Intro

Discover 5 ways to save money, featuring budgeting tips, frugal living, and smart financial planning strategies to reduce expenses and boost savings, achieving long-term financial stability.

Saving money is an essential aspect of personal finance, allowing individuals to achieve financial stability, security, and freedom. In today's economy, it's more important than ever to be mindful of one's spending habits and make conscious efforts to save. With the rising costs of living, saving money can seem like a daunting task, but with the right strategies and mindset, it's achievable. Whether you're looking to pay off debt, build an emergency fund, or save for long-term goals, such as retirement or a down payment on a house, saving money is crucial.

Effective money-saving techniques can help individuals develop healthy financial habits, reduce stress, and increase their sense of financial security. By implementing simple yet powerful strategies, individuals can make significant progress towards their financial goals. Saving money requires discipline, patience, and persistence, but the benefits far outweigh the challenges. With the right approach, anyone can develop a savings plan that works for them and achieve financial success.

In addition to the personal benefits, saving money can also have a positive impact on the economy. When individuals save, they are more likely to invest in assets that generate income, such as stocks, bonds, or real estate, which can help stimulate economic growth. Furthermore, saving money can also reduce reliance on debt, which can lead to financial instability and stress. By prioritizing saving, individuals can take control of their financial lives and make progress towards a more secure and prosperous future.

Understanding the Importance of Saving

Saving money is not just about setting aside a portion of one's income; it's about creating a safety net, achieving financial goals, and securing a better future. By saving, individuals can protect themselves against unexpected expenses, job loss, or other financial shocks. Moreover, saving can provide the means to invest in assets that appreciate in value over time, such as stocks, real estate, or education, which can lead to long-term financial growth and prosperity.

To develop an effective savings plan, it's essential to understand the importance of saving and how it can benefit one's financial life. By recognizing the value of saving, individuals can motivate themselves to make saving a priority and develop healthy financial habits. This includes creating a budget, tracking expenses, and setting realistic savings goals.

Setting Financial Goals

Setting financial goals is a critical step in developing a savings plan. By defining what they want to achieve, individuals can create a clear roadmap for their financial journey. This may include short-term goals, such as saving for a vacation or a down payment on a car, or long-term goals, such as retirement or a child's education. Whatever the goal, having a clear vision can help individuals stay motivated and focused on their savings objectives.

To set effective financial goals, individuals should consider their values, priorities, and financial situation. This includes assessing their income, expenses, debts, and assets to determine how much they can realistically save each month. By setting specific, measurable, achievable, relevant, and time-bound (SMART) goals, individuals can create a savings plan that is tailored to their unique needs and circumstances.

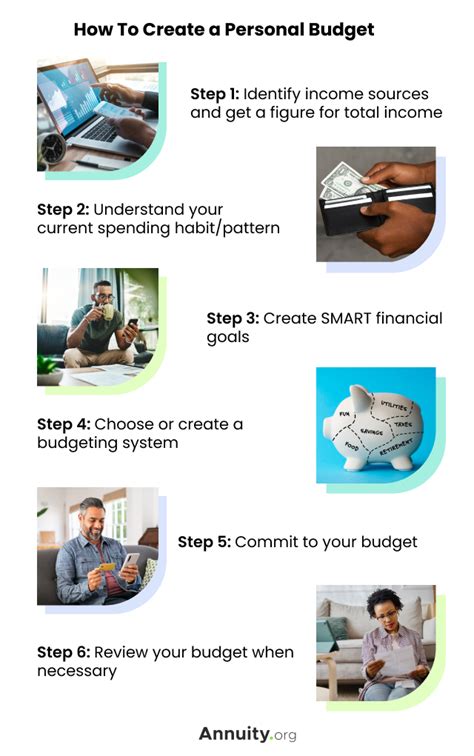

Creating a Budget

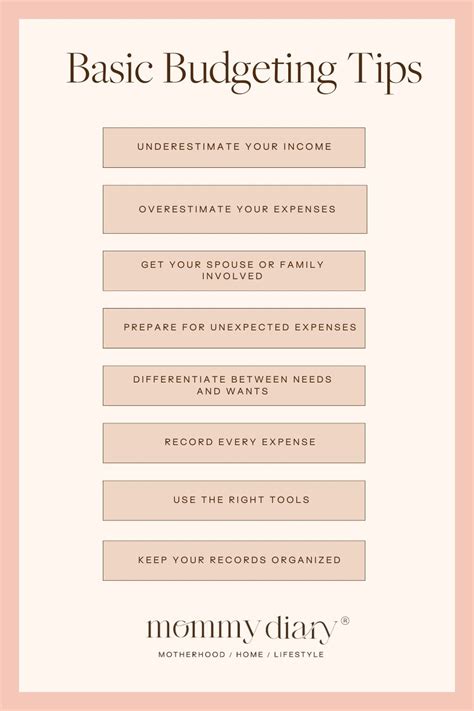

Creating a budget is an essential step in managing one's finances and achieving savings goals. A budget helps individuals track their income and expenses, identify areas for cost reduction, and allocate their resources effectively. By prioritizing needs over wants, individuals can make conscious decisions about how they spend their money and ensure that they are saving enough to meet their financial objectives.

To create an effective budget, individuals should start by tracking their income and expenses over a period of time. This can help them identify patterns and trends in their spending habits and pinpoint areas where they can cut back. By categorizing expenses into needs (housing, food, transportation) and wants (entertainment, hobbies), individuals can make informed decisions about how to allocate their resources and ensure that they are saving enough to meet their financial goals.

Implementing Savings Strategies

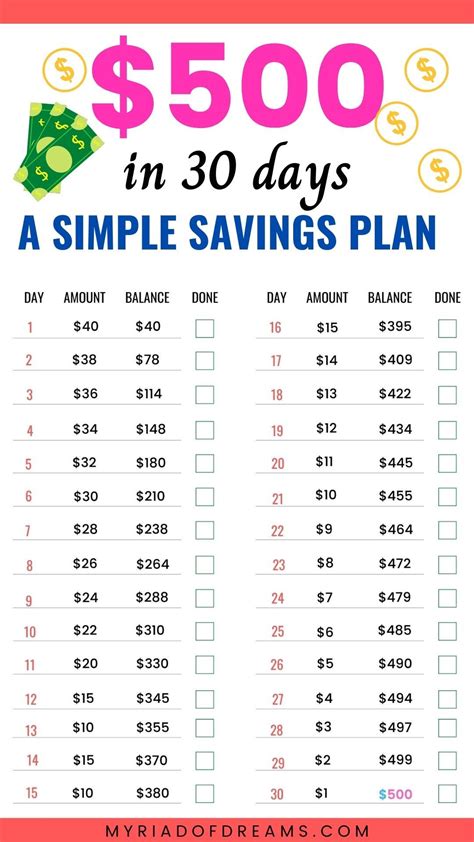

Implementing savings strategies is critical to achieving financial goals. This may include techniques such as automating savings, using the 50/30/20 rule, or taking advantage of tax-advantaged savings vehicles. By implementing these strategies, individuals can make saving easier, less prone to being neglected, and more effective.

Some popular savings strategies include:

- Automating savings: Setting up automatic transfers from a checking account to a savings or investment account can help individuals save consistently and avoid the temptation to spend.

- Using the 50/30/20 rule: Allocating 50% of income towards needs, 30% towards wants, and 20% towards saving and debt repayment can help individuals prioritize their spending and ensure that they are saving enough.

- Taking advantage of tax-advantaged savings vehicles: Utilizing tax-advantaged accounts such as 401(k), IRA, or Roth IRA can help individuals save for retirement and other long-term goals while reducing their tax liability.

Overcoming Savings Challenges

Overcoming savings challenges is essential to achieving financial goals. Despite the best intentions, individuals may face obstacles that hinder their ability to save, such as unexpected expenses, debt, or lack of motivation. By recognizing these challenges and developing strategies to overcome them, individuals can stay on track with their savings goals and achieve financial success.

Some common savings challenges include:

- Lack of motivation: Setting clear financial goals and tracking progress can help individuals stay motivated and focused on their savings objectives.

- Unexpected expenses: Building an emergency fund can help individuals cover unexpected expenses and avoid going into debt.

- Debt: Prioritizing debt repayment and using strategies such as the snowball method or avalanche method can help individuals pay off debt and free up more money for savings.

Gallery of Savings Strategies

Savings Strategies Image Gallery

What are the benefits of saving money?

+Saving money provides a sense of financial security, allows for long-term investments, and helps individuals achieve their financial goals.

How can I create a budget that works for me?

+To create a budget, track your income and expenses, categorize your spending, and prioritize your needs over your wants.

What are some effective savings strategies?

+Effective savings strategies include automating savings, using the 50/30/20 rule, and taking advantage of tax-advantaged savings vehicles.

How can I overcome savings challenges?

+To overcome savings challenges, identify the obstacles, develop a plan to overcome them, and stay motivated and focused on your savings goals.

Why is it important to have an emergency fund?

+An emergency fund provides a safety net in case of unexpected expenses, job loss, or other financial shocks, helping individuals avoid debt and stay on track with their savings goals.

In conclusion, saving money is a crucial aspect of personal finance that requires discipline, patience, and persistence. By understanding the importance of saving, setting financial goals, creating a budget, implementing savings strategies, and overcoming savings challenges, individuals can achieve financial stability, security, and freedom. We invite you to share your thoughts on savings strategies, ask questions, or provide feedback on this article. Your input is valuable to us, and we look forward to hearing from you. Additionally, if you found this article helpful, please consider sharing it with others who may benefit from the information. Together, we can work towards achieving financial success and securing a brighter financial future.