Intro

Download a free Idaho Promissory Note Template to create a legally binding loan agreement, outlining repayment terms, interest rates, and borrower obligations, with optional secured or unsecured loan provisions.

The Idaho Promissory Note Template is a crucial document for individuals and businesses in Idaho, serving as a written promise to pay a certain amount of money to another party. This document is essential for establishing a clear understanding of the terms and conditions of a loan, including the amount borrowed, interest rate, repayment schedule, and any other relevant details. In this article, we will delve into the importance of using a promissory note template in Idaho, its benefits, and provide a comprehensive guide on how to create and use one.

A promissory note is a binding contract between two parties, where one party (the borrower) agrees to pay a certain amount of money to the other party (the lender). This document is commonly used in various financial transactions, including personal loans, business loans, and real estate transactions. The Idaho Promissory Note Template is designed to provide a clear and concise outline of the loan terms, ensuring that both parties understand their obligations and responsibilities.

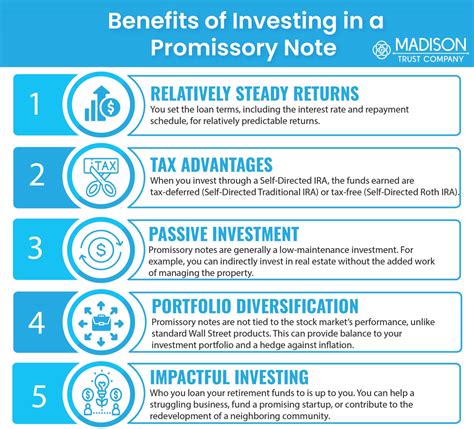

Using a promissory note template in Idaho offers several benefits, including:

- Clarifies the loan terms and conditions

- Establishes a clear repayment schedule

- Provides a written record of the loan agreement

- Helps to prevent disputes and misunderstandings

- Can be used as evidence in court if necessary

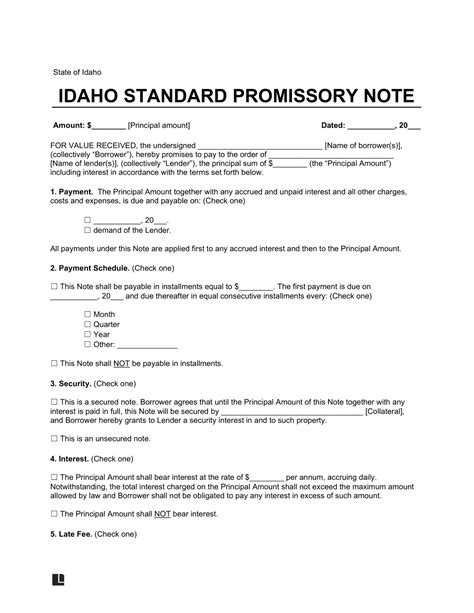

Idaho Promissory Note Template Overview

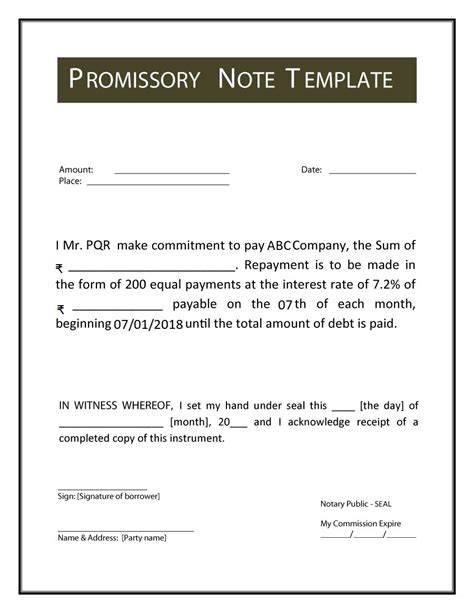

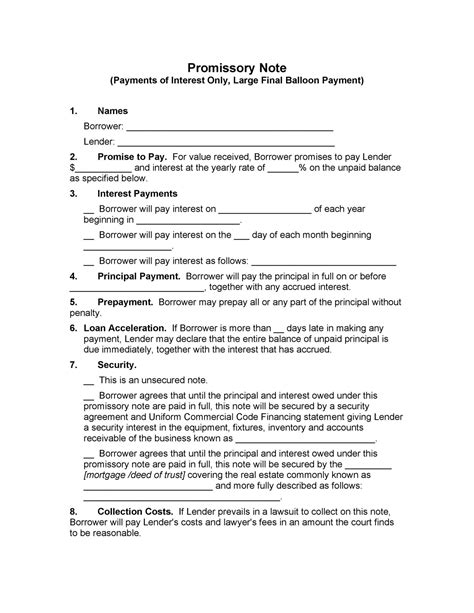

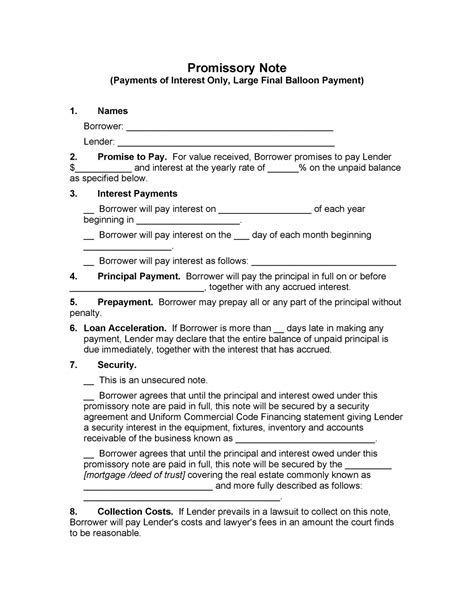

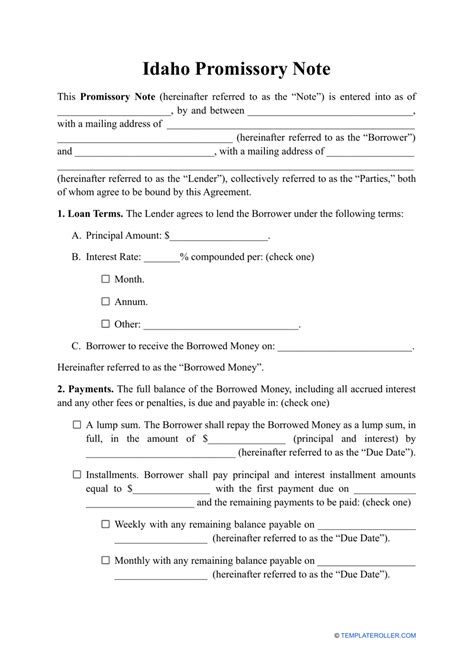

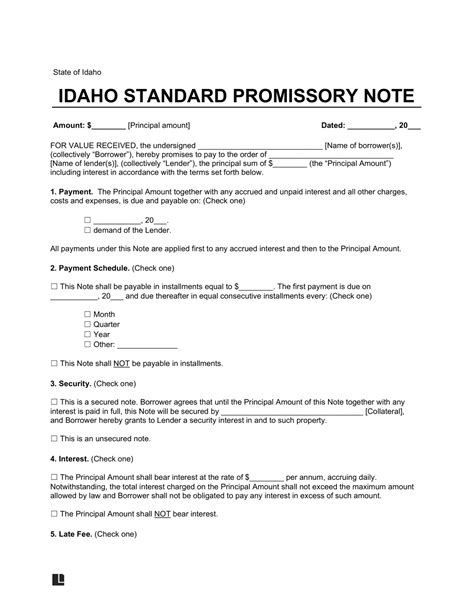

The Idaho Promissory Note Template typically includes the following essential elements:

- The names and addresses of the borrower and lender

- The amount of money being borrowed

- The interest rate and any applicable fees

- The repayment schedule, including the payment amount and due date

- Any security or collateral provided for the loan

- The date and location of the loan agreement

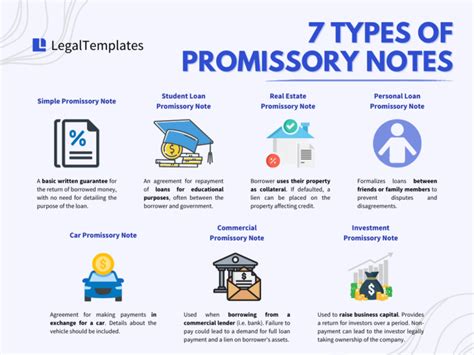

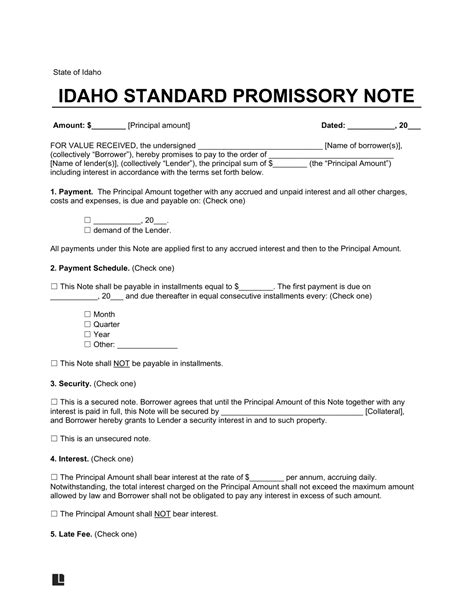

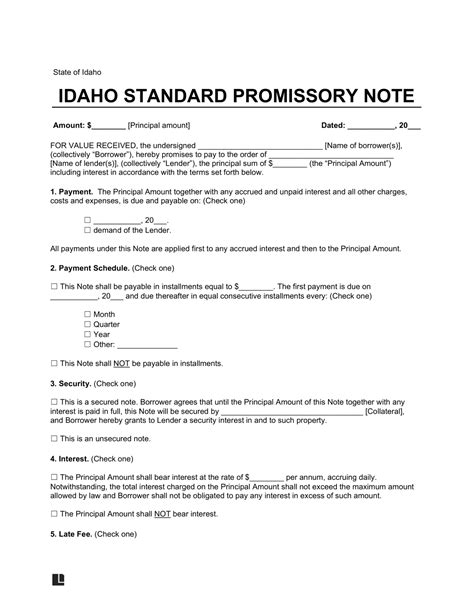

Types of Promissory Notes in Idaho

There are several types of promissory notes that can be used in Idaho, including:

- Secured promissory notes: These notes are backed by collateral, such as a house or car, which can be seized by the lender if the borrower defaults on the loan.

- Unsecured promissory notes: These notes do not require collateral and are often used for personal loans or business loans.

- Demand promissory notes: These notes require the borrower to repay the loan on demand, rather than following a fixed repayment schedule.

- Installment promissory notes: These notes require the borrower to make regular payments, such as monthly or quarterly, until the loan is paid in full.

How to Create an Idaho Promissory Note Template

Creating an Idaho Promissory Note Template is a straightforward process that requires careful consideration of the loan terms and conditions. Here are the steps to follow:

- Determine the loan amount and interest rate

- Choose the type of promissory note that best suits your needs

- Include the essential elements, such as the names and addresses of the parties, loan amount, interest rate, and repayment schedule

- Specify any security or collateral provided for the loan

- Include a default clause that outlines the consequences of failing to repay the loan

- Sign and date the promissory note in the presence of a witness or notary public

Idaho Promissory Note Template Benefits

Using an Idaho Promissory Note Template offers several benefits, including:

- Provides a clear and concise outline of the loan terms and conditions

- Helps to prevent disputes and misunderstandings

- Establishes a clear repayment schedule and expectations

- Can be used as evidence in court if necessary

- Provides a written record of the loan agreement

Idaho Promissory Note Template Examples

Here are some examples of Idaho Promissory Note Templates:

- Personal loan promissory note: This type of note is used for personal loans between individuals, such as a loan from a friend or family member.

- Business loan promissory note: This type of note is used for business loans, such as a loan from a bank or investor.

- Real estate promissory note: This type of note is used for real estate transactions, such as a mortgage or deed of trust.

Idaho Promissory Note Template Tips

Here are some tips to keep in mind when using an Idaho Promissory Note Template:

- Read and understand the loan terms and conditions carefully

- Ensure that the promissory note is signed and dated in the presence of a witness or notary public

- Keep a copy of the promissory note for your records

- Make timely payments to avoid defaulting on the loan

- Consider seeking legal advice if you have any questions or concerns about the promissory note

Idaho Promissory Note Template Conclusion

In conclusion, the Idaho Promissory Note Template is a valuable tool for individuals and businesses in Idaho, providing a clear and concise outline of the loan terms and conditions. By understanding the benefits and uses of a promissory note template, you can ensure that your financial transactions are secure and legally binding.

Idaho Promissory Note Template Image Gallery

What is an Idaho Promissory Note Template?

+An Idaho Promissory Note Template is a written promise to pay a certain amount of money to another party, outlining the loan terms and conditions.

Why is an Idaho Promissory Note Template important?

+An Idaho Promissory Note Template is important because it provides a clear and concise outline of the loan terms and conditions, helping to prevent disputes and misunderstandings.

How do I create an Idaho Promissory Note Template?

+To create an Idaho Promissory Note Template, you can follow the steps outlined in this article, including determining the loan amount and interest rate, choosing the type of promissory note, and including the essential elements.

We hope this article has provided you with a comprehensive understanding of the Idaho Promissory Note Template and its importance in financial transactions. If you have any further questions or concerns, please do not hesitate to comment below. Additionally, feel free to share this article with others who may benefit from this information. By taking the time to understand the Idaho Promissory Note Template, you can ensure that your financial transactions are secure and legally binding.