Intro

Create accurate financial forecasts with a Pro Forma Income Statement Excel Template, featuring projected revenue, expenses, and cash flow, for effective business planning and financial analysis, including forecasting, budgeting, and financial modeling.

The pro forma income statement is a crucial financial tool used by businesses to forecast their future financial performance. It is an essential document that helps companies make informed decisions about investments, funding, and strategic planning. In this article, we will delve into the world of pro forma income statements, exploring their importance, benefits, and how to create one using an Excel template.

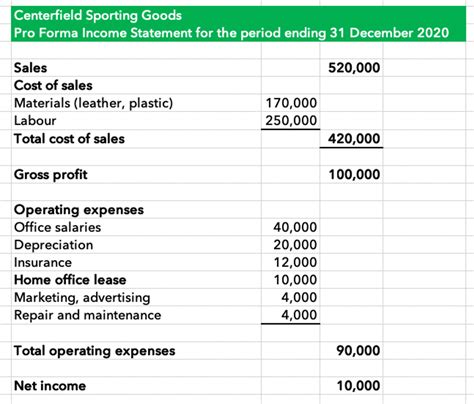

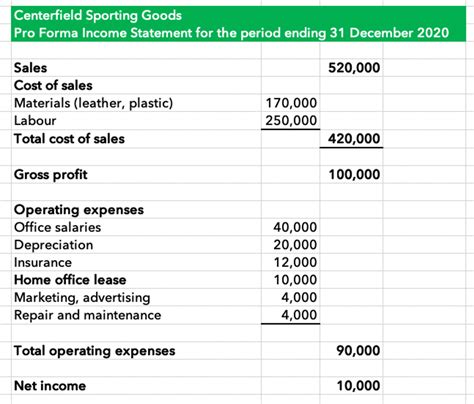

A pro forma income statement is a financial statement that presents a company's projected income and expenses over a specific period, usually a quarter or a year. It is based on historical data, industry trends, and management's assumptions about future performance. The statement is called "pro forma" because it is a hypothetical representation of the company's financial situation, rather than an actual historical record. By analyzing the pro forma income statement, businesses can identify areas of strength and weakness, make adjustments to their strategies, and predict future cash flows.

The importance of pro forma income statements cannot be overstated. They provide a roadmap for companies to navigate the complexities of financial planning, helping them to anticipate challenges and capitalize on opportunities. With a pro forma income statement, businesses can evaluate different scenarios, such as the impact of changes in market conditions, pricing strategies, or operational efficiencies. This enables them to make data-driven decisions, reduce risks, and optimize their financial performance.

Benefits of Pro Forma Income Statements

The benefits of pro forma income statements are numerous. Some of the most significant advantages include:

- Improved financial planning: Pro forma income statements help businesses anticipate future cash flows, identify potential financial risks, and develop strategies to mitigate them.

- Enhanced decision-making: By analyzing different scenarios, companies can make informed decisions about investments, funding, and resource allocation.

- Increased transparency: Pro forma income statements provide a clear and concise picture of a company's financial situation, enabling stakeholders to understand the business's prospects and challenges.

- Better risk management: Pro forma income statements help businesses identify potential risks and develop strategies to manage them, reducing the likelihood of financial distress.

Creating a Pro Forma Income Statement in Excel

Creating a pro forma income statement in Excel is a straightforward process. Here are the steps to follow:

- Determine the forecast period: Decide on the time frame for your pro forma income statement, such as a quarter or a year.

- Gather historical data: Collect historical financial data, including income statements, balance sheets, and cash flow statements.

- Estimate revenue and expenses: Use historical data and industry trends to estimate future revenue and expenses.

- Calculate net income: Calculate net income by subtracting total expenses from total revenue.

- Format the statement: Use Excel to format the pro forma income statement, including headers, footers, and columns for different line items.

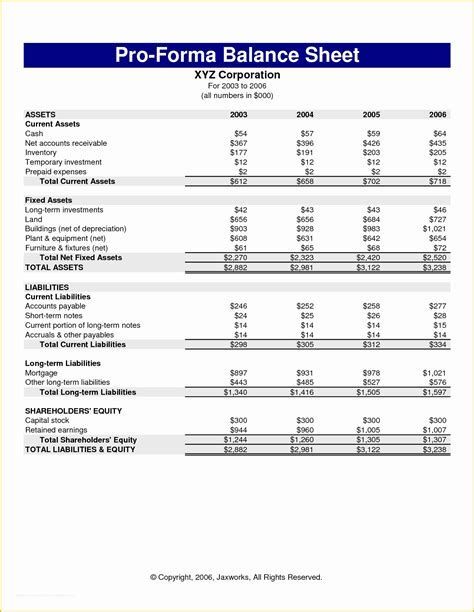

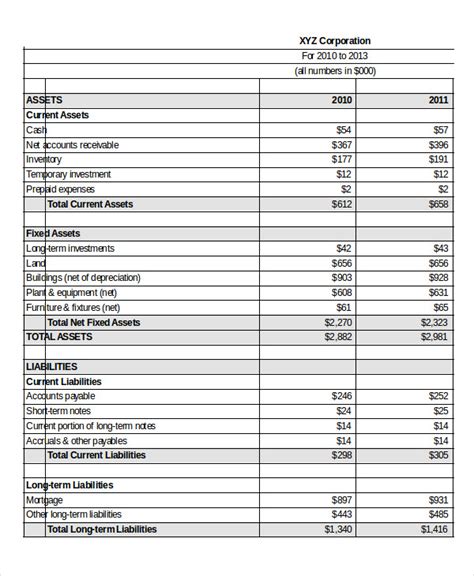

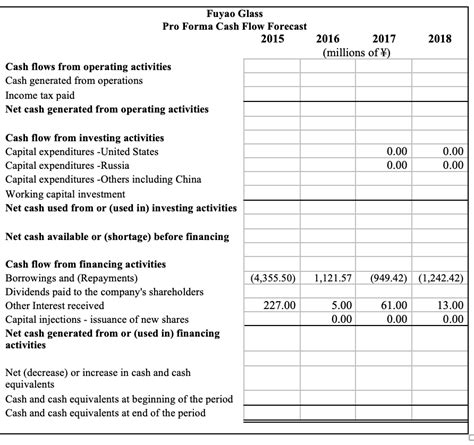

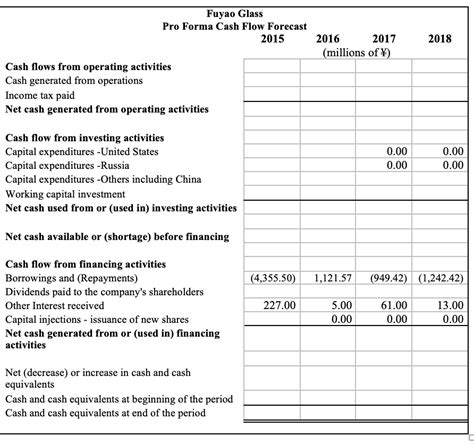

Pro Forma Income Statement Excel Template

A pro forma income statement Excel template can be a valuable tool for businesses. Here are some key features to include:

- Revenue projections: Include columns for different revenue streams, such as sales, services, and interest income.

- Expense categories: Include columns for different expense categories, such as cost of goods sold, operating expenses, and interest expenses.

- Net income calculation: Include a formula to calculate net income based on revenue and expenses.

- Assumptions and notes: Include a section for assumptions and notes to provide context for the pro forma income statement.

Best Practices for Creating a Pro Forma Income Statement

When creating a pro forma income statement, there are several best practices to keep in mind:

- Use historical data: Use historical financial data to inform your projections and assumptions.

- Consider industry trends: Consider industry trends and market conditions when estimating future revenue and expenses.

- Be conservative: Be conservative in your projections and assumptions to avoid overestimating future performance.

- Review and revise: Review and revise your pro forma income statement regularly to ensure it remains accurate and relevant.

Common Mistakes to Avoid

When creating a pro forma income statement, there are several common mistakes to avoid:

- Overestimating revenue: Overestimating revenue can lead to unrealistic projections and poor decision-making.

- Underestimating expenses: Underestimating expenses can lead to cash flow problems and financial distress.

- Failing to consider risks: Failing to consider risks and uncertainties can lead to unexpected challenges and poor performance.

- Not reviewing and revising: Not reviewing and revising the pro forma income statement regularly can lead to inaccurate and outdated projections.

Conclusion and Next Steps

In conclusion, a pro forma income statement is a powerful tool for businesses to forecast their future financial performance. By following best practices and avoiding common mistakes, companies can create accurate and reliable pro forma income statements that inform their decision-making and drive success. The next steps for businesses are to create a pro forma income statement using an Excel template, review and revise it regularly, and use it to make informed decisions about investments, funding, and strategic planning.

Pro Forma Income Statement Image Gallery

What is a pro forma income statement?

+A pro forma income statement is a financial statement that presents a company's projected income and expenses over a specific period.

Why is a pro forma income statement important?

+A pro forma income statement is important because it helps businesses make informed decisions about investments, funding, and strategic planning.

How do I create a pro forma income statement in Excel?

+To create a pro forma income statement in Excel, determine the forecast period, gather historical data, estimate revenue and expenses, calculate net income, and format the statement.

What are some common mistakes to avoid when creating a pro forma income statement?

+Some common mistakes to avoid when creating a pro forma income statement include overestimating revenue, underestimating expenses, failing to consider risks, and not reviewing and revising the statement regularly.

How often should I review and revise my pro forma income statement?

+You should review and revise your pro forma income statement regularly, such as quarterly or annually, to ensure it remains accurate and relevant.

We hope this article has provided you with a comprehensive understanding of pro forma income statements and how to create one using an Excel template. If you have any further questions or would like to share your experiences with pro forma income statements, please comment below. Additionally, feel free to share this article with others who may benefit from this information.