Intro

Discover 5 ways probate 13100 simplifies estate administration, including asset distribution, heirship, and tax benefits, streamlining the probate process with court guidance.

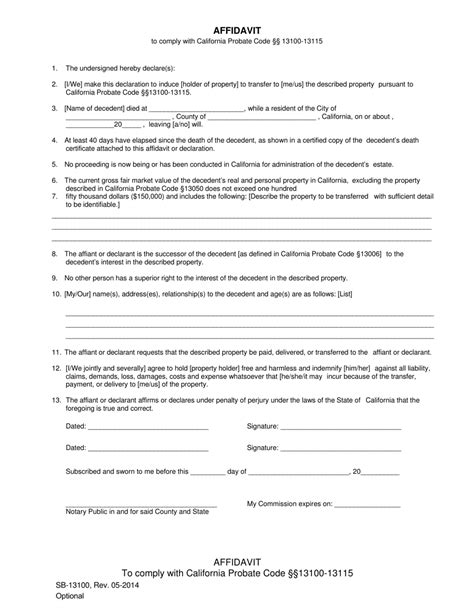

The process of probate can be a complex and overwhelming experience for those who are dealing with the estate of a loved one. Probate is the legal process by which a deceased person's assets are distributed to their heirs or beneficiaries. In California, the probate code is outlined in Section 13100 of the California Probate Code. This section provides guidelines for the administration of estates, including the duties and responsibilities of the personal representative, also known as the executor or administrator.

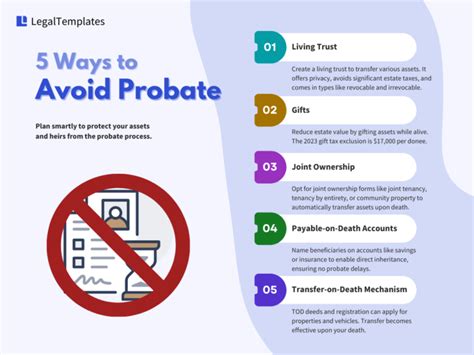

Probate can be a lengthy and costly process, but there are ways to avoid it or minimize its impact. Here are 5 ways to avoid probate, or at least make the process easier to navigate.

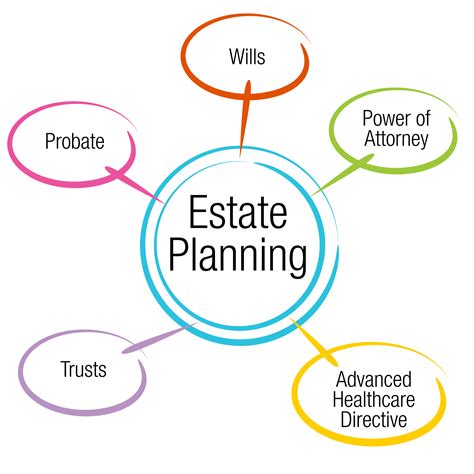

Probate can be avoided through careful estate planning, which includes creating a will, establishing a trust, and designating beneficiaries for certain assets. By taking these steps, individuals can ensure that their assets are distributed according to their wishes, without the need for probate.

Understanding Probate Code 13100

The California Probate Code Section 13100 outlines the guidelines for the administration of estates. This section provides a framework for the personal representative to follow, including the duties and responsibilities of the executor or administrator. Understanding this code is essential for navigating the probate process.

The probate process can be complex and time-consuming, involving multiple steps and requirements. It is essential to have a clear understanding of the process and the laws that govern it. By working with an experienced attorney or estate planner, individuals can ensure that they are in compliance with the law and that their estate is administered according to their wishes.

Benefits of Avoiding Probate

There are several benefits to avoiding probate, including reducing costs, minimizing delays, and maintaining privacy. Probate can be a costly process, with fees and expenses eating into the value of the estate. By avoiding probate, individuals can save money and ensure that their assets are distributed according to their wishes.

Additionally, probate can be a time-consuming process, taking months or even years to complete. By avoiding probate, individuals can minimize delays and ensure that their assets are distributed quickly and efficiently. Probate is also a public process, which means that the details of the estate are publicly available. By avoiding probate, individuals can maintain their privacy and keep the details of their estate confidential.

Ways to Avoid Probate

There are several ways to avoid probate, including creating a living trust, designating beneficiaries, using joint ownership, gifting assets, and creating a payable-on-death (POD) account. A living trust is a legal document that allows individuals to transfer ownership of their assets to a trust, which is managed by a trustee. By creating a living trust, individuals can avoid probate and ensure that their assets are distributed according to their wishes.

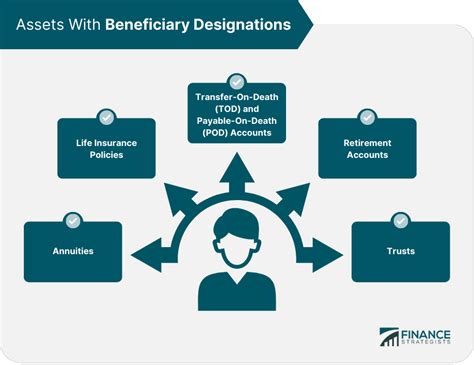

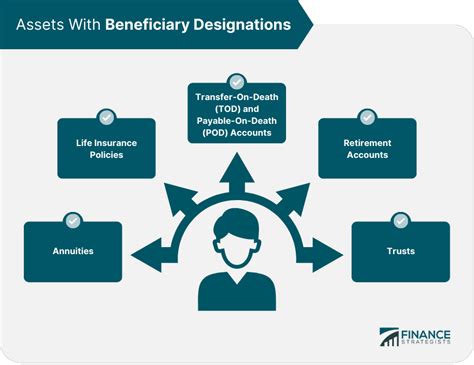

Designating beneficiaries is another way to avoid probate. By naming beneficiaries for certain assets, such as life insurance policies or retirement accounts, individuals can ensure that these assets are distributed directly to the beneficiaries, without the need for probate. Joint ownership is also a way to avoid probate, as jointly owned assets are automatically transferred to the surviving owner upon the death of the other owner.

Gifting assets is another way to avoid probate, as gifted assets are no longer part of the estate and are not subject to probate. Finally, creating a payable-on-death (POD) account is a way to avoid probate, as the assets in the account are automatically transferred to the designated beneficiary upon the death of the account owner.

Creating a Living Trust

Creating a living trust is a popular way to avoid probate. A living trust is a legal document that allows individuals to transfer ownership of their assets to a trust, which is managed by a trustee. By creating a living trust, individuals can ensure that their assets are distributed according to their wishes, without the need for probate.

To create a living trust, individuals will need to work with an experienced attorney or estate planner. The attorney will help individuals to create a trust document, which outlines the terms of the trust and the duties and responsibilities of the trustee. The trust document will also need to be signed and notarized, and the assets will need to be transferred to the trust.

Designating Beneficiaries

Designating beneficiaries is another way to avoid probate. By naming beneficiaries for certain assets, such as life insurance policies or retirement accounts, individuals can ensure that these assets are distributed directly to the beneficiaries, without the need for probate.

To designate beneficiaries, individuals will need to contact the financial institution or insurance company that holds the asset. The institution will provide a beneficiary designation form, which will need to be completed and signed. The form will ask for the name and contact information of the beneficiary, as well as the percentage of the asset that the beneficiary is to receive.

Gallery of Probate Images

Probate Image Gallery

Frequently Asked Questions

What is probate?

+Probate is the legal process by which a deceased person's assets are distributed to their heirs or beneficiaries.

How can I avoid probate?

+There are several ways to avoid probate, including creating a living trust, designating beneficiaries, using joint ownership, gifting assets, and creating a payable-on-death (POD) account.

What is a living trust?

+A living trust is a legal document that allows individuals to transfer ownership of their assets to a trust, which is managed by a trustee.

How do I create a living trust?

+To create a living trust, individuals will need to work with an experienced attorney or estate planner. The attorney will help individuals to create a trust document, which outlines the terms of the trust and the duties and responsibilities of the trustee.

What are the benefits of avoiding probate?

+The benefits of avoiding probate include reducing costs, minimizing delays, and maintaining privacy. Probate can be a costly process, with fees and expenses eating into the value of the estate. By avoiding probate, individuals can save money and ensure that their assets are distributed according to their wishes.

In conclusion, the process of probate can be complex and overwhelming, but there are ways to avoid it or minimize its impact. By understanding the California Probate Code Section 13100 and taking steps to avoid probate, individuals can ensure that their assets are distributed according to their wishes, without the need for probate. Whether through creating a living trust, designating beneficiaries, using joint ownership, gifting assets, or creating a payable-on-death (POD) account, individuals have options for avoiding probate and maintaining control over their estate. We encourage readers to share their experiences with probate and estate planning in the comments below, and to reach out to an experienced attorney or estate planner for guidance on navigating the probate process.