Intro

Discover 5 ways a Last Will protects assets, ensures estate planning, and secures legacy, including probate avoidance, beneficiary designation, and tax optimization, for a peaceful inheritance and wealth transfer process.

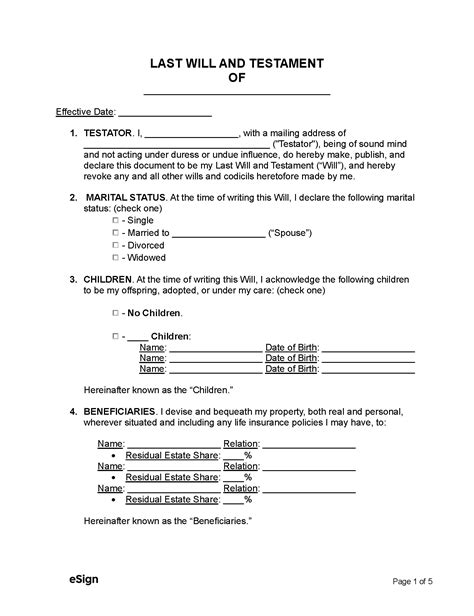

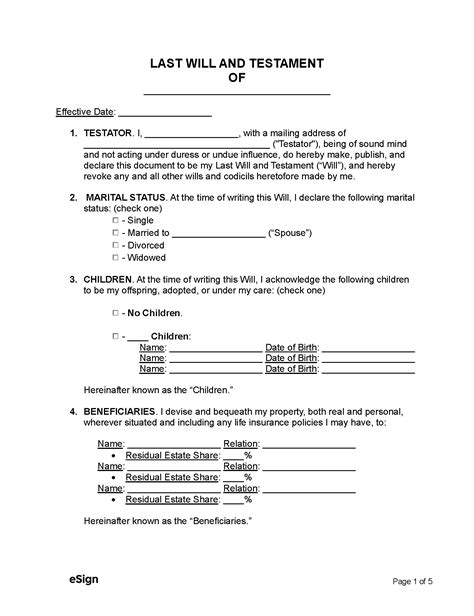

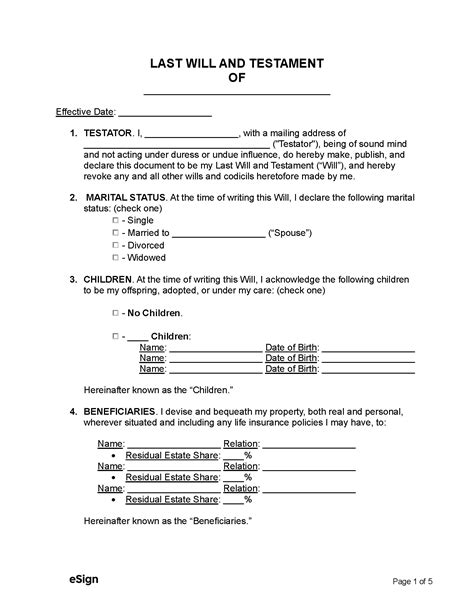

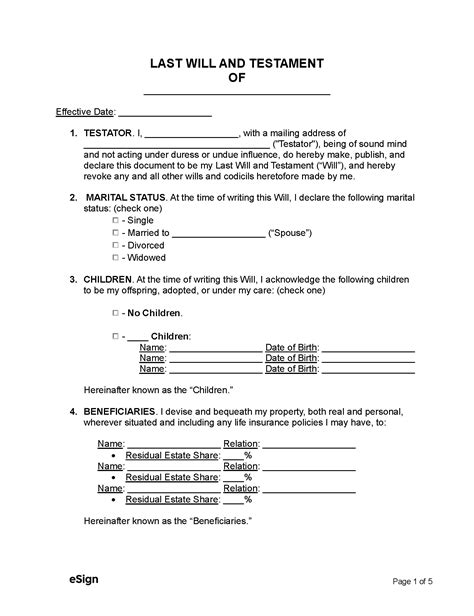

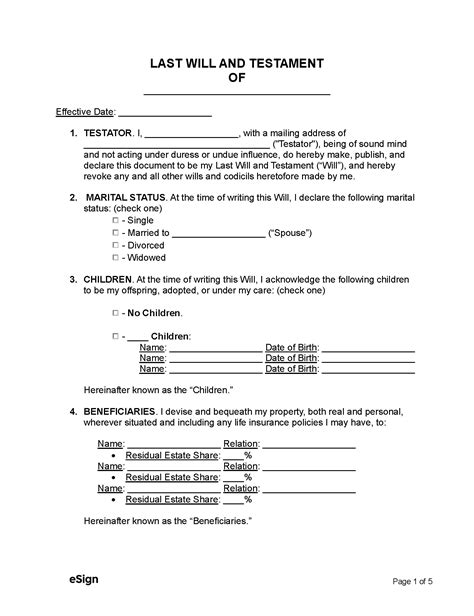

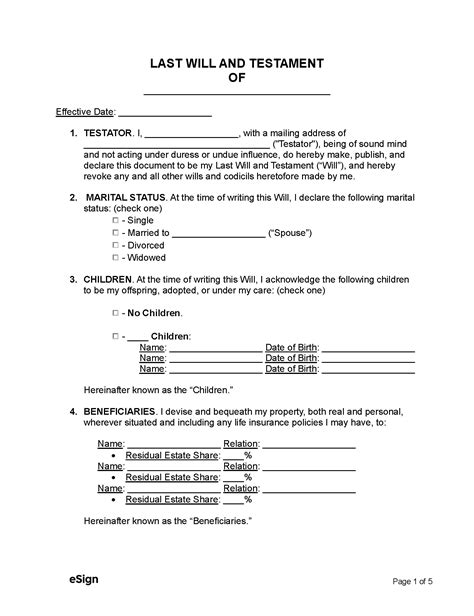

Creating a last will and testament is one of the most important steps you can take to ensure that your wishes are respected and your loved ones are protected after you're gone. A last will, also known as a will, is a legal document that outlines how you want your assets to be distributed, who will care for your minor children, and other important decisions. Without a will, the state will decide how your assets are distributed, which can lead to unintended consequences and family conflicts. In this article, we will explore the importance of having a last will and provide guidance on how to create one.

A last will is essential for anyone who wants to ensure that their assets are distributed according to their wishes. It's not just for the wealthy; anyone who owns property, has minor children, or wants to leave a legacy can benefit from having a will. A will can also help to reduce conflicts among family members and ensure that your loved ones are taken care of. With a will, you can appoint an executor to manage your estate, name guardians for your minor children, and leave specific gifts to loved ones.

Having a last will can also provide peace of mind, knowing that your wishes will be respected and your loved ones will be protected. It's a way to take control of your legacy and ensure that your assets are used to benefit those you care about. Creating a will is not a difficult process, and it's an important step in planning for the future. Whether you're young or old, married or single, having a will is an essential part of responsible estate planning.

Understanding the Importance of a Last Will

A last will is a crucial document that outlines how you want your assets to be distributed after you pass away. It's a way to ensure that your wishes are respected and your loved ones are protected. Without a will, the state will decide how your assets are distributed, which can lead to unintended consequences and family conflicts. A will can also help to reduce conflicts among family members and ensure that your loved ones are taken care of.

Benefits of Having a Last Will

Having a last will provides several benefits, including: * Ensuring that your assets are distributed according to your wishes * Appointing an executor to manage your estate * Naming guardians for your minor children * Leaving specific gifts to loved ones * Reducing conflicts among family members * Ensuring that your loved ones are taken care ofCreating a Last Will: A Step-by-Step Guide

Creating a last will is a relatively simple process that involves several steps. Here's a step-by-step guide to help you get started:

- Determine your assets: Make a list of your assets, including property, bank accounts, investments, and personal belongings.

- Decide how you want to distribute your assets: Think about how you want to distribute your assets, including who will inherit your property, bank accounts, and personal belongings.

- Choose an executor: Select a trusted person to manage your estate and ensure that your wishes are carried out.

- Name guardians for your minor children: If you have minor children, choose a trusted person to care for them in the event of your passing.

- Leave specific gifts: Consider leaving specific gifts to loved ones, such as a family heirloom or a special memento.

Types of Last Wills

There are several types of last wills, including: * Simple will: A simple will is a basic will that outlines how you want your assets to be distributed. * Joint will: A joint will is a will that is created by two people, usually a married couple. * Living will: A living will is a will that outlines your wishes for end-of-life care. * Trust will: A trust will is a will that creates a trust to manage your assets.Common Mistakes to Avoid When Creating a Last Will

When creating a last will, there are several common mistakes to avoid. Here are some of the most common mistakes:

- Not having a will: Not having a will is one of the biggest mistakes you can make. Without a will, the state will decide how your assets are distributed.

- Not updating your will: Failing to update your will can lead to unintended consequences and family conflicts.

- Not signing your will: A will must be signed in the presence of witnesses to be valid.

- Not naming an executor: Failing to name an executor can lead to delays and conflicts in the probate process.

Updating Your Last Will

It's essential to update your will regularly to ensure that it reflects your current wishes and circumstances. Here are some reasons to update your will: * Marriage or divorce * Birth or adoption of a child * Death of a beneficiary or executor * Changes in assets or property * Changes in your wishes or circumstancesWhat to Expect During the Probate Process

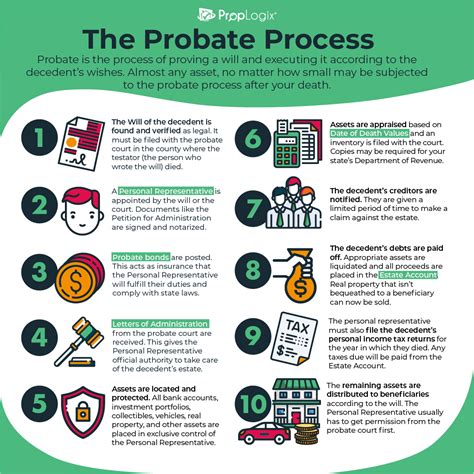

The probate process is the legal process of settling an estate after someone passes away. Here's what you can expect during the probate process:

- Filing the will: The executor will file the will with the probate court.

- Appointing an administrator: If there is no will, the court will appoint an administrator to manage the estate.

- Notifying beneficiaries: The executor or administrator will notify the beneficiaries of the estate.

- Paying debts: The executor or administrator will pay any debts or taxes owed by the estate.

- Distributing assets: The executor or administrator will distribute the assets according to the will or state law.

Probate Costs and Fees

The probate process can be costly and time-consuming. Here are some of the costs and fees associated with probate: * Court fees: The court will charge fees for filing the will and administering the estate. * Attorney fees: The executor or administrator may hire an attorney to help with the probate process. * Appraisal fees: The executor or administrator may need to hire an appraiser to value the assets of the estate. * Other costs: There may be other costs associated with the probate process, such as funeral expenses and taxes.Alternatives to Traditional Probate

There are several alternatives to traditional probate, including:

- Living trusts: A living trust is a trust that is created during your lifetime to manage your assets.

- Joint ownership: Joint ownership allows you to own property with someone else, avoiding the need for probate.

- Payable-on-death accounts: Payable-on-death accounts allow you to name a beneficiary to receive the assets in the account after your passing.

- Transfer-on-death deeds: Transfer-on-death deeds allow you to transfer property to a beneficiary after your passing.

Benefits of Alternatives to Traditional Probate

The alternatives to traditional probate offer several benefits, including: * Avoiding probate costs and fees * Reducing the time and complexity of the probate process * Maintaining control over your assets * Ensuring that your wishes are respectedGallery of Last Will and Testament Images

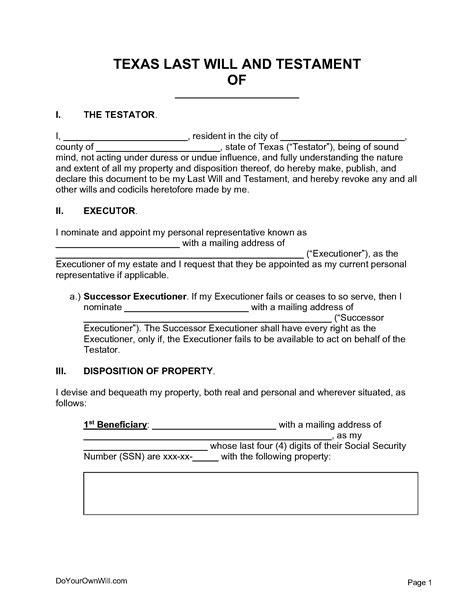

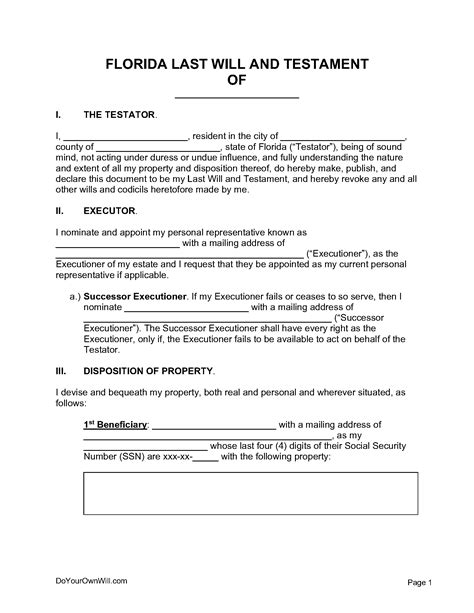

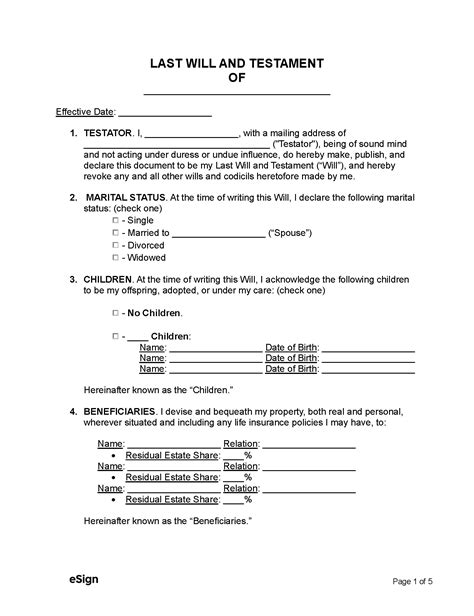

Last Will and Testament Image Gallery

What is a last will and testament?

+A last will and testament is a legal document that outlines how you want your assets to be distributed after you pass away.

Why do I need a last will and testament?

+You need a last will and testament to ensure that your wishes are respected and your loved ones are protected after you're gone.

How do I create a last will and testament?

+You can create a last will and testament by determining your assets, deciding how you want to distribute them, choosing an executor, and signing the document in the presence of witnesses.

What happens if I don't have a last will and testament?

+If you don't have a last will and testament, the state will decide how your assets are distributed, which can lead to unintended consequences and family conflicts.

Can I update my last will and testament?

+Yes, you can update your last will and testament by creating a new will or adding a codicil to your existing will.

In