Intro

Get Oklahoma Tax Form 511 printable, filing instructions, and tax calculation guides, including individual income tax returns, deductions, and credits, for easy state tax filing and compliance.

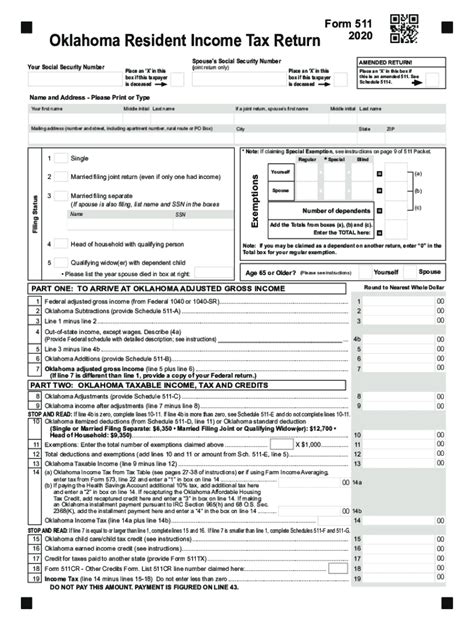

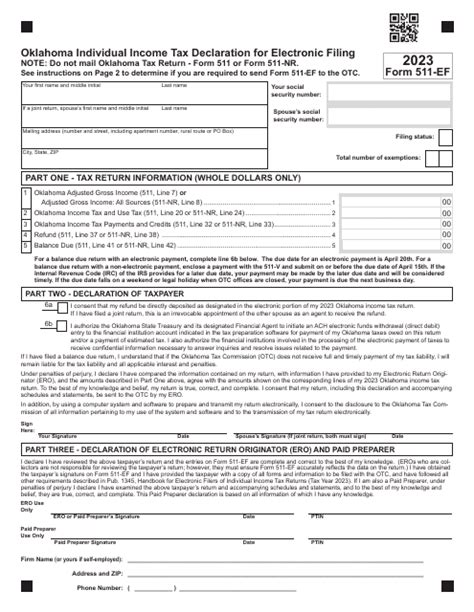

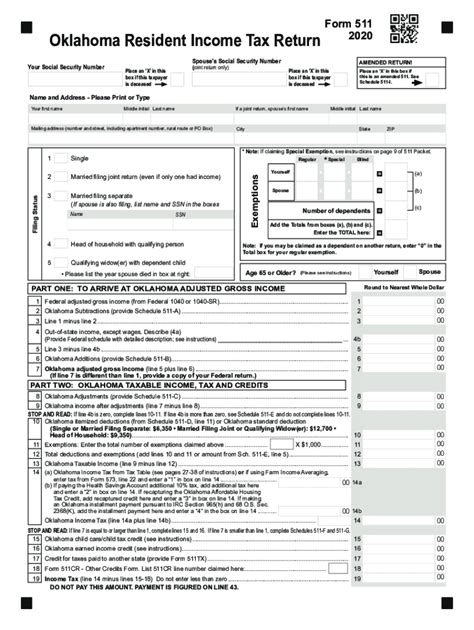

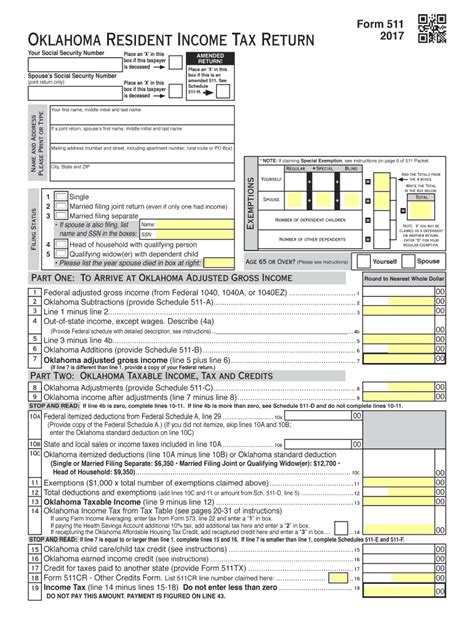

The Oklahoma Tax Form 511 is a crucial document for residents of Oklahoma, as it is used to file their state income tax returns. The form is designed to be easy to understand and fill out, but it can still be a bit overwhelming for those who are not familiar with tax terminology or have complex financial situations. In this article, we will delve into the world of Oklahoma Tax Form 511, exploring its importance, benefits, and providing guidance on how to fill it out accurately.

Filing taxes can be a daunting task, especially for those who are new to the process. However, it is essential to understand the importance of filing taxes, as it helps to fund public goods and services, such as roads, schools, and healthcare. The Oklahoma Tax Form 511 is a key component of the state's tax system, and it is used to calculate the amount of taxes owed by individuals and businesses. By understanding how to fill out the form correctly, individuals can ensure that they are taking advantage of all the deductions and credits available to them, which can help to reduce their tax liability.

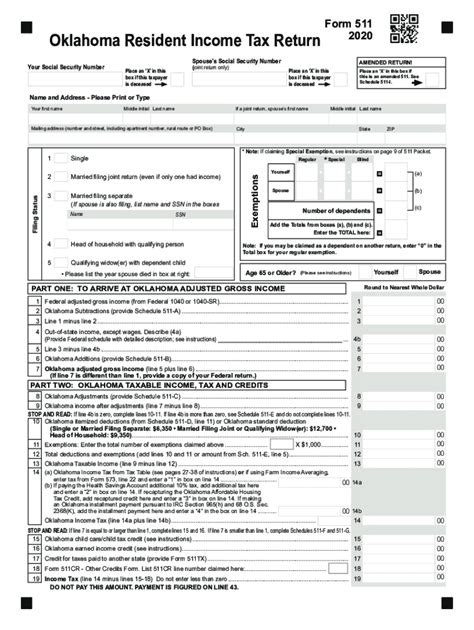

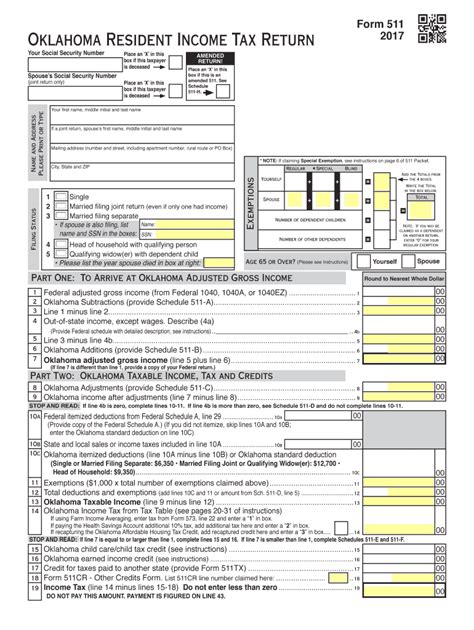

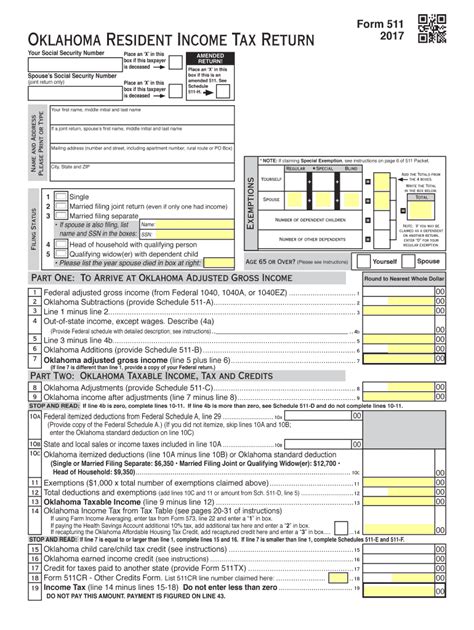

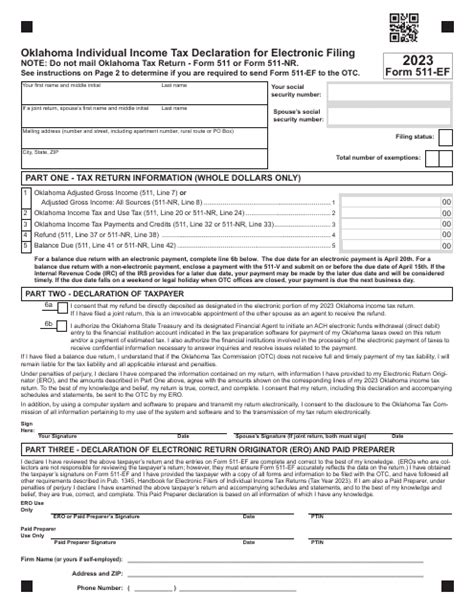

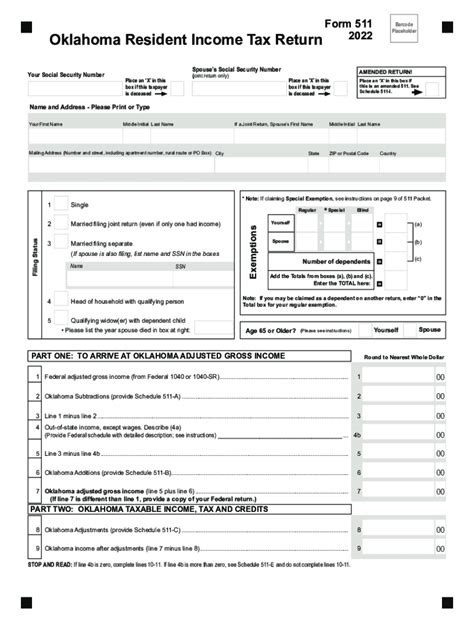

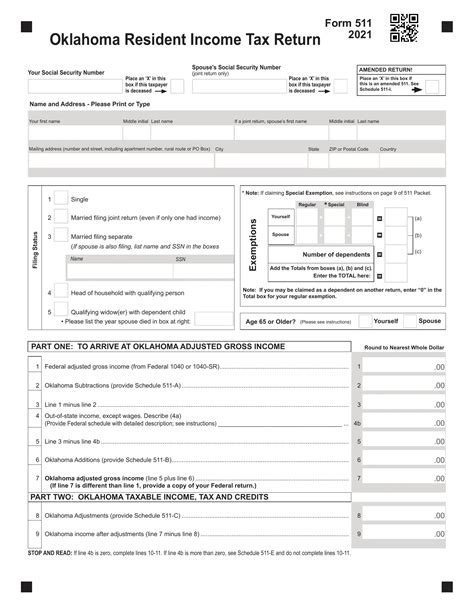

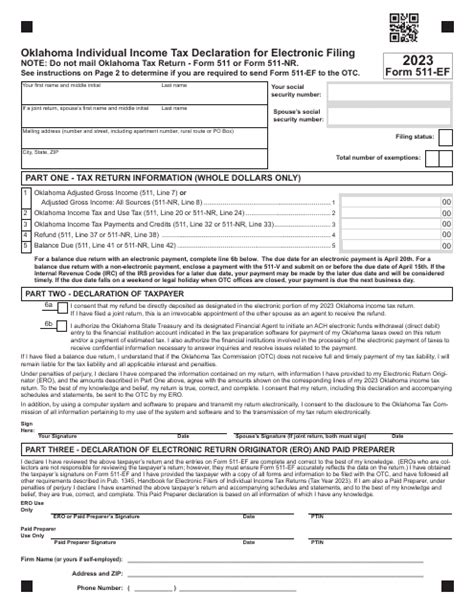

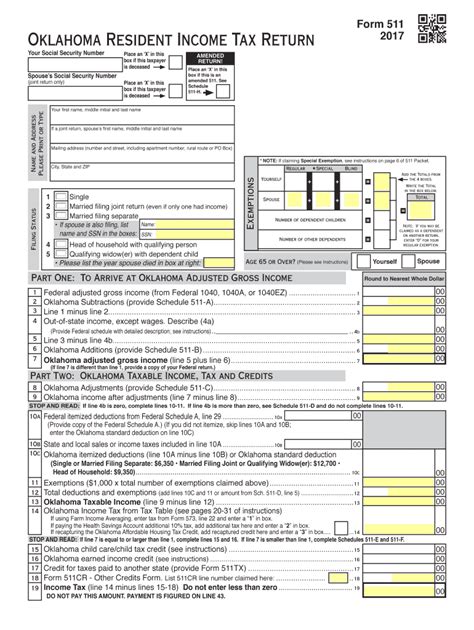

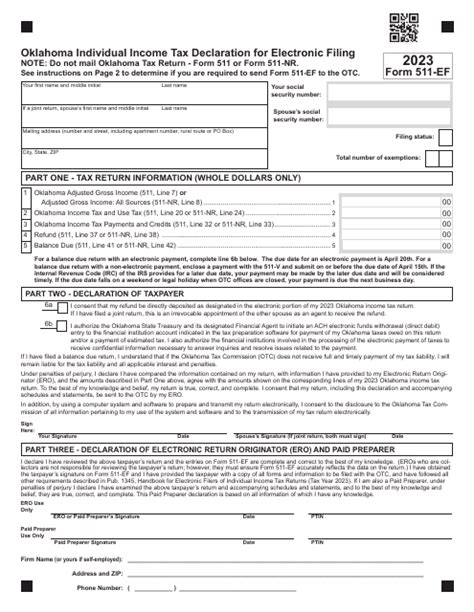

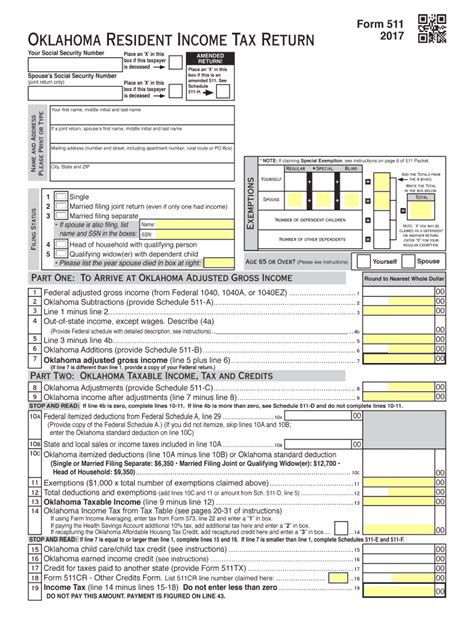

The Oklahoma Tax Form 511 is a printable document that can be downloaded from the official website of the Oklahoma Tax Commission. The form is typically updated annually to reflect any changes in tax laws or regulations, so it is essential to use the most recent version when filing taxes. The form is designed to be self-explanatory, with clear instructions and examples to help guide individuals through the process. However, for those who are still unsure about how to fill out the form, there are many resources available, including online tutorials and tax professionals who can provide guidance and support.

Oklahoma Tax Form 511 Instructions

The Oklahoma Tax Form 511 instructions are designed to be easy to follow, with step-by-step guidance on how to fill out the form. The instructions cover everything from how to report income and deductions to how to calculate taxes owed. The form is divided into several sections, each of which deals with a specific aspect of tax filing, such as income, deductions, and credits. By following the instructions carefully, individuals can ensure that they are filling out the form accurately and taking advantage of all the deductions and credits available to them.

One of the most important things to keep in mind when filling out the Oklahoma Tax Form 511 is to make sure that all information is accurate and complete. This includes reporting all income, deductions, and credits, as well as providing all required documentation, such as W-2 forms and receipts for deductions. Failure to provide accurate and complete information can result in delays or even penalties, so it is essential to take the time to review the form carefully before submitting it.

Oklahoma Tax Form 511 Benefits

The Oklahoma Tax Form 511 offers several benefits to individuals and businesses, including the ability to claim deductions and credits that can help to reduce tax liability. The form also provides a clear and concise way to report income and expenses, making it easier to keep track of financial information. Additionally, the form is designed to be easy to understand, with clear instructions and examples to help guide individuals through the process.

Some of the most common deductions and credits available on the Oklahoma Tax Form 511 include:

- Standard deduction: This is a fixed amount that can be deducted from taxable income, regardless of actual expenses.

- Itemized deductions: These are deductions for specific expenses, such as mortgage interest, charitable donations, and medical expenses.

- Earned Income Tax Credit (EITC): This is a credit for low-to-moderate-income working individuals and families.

- Child Tax Credit: This is a credit for families with qualifying children under the age of 17.

By taking advantage of these deductions and credits, individuals and businesses can reduce their tax liability and keep more of their hard-earned money.

Oklahoma Tax Form 511 Steps

Filling out the Oklahoma Tax Form 511 involves several steps, including:

- Gathering all required documentation, such as W-2 forms and receipts for deductions.

- Reporting all income, including wages, salaries, and tips.

- Claiming deductions and credits, such as the standard deduction, itemized deductions, and the Earned Income Tax Credit.

- Calculating taxes owed, using the tax tables or tax calculator provided with the form.

- Reviewing the form carefully to ensure that all information is accurate and complete.

By following these steps, individuals can ensure that they are filling out the form correctly and taking advantage of all the deductions and credits available to them.

Oklahoma Tax Form 511 Example

To illustrate how to fill out the Oklahoma Tax Form 511, let's consider an example. Suppose John is a single individual with a taxable income of $50,000. He has a standard deduction of $6,300 and itemized deductions of $10,000. He also qualifies for the Earned Income Tax Credit.

Using the tax tables provided with the form, John calculates his taxes owed to be $10,000. However, after claiming his deductions and credits, his tax liability is reduced to $5,000. This means that John will owe $5,000 in taxes, rather than the original $10,000.

This example illustrates the importance of claiming deductions and credits on the Oklahoma Tax Form 511. By taking advantage of these tax savings opportunities, individuals can reduce their tax liability and keep more of their hard-earned money.

Oklahoma Tax Form 511 FAQs

Here are some frequently asked questions about the Oklahoma Tax Form 511:

- What is the deadline for filing the Oklahoma Tax Form 511?

- How do I report income from self-employment on the Oklahoma Tax Form 511?

- Can I claim the Earned Income Tax Credit on the Oklahoma Tax Form 511?

- How do I calculate my taxes owed using the Oklahoma Tax Form 511?

These are just a few examples of the many questions that individuals may have about the Oklahoma Tax Form 511. By understanding the answers to these questions, individuals can ensure that they are filling out the form correctly and taking advantage of all the deductions and credits available to them.

Oklahoma Tax Form 511 Gallery

Oklahoma Tax Form 511 Image Gallery

Oklahoma Tax Form 511 FAQs Section

What is the Oklahoma Tax Form 511?

+The Oklahoma Tax Form 511 is a state income tax return form used by residents of Oklahoma to report their income and claim deductions and credits.

How do I file the Oklahoma Tax Form 511?

+The Oklahoma Tax Form 511 can be filed electronically or by mail. To file electronically, visit the Oklahoma Tax Commission website and follow the instructions. To file by mail, complete the form and attach all required documentation, then mail it to the address listed on the form.

What is the deadline for filing the Oklahoma Tax Form 511?

+The deadline for filing the Oklahoma Tax Form 511 is typically April 15th of each year, but this date may be extended in certain circumstances. It is essential to check the Oklahoma Tax Commission website for the most up-to-date information on filing deadlines.

In conclusion, the Oklahoma Tax Form 511 is a critical document for residents of Oklahoma, as it is used to file their state income tax returns. By understanding how to fill out the form correctly and taking advantage of all the deductions and credits available, individuals can reduce their tax liability and keep more of their hard-earned money. Whether you are a seasoned tax filer or just starting out, it is essential to take the time to review the form carefully and seek guidance if needed. With the right knowledge and resources, filing the Oklahoma Tax Form 511 can be a straightforward and stress-free process. So why not take the first step today and start exploring the world of Oklahoma tax filing? With the information and guidance provided in this article, you will be well on your way to becoming a tax filing pro.