Intro

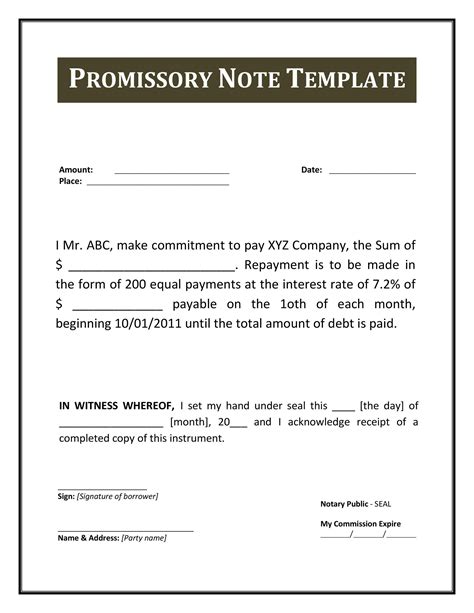

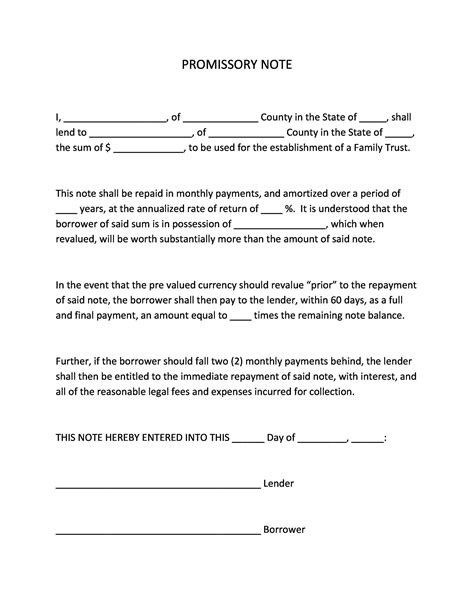

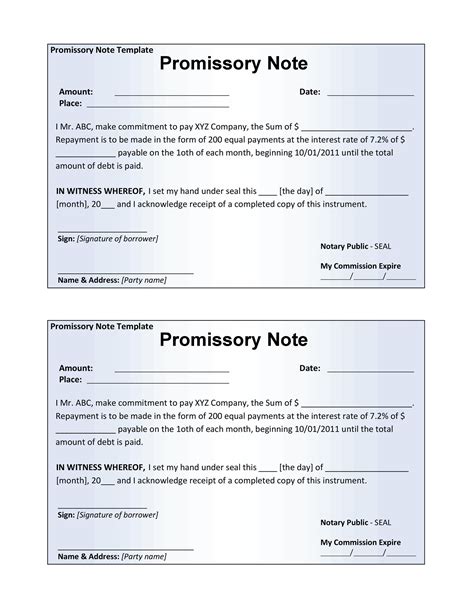

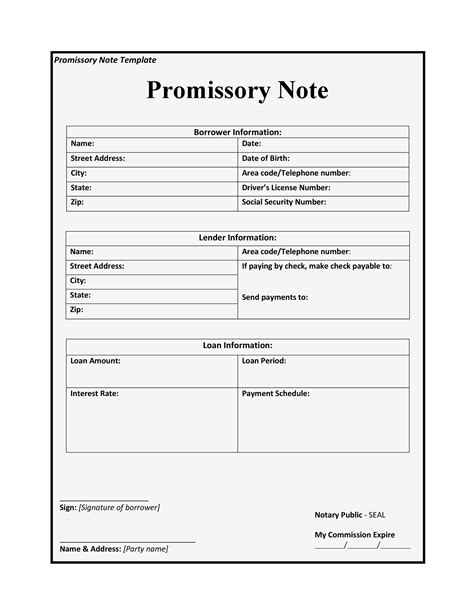

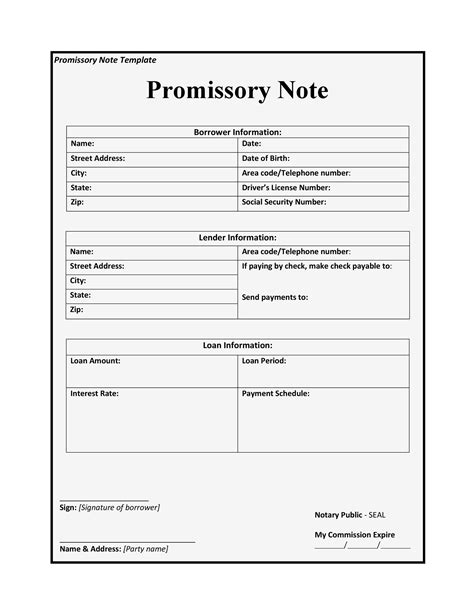

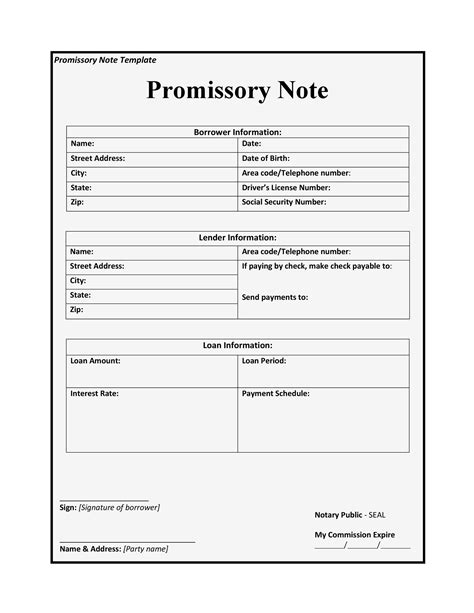

Create a binding agreement with a simple promissory note template, featuring repayment terms, loan details, and borrower obligations, ideal for personal or business loans, debt repayment, and financial transactions.

A simple promissory note is a crucial financial instrument that allows individuals or entities to borrow money from others with a clear agreement on repayment terms. This document is essential in various transactions, including personal loans, business loans, and real estate deals. Understanding the components and implications of a simple promissory note is vital for both lenders and borrowers to ensure a smooth and legally binding agreement.

The importance of having a well-structured promissory note cannot be overstated. It provides a clear outline of the loan terms, including the loan amount, interest rate, repayment schedule, and any penalties for late payments. This clarity helps prevent misunderstandings and legal disputes that may arise during the repayment period. Moreover, a simple promissory note serves as a legally enforceable contract, offering protection to both parties involved in the transaction.

For individuals and businesses looking to lend or borrow money, a simple promissory note template can be a valuable resource. This template provides a basic structure that can be customized to fit the specific needs of the loan agreement. It typically includes essential details such as the names and addresses of the borrower and lender, the loan amount, the interest rate, the repayment terms, and the date of the agreement. By using a template, parties can ensure that their agreement covers all necessary aspects, thereby reducing the risk of disputes and ensuring a clear understanding of the loan's terms.

Understanding the Components of a Simple Promissory Note

A simple promissory note is composed of several key components, each playing a critical role in defining the terms of the loan. These components include:

- Loan Amount: The total amount of money borrowed by the borrower from the lender.

- Interest Rate: The percentage of the loan amount that the borrower must pay as interest over the life of the loan.

- Repayment Terms: The schedule outlining when and how the borrower will repay the loan, including the payment amounts and due dates.

- Penalty for Late Payments: The fees or additional interest charged if the borrower fails to make payments on time.

- Default Conditions: The circumstances under which the lender can demand full repayment of the loan, such as if the borrower misses a payment.

Benefits of Using a Simple Promissory Note

The use of a simple promissory note offers several benefits to both lenders and borrowers. For lenders, it provides a legally binding agreement that ensures repayment of the loan. For borrowers, it outlines the clear terms of the loan, helping them understand their financial obligations and plan their repayments accordingly. Additionally, a simple promissory note can be less complex and more straightforward than other financial agreements, making it easier for parties to negotiate and agree on the terms.Creating a Simple Promissory Note Template

To create a simple promissory note template, follow these steps:

- Identify the Parties: Include the full names and addresses of both the borrower and the lender.

- Specify the Loan Amount: Clearly state the total amount of money being borrowed.

- Define the Interest Rate: Specify the interest rate and how it will be calculated.

- Outline Repayment Terms: Detail the repayment schedule, including the amount and frequency of payments.

- Include Penalty Clauses: Specify any penalties for late payments or default.

- Add a Signature Block: Provide a space for both parties to sign and date the agreement.

Customizing the Template

While a simple promissory note template provides a basic framework, it may need to be customized to fit the specific requirements of the loan. This could involve adding clauses related to security (if the loan is secured by collateral), prepayment penalties, or the governing law in case of disputes. It's essential to review and understand each clause before signing the agreement to ensure it accurately reflects the intentions of both parties.Using a Simple Promissory Note in Different Contexts

Simple promissory notes are versatile and can be used in various financial transactions, including:

- Personal Loans: Between friends, family members, or private lenders and borrowers.

- Business Loans: For companies borrowing from investors, banks, or other businesses.

- Real Estate Transactions: As part of the financing agreement for property purchases.

In each context, the simple promissory note serves as a foundational document that outlines the financial obligations and expectations of the parties involved.

Legal Considerations

It's crucial to understand the legal implications of a simple promissory note. The document is legally binding and can be enforced in a court of law if one party fails to meet their obligations. Therefore, it's advisable for both lenders and borrowers to seek legal advice before signing a promissory note, especially for large or complex transactions.Best Practices for Lenders and Borrowers

For lenders and borrowers, several best practices can ensure a smooth and successful loan experience:

- Clear Communication: Ensure both parties fully understand the terms of the loan.

- Thorough Review: Carefully review the promissory note before signing.

- Legal Consultation: Consider seeking legal advice, especially for significant loans.

- Record Keeping: Maintain accurate records of payments and communications.

By following these practices, parties can reduce the risk of misunderstandings and disputes, fostering a positive and productive lending relationship.

Conclusion and Next Steps

In conclusion, a simple promissory note is a valuable tool for facilitating loans between individuals and entities. Its clarity, legality, and flexibility make it an essential document in various financial transactions. Whether you're a lender looking to provide a loan or a borrower seeking financing, understanding the components, benefits, and best practices related to simple promissory notes can help you navigate the lending process with confidence.Simple Promissory Note Image Gallery

What is a simple promissory note?

+A simple promissory note is a document that outlines the terms of a loan between a lender and a borrower, including the loan amount, interest rate, and repayment terms.

Why is a simple promissory note important?

+A simple promissory note is important because it provides a clear and legally binding agreement between the lender and borrower, protecting both parties and reducing the risk of disputes.

How do I create a simple promissory note template?

+To create a simple promissory note template, identify the parties involved, specify the loan amount, define the interest rate, outline the repayment terms, include penalty clauses, and add a signature block.

If you have found this information helpful, please consider sharing it with others who might benefit from understanding the basics and applications of a simple promissory note. Your feedback and comments are also welcome, as they help us improve and provide more relevant content in the future. Whether you're engaged in personal or business financial transactions, having a clear grasp of simple promissory notes can empower you to make informed decisions and navigate the lending process with greater ease and confidence.