Intro

Transfer property in Illinois with a free Quit Claim Deed Form, featuring deed templates, property transfer guides, and Illinois real estate laws, to ensure a smooth conveyance process.

The state of Illinois provides a straightforward process for transferring property ownership using a quit claim deed. This type of deed is commonly used to transfer property between family members, in divorce proceedings, or to add/remove someone's name from a property title. Understanding the process and having access to the necessary forms can simplify the transfer of property ownership.

In Illinois, a quit claim deed is a legal document that allows one party to transfer their interest in a property to another party. The deed does not guarantee that the grantor (the person transferring the property) has clear title to the property, but rather transfers any interest they may have. This is why it's essential to work with a title company or attorney to ensure the property title is clear and the transfer is handled correctly.

To obtain a quit claim deed form in Illinois, you can visit the county recorder's office or website where the property is located. Many counties provide downloadable forms on their websites, which can be filled out and printed. Alternatively, you can purchase a quit claim deed form from a office supply store or online legal document provider. However, it's crucial to ensure the form is specific to Illinois and compliant with state laws.

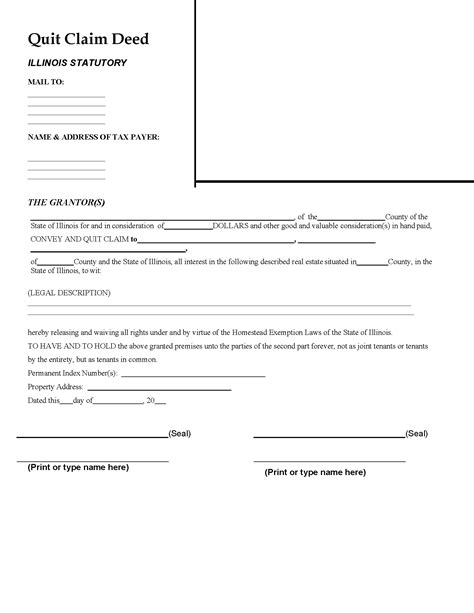

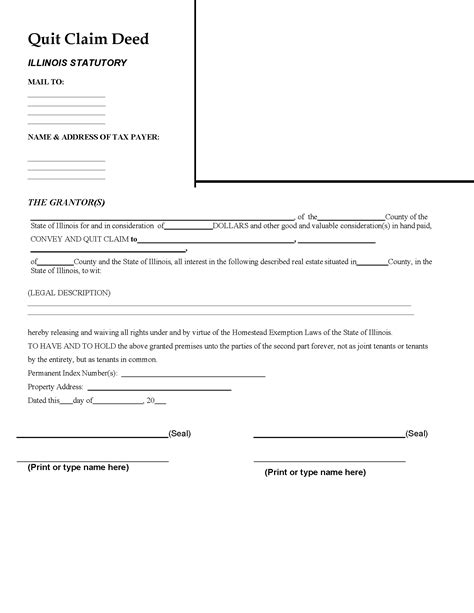

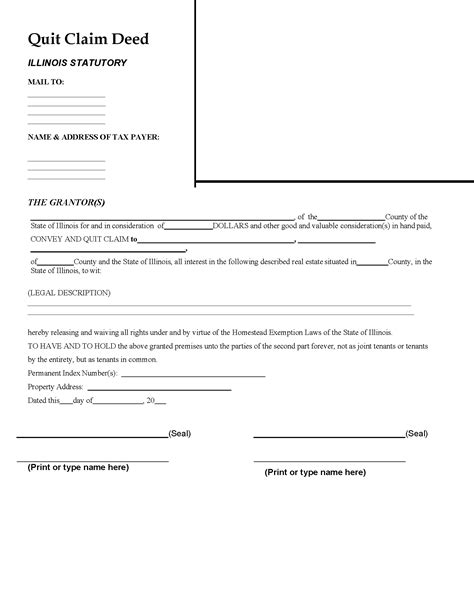

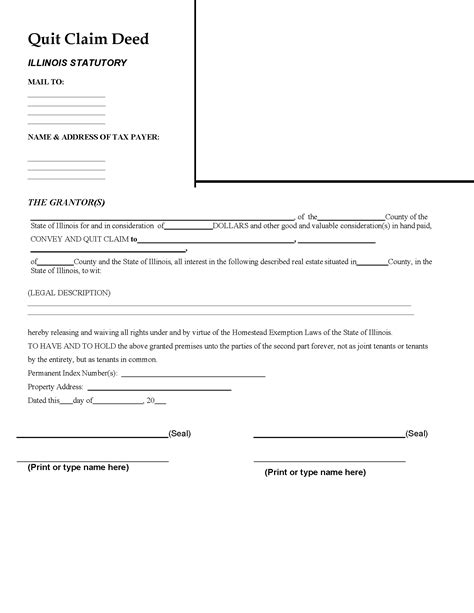

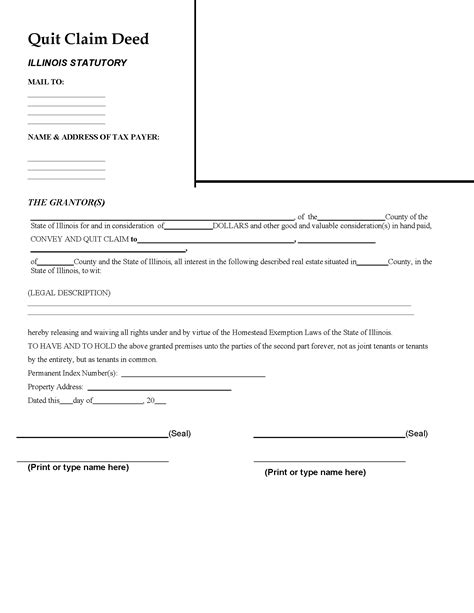

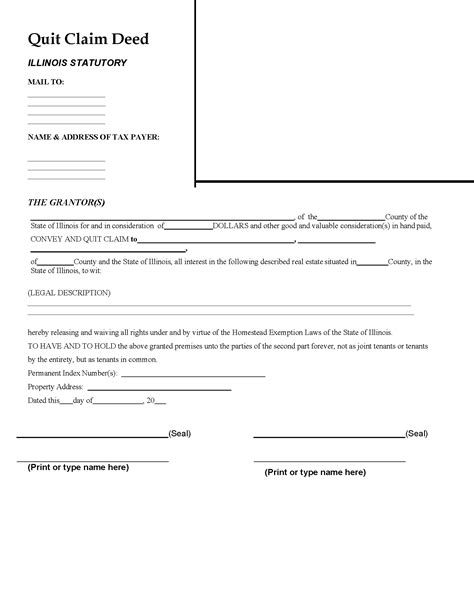

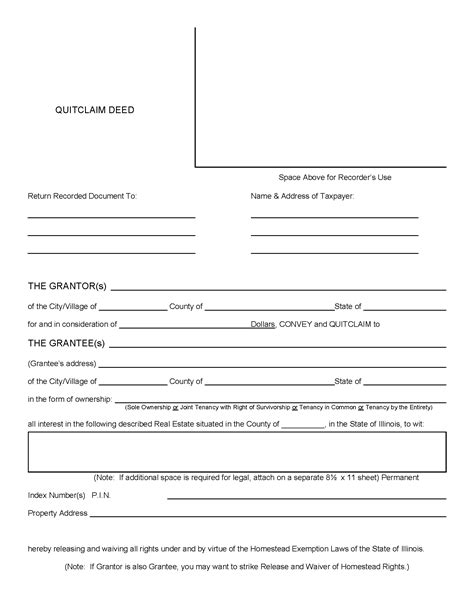

When filling out the quit claim deed form, you'll need to provide the following information:

- The names and addresses of the grantor (the person transferring the property) and the grantee (the person receiving the property)

- A detailed description of the property, including the address and parcel number

- The grantor's signature, which must be notarized

- Any other relevant information, such as the consideration (the amount paid for the property) and the type of property being transferred

Here are the steps to complete and file a quit claim deed in Illinois:

- Fill out the quit claim deed form, making sure to include all required information

- Sign the deed in the presence of a notary public

- Record the deed with the county recorder's office where the property is located

- Pay the required filing fee, which varies by county

It's essential to note that a quit claim deed does not remove any existing liens or mortgages on the property. If there are outstanding debts or liens, they will remain attached to the property, even after the transfer.

Benefits of Using a Quit Claim Deed in Illinois

Using a quit claim deed in Illinois offers several benefits, including:

- Simplified transfer process: Quit claim deeds are often easier to use than other types of deeds, as they do not require a warranty of title.

- Flexibility: Quit claim deeds can be used to transfer property between family members, in divorce proceedings, or to add/remove someone's name from a property title.

- Cost-effective: Quit claim deeds are generally less expensive than other types of deeds, as they do not require a title search or insurance.

However, it's crucial to understand the potential drawbacks of using a quit claim deed, including:

- Lack of title guarantee: Quit claim deeds do not guarantee that the grantor has clear title to the property.

- Potential for existing liens: Quit claim deeds do not remove any existing liens or mortgages on the property.

Types of Quit Claim Deeds in Illinois

There are several types of quit claim deeds used in Illinois, including:

- Individual to individual: This type of deed is used to transfer property from one person to another.

- Joint tenancy: This type of deed is used to transfer property to multiple people, who will own the property as joint tenants.

- Tenancy by the entirety: This type of deed is used to transfer property to a married couple, who will own the property as tenants by the entirety.

Illinois Quit Claim Deed Form Requirements

To ensure a quit claim deed is valid in Illinois, it must meet certain requirements, including:

- The deed must be in writing and signed by the grantor.

- The deed must include a detailed description of the property, including the address and parcel number.

- The deed must be notarized.

- The deed must be recorded with the county recorder's office where the property is located.

Common Uses of Quit Claim Deeds in Illinois

Quit claim deeds are commonly used in Illinois for:

- Transferring property between family members

- Adding or removing someone's name from a property title

- Divorce proceedings

- Estate planning

Illinois Quit Claim Deed Tax Implications

When transferring property using a quit claim deed in Illinois, there may be tax implications to consider, including:

- Transfer taxes: Illinois imposes a transfer tax on the sale or transfer of real property.

- Capital gains tax: If the property is sold or transferred for a gain, the grantor may be subject to capital gains tax.

- Gift tax: If the property is transferred as a gift, the grantor may be subject to gift tax.

Illinois Quit Claim Deed FAQs

Here are some frequently asked questions about quit claim deeds in Illinois:

- Q: What is a quit claim deed?

- A: A quit claim deed is a legal document that allows one party to transfer their interest in a property to another party.

- Q: How do I obtain a quit claim deed form in Illinois?

- A: You can obtain a quit claim deed form from the county recorder's office or website where the property is located, or purchase one from a office supply store or online legal document provider.

- Q: Do I need to have the deed notarized?

- A: Yes, the deed must be notarized to be valid.

Illinois Quit Claim Deed Image Gallery

What is a quit claim deed in Illinois?

+A quit claim deed is a legal document that allows one party to transfer their interest in a property to another party.

How do I obtain a quit claim deed form in Illinois?

+You can obtain a quit claim deed form from the county recorder's office or website where the property is located, or purchase one from a office supply store or online legal document provider.

Do I need to have the deed notarized?

+Yes, the deed must be notarized to be valid.

What are the tax implications of transferring property using a quit claim deed in Illinois?

+There may be transfer taxes, capital gains tax, and gift tax implications when transferring property using a quit claim deed in Illinois.

Can I use a quit claim deed to transfer property to a minor in Illinois?

+Yes, but it's recommended to consult with an attorney to ensure the transfer is handled correctly and in compliance with Illinois laws.

In conclusion, understanding the process and requirements for using a quit claim deed in Illinois can simplify the transfer of property ownership. By following the steps outlined in this article and consulting with a title company or attorney, you can ensure a smooth and successful transfer of property. If you have any further questions or concerns, please don't hesitate to comment below or share this article with others who may find it helpful.