficient way to borrow and lend money. By understanding the basics of Missouri notes, creating a well-crafted note, and managing the repayment process effectively, individuals and businesses can reduce their risk, increase their returns, and achieve their financial goals. Whether you're a seasoned investor or just starting out, Missouri notes offer a powerful tool for achieving financial success. We invite you to share your thoughts and experiences with Missouri notes in the comments below, and to explore our other articles and resources for more information on this topic.