Intro

Discover 5 ways to use a Michigan Quit Claim Deed, including property transfer, divorce, and estate planning, with expert tips on deed preparation, filing, and tax implications, to ensure a smooth transfer of property ownership in Michigan.

The state of Michigan has its own set of rules and regulations when it comes to quit claim deeds. A quit claim deed is a type of deed that allows one party to transfer their interest in a property to another party, without making any guarantees or warranties about the property's title. In Michigan, quit claim deeds are commonly used to transfer property between family members, to add or remove a spouse from a property title, or to transfer property into a trust. Here are five ways Michigan quit claim deeds can be used:

Michigan quit claim deeds are an important tool for property owners in the state. They can be used to quickly and easily transfer property, without the need for a lengthy and expensive title search. However, it's essential to understand the implications of using a quit claim deed and to ensure that it's properly executed and recorded.

What is a Quit Claim Deed in Michigan?

Types of Quit Claim Deeds in Michigan

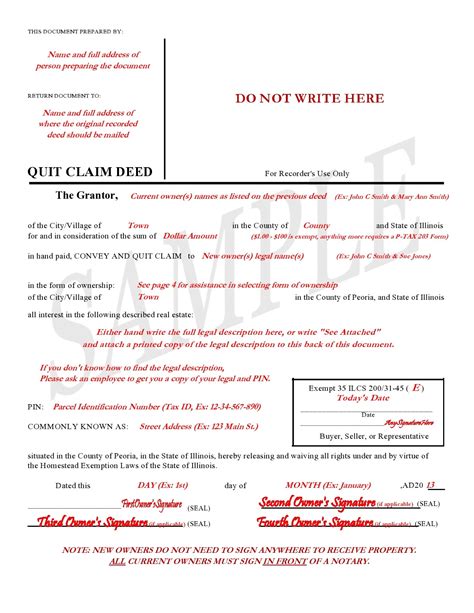

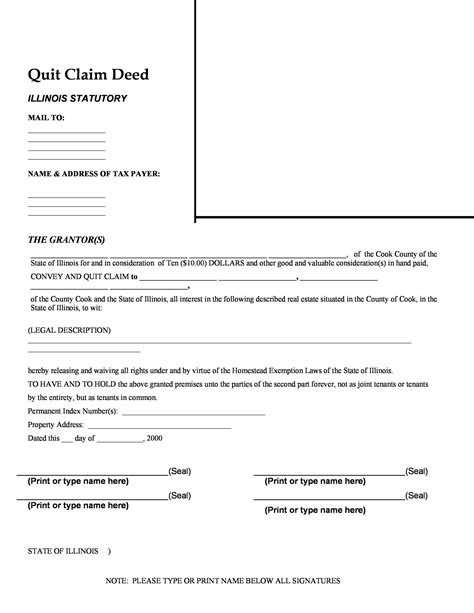

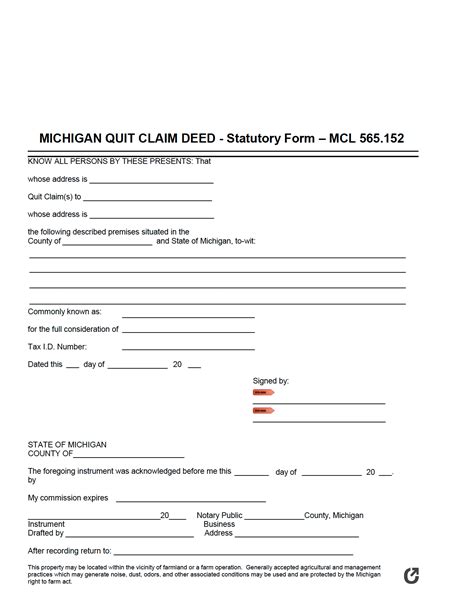

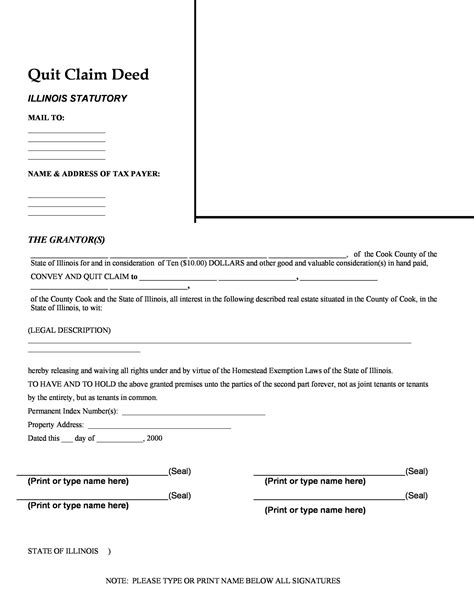

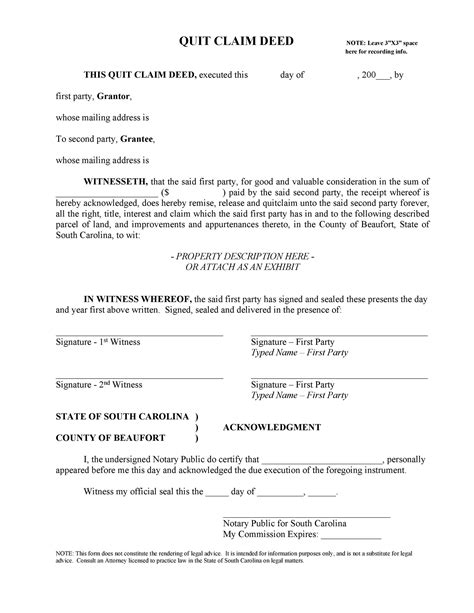

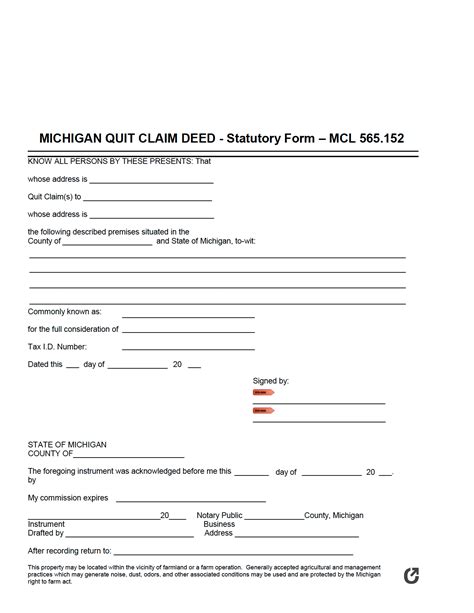

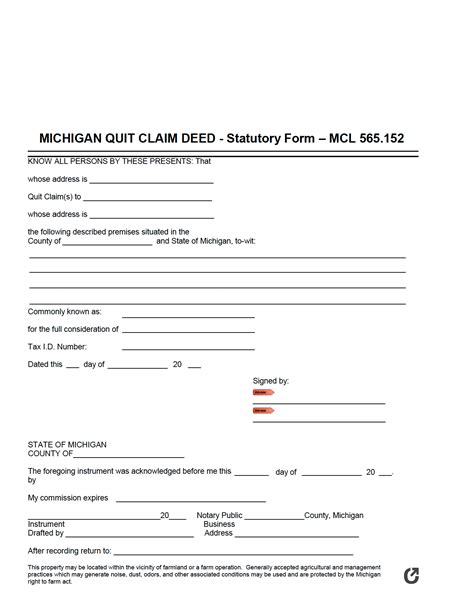

There are several types of quit claim deeds that can be used in Michigan, including: * Individual to individual: This type of quit claim deed is used to transfer property from one individual to another. * Husband and wife to husband and wife: This type of quit claim deed is used to transfer property from a husband and wife to another husband and wife. * Corporation to individual: This type of quit claim deed is used to transfer property from a corporation to an individual. * Trust to individual: This type of quit claim deed is used to transfer property from a trust to an individual.How to Fill Out a Quit Claim Deed in Michigan

Recording a Quit Claim Deed in Michigan

After the quit claim deed has been properly executed, it must be recorded with the county recorder's office in the county where the property is located. This is typically done by submitting the deed to the recorder's office, along with the required recording fee. Once the deed has been recorded, it becomes a public record and provides notice to others that the property has been transferred.Uses of Quit Claim Deeds in Michigan

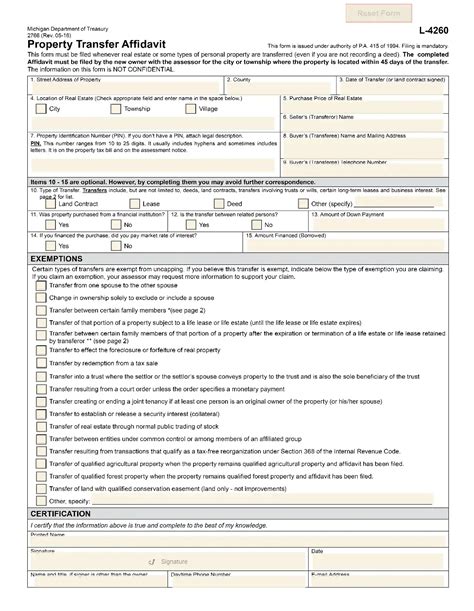

Tax Implications of Quit Claim Deeds in Michigan

The tax implications of using a quit claim deed in Michigan will depend on the specific circumstances of the transfer. In general, the transfer of property through a quit claim deed may be subject to state and local transfer taxes, as well as federal gift taxes. It's essential to consult with a tax professional to understand the potential tax implications of using a quit claim deed.Benefits of Using a Quit Claim Deed in Michigan

Risks of Using a Quit Claim Deed in Michigan

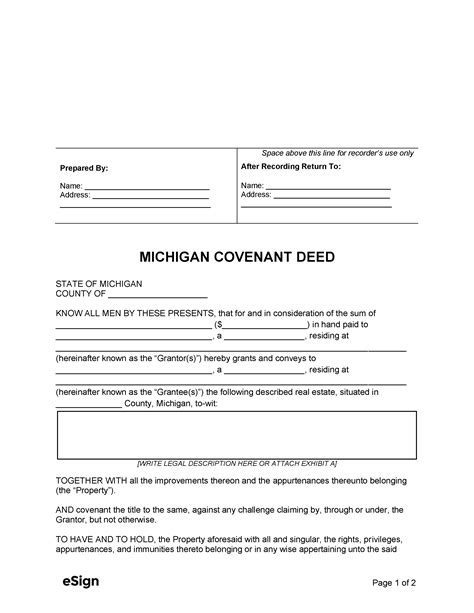

While quit claim deeds can be a useful tool for transferring property in Michigan, there are also some risks to consider. For example: * The grantor may be giving up their rights to the property without receiving anything in return * The grantee may be taking on unknown liabilities or debts associated with the property * The transfer may be subject to state and local transfer taxes, as well as federal gift taxesAlternatives to Quit Claim Deeds in Michigan

Conclusion and Next Steps

In conclusion, quit claim deeds can be a useful tool for transferring property in Michigan. However, it's essential to understand the implications of using a quit claim deed and to ensure that it's properly executed and recorded. If you're considering using a quit claim deed, it's a good idea to consult with an attorney or other qualified professional to ensure that you're making an informed decision.Michigan Quit Claim Deed Image Gallery

What is a quit claim deed in Michigan?

+A quit claim deed in Michigan is a type of deed that allows one party to transfer their interest in a property to another party, without making any guarantees or warranties about the property's title.

How do I fill out a quit claim deed in Michigan?

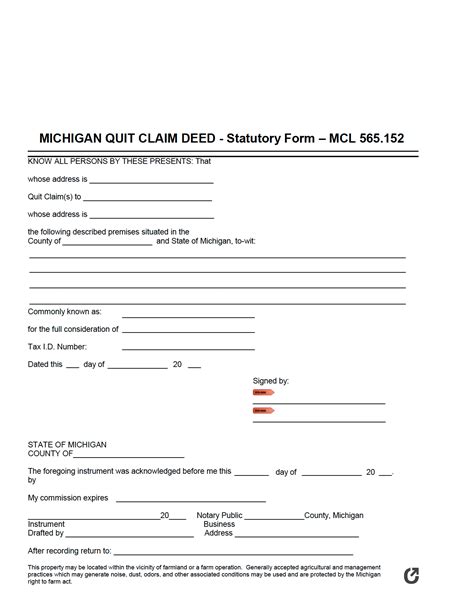

+To fill out a quit claim deed in Michigan, you will need to provide certain information, including the names and addresses of the grantor and grantee, a description of the property being transferred, and the signature of the grantor and a notary public.

What are the benefits of using a quit claim deed in Michigan?

+The benefits of using a quit claim deed in Michigan include quick and easy transfer of property, no need for a lengthy and expensive title search, and the ability to transfer property between family members or to add or remove a spouse from a property title.

What are the risks of using a quit claim deed in Michigan?

+The risks of using a quit claim deed in Michigan include the grantor giving up their rights to the property without receiving anything in return, the grantee taking on unknown liabilities or debts associated with the property, and the transfer being subject to state and local transfer taxes, as well as federal gift taxes.

Can I use a quit claim deed to transfer property in Michigan?

+Yes, you can use a quit claim deed to transfer property in Michigan. However, it's essential to understand the implications of using a quit claim deed and to ensure that it's properly executed and recorded.

We hope this article has provided you with a comprehensive understanding of quit claim deeds in Michigan. If you have any further questions or would like to learn more about this topic, please don't hesitate to comment below or share this article with others. Additionally, if you're considering using a quit claim deed to transfer property in Michigan, we recommend consulting with an attorney or other qualified professional to ensure that you're making an informed decision.