Intro

Learn 5 essential tips for a promissory note in Mississippi, including secured loans, interest rates, and repayment terms, to ensure a legally binding agreement and protect lenders and borrowers in Mississippi debt collection and contract law.

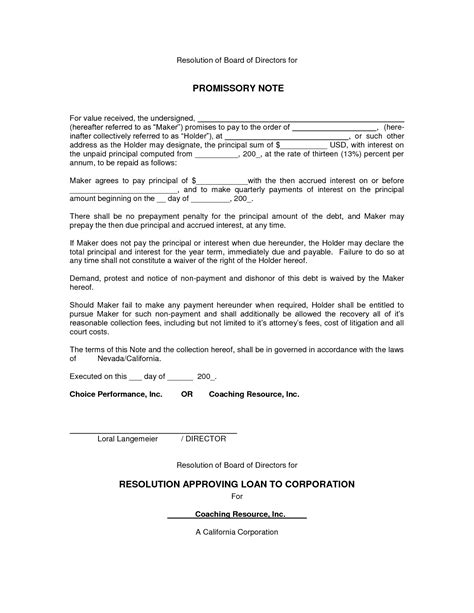

The concept of a promissory note is a crucial aspect of financial transactions, particularly in the state of Mississippi. A promissory note is a written agreement where one party, known as the borrower or maker, promises to pay a certain amount of money to another party, known as the lender or payee. This agreement is a vital tool for both individuals and businesses, as it provides a clear understanding of the terms and conditions of the loan. In Mississippi, promissory notes are governed by the state's laws and regulations, which provide a framework for the creation, execution, and enforcement of these agreements.

The importance of understanding promissory notes cannot be overstated, as they are used in a wide range of financial transactions, from personal loans to business investments. In Mississippi, promissory notes are commonly used for real estate transactions, business loans, and personal financing. With the rise of online lending platforms and peer-to-peer lending, the use of promissory notes has become even more prevalent. As a result, it is essential for individuals and businesses to understand the basics of promissory notes, including how to create, negotiate, and enforce them.

In Mississippi, the laws governing promissory notes are designed to protect both the lender and the borrower. The state's laws provide a clear framework for the creation and execution of promissory notes, including the requirements for the note's content, format, and signing. Additionally, the laws provide remedies for both parties in the event of a dispute or default. With the help of a qualified attorney, individuals and businesses can navigate the complex world of promissory notes and ensure that their financial transactions are secure and enforceable.

Understanding Promissory Notes in Mississippi

Key Elements of a Promissory Note

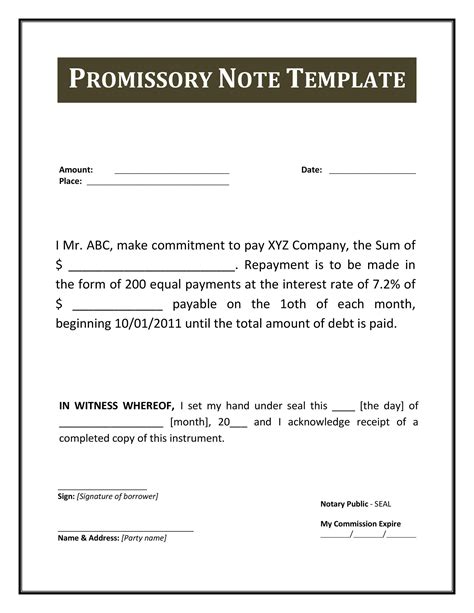

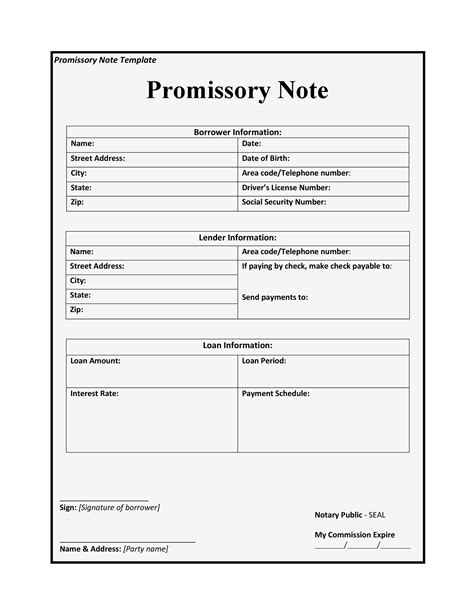

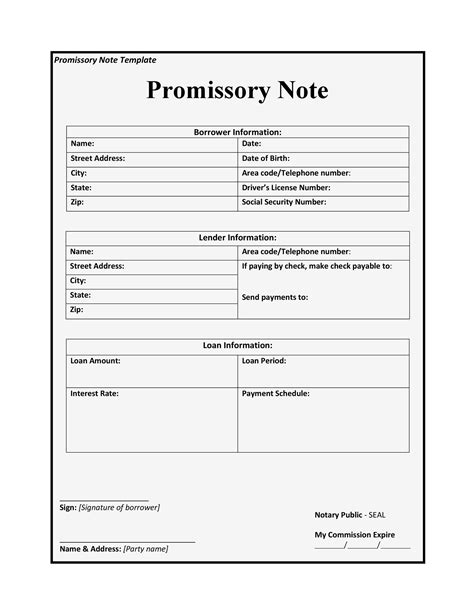

The key elements of a promissory note in Mississippi include: * The amount of the loan: The note must clearly state the amount of the loan, including the principal amount and any interest or fees. * The interest rate: The note must include the interest rate, which can be fixed or variable, and the method of calculating the interest. * The repayment terms: The note must include the repayment terms, including the payment schedule, the payment amount, and the payment method. * The date of the note: The note must include the date of the note, which is the date the borrower signs the agreement. * The borrower's promise to pay: The note must include the borrower's promise to pay the loan, including the amount, interest, and any fees.Creating a Promissory Note in Mississippi

Steps to Create a Promissory Note

The steps to create a promissory note in Mississippi include: 1. Negotiate the terms of the loan: The parties must negotiate the terms of the loan, including the amount, interest rate, and repayment terms. 2. Put the agreement in writing: The parties must put the agreement in writing, using a promissory note template or a custom-drafted note. 3. Include all essential elements: The note must include all the essential elements, including the borrower's promise to pay, the amount of the loan, and the repayment terms. 4. Sign the note: The parties must sign the note, with the borrower signing as the maker and the lender signing as the payee.Enforcing a Promissory Note in Mississippi

Remedies for the Lender

The remedies for the lender in Mississippi include: * Filing a lawsuit: The lender can file a lawsuit to collect the debt, which can result in a judgment in favor of the lender. * Wage garnishment: The lender can garnish the borrower's wages to collect the debt. * Bank account levies: The lender can levy the borrower's bank account to collect the debt. * Property liens: The lender can place a lien on the borrower's property to secure the debt.Tips for Borrowers in Mississippi

Best Practices for Borrowers

The best practices for borrowers in Mississippi include: * Carefully review the note: The borrower should carefully review the note, including the amount of the loan, the interest rate, and the repayment terms. * Ensure the note includes all essential elements: The borrower should ensure that the note includes all the essential elements, including the borrower's promise to pay and the lender's obligations. * Seek the advice of a qualified attorney: The borrower should consider seeking the advice of a qualified attorney to ensure that the note is valid and enforceable.5 Tips for Promissory Notes in Mississippi

Promissory Note Image Gallery

What is a promissory note in Mississippi?

+A promissory note in Mississippi is a written agreement where one party promises to pay a certain amount of money to another party.

What are the essential elements of a promissory note in Mississippi?

+The essential elements of a promissory note in Mississippi include the amount of the loan, the interest rate, the repayment terms, and the date of the note.

How can a lender enforce a promissory note in Mississippi?

+A lender can enforce a promissory note in Mississippi by filing a lawsuit to collect the debt, which can result in a judgment in favor of the lender.

What are the remedies for a borrower who defaults on a promissory note in Mississippi?

+The remedies for a borrower who defaults on a promissory note in Mississippi include wage garnishment, bank account levies, and property liens.

Can a borrower negotiate the terms of a promissory note in Mississippi?

+Yes, a borrower can negotiate the terms of a promissory note in Mississippi, including the amount of the loan, the interest rate, and the repayment terms.

In conclusion, promissory notes are an essential tool for financial transactions in Mississippi, providing a clear understanding of the terms and conditions of the loan. By understanding the basics of promissory notes, including how to create, negotiate, and enforce them, individuals and businesses can navigate the complex world of financial transactions with confidence. Whether you are a borrower or a lender, it is essential to carefully review the terms and conditions of the promissory note, including the amount of the loan, the interest rate, and the repayment terms. With the help of a qualified attorney, you can ensure that your financial transactions are secure and enforceable, and that you are protected in the event of a dispute or default. So why wait? Take the first step towards securing your financial future by learning more about promissory notes in Mississippi today!